[ NFT ] Análise NFT

Explique o que são NFT e casos de uso, mergulhe na estrutura blockchain. Pesquise e diferencie 11 mercados de NFT.

・O que são NFTs?

Os tokens não fungíveis (NFTs) são ativos digitais que são únicos e não podem ser trocados por outros ativos numa base um-a-um. Eles são armazenados numa blockchain, um registo digital descentralizado que permite uma manutenção de registos segura e transparente. Os NFTs podem representar uma vasta gama de ativos digitais, incluindo arte, colecionáveis, itens de jogos e muito mais.

Ao contrário das criptomoedas tradicionais, como o Bitcoin ou o Ethereum, que são intercambiáveis e têm um valor fixo, as NFTs têm características únicas e podem ter valores variáveis dependendo da sua raridade e procura. Muitas vezes, têm também metadados adicionais associados, como informações de propriedade, proveniência e outros detalhes que as tornam únicas.

Os tokens não fungíveis (NFTs) oferecem uma série de benefícios que os tornam uma tecnologia valiosa para várias indústrias. A seguir estão alguns dos principais benefícios.

- Imutabilidade: Os NFTs são armazenados numa blockchain. Isto significa que a informação contida num NFT não pode ser alterada ou adulterada, proporcionando um registo permanente de propriedade e proveniência.

- Escassez: Os NFTs podem ser criados em quantidades limitadas, tornando-os raros e valiosos. Isso pode aumentar o valor e a demanda por NFTs, especialmente no caso de arte digital ou colecionáveis.

- Verificação de propriedade: Os NFTs fornecem um registo verificável e imutável de propriedade, o que pode ser importante em indústrias como a arte e os colecionáveis, onde a proveniência é importante.

- Outros benefícios: Além dos mencionados acima, as NFTs oferecem vários outros benefícios que as tornam uma tecnologia valiosa. Por exemplo, as NFTs podem possibilitar a criação de novos modelos de negócios, como a capacidade de vender itens ou ativos de jogos como NFTs. Elas também podem permitir a criação de novos tipos de ativos digitais, como imóveis virtuais ou bilhetes de eventos virtuais.

À medida que o uso de tokens não fungíveis (NFTs) tem crescido em popularidade, questões têm sido levantadas sobre o implicações culturais e sociaisdesta nova tecnologia. Mencionando apenas algumas das implicações:

- Alargar o fosso entre os que têm e os que não têm. Uma preocupação potencial sobre NFTs é que eles podem alargar o fosso entre aqueles que têm possibilidade de os comprar e aqueles que não têm. Por exemplo, se o acesso a certos tipos de conteúdo digital for limitado àqueles que podem comprar NFTs, poderá excluir certos segmentos da população.

- Democratizar o mundo da arte. Por outro lado, alguns argumentam que os NFTs têm o potencial de democratizar o mundo da arte, permitindo que os artistas vendam seu trabalho diretamente aos compradores, contornando os tradicionais Gate.comkeepers. Isso poderia permitir a uma gama mais ampla de artistas ganhar exposição e vender seu trabalho, potencialmente levando a uma cena artística mais diversificada e vibrante.

- Mudando a forma como pensamos sobre a propriedade: O conceito de propriedade também está a ser desafiado pelos NFTs. Por exemplo, se uma obra de arte digital é vendida como um NFT, será que o comprador realmente possui a obra de arte, ou está apenas a adquirir o direito de a exibir?

・Casos de uso

Existe um vasto número de aplicações NFT. Vamos mencionar algumas das mais populares:

Categorização de pegadas de NFTs

- Coleções

Os NFTs podem ser usados para representar colecionáveis físicos ou virtuais, como cartas de troca, miniaturas ou itens de jogos. Ao criar um NFT para um colecionável, o criador pode comprovar a propriedade e escassez, e os compradores podem verificar a autenticidade do colecionável que estão adquirindo.

Os colecionáveis foram o primeiro tipo de NFT a se tornar mainstream. Lá atrás, em 2017, as pessoas começaram a pagar muito dinheiro por tipos estranhos de imagens de computador chamadas Curio Cards, Rare Pepes e CryptoPunks. Dentro de alguns anos, a palavra "NFT" tornou-se um item doméstico e perfis de utilidade gratuitos, destinados a serem mantidos e colecionados, tornaram-se sinônimos dessa classe de ativo digital. Depois surgiram o Bored Ape Yacht Club, MAYC, etc., todos tentando transformar as comunidades em torno desses colecionáveis em algo maior.

BAYC, MAYC e CryptoPunks são as maiores coleções por capitalização de mercado, volume de negociação e preço mínimo. Eles são os projetos mais populares em comparação com as categorias de jogos de arte e ativos digitais e também estão listados no Índice de Blue Chip de NFT.

Análise da pegada ecológica - Blue Chip NFT

- Arte

Captura de ecrã da origem - Tipos de Arte da OpenSea

Outro género popular de NFT é a arte digital.

Os NFTs podem ser usados para representar arte digital, como pinturas, ilustrações e outros meios visuais. Ao criar um NFT para uma obra de arte digital, o artista pode provar a propriedade e escassez, e os compradores podem verificar a autenticidade da arte que estão adquirindo.

Mais impressionante ainda, a obra "Everydays: The First 5000 Days" de Beeple foi vendida por uma quantia impressionante de $69.3 milhões em leilão em março de 2021. Isso levou o tipo de arte NFT a desencadear novamente uma onda, e os projetos de arte NFT continuam a surgir. Por exemplo, o projeto representativo é o Art Blocks Curated, que ocupa o 7º lugar em termos de volume de transações nos últimos 30 dias.

Screenshot Source -Principais Coleções

- Jogos

Muitos jogos atualmente têm um modelo de jogo para ganhar, onde cada personagem dentro do jogo é um NFT, como avatares, equipamentos e cartas no jogo. Os jogadores podem adquirir esses ativos digitais participando do jogo, e eles acreditam que as características de singularidade, escassez, transferibilidade e propriedade comprovável dos NFTs são de grande importância para aumentar o valor dos itens no jogo.

No entanto, após NFT ter começado a ganhar popularidade no início de 2021, tornou-se claro que o programa de jogo P2E combinado com NFT tinha apelado a muitos. De acordo com os dados, o número de utilizadores a participar nos jogos aumentou mês a mês até atingir um pico de todos os tempos em janeiro de 2022.

Análise da pegada ecológica - Utilizadores mensais de GameFi

Axie Infinity foi um dos primeiros a usar este modelo para fazer com que os jogadores passem cada vez mais tempo no jogo. O país mais visível é as Filipinas, onde centenas de milhares de pessoas jogam jogos NFT todos os dias. Durante a epidemia, eles conseguiram ganhar mais renda jogando jogos do que com empregos convencionais. Depois veio a emergência de vários modos de aplicações relacionadas com jogos, como M2E.

- Desportos

NBA Top Shot é um dos casos de parceria mais bem-sucedidos entre esportes profissionais e NFTs. NBA Top Shot é essencialmente uma coleção de cartões de basquete em formato NFT com seu próprio mercado.

Um dos vídeos mais famosos da NBA Top Shot é um vídeo de Lebron James enterrando, parte da série Throwdowns, que atualmente é vendido por mais de $380,000, tornando-se um dos itens colecionáveis esportivos mais caros já feitos.

- Nomes de domínio

Os domínios ENS são construídos na blockchain Ethereum e são carteiras de criptomoeda personalizadas que contêm nomes ou números reconhecíveis. Simplificam o típico endereço Ethereum, que é apenas uma longa sequência de caracteres alfanuméricos, o mais popular dos quais é ".eth". Permitem aos utilizadores enviar e receber fundos de forma mais fácil.

Os nomes de domínio ENS podem ser usados para endereços de sites e aplicações, e também podem ser vendidos como NFTs. Os utilizadores podem registar domínios no site do Serviço de Nomes Ether por entre $5 e $640 ETH.

ENS: O Serviço de Nomes Ethereum classificou-se entre os 10 primeiros em termos de volume de transações nos últimos seis meses, de acordo com Análise de pegada'classificações. Apenas em setembro, o número de novos registos atingiu 437.000. O aumento do interesse dos utilizadores deve-se principalmente ao facto de que estes domínios podem ser negociados por milhões de dólares.

No entanto, a maior desvantagem dos domínios encriptados é que a maioria dos navegadores atuais não os suporta.

- Mundos virtuais

Propriedade em Decentraland por John Lam em (29,-5)

Mundos virtuais incluem jogos digitais e terras no metaverso. Embora ainda altamente especulativa, esta categoria de NFT tem um enorme potencial, com a possibilidade de ser usada para anúncios em jogos digitais, criando ativos virtuais e muito mais.

Estes são apenas alguns exemplos dos muitos tipos de NFTs que existem. Os NFTs podem representar uma ampla gama de ativos digitais, e os casos de uso para os NFTs estão em constante evolução.

Porquê blockchain?

A tecnologia blockchain desempenha um papel fundamental na criação e funcionamento dos NFTs. Quando um NFT é criado, é armazenado na blockchain e recebe um identificador único, conhecido como um “contrato inteligente”. Este contrato inteligente contém informações sobre o NFT, como a sua propriedade, proveniência e outros detalhes que o tornam único.

A utilização da tecnologia blockchain em NFTs tem várias vantagens. Permite um registo seguro e transparente, uma vez que a blockchain é descentralizada e não pode ser alterada ou adulterada. Também permite uma propriedade e proveniência verificáveis, uma vez que a informação armazenada na blockchain é permanente e não pode ser alterada. Mais detalhes técnicos sobre a implementação em contratos inteligentes serão fornecidos posteriormente.

Existem vários padrões NFT que foram desenvolvidos para garantir a interoperabilidade e compatibilidade entre diferentes projetos NFT. Aqui estão alguns exemplos :

- ERC-721: Este é um padrão para NFTs na blockchain Ethereum. Define um conjunto de regras para criar e gerir NFTs, incluindo a capacidade de transferir a propriedade e rastrear o histórico de um NFT.

- ERC-1155: Este é um padrão que combina as características tanto do ERC-20 como do ERC-721, permitindo a criação de tokens fungíveis e não fungíveis num único contrato inteligente.

- ERC-998: Este é um padrão para NFTs "componíveis", que são NFTs que podem conter outros NFTs como parte dos seus metadados.

- BEP-721: Este é um padrão para NFTs na Binance Smart Chain (BSC), que é uma plataforma blockchain desenvolvida pela Binance. É semelhante ao padrão ERC-721, mas é específico para o BSC.

Esses foram apenas os exemplos de implementações NFT na EVM. À medida que o uso de NFTs continua a evoluir, novos padrões podem ser desenvolvidos para atender às necessidades de diferentes projetos e casos de uso.

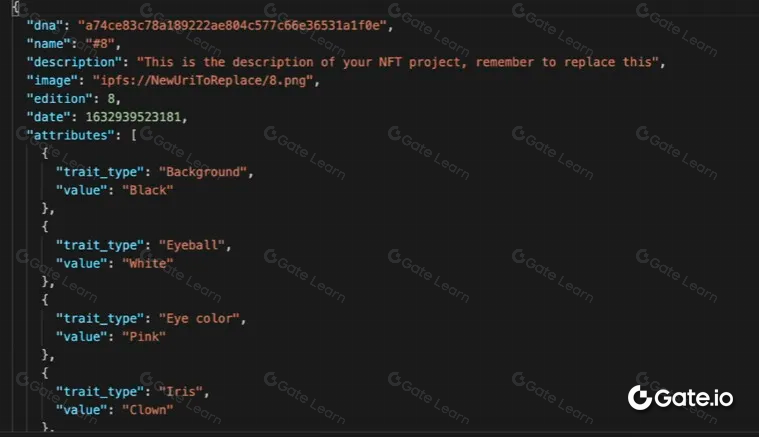

・O que é metadados?

Os metadados são importantes na indústria NFT porque permitem que os NFTs contenham informações adicionais para além do seu identificador único. Isto pode ser particularmente útil para NFTs que representam ativos digitais, como arte, colecionáveis ou itens de jogo.

Por exemplo, um NFT para uma obra de arte digital pode incluir metadados sobre o artista, o título da obra, a data em que foi criada e outros detalhes. Estes metadados podem ajudar a fornecer contexto e informações de fundo sobre o NFT, tornando-o mais valioso e desejável para colecionadores.

Além disso, os metadados podem ser usados para codificar regras ou restrições sobre o uso ou transferência de um NFT. Por exemplo, um NFT para um ativo de imóveis virtuais pode incluir metadados que especificam os termos de propriedade, como se o proprietário pode vender ou alugar a propriedade.

No caso da coleção Moon Men, os metadados são o nome, a foto, a descrição e outros atributos característicos do NFT. No caso das cartas de jogo NFT, os metadados podem conter atributos como nível, raridade e qualidade. Os dados de um dos metadados NFT na série Moon Men acima mostram:

“nome”: “Moon Men #1”

“descrição”: “Moon Men é uma coleção de 807 NFTs gerados pela comunidade enraizados em utilidade. Os contribuintes que recebem um Moon Man podem usá-lo como um PFP de magnitude astronômica e receber um desconto em um Plano de Negócios de Pegada. Há toneladas de outros benefícios.”

"imagem": "https://static.footprint.network/moonmen/nft/1.png“

Clique no link da “imagem” para exibir uma imagem da NFT. Conforme mostrado na figura:

NFT da Footprint Analytics Moon Men

Na maioria dos casos, os metadados não são armazenados diretamente na blockchain. Em vez disso, são tipicamente armazenados off-chain, com uma referência ou apontador para os metadados incluídos na transação da blockchain. Esta abordagem é usada porque a blockchain é um livro-razão descentralizado e distribuído, o que significa que é projetado para armazenar e rastrear o movimento de ativos digitais em vez de grandes quantidades de dados. Armazenar grandes quantidades de dados diretamente na blockchain pode ser ineficiente e dispendioso, pois exigiria um grande número de transações para registar todos os dados.

Portanto, ao criar um NFT, os metadados são tipicamente armazenados off-chain, enquanto uma referência ou apontador para os metadados é incluída na transação da blockchain. Isso permite que o NFT contenha informações adicionais além do seu identificador único, mantendo ainda a eficiência e a economia de custos da blockchain.

・Onde armazenar metadados?

Avaliar alguns protocolos de armazenamento e fornecedores de armazenamento:

- Pobre: Hospedagem do site do projeto, fornecedores são AWS, Geocities, etc.

- Bom: IPFS, os fornecedores são NFT.storage, Filecoin, etc.

- Melhor: Arweave, o fornecedor é ardrive.io

- Melhor: Combinação de Arweave e IPFS, fornecedor múltiplo

Para muitos utilizadores, o IPFS é considerado um protocolo de armazenamento muito bom. Armazena metadados em IPFS de armazenamento distribuído e segue a abordagem de endereçamento de conteúdo (entendido que o mesmo link do protocolo IPFS é aberto qualquer número de vezes e o conteúdo obtido é consistente). Portanto, não há necessidade de se preocupar que os metadados do NFT adquirido sejam adulterados pela organização. No entanto, é classificado como "bom" porque não garante a persistência de armazenamento, e o seu CID (Identificador do Cliente) é público, exigindo medidas adicionais para manter os dados privados.

Arweave é semelhante ao IPFS, a principal diferença com Arweave é que os utilizadores pagam uma taxa baixa de $2.927/GB (paga em AR, calculada dinamicamente) para armazenar dados permanentemente. Os metadados não podem ser adulterados por organizações centralizadas, mas há uma perda de metadados quando estes são corrompidos.

A tecnologia combinada de armazenamento de dados do Arweave e do IPFS surgiu como uma forma de carregar dados carregados no IPFS para o Arweave e manter os dados no Arweave em seus próprios nós IPFS. Essa tecnologia permite o armazenamento de dados em vários nós e cria um sistema de retenção de dados mais robusto.

Claro, existem muitos outros protocolos de armazenamento, como Filecoin, Storj e Sia.

・Análise de pegada

Os dados brutos que uma determinada blockchain está a armazenar devem ser conhecidos por si se alguma vez utilizou um explorador de blocos. Estes detalhes diferem entre as cadeias, no entanto, como ilustração, a maioria das cadeias alimentadas pela Máquina Virtual Ethereum (EVM) incluem:

- Blocos - grupos de transações acrescentadas à cadeia

- Transações - instruções de estado de blockchain assinadas criptograficamente

- Registos - eventos criados por contratos inteligentes

- Rastros - registro passo a passo do que aconteceu durante a execução de uma transação

Na realidade, as entidades mencionadas compõem a totalidade da blockchain. Isso indica que, ao usá-las sozinhas, qualquer ecossistema descentralizado pode já ser totalmente analisado. Embora os dados nessas tabelas possam ser lidos por humanos (ao contrário do bytecode), fazê-lo exige uma compreensão profunda da blockchain.

Portanto, fazemos abstrações. A transformação de dados brutos em informações perspicazes nunca é uma tarefa trivial. Embora difícil, trabalhar com isso é viável. Construir e ajustar modelos ETL é apenas uma pequena parte do esforço que muitos empreendedores de dados realizam diariamente. Mais sobre o conceito de design está emhttps://docs.footprint.network/docs/designconcept.

O domínio NFT na nossa base de dados também está a ter as abstrações - o esquema visual simplificado completo do processo ETL relacionado com os NFTs pode ser visto na seguinte imagem:

Vamos analisar o processo de ETL usando um exemplo de indexação de uma transação para a venda de um NFT em um marketplace. Como mostrado no diagrama, nosso mecanismo primeiro salva a transação como parte da transferência de token, já que o EVM de blockchains NFT representa um contrato inteligente de um determinado padrão. Uma vez que nosso ETL recebe esses dados do blockchain, ele pode identificar imediatamente o tipo de NFT que é (por exemplo, ERC721) e armazená-los na tabela de prata correspondente. Depois, é feita uma abstração para a tabela nft_transfer, pois o contrato inteligente ERC721 é sempre um NFT. Segue-se uma nova abstração para a tabela nft_transactions. Por fim, as métricas de negócios são geradas de acordo com um cronograma pré-determinado, como marketplace_nft_collection_daily_stats e nft_collection_transfers_daily_stats.

A tabela específica a ser usada dependerá do seu caso de uso específico. Uma lista abrangente de todas as tabelas relevantes, juntamente com uma descrição detalhada de cada uma, pode ser encontrada no seguinte link:https://www.footprint.network/guest/chart/NFT-fp-267f52a1-38ce-4c51-b6b6-f5680d9a6a4c.

・Coleções

Neste capítulo, iremos analisar colecionáveis NFT em termos de comportamento de preço, padrões de titularidade, características de raridade e classificações para compreender a oferta e procura.

Os indicadores não são regras fixas para negociação. São um conjunto de ferramentas para construir uma imagem abrangente de projetos e tendências.

・Mercados

Os mercados de NFT são plataformas online onde tokens não fungíveis (NFTs) podem ser comprados e vendidos. Os mercados de NFT permitem aos utilizadores listar NFTs para venda, navegar e descobrir NFTs e comprar NFTs usando uma variedade de métodos de pagamento.

Os mercados de NFT podem ser especializados, focando-se num tipo específico de NFT, como arte digital ou colecionáveis, ou podem ser mais genéricos, oferecendo uma ampla gama de NFTs de diferentes categorias.

Os mercados são todos diferentes, mas giram em torno de ações centrais semelhantes para os utilizadores :

- Criar uma conta : Compradores e vendedores registam-se para usar a plataforma.

- Configurar uma carteira: Após o registo, os utilizadores podem ligar as suas carteiras à conta. A maioria das principais plataformas de mercado tem integrações com as populares carteiras de criptomoedas, como MetaMask, WalletConnect e Coinbase, entre outras.

- Listar NFTs para venda : Os vendedores e criadores podem mostrar o seu trabalho nas listagens do mercado, que inclui informações sobre o trabalho, como nome, descrição, preço mínimo e total de NFTs na coleção.

- Explorar NFTs: Os mercados de NFTs agora possuem opções avançadas de pesquisa e filtragem para permitir que os compradores encontrem facilmente os NFTs que estão procurando.

- Compre ou licite NFTs: Os compradores podem comprar, licitar ou enviar ofertas para adquirir um NFT.

Todos os mercados têm as funcionalidades acima em comum. Mas depois divergem. Aqui está como diferem.

・Tipos de mercados de NFT

Mercado Geral de NFT

Um mercado geral de NFT é a escolha preferida da maioria dos colecionadores e criadores, permitindo que as pessoas listem todos os tipos de ativos digitais em vários estilos, preços e funcionalidades.

Exemplos de mercados gerais de NFT são:

- LooksRare

Os mercados gerais de NFT atualmente têm mais volume de negociação do que os mercados exclusivos de NFT ou mercados específicos de NFT.

Análise da pegada ecológica - Volume de NFT por Mercados em 30D

Mercado exclusivo de NFT

As plataformas exclusivas de NFTs concentram-se em obras de arte de alta qualidade, geralmente emitidas em pequenas quantidades e com aprovação da plataforma para listagem. A seletividade significa que os NFTs neste tipo de mercado tendem a ter um preço de venda médio por item muito mais alto do que em mercados gerais.

Exemplos de mercados exclusivos de NFT incluem :

- Solanart

Estas plataformas listam principalmente arte e colecionáveis em vez de NFTs de jogos e NFTs comunitários.

Os mercados exclusivos de NFT também têm várias desvantagens.

- Pequena seleção

- Preço de venda elevado

- Baixa liquidez

- Mercado específico de NFT

O terceiro tipo de mercado de NFT abrange aqueles que servem a uma coleção específica ou segmento de mercado de nicho. Por exemplo, uma plataforma de negociação para compras de NFT no jogo para um único jogo (como o The Sandbox, por exemplo), ou uma plataforma de negociação apenas para NFTs de cartões esportivos de uma empresa (NBA Top Shot). Para colecionadores que acompanham coleções específicas para fins de pesquisa ou investimento, os mercados específicos acompanham as flutuações do mercado e respondem mais rapidamente do que os mercados gerais de NFT.

Exemplos de mercados NFT específicos incluem:

Captura de tela da fonte - CryptoPunk

Ao focar-se apenas numa única área, produto ou jogo, esses mercados têm um volume relativamente pequeno de transações.

Estatísticas da Footprint a partir de 28 de julho

As diferenças vão muito além da superfície da página de destino. Estes mercados visam construir comunidades em torno de si mesmos com as suas próprias características distintas. Qual deles é o mais adequado para si?

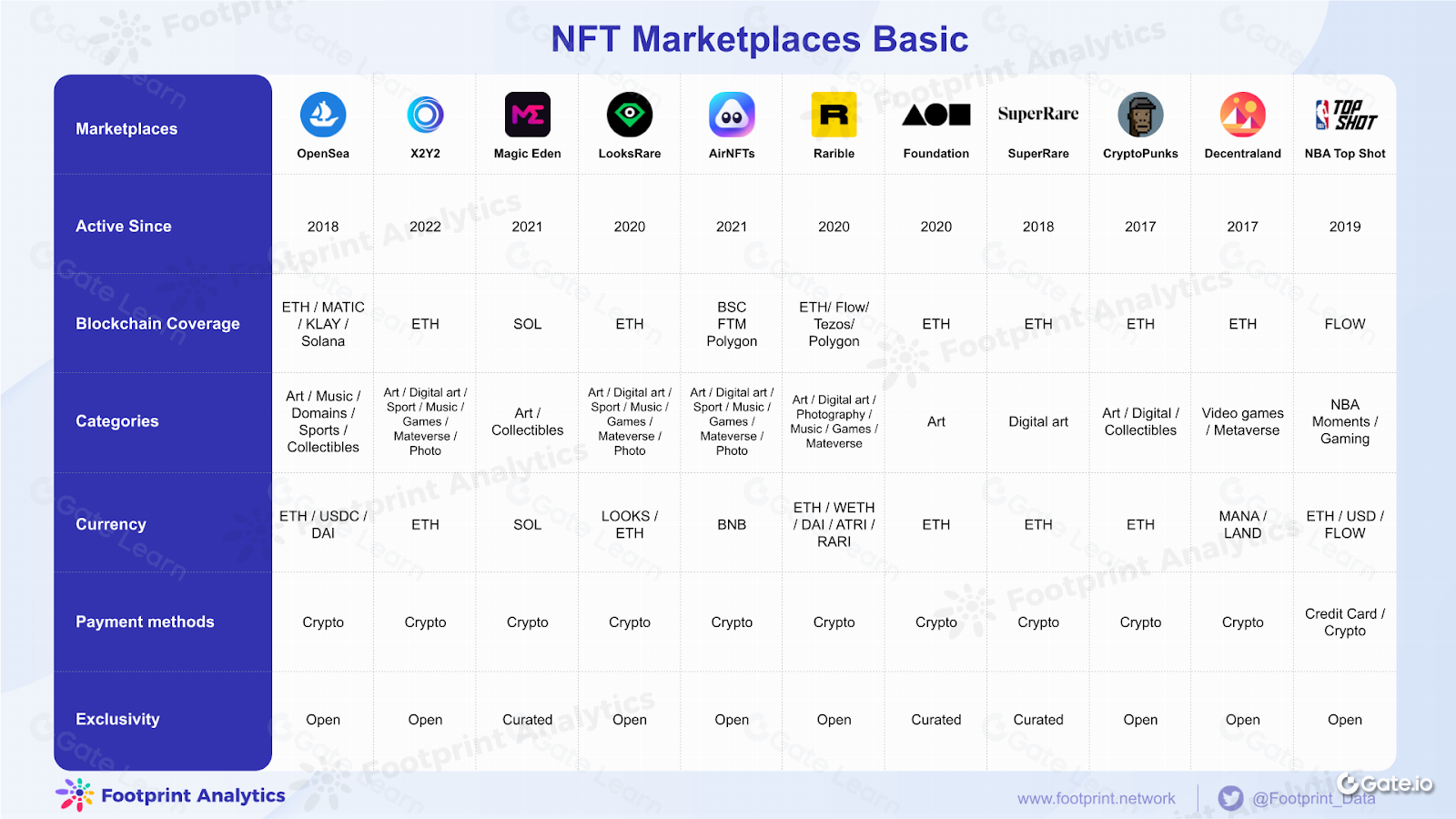

・Comparação

A Footprint Analytics conduziu uma extensa pesquisa em 11 plataformas de negociação de NFTs para ver como elas se diferenciam. Aqui estão os resultados:

https://www.footprint.network/@

Shelly/Tudo-o-que-precisa-saber-sobre-mercados-de-NFT

Análise de Pegada - Mercado Básico de NFT

Análise de Pegada - Recursos do Mercado de NFT

Análise de Pegada - Economia de Token do Mercado NFT

Análise da pegada ecológica - Principais Mercados

・Como escolher o mercado NFT certo

Ao escolher uma plataforma de mercado NFT, faça estas 4 perguntas:

Há quanto tempo a plataforma existe ?

Embora o tempo de estabelecimento não seja um fator decisivo, quanto mais tempo tiver passado, mais estável é provável que seja.

O que dizem os dados sobre o mercado?

Os dados relacionados com a plataforma incluem o número de coleções. Se for pequeno, então é difícil encontrar um NFT específico. Alterações esporádicas de baixa liquidez no número de compradores e vendedores podem tornar a compra ou venda de NFTs a um preço justo mais difícil.

Com que frequência são atualizados os anúncios?

Verifique se o mercado é atualizado regularmente - você quer ver rapidamente o trabalho NFT mais recente e melhor.

Posso pagar por coisas com os métodos disponíveis?

Alguns mercados agora oferecem a compra direta com cartão de crédito de criptomoedas na plataforma, a maioria dos quais exige que você tenha uma carteira de criptomoedas.