# TraditionalFinanceAcceleratesTokenization

3.18K

CryptoChampion

#TraditionalFinanceAcceleratesTokenization

Traditional Finance Accelerates Tokenization: A New Era of Global Markets

The financial world is standing at a historic crossroads. What once felt like a futuristic experiment is now becoming a core strategy: Traditional Finance (TradFi) is rapidly accelerating tokenization. From global banks to asset managers and stock exchanges, legacy institutions are no longer asking if tokenization will reshape finance they’re asking how fast they can adopt it.

Tokenization refers to converting real-world assets such as bonds, equities, real estate, commodities,

Traditional Finance Accelerates Tokenization: A New Era of Global Markets

The financial world is standing at a historic crossroads. What once felt like a futuristic experiment is now becoming a core strategy: Traditional Finance (TradFi) is rapidly accelerating tokenization. From global banks to asset managers and stock exchanges, legacy institutions are no longer asking if tokenization will reshape finance they’re asking how fast they can adopt it.

Tokenization refers to converting real-world assets such as bonds, equities, real estate, commodities,

- Reward

- 2

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#TraditionalFinanceAcceleratesTokenization

One of the most consequential shifts in global finance is underway: traditional financial institutions are accelerating their embrace of tokenization, fundamentally reshaping how assets are issued, traded, settled, and accessed. What once was viewed as a niche application of blockchain technology has matured into a strategic priority for legacy banks, asset managers, regulators, and market infrastructure providers. The hashtag #TraditionalFinanceAcceleratesTokenization captures this transformation not as a speculative buzzword, but as a structural ev

One of the most consequential shifts in global finance is underway: traditional financial institutions are accelerating their embrace of tokenization, fundamentally reshaping how assets are issued, traded, settled, and accessed. What once was viewed as a niche application of blockchain technology has matured into a strategic priority for legacy banks, asset managers, regulators, and market infrastructure providers. The hashtag #TraditionalFinanceAcceleratesTokenization captures this transformation not as a speculative buzzword, but as a structural ev

- Reward

- 3

- 5

- Repost

- Share

Falcon_Official :

:

DYOR 🤓View More

#TraditionalFinanceAcceleratesTokenization Traditional Finance Accelerates Tokenization

Traditional finance is entering a new phase as tokenization rapidly moves from theory to execution. What was once an experimental concept discussed mainly in blockchain circles is now being actively adopted by major financial institutions. Banks asset managers exchanges and regulators are no longer asking if tokenization will happen. They are asking how fast it can scale and who will lead the transition.

Tokenization refers to the process of converting real world assets into digital tokens on a blockchain.

Traditional finance is entering a new phase as tokenization rapidly moves from theory to execution. What was once an experimental concept discussed mainly in blockchain circles is now being actively adopted by major financial institutions. Banks asset managers exchanges and regulators are no longer asking if tokenization will happen. They are asking how fast it can scale and who will lead the transition.

Tokenization refers to the process of converting real world assets into digital tokens on a blockchain.

- Reward

- 2

- 2

- Repost

- Share

Vortex_King :

:

2026 GOGOGO 👊View More

#TraditionalFinanceAcceleratesTokenization #TraditionalFinanceAcceleratesTokenization

The convergence of traditional finance (TradFi) and blockchain technology is accelerating at an unprecedented pace. Tokenization—the process of converting real-world assets into digital tokens on a blockchain—is no longer just a theoretical concept; it’s rapidly becoming a mainstream financial practice. As legacy institutions explore tokenized assets, we are entering a new era where liquidity, accessibility, and efficiency are being redefined.

Why Tokenization Matters

Liquidity Across Asset Classes:

Tradition

The convergence of traditional finance (TradFi) and blockchain technology is accelerating at an unprecedented pace. Tokenization—the process of converting real-world assets into digital tokens on a blockchain—is no longer just a theoretical concept; it’s rapidly becoming a mainstream financial practice. As legacy institutions explore tokenized assets, we are entering a new era where liquidity, accessibility, and efficiency are being redefined.

Why Tokenization Matters

Liquidity Across Asset Classes:

Tradition

- Reward

- 1

- 1

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊#TraditionalFinanceAcceleratesTokenization 🚀reflects the growing trend of mainstream financial institutions leveraging blockchain technology to tokenize traditional assets. From equities and bonds to real estate and commodities, major banks, investment funds, and insurance companies are increasingly converting their physical or financial assets into digital tokens. Tokenization allows these assets to be traded, transferred, or fractionalized on blockchain networks, offering unprecedented levels of liquidity, transparency, and accessibility.

📈 How Traditional Finance is Driving Tokenization c

📈 How Traditional Finance is Driving Tokenization c

ETH-0,45%

- Reward

- 4

- 2

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#TraditionalFinanceAcceleratesTokenization Traditional finance is no longer observing tokenization from a distance. It is actively accelerating toward it. What was once framed as an experimental concept is now becoming a structural strategy as banks, asset managers, and financial institutions seek faster settlement, lower operational costs, and programmable ownership. Tokenization is evolving from a crypto-native idea into a core pillar of modern financial infrastructure.

At its core, tokenization is about efficiency and control. By representing real-world assets on blockchain networks, instit

At its core, tokenization is about efficiency and control. By representing real-world assets on blockchain networks, instit

- Reward

- 10

- 13

- Repost

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

#TraditionalFinanceAcceleratesTokenization

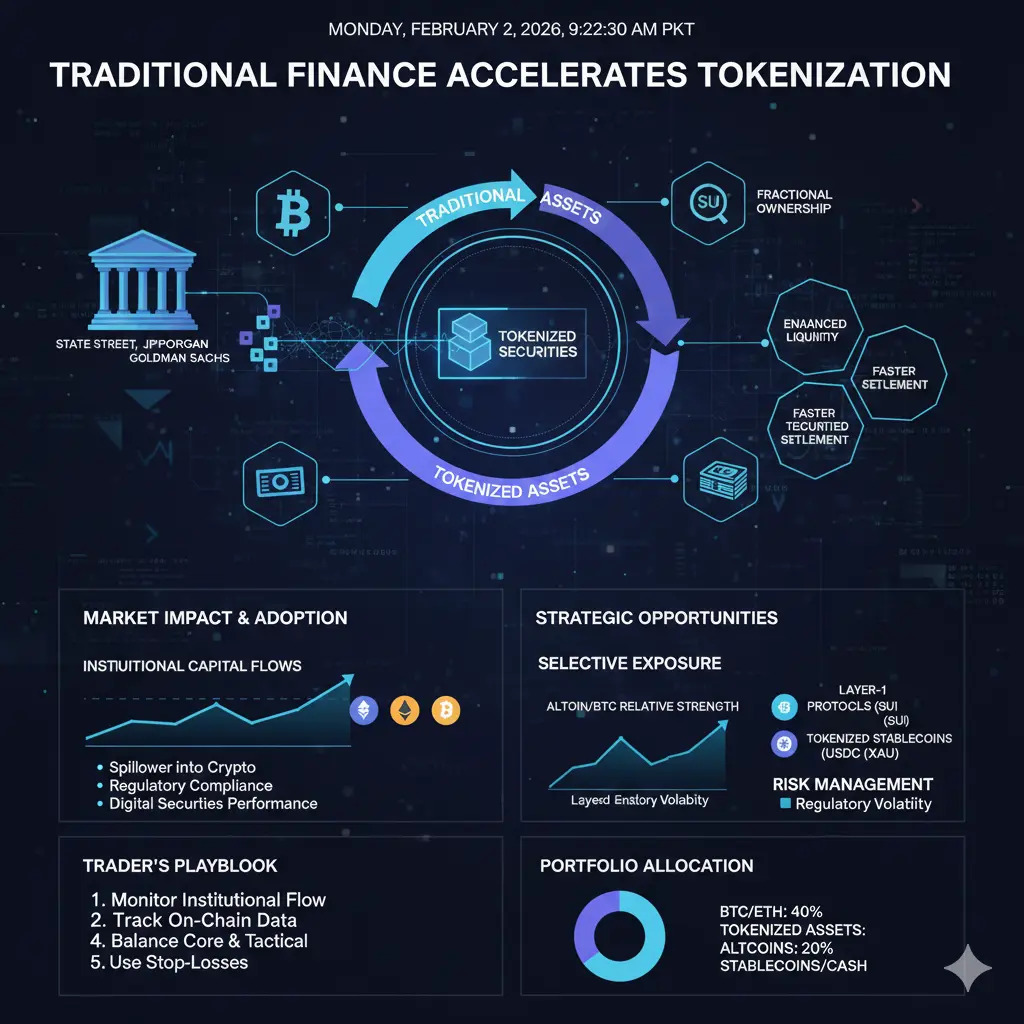

The financial industry is undergoing a transformative shift as leading traditional institutions increasingly adopt blockchain technology and digital asset platforms. Major players such as State Street, JPMorgan, and Goldman Sachs are no longer merely exploring blockchain applications they are actively implementing solutions for asset tokenization, signaling a strategic pivot toward digitized financial products. Tokenization represents the process of converting traditional financial instruments, including equities, bonds, and derivatives, into digital

The financial industry is undergoing a transformative shift as leading traditional institutions increasingly adopt blockchain technology and digital asset platforms. Major players such as State Street, JPMorgan, and Goldman Sachs are no longer merely exploring blockchain applications they are actively implementing solutions for asset tokenization, signaling a strategic pivot toward digitized financial products. Tokenization represents the process of converting traditional financial instruments, including equities, bonds, and derivatives, into digital

- Reward

- 5

- 12

- Repost

- Share

ybaser :

:

1000x VIbes 🤑View More

#TraditionalFinanceAcceleratesTokenization 🌐 Traditional Finance Meets Blockchain: A Paradigm Shift

Major financial institutions like State Street, JPMorgan, and Goldman Sachs are actively embracing blockchain technology, launching digital asset platforms to enable asset tokenization. This marks a significant step in bridging traditional finance with the digital asset ecosystem.

💡 Key Insights:

Tokenization of Assets:

Physical and financial assets are being digitized into blockchain-based tokens.

This allows for fractional ownership, easier transfer, and broader accessibility.

Efficiency & L

Major financial institutions like State Street, JPMorgan, and Goldman Sachs are actively embracing blockchain technology, launching digital asset platforms to enable asset tokenization. This marks a significant step in bridging traditional finance with the digital asset ecosystem.

💡 Key Insights:

Tokenization of Assets:

Physical and financial assets are being digitized into blockchain-based tokens.

This allows for fractional ownership, easier transfer, and broader accessibility.

Efficiency & L

- Reward

- 4

- 2

- Repost

- Share

DragonFlyOfficial :

:

Buy To Earn 💎View More

#TraditionalFinanceAcceleratesTokenization

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

- Reward

- 4

- Comment

- Repost

- Share

⚡ Institutional Adoption of Blockchain Accelerates

Current Trend:

Traditional financial institutions such as State Street, JPMorgan, and Goldman Sachs are actively adopting blockchain technology.

They are launching digital asset platforms to tokenize financial products and enhance operational efficiency.

📉 Market Implications: Digitization of Traditional Finance

Adoption Signals:

Blockchain integration allows real-time settlement and increased transparency.

Tokenization enables fractional ownership of assets, improving liquidity and circulation efficiency.

Financial institutions are experimen

Current Trend:

Traditional financial institutions such as State Street, JPMorgan, and Goldman Sachs are actively adopting blockchain technology.

They are launching digital asset platforms to tokenize financial products and enhance operational efficiency.

📉 Market Implications: Digitization of Traditional Finance

Adoption Signals:

Blockchain integration allows real-time settlement and increased transparency.

Tokenization enables fractional ownership of assets, improving liquidity and circulation efficiency.

Financial institutions are experimen

- Reward

- 14

- 11

- Repost

- Share

DragonFlyOfficial :

:

Traditional finance is going digital! Are you exploring tokenized products or observing how institutional adoption will reshape markets? Share your thoughts!View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

381.97K Popularity

12K Popularity

11.47K Popularity

6.99K Popularity

4.88K Popularity

7.62K Popularity

5.49K Popularity

5.67K Popularity

2.31K Popularity

43 Popularity

55.89K Popularity

74.01K Popularity

21.11K Popularity

27.74K Popularity

220.35K Popularity

News

View MoreThe US Dollar Index increased by 0.67%, closing at 97.635.

20 m

Data: 23,100 SOL transferred out from Bullish.com, worth approximately $2.4 million. This transfer indicates a significant movement of assets, reflecting trading activity or portfolio adjustments. Please review the transaction details for security and record-keeping purposes.

50 m

Data: 307.63 BTC transferred from an anonymous address, valued at approximately $23.54 million USD.

1 h

Data: If ETH drops below $2,221, the total long liquidation strength on major CEXs will reach $850 million.

2 h

Bostick: If interest rates are cut, inflation is highly unlikely to drop to 2%. He explained that the current inflation rate is driven by factors that are not easily reversed by monetary policy alone, and that a significant reduction to 2% would require a much more aggressive approach or a change in underlying economic conditions. Therefore, policymakers should be cautious about expecting a quick decline in inflation just through lowering interest rates.

2 h

Pin