The Road to Liquid Restaking 2.0

This module introduces the concept of liquid restaking and explains how Liquid Restaking 2.0 improves upon earlier staking models. It covers the role of EigenLayer, how restaking extends Ethereum’s security to new services, and why modular security markets are becoming foundational in DeFi. Readers gain a clear understanding of how restaking shifts capital efficiency, validator incentives, and protocol design in Web3.

From Staking to Restaking

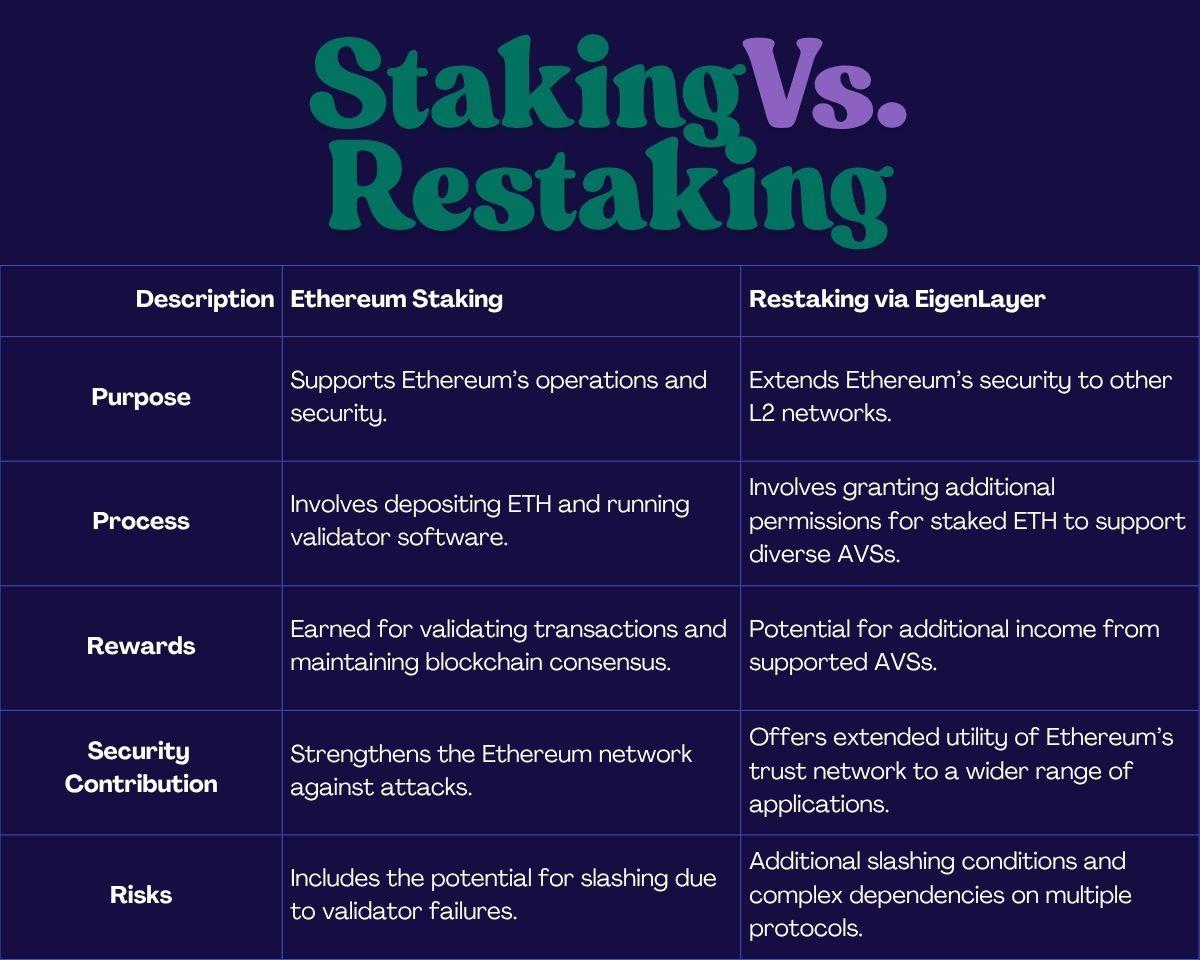

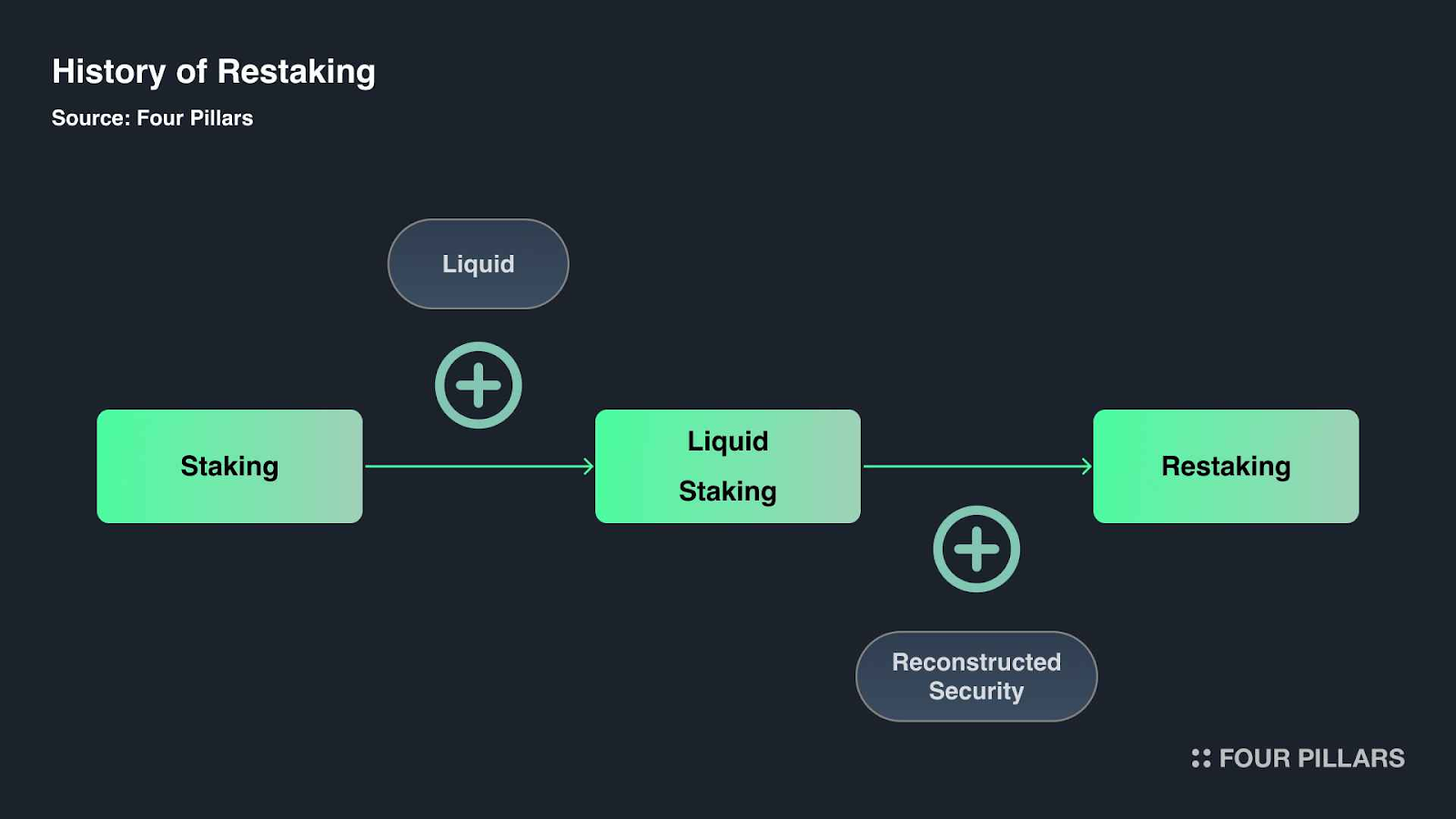

The concept of restaking emerged as a powerful extension of Ethereum’s proof-of-stake system, allowing staked ETH to be reused as collateral for securing additional services beyond the Ethereum base layer. Initially pioneered by EigenLayer, restaking introduced a modular framework where validators could opt in to secure middleware, data availability layers, oracles, and other actively validated services (AVSs). This mechanism effectively pooled Ethereum’s trust layer across multiple decentralized networks, improving security and bootstrapping early infrastructure in the modular blockchain ecosystem.

Ethereum transitioned from proof-of-work to proof-of-stake in September 2022 via the Merge. Validators began locking up ETH to participate in consensus and secure the chain. This staked ETH earned protocol rewards but remained relatively siloed in terms of utility. Restaking introduced the idea that already-staked ETH could be used to secure additional networks without compromising Ethereum’s base layer security. The validator could opt in to run additional software and sign messages for external AVSs, in return for additional rewards.

EigenLayer, the most prominent restaking protocol, formalized this mechanism by allowing users to either restake their native ETH (by delegating it to an EigenPod) or their Liquid Staking Tokens (LSTs) such as stETH, rETH, or cbETH. This created a programmable framework for decentralized services to borrow security from Ethereum without bootstrapping an entirely new validator set. However, in its initial phase, the system was limited in scalability, lacked standardization for reward aggregation, and had no live slashing. These limitations prompted a push toward a more robust model—Liquid Restaking 2.0.

Why Liquid Restaking Emerged

While restaking increased the utility of staked ETH, it presented significant constraints. Native restaking required users to run their own validator infrastructure or rely on intermediaries. Liquid staking had already solved a similar challenge by abstracting the validator responsibilities away from users and issuing tokenized representations of staked ETH, which could then be used across DeFi.

Liquid Restaking extended this principle. Instead of restaking stETH or other LSTs manually into EigenLayer, protocols such as Ether.fi, Renzo, Puffer, and Kelp DAO began offering simplified, tokenized interfaces for restaking. Users would deposit ETH or LSTs and receive a new token, known as a Liquid Restaking Token (LRT), that represented their restaked position. These LRTs could be used across DeFi, traded on secondary markets, or used as collateral in lending protocols, providing users with additional liquidity and utility while securing AVSs in the background.

The value proposition was twofold: users could compound yield by earning staking rewards, EigenLayer points, and LRT protocol incentives, while the modular Ethereum ecosystem could tap into a large pool of distributed security without spinning up bespoke validator infrastructure.

The Shift to Liquid Restaking 2.0

By mid-2025, the limitations of the initial liquid restaking model became apparent. There was no standardized framework for aggregating rewards, points, and slashing risks across different LRTs. EigenLayer’s slashing conditions were still off-chain, and each LRT protocol implemented its own reward logic and AVS engagement, leading to fragmented incentives and inconsistent user experiences.

Liquid Restaking 2.0 introduced several key changes to address these concerns. First, EigenLayer launched its on-chain slashing module, enabling protocols to enforce penalty mechanisms for misbehavior, thereby enhancing economic security guarantees for AVSs. Second, the architecture of rewards was overhauled through the introduction of a shared delegation marketplace and a unified restaking vault architecture. This upgrade allowed AVSs to post bounties, while LRT protocols could delegate restaked assets into these vaults without duplicating infrastructure. The result was a standardized and scalable restaking pipeline.

A new reward token standard known as LRT² (Liquid Restaking Token Rewards) was introduced to unify reward distribution across multiple LRT protocols. LRT² created a modular mechanism for distributing EigenLayer points, AVS fees, and LRT protocol incentives in a transparent and auditable way. Instead of each LRT managing its own accounting system, LRT² enabled a cross-protocol rewards framework, improving transparency and composability.

Additionally, Liquid Restaking 2.0 introduced more granular opt-in mechanisms for validators and stakers. Rather than blanket participation, users could select which AVSs their assets supported, aligning risk preferences and allowing for differentiated fee structures based on AVS reputation or demand.

Modular Security and EigenLayer’s Role

The Ethereum ecosystem is increasingly modular. Rollups, sidechains, and middleware services require independent security but often lack the economic scale to launch dedicated validator networks. Restaking offers a way to reuse Ethereum’s validator set and staked capital to bootstrap these networks.

EigenLayer acts as the coordination layer for this modular security market. It aggregates restaked assets and enables AVSs to rent Ethereum’s trust. With Liquid Restaking 2.0, EigenLayer’s market design now supports dynamic pricing, fee-sharing, and automated delegation – all of which help AVSs attract security and incentivize validators. This modular design is a critical infrastructure piece that allows Ethereum to serve as more than a single blockchain. It becomes a trust engine for the broader decentralized economy.

The inclusion of AVS-specific slashing criteria and real-time monitoring tools also allows each AVS to define its own slashing policies. This flexibility is necessary for scaling to hundreds of services that may require different forms of validator behavior.

Addressing Criticism and Risk

Vitalik Buterin and other Ethereum researchers have voiced concern about the systemic risks of aggressive restaking. One of the primary criticisms is the potential for correlated slashing or validator overextension, where a small number of validators restake across many services and expose the Ethereum base layer to cascading risks.

Liquid Restaking 2.0 attempts to address these concerns through better opt-in management, AVS isolation, and slashing enforcement. Validators are no longer incentivized to blindly restake to all AVSs. Instead, risk-adjusted returns, transparent service-level agreements (SLAs), and customizable delegation structures provide a more stable and transparent model. Additionally, the separation between native restakers, LRT issuers, and delegated validators introduces clearer accountability.

The protocol’s focus on permissionless AVS registration, service fee curation, and smart-contract-enforced delegation rules reduces the risk of centralization and misaligned incentives. As a result, the new model is more adaptable, scalable, and robust than its predecessor.

Market Adoption and Growth Metrics

As of mid-2025, almost $20 billion in total value has been restaked through EigenLayer, with more than half of that capital flowing through Liquid Restaking protocols. Ether.fi and Renzo have emerged as the dominant LRT providers, with each managing more than $2 billion in assets. New entrants like Symbiotic are expanding the model beyond Ethereum by enabling restaking across different asset classes and chains, including Bitcoin-native assets and Solana-based staking derivatives.

The user base has shifted from early DeFi adopters to institutional asset managers, DAOs, and rollup teams, all seeking to benefit from Ethereum’s shared security without building bespoke staking infrastructure. Point reward systems, DeFi integrations, and composable LRT-Fi strategies have driven participation across both yield-maximizing users and infrastructure providers.

With Liquid Restaking 2.0 now live, the market is entering a phase of consolidation and specialization. AVSs are competing for delegation, LRT protocols are differentiating based on reward structure and user experience, and restakers are optimizing for composability, liquidity, and risk-adjusted yield.