Inside LRTs & LSTs: How the Tokens Work

Here, the course dives into the key building blocks: Liquid Staking Tokens (LSTs), Liquid Restaking Tokens (LRTs), and how they integrate with decentralized finance. It breaks down the differences between LSTs and LRTs, how restaking protocols are structured, and how the LST-Fi ecosystem enables yield aggregation, validator delegation, and composable staking products.

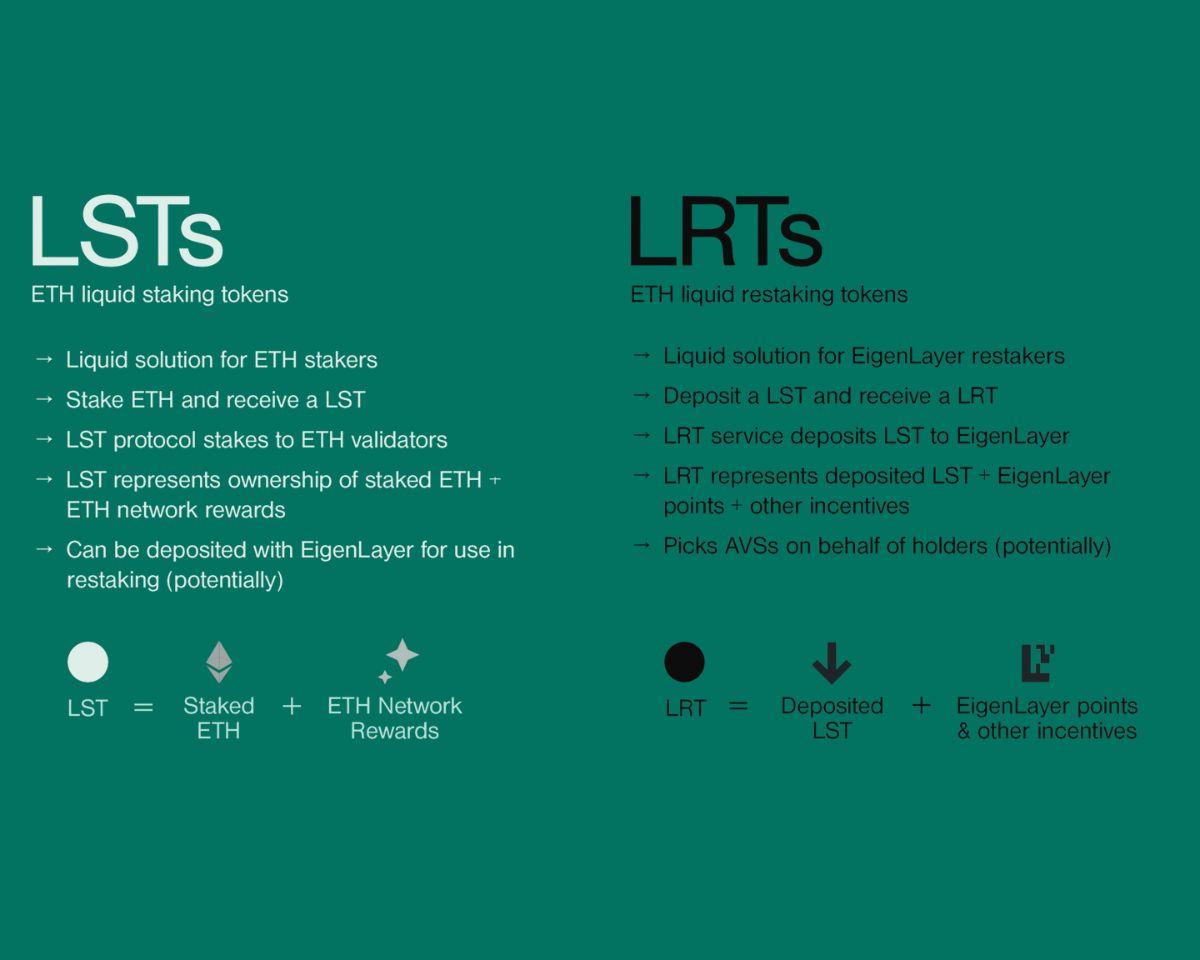

From LSTs to LRTs: A Structural Shift

Liquid Staking Tokens were developed to solve a problem introduced by Ethereum’s staking mechanism: capital lock-up. In exchange for securing the network, stakers receive staking rewards, but their staked ETH becomes illiquid. Protocols such as Lido (stETH), Rocket Pool (rETH), and Coinbase (cbETH) introduced tokenized staking solutions that issued transferable tokens in return for deposited ETH. These tokens could be used in DeFi while still earning staking rewards.

Liquid Restaking Tokens build on the same idea but extend it to the context of restaking. Instead of simply representing ETH that earns staking rewards, LRTs represent ETH or LSTs that are delegated into EigenLayer to secure additional services. This added layer of utility allows the same capital to earn multiple yield streams: Ethereum staking rewards, EigenLayer points or service fees, and LRT protocol incentives. The LRT token acts as a composable wrapper that tracks this restaked position.

The key difference lies in complexity. While LSTs reflect a single source of yield from Ethereum staking, LRTs represent more dynamic positions involving multiple services, potential slashing conditions, and layered incentives. As a result, LRTs are designed with more robust token mechanics, governance modules, and redemption logic.

How LRTs Work

The issuance of an LRT begins when a user deposits ETH or an LST into a liquid restaking protocol. The protocol, such as Ether.fi or Renzo, then delegates the deposited asset to EigenLayer using its own whitelisted validator set or node operator network. The user receives an LRT that tracks the amount restaked, the expected rewards, and the proportional exposure to EigenLayer’s AVSs.

LRTs are fungible and transferable, allowing them to be used in liquidity pools, lending markets, and structured yield products. Behind the scenes, the LRT protocol actively manages delegation, reward harvesting, and AVS interaction. It also monitors slashing risk and tracks validator performance. Some protocols offer additional utility, such as automatic compounding of EigenLayer points or built-in slashing insurance.

Unlike native restaking, where users must run their own infrastructure or directly engage with EigenLayer contracts, LRTs abstract this complexity into a user-friendly token model. The result is a fluid on-chain asset that grants users exposure to restaking while maintaining full liquidity.

Key Differences Between LSTs and LRTs

LSTs and LRTs serve similar purposes, unlocking liquidity for staked ETH, but their underlying mechanics are different. LSTs represent pure staking positions on Ethereum’s consensus layer. They are passively maintained by protocols that batch stake ETH and distribute rewards. Their risk exposure is limited to validator performance within Ethereum’s protocol rules.

LRTs, on the other hand, reflect delegated positions in a secondary staking layer governed by EigenLayer and its AVSs. This introduces new variables, such as third-party slashing rules, multiple reward sources, and cross-protocol dependencies. While LSTs are exposed to Ethereum’s base-layer risk, LRTs are exposed to additional application-layer risks associated with the services they secure.

Another distinction lies in composability. LSTs have been widely adopted across DeFi protocols for collateral, trading, and farming purposes. LRTs are now being integrated similarly but with added complexity. DeFi integrations must account for EigenLayer-specific conditions, slashing logic, and restaking withdrawal queues. As a result, LRT composability requires more robust infrastructure and tighter integration with on-chain reward systems.

The Rise of LRT Protocols

By 2025, several protocols have emerged as dominant players in the LRT market. Ether.fi and Renzo are among the largest, each managing billions in total value restaked. Ether.fi introduced eETH and weETH as liquid restaking tokens, with features such as auto-compounding, AVS fee aggregation, and a robust validator marketplace. Renzo launched ezETH, focusing on DeFi-first integration and early exposure to AVS yields. Both protocols integrated tightly with EigenLayer’s new slashing modules and delegated vault system.

Other notable protocols include Puffer, which combines LRT issuance with validator decentralization incentives, and Kelp DAO, which focuses on community-driven restaking. Swell also launched its own LRT strategy, built on top of swETH and designed to optimize EigenLayer point accrual and stablecoin farming.

These protocols compete on user experience, fee structure, loyalty programs, and risk management features. Some offer “points” systems tied to future airdrops, while others prioritize low-fee structures or automatic restaking rebalancing. As the market matures, LRT protocols are increasingly differentiated by how they manage AVS exposure and reward distribution.

Reward Aggregation and the LRT² Standard

One of the core innovations introduced in Liquid Restaking 2.0 is the concept of LRT², which is a modular rewards framework that standardizes the way LRTs aggregate, track, and distribute restaking rewards. In the early phase of liquid restaking, each protocol issued its own rewards independently. Users received EigenLayer points, AVS fees, and protocol incentives in siloed systems, often leading to inconsistent user experiences and opaque accounting.

LRT² solves this by creating a unified architecture for reward distribution. Each LRT issued under this framework can plug into a shared reward vault system, where point multipliers, fee curves, and time-weighted incentives are managed transparently. This modular approach allows users to compare yield opportunities across protocols and AVSs, while ensuring that restaking participation is auditable and standardized.

Protocols using LRT² can also integrate automated delegation to AVS vaults, which broadcast their fee structure and slashing rules on-chain. This creates a competitive marketplace for security and aligns restakers with the AVSs that offer the most attractive or reliable rewards.

The introduction of LRT² marks a shift from fragmented, protocol-specific reward logic to a composable, cross-platform standard that enables interoperability and long-term ecosystem growth.

Multichain Expansion and the Role of Symbiotic

While EigenLayer has focused on Ethereum, new restaking protocols such as Symbiotic are expanding the concept to other chains and asset classes. Symbiotic offers an asset-agnostic restaking framework that supports ETH, LSTs, stablecoins, and even Bitcoin-wrapped assets. Its restaking mechanism decouples the security layer from the staking asset, allowing new services and rollups to bootstrap trust using diverse collateral.

This multichain expansion is significant because it opens the restaking model to ecosystems beyond Ethereum. It also reduces reliance on ETH as the sole trust asset and introduces new market dynamics, such as collateral diversity and cross-chain validator delegation.

Symbiotic’s protocol design includes slashing modules, delegation incentives, and AVS compatibility, similar to EigenLayer, but with added flexibility for chain-agnostic deployments. It supports both permissionless and curated AVSs, enabling developers to create specialized middleware or infrastructure layers using a shared security substrate.

The emergence of multichain restaking protocols suggests that the LRT model may soon evolve into a broader category of liquid security tokens (LSTs in a new context), powering a universal trust layer for Web3.