O que são Produtos de Dupla Moeda?

Gate Dual Investment é um produto financeiro sem garantia de capital, com rendimento variável. No momento da subscrição, a taxa de retorno é fixa e definida de forma clara. Uma vez concluída a subscrição, a ordem não pode ser cancelada, nem é permitido o levantamento antecipado antes da maturidade. Ao adquirir o produto, o investidor recebe um retorno mínimo fixo na moeda originalmente investida, na data de liquidação. Contudo, devido às flutuações do mercado, a moeda investida pode ser convertida noutra moeda. Este é o fator que distingue o Dual Investment e o torna especialmente atrativo para investidores.

O que é o Gate Dual Investment?

Gate Dual Investment é um produto financeiro sem garantia de capital, com rendimento variável. A taxa de rendimento deste produto é fixa e definida no momento da subscrição. Depois de concluída a subscrição, não é possível cancelar a ordem, nem resgatar antecipadamente antes da maturidade. No ato de compra, o investidor tem garantido um retorno mínimo fixo na moeda inicialmente investida na data de liquidação. Contudo, as oscilações do mercado podem levar à conversão da moeda investida noutra moeda, sendo esta a característica que distingue o Dual Investment e o torna atrativo para os investidores.

Face à volatilidade permanente do mercado cripto, a moeda de liquidação do Dual Investment permanece incerta. Na maturidade, a moeda de liquidação é determinada pela comparação entre o preço de liquidação e o preço-alvo. Por exemplo, se o preço de liquidação for superior ao preço-alvo, o rendimento é em USDT; se for inferior ao preço-alvo, o rendimento é em BTC.

Em resumo, o Dual Investment permite depositar uma criptomoeda e obter rendimentos com base em dois ativos. Ao fixar uma taxa de rendimento, pode gerar retornos quando o valor dos ativos investidos cresce. O montante final dos lucros dependerá do desempenho do ativo bloqueado na data de maturidade.

Como funciona o Dual Investment

A estratégia central do Dual Investment consiste em Comprar em Baixa e Vender em Alta.

- Dual Investment: Comprar em Baixa. Quando o utilizador deseja adquirir criptomoeda mas não sabe o melhor momento para entrar no mercado, pode recorrer à estratégia “Comprar em Baixa” do Dual Investment. Independentemente do sucesso da compra, o utilizador obtém rendimentos.

Exemplo:

A Alice seleciona um produto com prazo de 5 dias e preço-alvo de 60 000 $ para BTC.

Na data de liquidação, prevêem-se dois cenários:

- Preço de liquidação de BTC > 60 000 $: A estratégia de rendimento resulta e a Alice recebe o principal em USDT e os juros em USDT relativos ao período de investimento.

- Preço de liquidação de BTC ≤ 60 000 $: A estratégia “Comprar em Baixa” resulta e a Alice adquire BTC a 60 000 $, recebendo ainda juros em BTC pelo período de investimento.

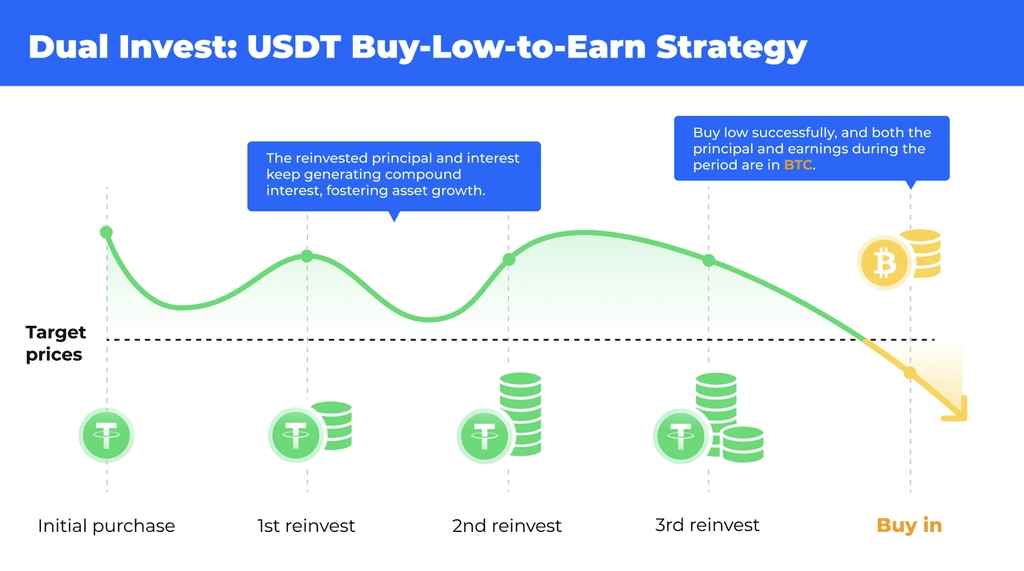

Estratégia USDT Comprar em Baixa e Rentabilizar – Reinvestimento Automático

A função de Reinvestimento Automático mantém ativa uma estratégia contínua de compra em baixa de USDT. Quando não é possível realizar a compra em baixa, o utilizador recebe juros em USDT, que são automaticamente reinvestidos para gerar rendimentos compostos, promovendo uma estratégia sustentável de ganhos consistentes em USDT.

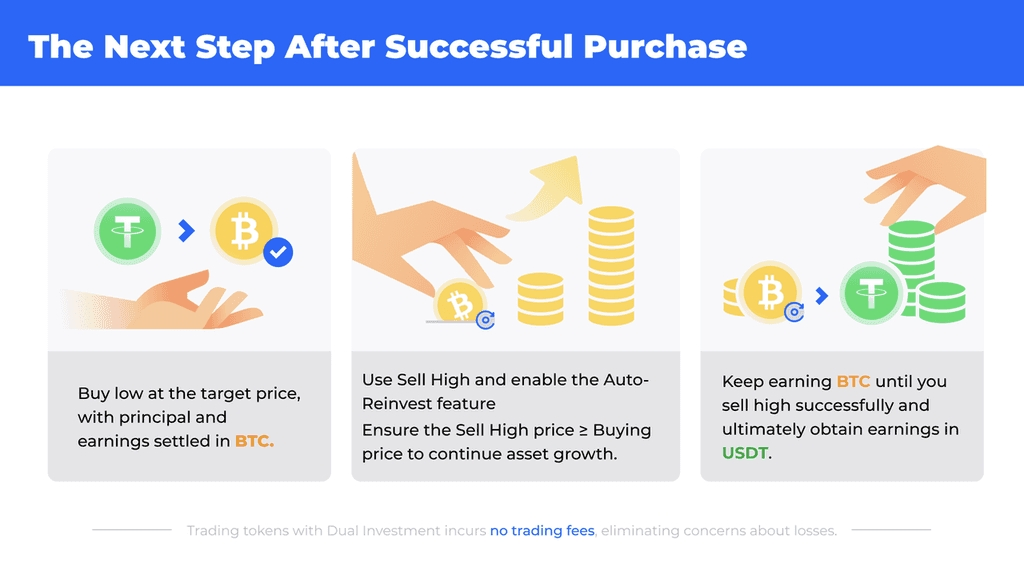

- Reinvestimento Automático Básico: Esta estratégia realiza compras a um preço-alvo pré-definido, automatizando a abordagem Comprar em Baixa e Rentabilizar. Após a execução da compra em baixa, o sistema converte o investimento inicial e os juros acumulados em BTC.

Após converter para BTC, o utilizador pode continuar a vender em alta ao preço-alvo (venda no mesmo patamar de preço). Com o reinvestimento automático e a capitalização dos juros, os ativos crescem por efeito de juros compostos.

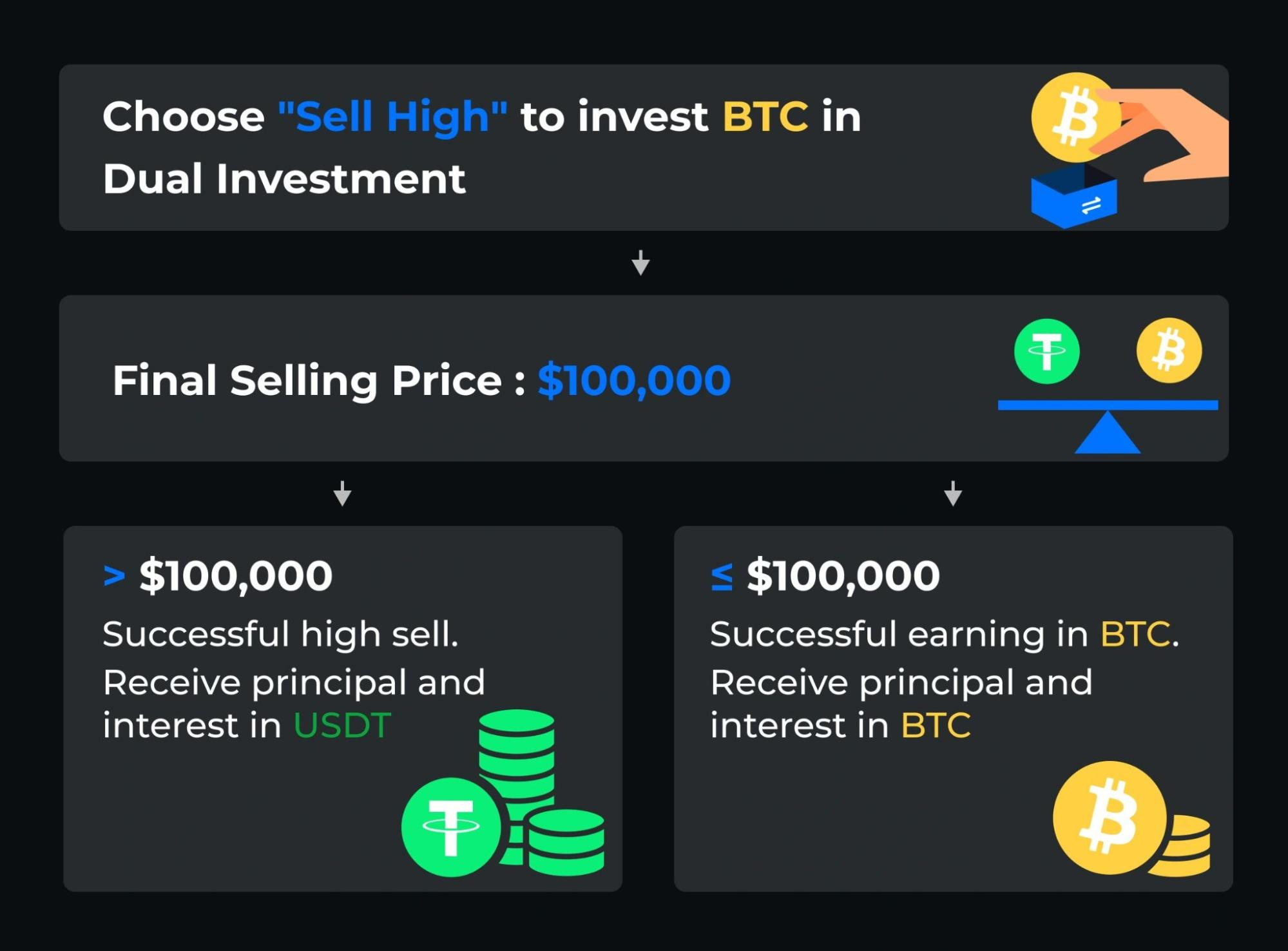

- Dual Investment: Vender em Alta. Quando o utilizador detém criptomoeda e pretende vender em picos de mercado, mas não consegue prever o timing ideal, pode adotar a estratégia Dual Investment: Vender em Alta. Independentemente do sucesso da venda em alta, o utilizador obtém rendimentos.

Exemplo:

O Bob investe num produto BTC com subscrição de 3 dias e preço-alvo de 100 000 $ BTC para vender em alta. Na data de liquidação:

- Preço de liquidação de BTC > 100 000 $: A estratégia “Vender em Alta” resulta, o BTC é vendido ao preço-alvo e o Bob recebe juros em USDT pelo período de investimento.

- Preço de liquidação de BTC ≤ 100 000 $: A estratégia de rendimento resulta e o Bob recebe o principal em BTC mais os juros em BTC pelo período.

Vantagens do Dual Investment

- Elevados Rendimentos: Comprar cripto a preços reduzidos e vender stablecoins a preços elevados para maximizar o lucro.

- Juros Garantidos: Ganhos de juros constantes enquanto os fundos permanecem investidos.

- Comissões Nulas: Sem taxas de transação em compras ou vendas.

- Sem Slippage: O Dual Investment elimina o slippage, reduzindo custos transacionais.

Princípios do Produto Gate Dual Investment

No setor financeiro tradicional, produtos Dual Currency similares existem há muitos anos, sobretudo no mercado cambial. Do ponto de vista financeiro, Dual Currency Products são investimentos simplificados baseados em opções. O utilizador que subscreve Dual Currency Products equivale a vender um conjunto de opções à plataforma.

Ao adquirir Dual Investment, equivale a vender um conjunto de opções à plataforma. As opções são instrumentos financeiros complexos, originários dos direitos de escolha em contratos de futuros. Ao comprar opções, o investidor paga um prémio e obtém o direito de negociar ao preço acordado (preço de exercício) durante um período específico.

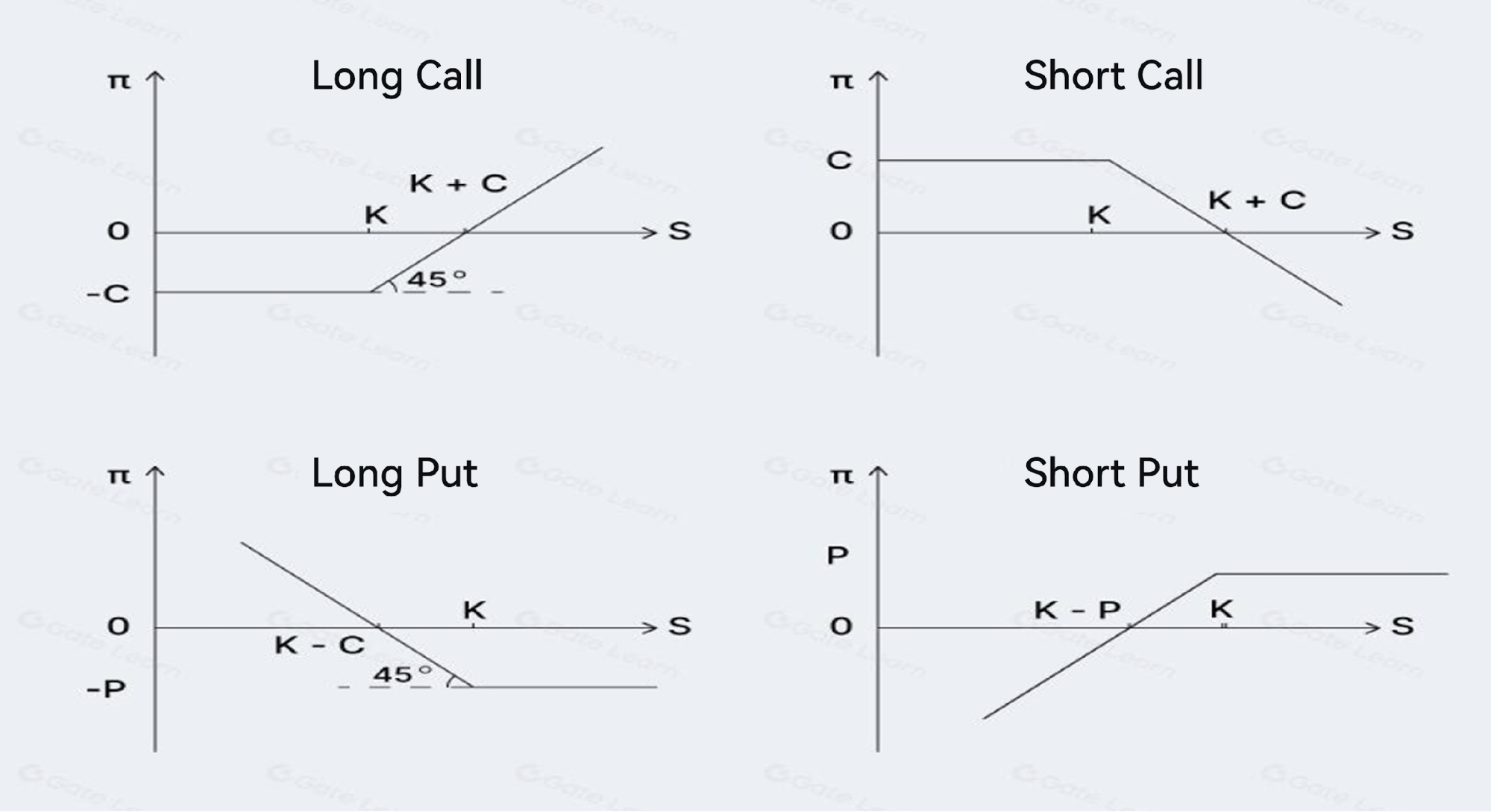

Existem dois tipos de opções: call options (compra) e put options (venda). O comprador de uma call option adquire o direito de “comprar” ativos ao vendedor da opção; o comprador de uma put option adquire o direito de “vender” ativos ao vendedor da opção. Dependendo das operações de compra e venda, as opções podem dividir-se em quatro categorias:

Podem ser estruturadas diversas estratégias com base nos quatro tipos de opções acima indicados. Entre elas, Dual Currency Products corresponde à combinação da venda de call e put options. Ao adquirir Dual Currency Products, o investidor vende simultaneamente uma call option e uma put option à plataforma. Independentemente de o mercado subir ou descer dentro do intervalo do preço de exercício, o investidor pode lucrar, sendo uma estratégia eficaz para beneficiar da volatilidade.

O máximo lucro é atingido quando o preço de liquidação iguala o preço de referência. Em cenários de direção de mercado incerta, Dual Currency Products permite ao investidor obter ganhos independentemente do comportamento dos preços dentro de determinado intervalo de flutuação. Quanto maior a volatilidade do mercado, maior o potencial de rendimento disponível nos Dual Currency Products. No entanto, se o preço de mercado se afastar significativamente do preço de referência, Dual Currency Products pode também gerar perdas. Por isso, são produtos financeiros de rendimento fixo sem garantia de capital.

Conclusão

Gate Dual Investment, enquanto produto financeiro estruturado derivado de opções simples, é um produto sem garantia de capital e com rendimento variável, equilibrando de forma eficaz o risco e a rentabilidade. Permite ao utilizador maximizar o potencial de rendimento mantendo uma exposição ao risco relativamente baixa. O Dual Investment pode aumentar a eficiência e utilização de capital em mercados voláteis, permitindo captar mais oportunidades sempre que surjam situações favoráveis.