Novialanis

No content yet

Novialanis

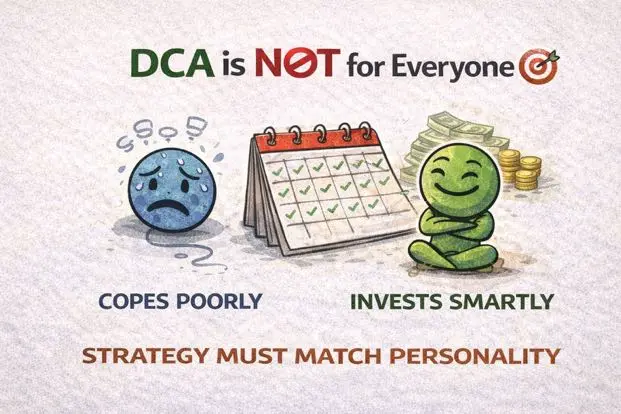

DCA Is NOT for Everyone 🎯

DCA (Dollar Cost Averaging) sounds safe.

Buy regularly. Ignore the noise. Sleep peacefully.

But here’s the truth:

DCA only works if 👇

– You believe in the long-term thesis

– You can handle drawdowns

– You have consistent cash flow

– You’re patient

If you panic every dip…

DCA won’t save you.

If you DCA into weak projects…

Time won’t fix it.

If you need quick profits…

DCA will feel “too slow.”

DCA is a strategy.

Not a magic button.

It rewards discipline.

It punishes impatience.

Before you DCA, ask yourself:

Are you investing… or just coping?

In crypto,

strategy must m

DCA (Dollar Cost Averaging) sounds safe.

Buy regularly. Ignore the noise. Sleep peacefully.

But here’s the truth:

DCA only works if 👇

– You believe in the long-term thesis

– You can handle drawdowns

– You have consistent cash flow

– You’re patient

If you panic every dip…

DCA won’t save you.

If you DCA into weak projects…

Time won’t fix it.

If you need quick profits…

DCA will feel “too slow.”

DCA is a strategy.

Not a magic button.

It rewards discipline.

It punishes impatience.

Before you DCA, ask yourself:

Are you investing… or just coping?

In crypto,

strategy must m

- Reward

- 1

- Comment

- Repost

- Share

Why Going All-In Is a Trap 🎯 (Thread)

1/

Going all-in feels heroic.

Like you have the strongest conviction.

But most of the time, it’s just FOMO disguised as confidence.

2/

When you go all-in, you lose:

– Diversification

– Flexibility

– Ammo to average down

One wrong move = mental & capital damage.

3/

Crypto is volatile.

Even strong assets like Bitcoin can drop 20–30% fast.

If you’re all-in with leverage? Even more brutal.

4/

All-in lets emotions take control:

Small dip → panic.

Small pump → greed.

You become reactive, not strategic.

5/

Professional traders focus on risk management,

not ego o

1/

Going all-in feels heroic.

Like you have the strongest conviction.

But most of the time, it’s just FOMO disguised as confidence.

2/

When you go all-in, you lose:

– Diversification

– Flexibility

– Ammo to average down

One wrong move = mental & capital damage.

3/

Crypto is volatile.

Even strong assets like Bitcoin can drop 20–30% fast.

If you’re all-in with leverage? Even more brutal.

4/

All-in lets emotions take control:

Small dip → panic.

Small pump → greed.

You become reactive, not strategic.

5/

Professional traders focus on risk management,

not ego o

BTC-1,28%

- Reward

- 1

- Comment

- Repost

- Share

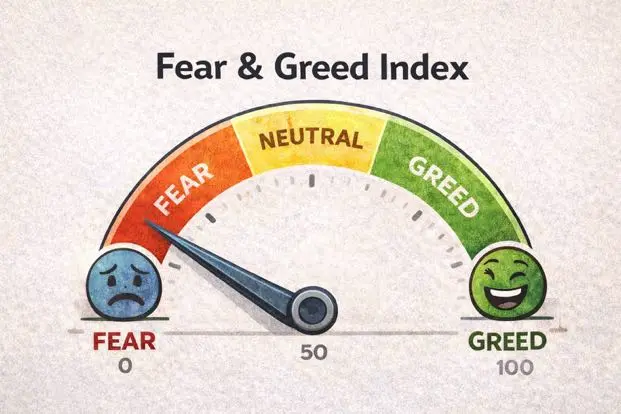

🧠 Fear & Greed Index: When Should You Be Careful?

Current Crypto Sentiment (latest available):

📉 Fear & Greed Index: ~26–38 → Fear Zone

This means traders are more fearful than greedy, a sign of caution or potential oversold conditions.

🟥 What It Implies

• Fear → sellers dominate, buyers hesitant

• Extreme Fear → markets may be oversold

• Greed → markets may be overheated

• Neutral → no strong bias

🧠 How to Use It

• High Fear: Sometimes a contrarian signal, opportunities could form if conviction returns

• High Greed: Market might be overextended → watch for reversals

• Always com

Current Crypto Sentiment (latest available):

📉 Fear & Greed Index: ~26–38 → Fear Zone

This means traders are more fearful than greedy, a sign of caution or potential oversold conditions.

🟥 What It Implies

• Fear → sellers dominate, buyers hesitant

• Extreme Fear → markets may be oversold

• Greed → markets may be overheated

• Neutral → no strong bias

🧠 How to Use It

• High Fear: Sometimes a contrarian signal, opportunities could form if conviction returns

• High Greed: Market might be overextended → watch for reversals

• Always com

- Reward

- 1

- Comment

- Repost

- Share

Risk Management: The 1% Rule

Want to survive in crypto?

Start with this simple rule 👇

1% Rule = Never risk more than 1% of your total capital on a single trade.

Example:

Capital = $1,000

Max risk per trade = $10

That means if your stop loss gets hit,

you only lose $10 — not your account.

Why it matters:

• Protects you from emotional trading

• Prevents account blow-ups

• Keeps you in the game long term

• Helps you think in probabilities, not hope

Remember:

You don’t need one big win.

You need consistent survival.

In crypto,

capital preservation > fast profit.

#RiskManagement #TradingPsycho

Want to survive in crypto?

Start with this simple rule 👇

1% Rule = Never risk more than 1% of your total capital on a single trade.

Example:

Capital = $1,000

Max risk per trade = $10

That means if your stop loss gets hit,

you only lose $10 — not your account.

Why it matters:

• Protects you from emotional trading

• Prevents account blow-ups

• Keeps you in the game long term

• Helps you think in probabilities, not hope

Remember:

You don’t need one big win.

You need consistent survival.

In crypto,

capital preservation > fast profit.

#RiskManagement #TradingPsycho

- Reward

- 2

- 2

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵View More

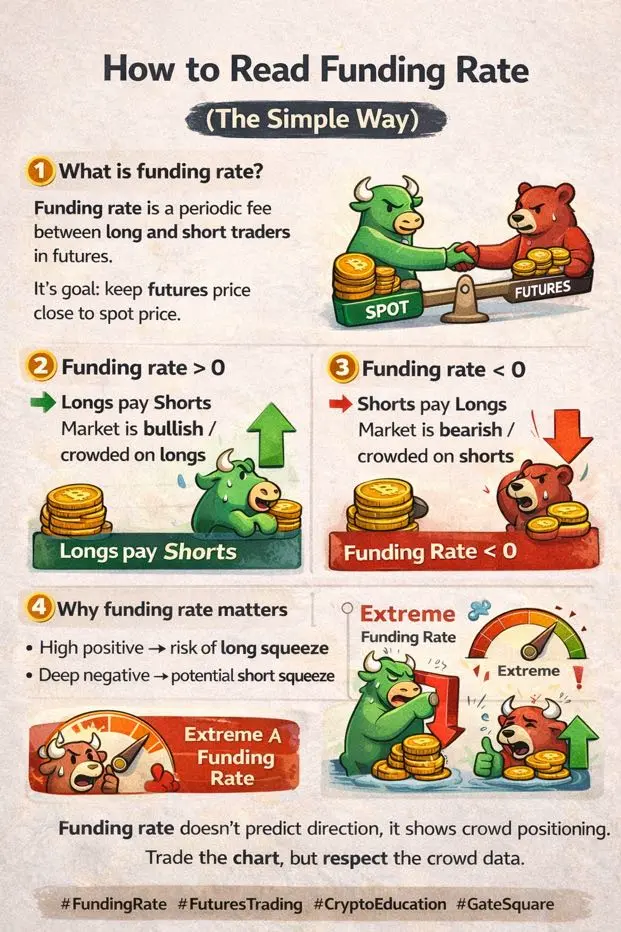

How to Read Funding Rate (The Simple Way)

1️⃣ What is funding rate?

Funding rate is a periodic fee between long and short traders in futures.

Its goal: keep futures price close to spot price.

2️⃣ Funding rate > 0

👉 Longs pay Shorts

👉 Market is bullish / crowded on longs

3️⃣ Funding rate < 0

👉 Shorts pay Longs

👉 Market is bearish / crowded on shorts

4️⃣ Why funding rate matters

• High positive → risk of long squeeze

• Deep negative → potential short squeeze

5️⃣ Simple rule

Extreme funding rate = be careful

Neutral funding rate = healthier market

Funding rate doesn’t predict direction,

it

1️⃣ What is funding rate?

Funding rate is a periodic fee between long and short traders in futures.

Its goal: keep futures price close to spot price.

2️⃣ Funding rate > 0

👉 Longs pay Shorts

👉 Market is bullish / crowded on longs

3️⃣ Funding rate < 0

👉 Shorts pay Longs

👉 Market is bearish / crowded on shorts

4️⃣ Why funding rate matters

• High positive → risk of long squeeze

• Deep negative → potential short squeeze

5️⃣ Simple rule

Extreme funding rate = be careful

Neutral funding rate = healthier market

Funding rate doesn’t predict direction,

it

- Reward

- 4

- Comment

- Repost

- Share

Spot vs Futures: Don’t Enter the Wrong Arena

Spot

• Buy the asset → you actually own it

• Profit from price increases

• More relaxed, ideal for holders & investors

• Lower risk, no liquidation

Futures

• Trade contracts, not the asset itself

• Can go long or short

• Uses leverage (both profits & losses are amplified)

• Risk of liquidation if the market moves against you

#CelebratingNewYearOnGateSquare

Spot

• Buy the asset → you actually own it

• Profit from price increases

• More relaxed, ideal for holders & investors

• Lower risk, no liquidation

Futures

• Trade contracts, not the asset itself

• Can go long or short

• Uses leverage (both profits & losses are amplified)

• Risk of liquidation if the market moves against you

#CelebratingNewYearOnGateSquare

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin is not just an asset; it is a symbol of financial freedom in the digital era.

Born from crisis, it was designed to endure without relying on anyone, with a fixed supply and rules that cannot be changed at will.

Amid inflation and global uncertainty, Bitcoin stands not merely as an asset, but as a store of trust.

In this cycle, I’ve learned a great deal, especially from investing in the wrong crypto assets.

I held altcoins without setting a stop loss, and now the price has fallen deeply; will it return to breakeven? Not necessarily.

Volatility tests emotions, but consistency is what tru

Born from crisis, it was designed to endure without relying on anyone, with a fixed supply and rules that cannot be changed at will.

Amid inflation and global uncertainty, Bitcoin stands not merely as an asset, but as a store of trust.

In this cycle, I’ve learned a great deal, especially from investing in the wrong crypto assets.

I held altcoins without setting a stop loss, and now the price has fallen deeply; will it return to breakeven? Not necessarily.

Volatility tests emotions, but consistency is what tru

BTC-1,28%

- Reward

- 1

- Comment

- Repost

- Share

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/id/campaigns/4044?ref=XgAVVw9d&ref_type=132

- Reward

- like

- 1

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵Hopefully the awaited pullback upward has arrived, let's shine again Ethereum!

#Ethereum ($ETH)

#Ethereum ($ETH)

ETH-0,83%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share