Agent8

No content yet

Agent8

Bitcoin and ETH are indeed making moves!

All the gains from Wednesday have been wiped out!

I mentioned on Thursday: if it drops back, then Wednesday's rise was just a trap to lure in buyers and trigger short squeezes!

The worst-case scenario I discussed yesterday: the US and Israel might take action against Iran over the weekend. With current liquidity, we could see a new low. Iran hasn't retaliated yet, so the worst is still ahead. The decline isn't over yet!

Bitcoin starting with 5 might be seen next week!

View OriginalAll the gains from Wednesday have been wiped out!

I mentioned on Thursday: if it drops back, then Wednesday's rise was just a trap to lure in buyers and trigger short squeezes!

The worst-case scenario I discussed yesterday: the US and Israel might take action against Iran over the weekend. With current liquidity, we could see a new low. Iran hasn't retaliated yet, so the worst is still ahead. The decline isn't over yet!

Bitcoin starting with 5 might be seen next week!

- Reward

- 2

- Comment

- Repost

- Share

As mentioned last night, the US stocks indeed filled the gap, and Bitcoin and $ETH are also following the upward trend!

If Bitcoin's trading volume causes it to break below 66,000, then the rebound is over, or this rally is just a trap to lure in buyers, while simultaneously triggering the short squeeze! The market maker is really unscrupulous!

View OriginalIf Bitcoin's trading volume causes it to break below 66,000, then the rebound is over, or this rally is just a trap to lure in buyers, while simultaneously triggering the short squeeze! The market maker is really unscrupulous!

- Reward

- like

- Comment

- Repost

- Share

Today during the day, Bitcoin didn't even have a weak rebound! It shows that Asian retail investors are also afraid to buy the dip, and many large and small investors holding positions are starting to cut losses.

So, is it going to fall to a new low tonight?

Now, large investors are gradually surrendering, but there are still people calling for a bottom, so this is not the bottom.

The bottom of the crypto market will only be established after countless people who think they see through the future are collectively liquidated, which means all the bulls are sacrificed. The escape of whales like B

So, is it going to fall to a new low tonight?

Now, large investors are gradually surrendering, but there are still people calling for a bottom, so this is not the bottom.

The bottom of the crypto market will only be established after countless people who think they see through the future are collectively liquidated, which means all the bulls are sacrificed. The escape of whales like B

BTC-4,37%

- Reward

- like

- Comment

- Repost

- Share

Currently, the market is retail investors in Asia buying during the day, with a volume-constrained rebound,

At night, major players in Europe and America sell off, increasing volume to dump and smash the market.

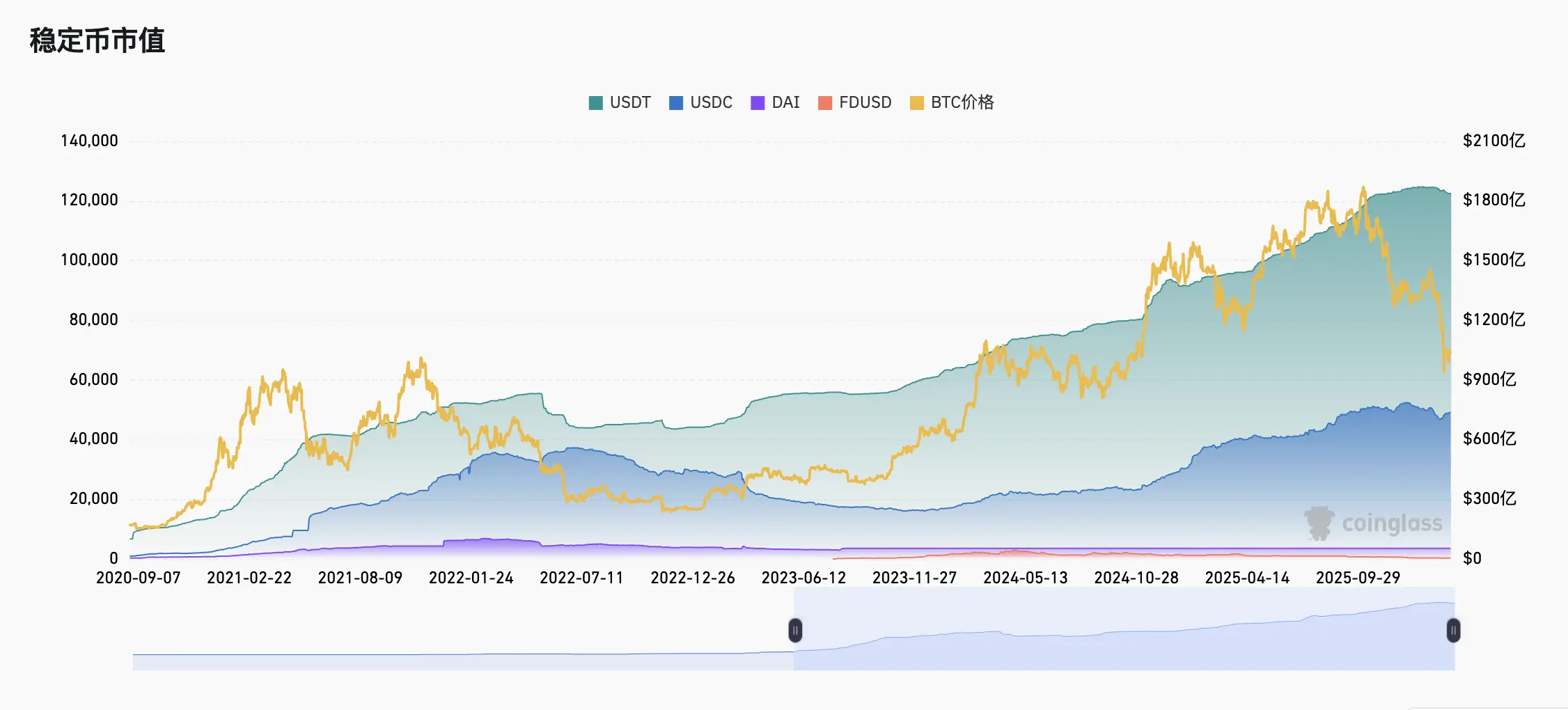

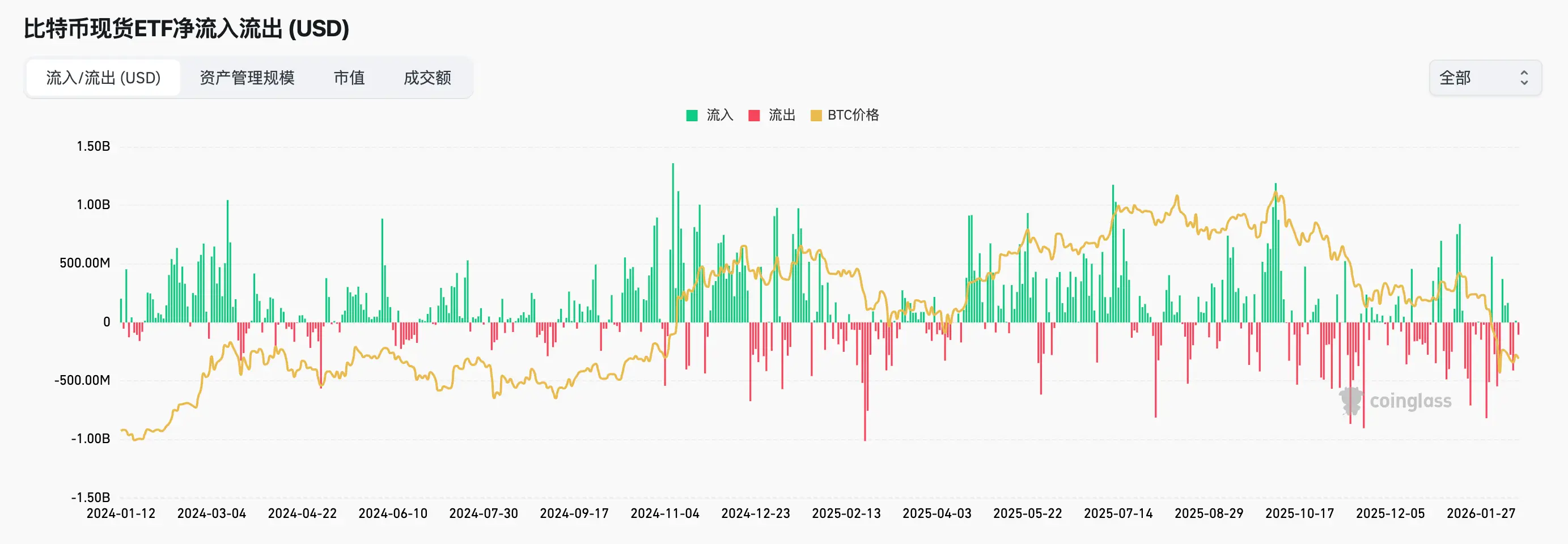

This situation is not a bottom; a global liquidity crisis is underway. Bitcoin, as a risk asset, is the first to be sold off, and the stablecoin market cap and ETF outflows both look very poor.

It still has to fall further until no one dares to call for a rally or buy the dip.

At night, major players in Europe and America sell off, increasing volume to dump and smash the market.

This situation is not a bottom; a global liquidity crisis is underway. Bitcoin, as a risk asset, is the first to be sold off, and the stablecoin market cap and ETF outflows both look very poor.

It still has to fall further until no one dares to call for a rally or buy the dip.

BTC-4,37%

- Reward

- 1

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Happy New Year 🧨U.S. stocks, gold, silver, Bitcoin$ETH , consecutive crashes!

This is not a bear market in the crypto world; it's a massive crash in global assets, indicating that a global liquidity crisis is brewing and erupting!

As the most sensitive and delicate canary in the coal mine, the crypto market is affected. When U.S. stocks and gold rise, there's a bloodsucking plunge; when U.S. stocks and gold fall, there's an even more panic-driven crash!

In short, one sentence: when the world has no money, the small pond of the crypto market will be infinitely siphoned by the ocean. Before the Federal Reserve

View OriginalThis is not a bear market in the crypto world; it's a massive crash in global assets, indicating that a global liquidity crisis is brewing and erupting!

As the most sensitive and delicate canary in the coal mine, the crypto market is affected. When U.S. stocks and gold rise, there's a bloodsucking plunge; when U.S. stocks and gold fall, there's an even more panic-driven crash!

In short, one sentence: when the world has no money, the small pond of the crypto market will be infinitely siphoned by the ocean. Before the Federal Reserve

- Reward

- like

- Comment

- Repost

- Share

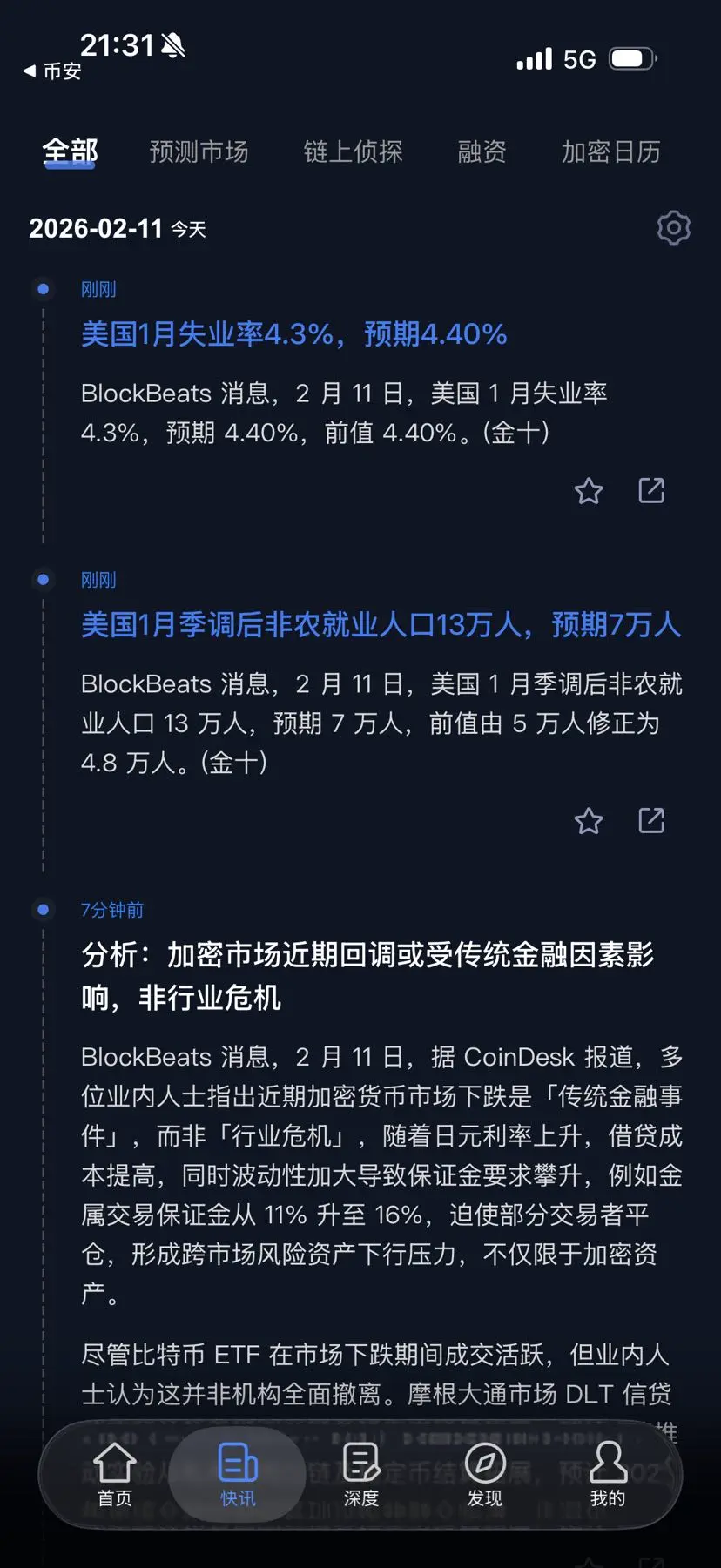

Non-farm payroll data release can be simply interpreted as: strong non-farm payrolls ➕ low unemployment rate, the Federal Reserve has no reason to cut interest rates, the US dollar index surges, and risk assets like Bitcoin are expected to decline, which is bearish for the market. $ETH

It all depends on how the US stock market opens in an hour—will it cause a crash in the crypto space!

Currently, Bitcoin is in the 60,000-70,000 range with little support, and Bitcoin starting with 5 is unavoidable.

View OriginalIt all depends on how the US stock market opens in an hour—will it cause a crash in the crypto space!

Currently, Bitcoin is in the 60,000-70,000 range with little support, and Bitcoin starting with 5 is unavoidable.

- Reward

- like

- Comment

- Repost

- Share

Currently, Bitcoin and ETH are: declining with increased volume, and rebounding with decreased volume!

This is a typical bearish market structure!

The main reason for this phenomenon is that a large amount of capital is actively selling, including long stop-losses/forced liquidations, big players selling, and trapped positions being unwound—all essentially capital fleeing the market.

The rebound with decreased volume is mainly short covering, small-scale bottom fishing, and technical repairs, but no large funds are entering.

It can be said that currently, declining with increased volume = genu

View OriginalThis is a typical bearish market structure!

The main reason for this phenomenon is that a large amount of capital is actively selling, including long stop-losses/forced liquidations, big players selling, and trapped positions being unwound—all essentially capital fleeing the market.

The rebound with decreased volume is mainly short covering, small-scale bottom fishing, and technical repairs, but no large funds are entering.

It can be said that currently, declining with increased volume = genu

- Reward

- like

- Comment

- Repost

- Share

Currently, is there a possibility that Bitcoin$BTC and ETH$ETH will experience a second dip to the bottom?

Historically, after such a sharp decline in the crypto market, the rebound and second test have a probability of over 70%! The main reasons can be summarized into three points:

1. A rapid plunge causes many to be unable to escape, forming trapped positions. After the rebound, some will break free or realize small losses;

2. The current bullish sentiment and market psychology are difficult to fully clear in one go. After a rebound and subsequent decline, both leverage and sentiment will

View OriginalHistorically, after such a sharp decline in the crypto market, the rebound and second test have a probability of over 70%! The main reasons can be summarized into three points:

1. A rapid plunge causes many to be unable to escape, forming trapped positions. After the rebound, some will break free or realize small losses;

2. The current bullish sentiment and market psychology are difficult to fully clear in one go. After a rebound and subsequent decline, both leverage and sentiment will

- Reward

- 1

- Comment

- Repost

- Share

After the sharp decline, it seems like a V-shaped rebound has occurred, so is the downward trend coming to an end?

The answer is no. Such a significant drop requires months to recover. This rebound can be seen as short-term buying caused by short sellers and hedge fund liquidations.

The volume spike and stagnation at the ETH top may indicate that traders who bought the dip during the previous decline are gradually taking profits.

Bitcoin's repeated fluctuations around the previous high near 69,000 are also due to a large accumulation of positions at that level!

Overall, the downward trend stil

View OriginalThe answer is no. Such a significant drop requires months to recover. This rebound can be seen as short-term buying caused by short sellers and hedge fund liquidations.

The volume spike and stagnation at the ETH top may indicate that traders who bought the dip during the previous decline are gradually taking profits.

Bitcoin's repeated fluctuations around the previous high near 69,000 are also due to a large accumulation of positions at that level!

Overall, the downward trend stil

- Reward

- like

- Comment

- Repost

- Share

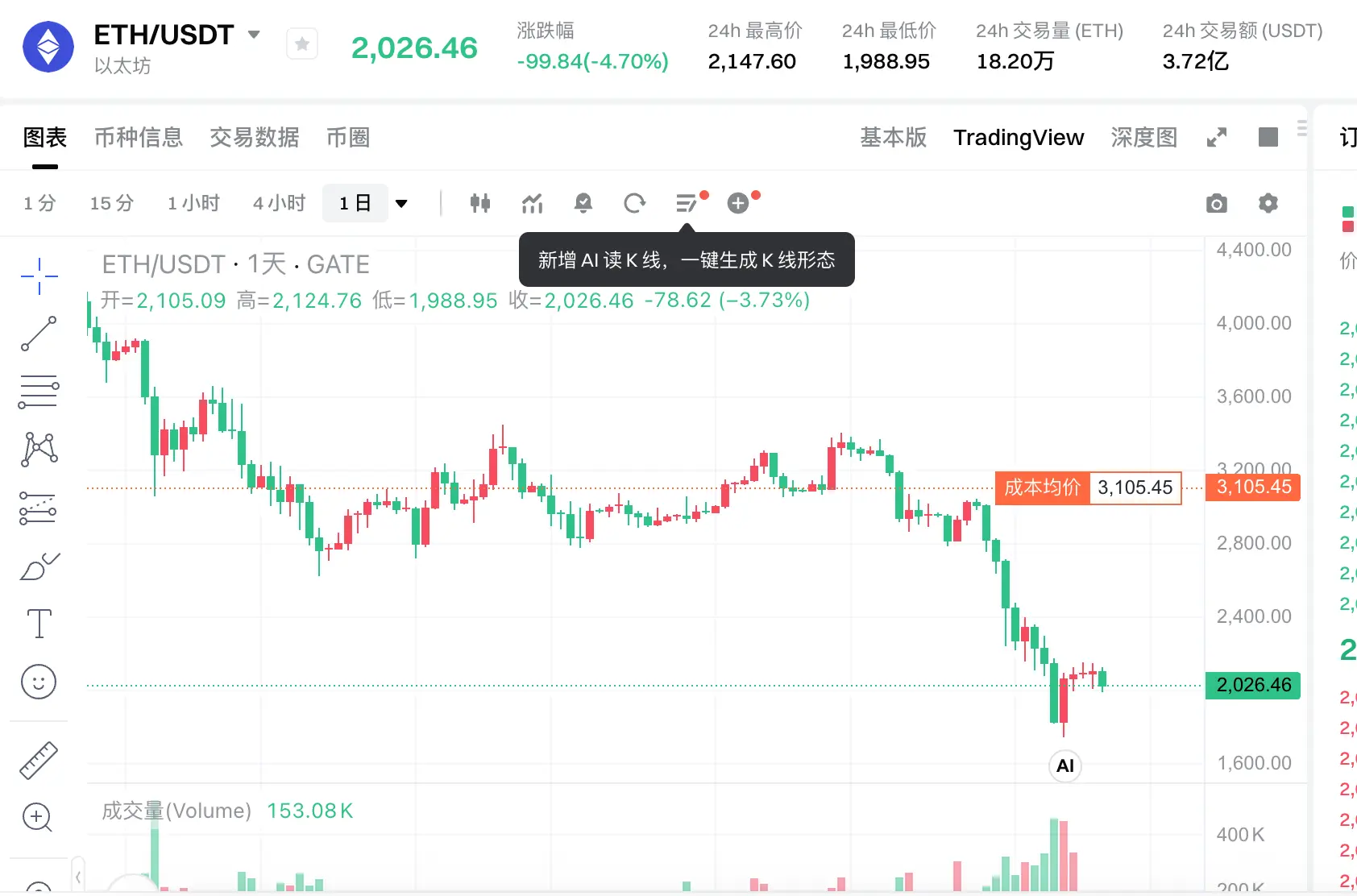

ETH plunged to 1747 early this morning. From the monthly chart, it just happens to be the support level from March to May last year. Currently, the rebound has gained 10 points, which is a significant strength. Will the decline continue?

From the 4-hour chart, the volume of the rebound is insufficient. At present, it appears to be a rebound at the support level, but the overall trend is still a continuation of the downtrend.

The 1450-1500 level is still highly likely to be reached.

In this current wave of decline, ETH has been relatively stronger than Bitcoin. Based on previous downward perfor

View OriginalFrom the 4-hour chart, the volume of the rebound is insufficient. At present, it appears to be a rebound at the support level, but the overall trend is still a continuation of the downtrend.

The 1450-1500 level is still highly likely to be reached.

In this current wave of decline, ETH has been relatively stronger than Bitcoin. Based on previous downward perfor

- Reward

- like

- Comment

- Repost

- Share

Bitcoin has dropped today, already halving the high point before October's halving!

The most frightening thing right now is that, despite the sharp decline, there has been no panic selling or large-volume drops to trigger a cascade!

It seems that the entire world is experiencing or brewing a black swan event somewhere we don't know about, just not yet fermented in the mainstream market.

Currently, Bitcoin appears to be between $60,000 and $70,000, seemingly with no resistance. The support bottom line needs to be checked on the monthly chart. Will it drop straight to $54,000-$58,000? ETH has dr

View OriginalThe most frightening thing right now is that, despite the sharp decline, there has been no panic selling or large-volume drops to trigger a cascade!

It seems that the entire world is experiencing or brewing a black swan event somewhere we don't know about, just not yet fermented in the mainstream market.

Currently, Bitcoin appears to be between $60,000 and $70,000, seemingly with no resistance. The support bottom line needs to be checked on the monthly chart. Will it drop straight to $54,000-$58,000? ETH has dr

- Reward

- like

- 2

- Repost

- Share

ChessCoinCircle :

:

Ethereum received 800 from the injectionView More

- Reward

- like

- 1

- Repost

- Share

EuTeDisse :

:

$BTC Venezuelan regime currencies are being dumped en masse... BTC 48,000.00 or close to it... Information is everything, stay tuned 👀👀

Bitcoin starting with 6 and ETH starting with 1 are both just one step away!

In the past month and a half, starting from 96,000, five target levels have been consecutively announced, all of which have been reached!

Brothers who have followed along should be earning big, so give yourself a pat on the back.

Sixth target level: 64000 and 1620, but probably won't be reached in the short term!

View OriginalIn the past month and a half, starting from 96,000, five target levels have been consecutively announced, all of which have been reached!

Brothers who have followed along should be earning big, so give yourself a pat on the back.

Sixth target level: 64000 and 1620, but probably won't be reached in the short term!

- Reward

- like

- Comment

- Repost

- Share

Brother Maji is really stubborn! Liquidated 262 times in a row, he goes long again $ETH , liquidation price $1933.

Maji won't die, and the bears won't stop!

So don't be superstitious about whales; whales are just big-handed retail investors!

Also, don't be stubborn and emotional in trading, or you'll end up badly hurt! Vote: Will you see a Bitcoin starting with 6 within 24 hours?

View OriginalMaji won't die, and the bears won't stop!

So don't be superstitious about whales; whales are just big-handed retail investors!

Also, don't be stubborn and emotional in trading, or you'll end up badly hurt! Vote: Will you see a Bitcoin starting with 6 within 24 hours?

- Reward

- like

- Comment

- Repost

- Share

Bitcoin$BTC is about to fall below a new low!

The current rebound is just symbolic, as we are in an early bear phase. The characteristic is violent declines that leave you no time to escape or panic sell.

Bitcoin has already dropped over 40% from its high, and ETH$ETH has been halved.

The early bear phase is about to end, and the mid-bear may occur between March and July, at which point the violent declines will end and we will see repeated choppy movements that test investor patience.

The end of the early bear phase may be marked by Bitcoin falling to around $65,000, after which the frustra

View OriginalThe current rebound is just symbolic, as we are in an early bear phase. The characteristic is violent declines that leave you no time to escape or panic sell.

Bitcoin has already dropped over 40% from its high, and ETH$ETH has been halved.

The early bear phase is about to end, and the mid-bear may occur between March and July, at which point the violent declines will end and we will see repeated choppy movements that test investor patience.

The end of the early bear phase may be marked by Bitcoin falling to around $65,000, after which the frustra

- Reward

- 1

- Comment

- Repost

- Share

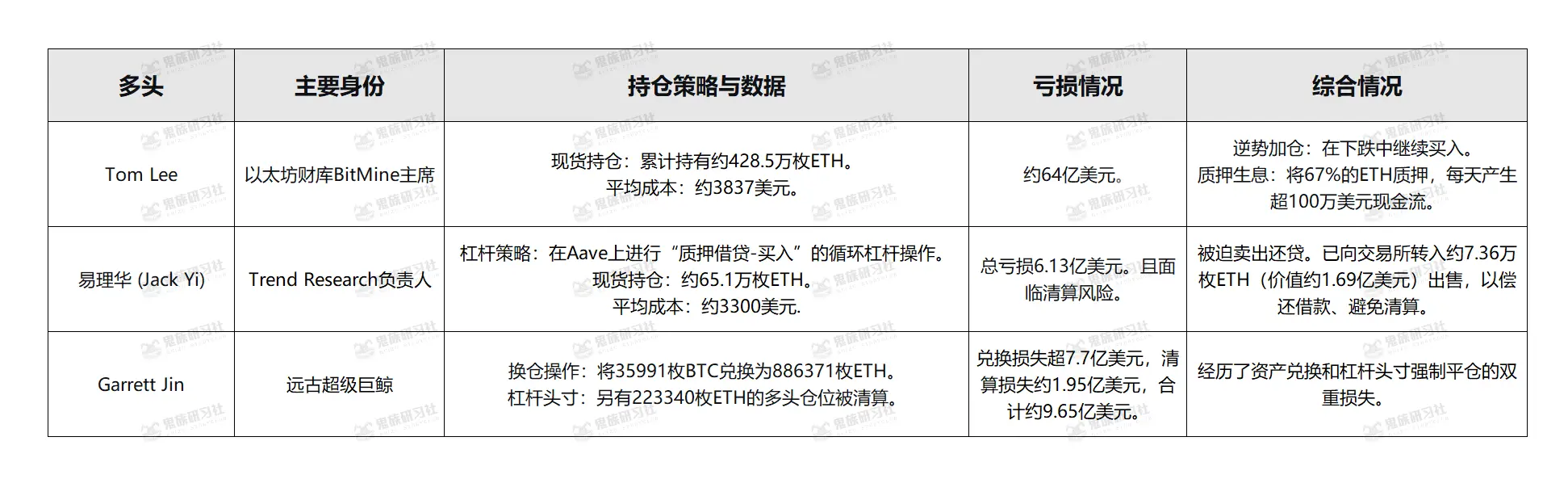

ETH whales are starting to sell to save themselves. Garrett Jin, Boss Yi, and Tom Lee are either selling ETH to repay collateralized loans to avoid liquidation (as shown in the chart below, created by Ghost Tribe Research Society), or they have already lost nearly $1 billion. Boss Yi has a liquidation price of 650,000 ETH at over $1,800. If the price drops, they will be forced to sell ETH to repay loans, causing the market to spiral downward.

Will bigger players target these whales and take them out?

Currently, the net inflow of Bitcoin whale addresses is almost negligible, indicating that the

View OriginalWill bigger players target these whales and take them out?

Currently, the net inflow of Bitcoin whale addresses is almost negligible, indicating that the

- Reward

- like

- Comment

- Repost

- Share

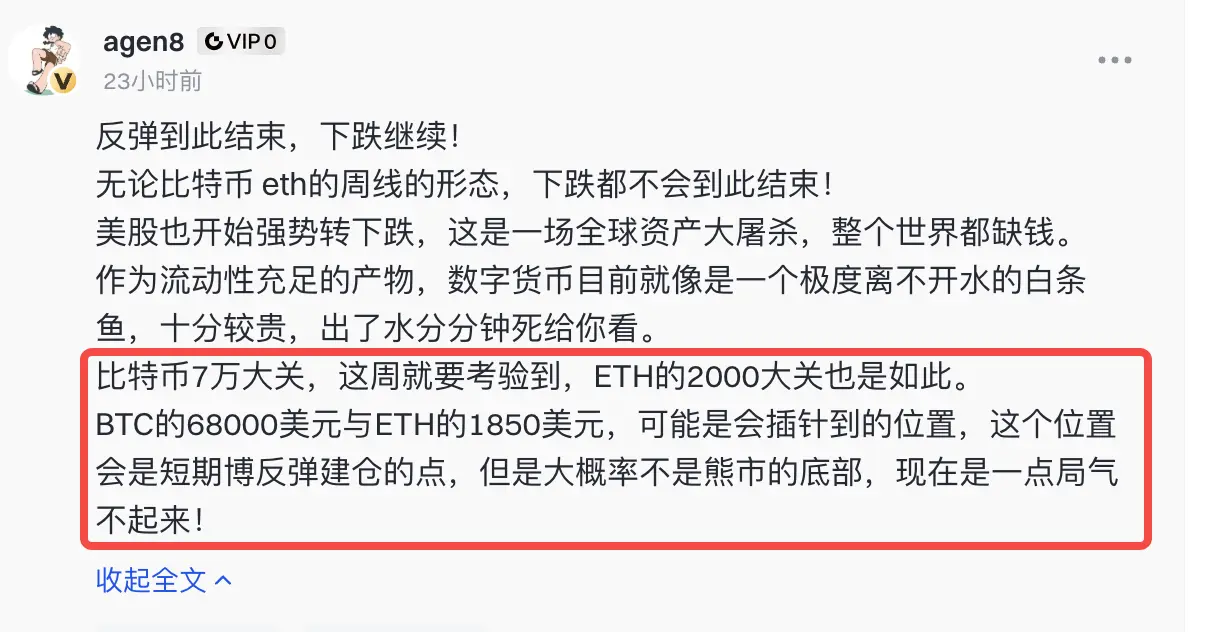

The rebound ends here, and the decline continues!

Regardless of the weekly chart patterns of Bitcoin and ETH, the decline will not end here!

The US stock market is also starting to turn strongly downward. This is a global asset massacre; the entire world is short of money.

As a product with abundant liquidity, digital currencies are currently like a white fish that cannot live without water—very expensive, and they die instantly once out of water.

Bitcoin's $70,000 threshold will be tested this week, and ETH's $2000 level is also the same.

The $68,000 mark for BTC and the $1850 for ETH might b

View OriginalRegardless of the weekly chart patterns of Bitcoin and ETH, the decline will not end here!

The US stock market is also starting to turn strongly downward. This is a global asset massacre; the entire world is short of money.

As a product with abundant liquidity, digital currencies are currently like a white fish that cannot live without water—very expensive, and they die instantly once out of water.

Bitcoin's $70,000 threshold will be tested this week, and ETH's $2000 level is also the same.

The $68,000 mark for BTC and the $1850 for ETH might b

- Reward

- like

- Comment

- Repost

- Share

When will the bottom of this bear market arrive? How low will it go?

If you try to predict precisely, the bottom of a bear market usually occurs about a year after the highest point of the bull market. The peak was $126,199 in October 2025, so the bear market bottom might not be reached until October 2026!

Currently, Bitcoin has fallen 40.8% from its high, and ETH has dropped 56.4%.

According to past patterns, after Bitcoin enters a bear market, the maximum decline is typically 70-80%. The three previous halvings saw maximum drops of 86%, 83%, and 77% (see the chart below).

This time, with ins

View OriginalIf you try to predict precisely, the bottom of a bear market usually occurs about a year after the highest point of the bull market. The peak was $126,199 in October 2025, so the bear market bottom might not be reached until October 2026!

Currently, Bitcoin has fallen 40.8% from its high, and ETH has dropped 56.4%.

According to past patterns, after Bitcoin enters a bear market, the maximum decline is typically 70-80%. The three previous halvings saw maximum drops of 86%, 83%, and 77% (see the chart below).

This time, with ins

- Reward

- like

- Comment

- Repost

- Share

The market has reached this point, and no matter how stubborn the bulls are, they have to admit that we are transitioning from a early bull to a deep bear!

Looking at the weekly charts of Bitcoin and ETH, it's clear that a head and shoulders top has formed!

Bitcoin's bottom in April was $74,508, and the current lowest point is $74,604, only $100 apart, just a 0.1% difference.

Correspondingly, ETH's bottom in April was $1,385, with the current bottom at $2,157, which is more similar to the June bottom of $2,111. From this perspective, ETH seems stronger, but it can also be said that ETH hasn't

View OriginalLooking at the weekly charts of Bitcoin and ETH, it's clear that a head and shoulders top has formed!

Bitcoin's bottom in April was $74,508, and the current lowest point is $74,604, only $100 apart, just a 0.1% difference.

Correspondingly, ETH's bottom in April was $1,385, with the current bottom at $2,157, which is more similar to the June bottom of $2,111. From this perspective, ETH seems stronger, but it can also be said that ETH hasn't

- Reward

- like

- Comment

- Repost

- Share

The plunge continues! The promised fourth target levels $BTC 74000 and $ETH 2100 are about to be reached.

In the past half month, four target levels have been announced consecutively. Bitcoin has been declining from around 96000, reaching each one, with some weak rebounds along the way. Crypto enthusiasts who have seen this and taken action should have a prosperous year!

Of course, as industry practitioners, we certainly don't want the decline to continue endlessly!

But be prepared to迎接 the fifth target levels: 68000 and 1850 USD!

View OriginalIn the past half month, four target levels have been announced consecutively. Bitcoin has been declining from around 96000, reaching each one, with some weak rebounds along the way. Crypto enthusiasts who have seen this and taken action should have a prosperous year!

Of course, as industry practitioners, we certainly don't want the decline to continue endlessly!

But be prepared to迎接 the fifth target levels: 68000 and 1850 USD!

- Reward

- like

- Comment

- Repost

- Share