Shenron1226

No content yet

Shenron1226

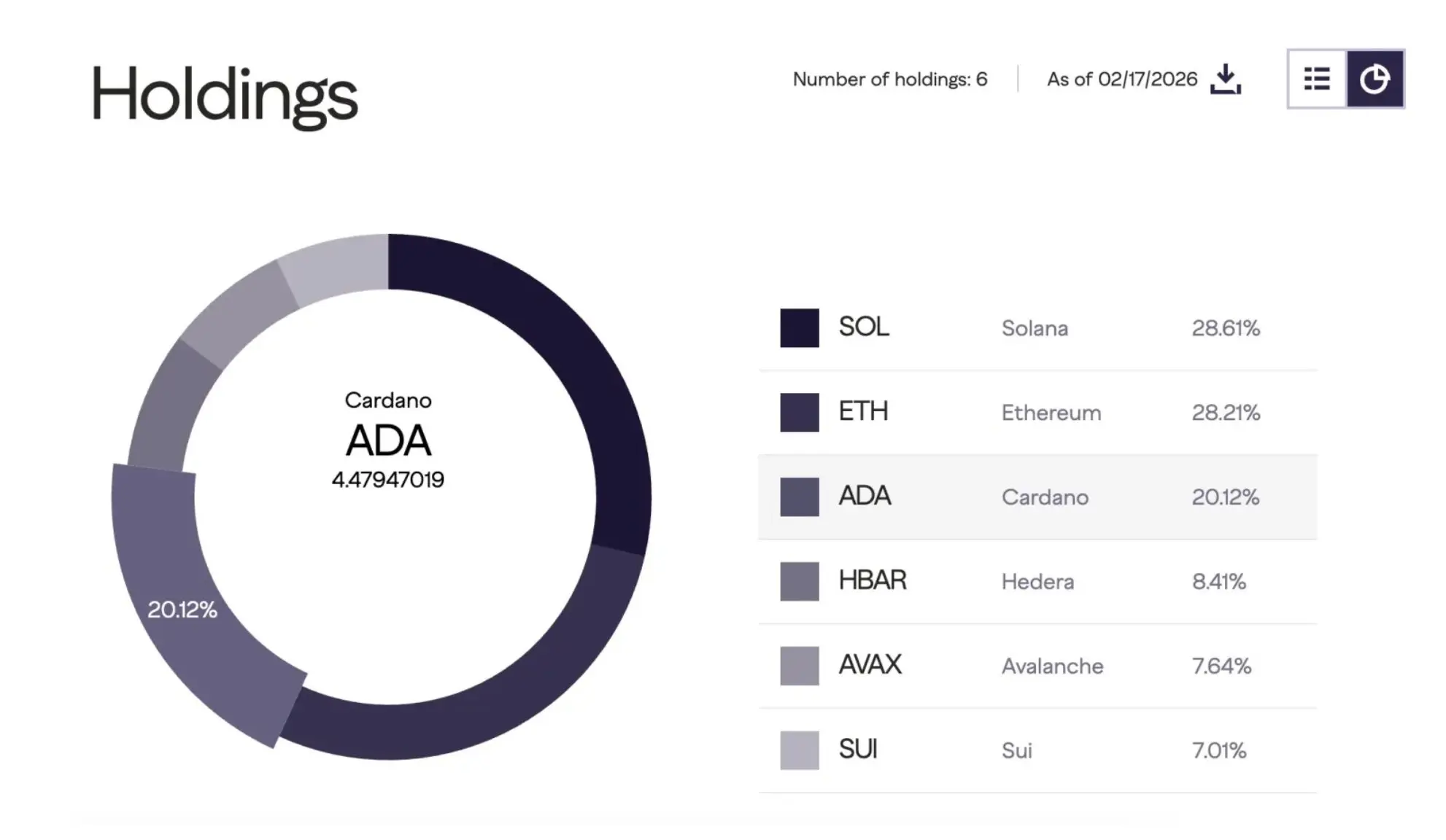

GRAYSCALE INCREASES ADA HOLDINGS

Grayscale Investments raised ADA’s weighting in its Smart Contract Fund to 20.12%, up from 19.50%.

Another consecutive

Grayscale Investments raised ADA’s weighting in its Smart Contract Fund to 20.12%, up from 19.50%.

Another consecutive

ADA-1,81%

- Reward

- 2

- 1

- Repost

- Share

GateUser-4a8b4621 :

:

2026 GOGOGO 👊🔥TIM DRAPER: BITCOIN COULD 4X BY 2028

VC investor Tim Draper says Bitcoin could quadruple by 2028, doubling down on his long-standing bullish stance.

He’s even inviting skeptics to bet against him on Polymarket.

VC investor Tim Draper says Bitcoin could quadruple by 2028, doubling down on his long-standing bullish stance.

He’s even inviting skeptics to bet against him on Polymarket.

BTC0,26%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

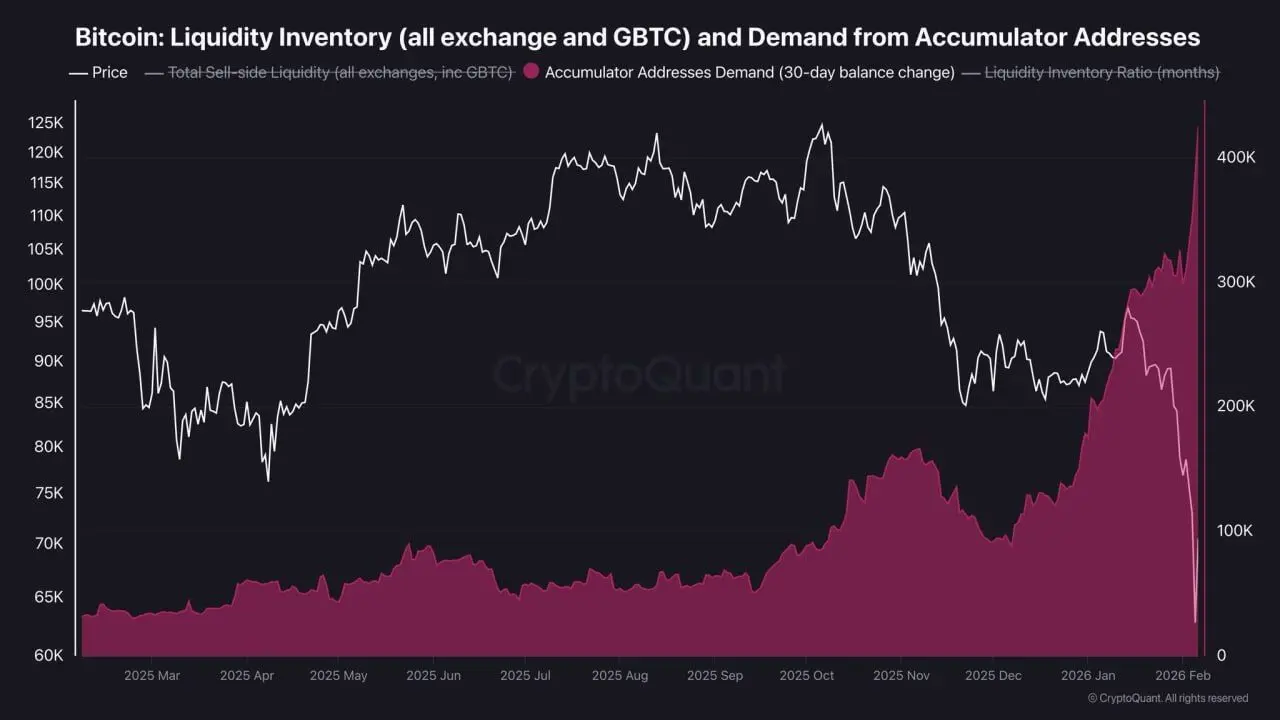

BIG: Demand from accumulator addresses spike in the past 7 days.

- Reward

- 1

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AlNCXFBY

- Reward

- 2

- Comment

- Repost

- Share

Precious Metals are SURGING again.

Gold is up 2.6% and has reclaimed $5,100, adding $900 Billion today.

Silver is up 9.42%% and has reclaimed $85, adding $400 Billion today.

Gold is up 2.6% and has reclaimed $5,100, adding $900 Billion today.

Silver is up 9.42%% and has reclaimed $85, adding $400 Billion today.

- Reward

- 2

- Comment

- Repost

- Share

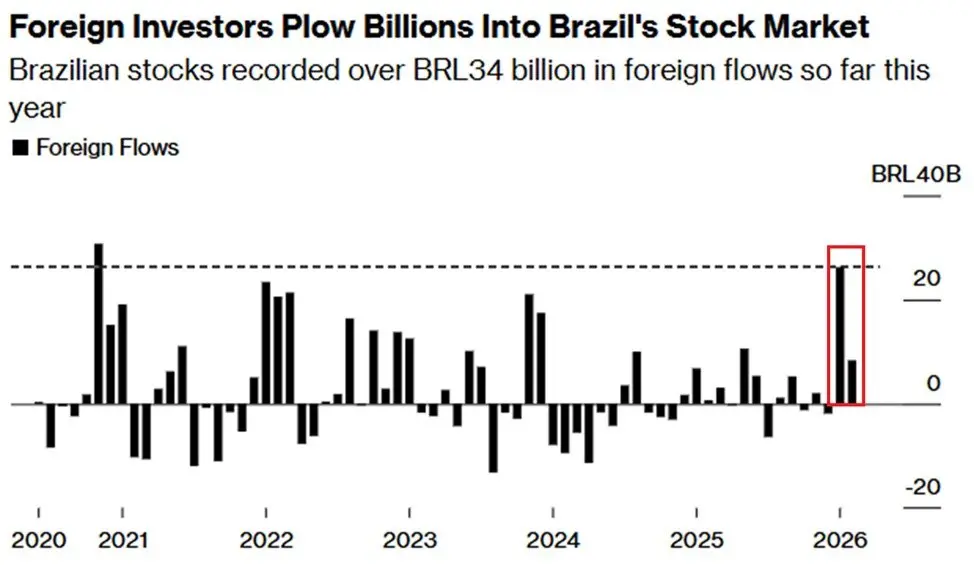

Global investors are increasingly piling into Brazilian stocks:

Brazilian stocks have recorded +$6.6 billion in foreign inflows so far in 2026.

This already surpasses the +$4.9 billion recorded in the entire 2025.

As a result, the average daily trading volume for Brazilian equities jumped to $6.1 billion last month, the highest since November 2022.

Furthermore, the Brazil ETF, $EWZ, which covers 85% of the nation's stocks, surged +17% in January, its best monthly performance since 2020.

A weakening US Dollar and higher commodity prices are driving the historic move higher.

Brazil's bull market

Brazilian stocks have recorded +$6.6 billion in foreign inflows so far in 2026.

This already surpasses the +$4.9 billion recorded in the entire 2025.

As a result, the average daily trading volume for Brazilian equities jumped to $6.1 billion last month, the highest since November 2022.

Furthermore, the Brazil ETF, $EWZ, which covers 85% of the nation's stocks, surged +17% in January, its best monthly performance since 2020.

A weakening US Dollar and higher commodity prices are driving the historic move higher.

Brazil's bull market

- Reward

- 2

- Comment

- Repost

- Share

COMPANIES ARE STOCKPILING XRP

11 companies are adding XRP to their corporate treasuries across fintech, tech, and transport. Over $2B+ already locked out of the open market.

Institutional adoption is happening FAST. XRP utility is taking over.

11 companies are adding XRP to their corporate treasuries across fintech, tech, and transport. Over $2B+ already locked out of the open market.

Institutional adoption is happening FAST. XRP utility is taking over.

XRP-0,69%

- Reward

- 1

- 1

- Repost

- Share

GateUser-e10723d9 :

:

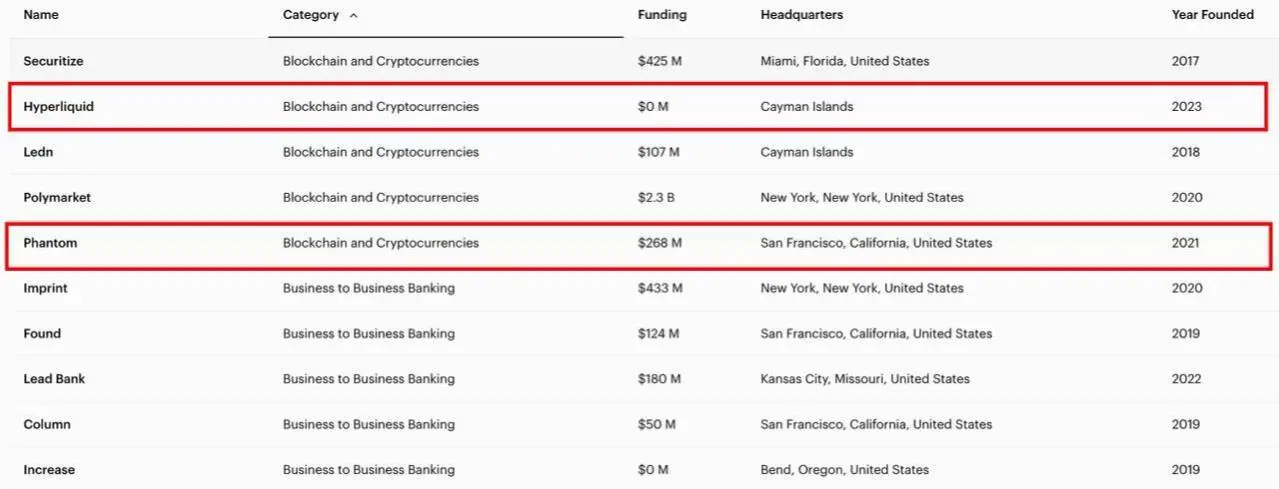

If you don't brag, you'll die😂🔥 BIG: Hyperliquid and Phantom made Forbes’ 11th annual Fintech 50 list of top private U.S. fintech companies.

- Reward

- 2

- 1

- Repost

- Share

GateUser-4a8b4621 :

:

To The Moon 🌕LATEST: 📈 Tokenized equities platform xStocks surpassed $25 billion in total transaction volume less than eight months after launch, reporting over 80,000 unique on-chain holders.

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊THE FUTURE BELONGS TO THE BOLD, NOT THE BUREAUCRATS.

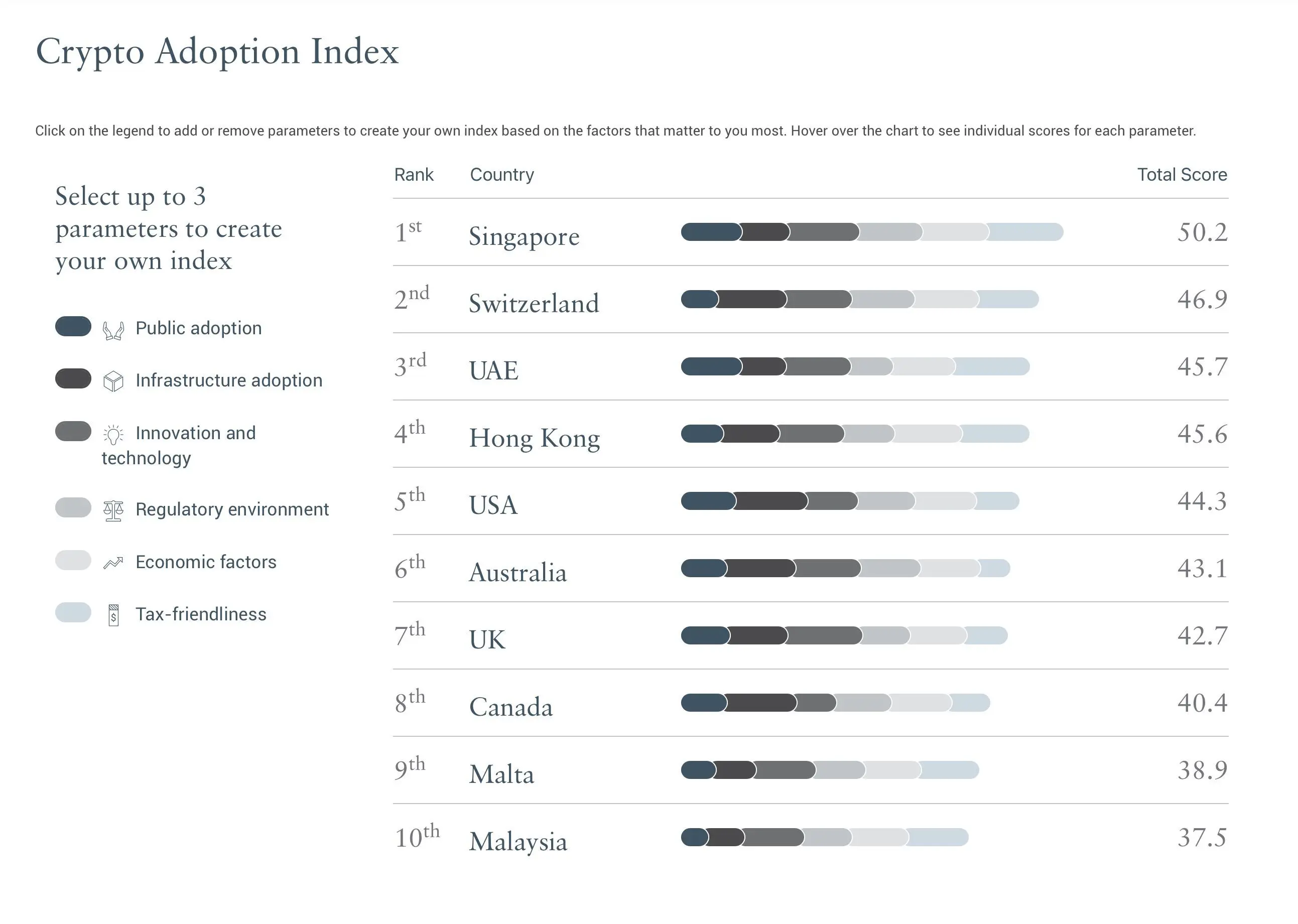

Coinbase CEO Brian Armstrong says, "Capital goes where it’s welcome. Countries that embrace crypto will likely see the most economic growth in the next decade."

We’ve seen this movie before: money and talent flow to places with clear rules, low friction, and strong property rights -- think Singapore’s rise or America’s tech boom.

Crypto accelerates that dynamic. Digital assets move instantly across borders. When a country offers clear rules, friendly taxes, and real infrastructure, capital pours in: VC funding, talent, startups, trading vol

Coinbase CEO Brian Armstrong says, "Capital goes where it’s welcome. Countries that embrace crypto will likely see the most economic growth in the next decade."

We’ve seen this movie before: money and talent flow to places with clear rules, low friction, and strong property rights -- think Singapore’s rise or America’s tech boom.

Crypto accelerates that dynamic. Digital assets move instantly across borders. When a country offers clear rules, friendly taxes, and real infrastructure, capital pours in: VC funding, talent, startups, trading vol

BTC0,26%

- Reward

- 2

- Comment

- Repost

- Share

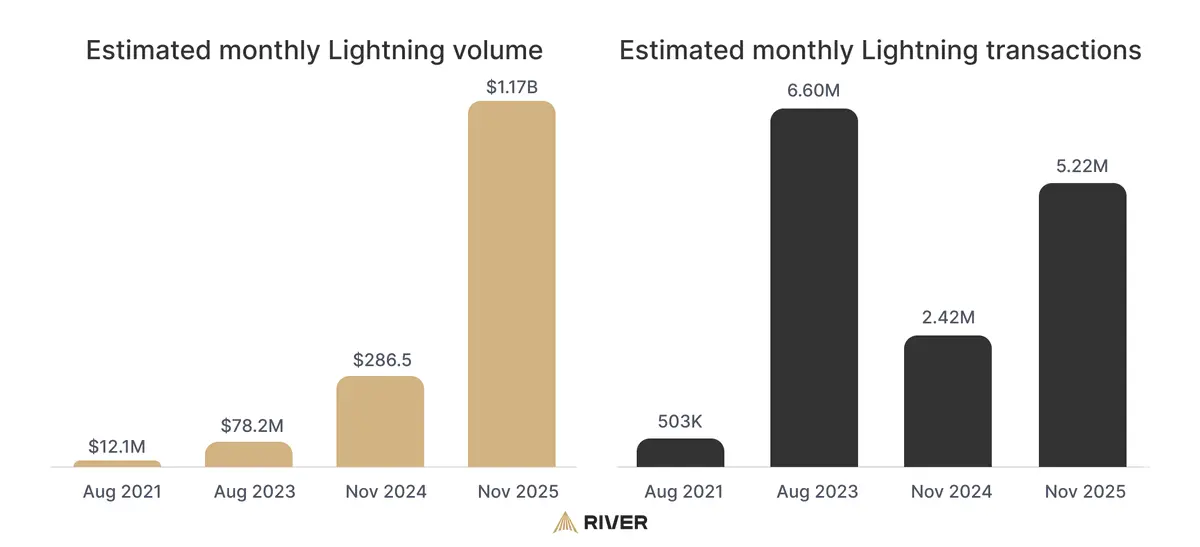

RIVER REPORT: Lightning Network volume has surged 400% in 2025.

An estimated $1.17B in monthly volume is now moving across the network, with roughly 5.22M transactions per month

An estimated $1.17B in monthly volume is now moving across the network, with roughly 5.22M transactions per month

- Reward

- 2

- 1

- Repost

- Share

GateUser-4a8b4621 :

:

2026 GOGOGO 👊SHARPLINK JUST STACKED NEARLY 868,000 ETH -- WORTH $1.68 BILLION.

SharpLink Gaming (Nasdaq: $SBET), the Consensys-backed #Ethereum treasury powerhouse, now holds 867,798 ETH as of Feb 15 -- making it one of the largest corporate ETH holders out there.

They're staking almost 100% of it (since day one), earning 13,615 ETH in rewards in under a year – all flowing straight to shareholders. 🤝

CEO Joseph Chalom (ex-BlackRock): "Even during volatile markets, we continue growing our $ETH concentration per share... institutions know they can trust us to keep generating long-term value."

Institutional

SharpLink Gaming (Nasdaq: $SBET), the Consensys-backed #Ethereum treasury powerhouse, now holds 867,798 ETH as of Feb 15 -- making it one of the largest corporate ETH holders out there.

They're staking almost 100% of it (since day one), earning 13,615 ETH in rewards in under a year – all flowing straight to shareholders. 🤝

CEO Joseph Chalom (ex-BlackRock): "Even during volatile markets, we continue growing our $ETH concentration per share... institutions know they can trust us to keep generating long-term value."

Institutional

ETH0,7%

- Reward

- 3

- 9

- Repost

- Share

MoonWalker_X :

:

1000x VIbes 🤑View More

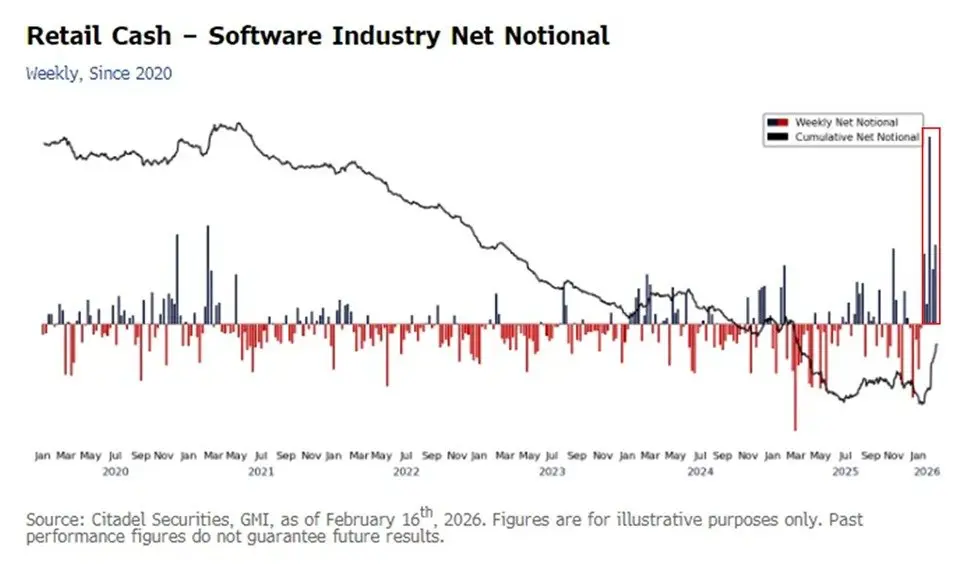

Retail investors are rushing into software stocks at a record pace:

Individual investors have bought software stocks for 7 consecutive weeks, the longest streak since at least 2017.

The magnitude, persistence, and breadth of buying activity have significantly exceeded all prior peaks, according to Citadel.

The pace of these purchases now equals 66% of the total net inflows posted during the entire 2025.

Furthermore, from January 2nd to February 13th, average retail daily demand for US equities was ~25% higher than the prior record in 2021 and DOUBLE the 2020 to 2025 average.

Retail is betting

Individual investors have bought software stocks for 7 consecutive weeks, the longest streak since at least 2017.

The magnitude, persistence, and breadth of buying activity have significantly exceeded all prior peaks, according to Citadel.

The pace of these purchases now equals 66% of the total net inflows posted during the entire 2025.

Furthermore, from January 2nd to February 13th, average retail daily demand for US equities was ~25% higher than the prior record in 2021 and DOUBLE the 2020 to 2025 average.

Retail is betting

- Reward

- 2

- Comment

- Repost

- Share

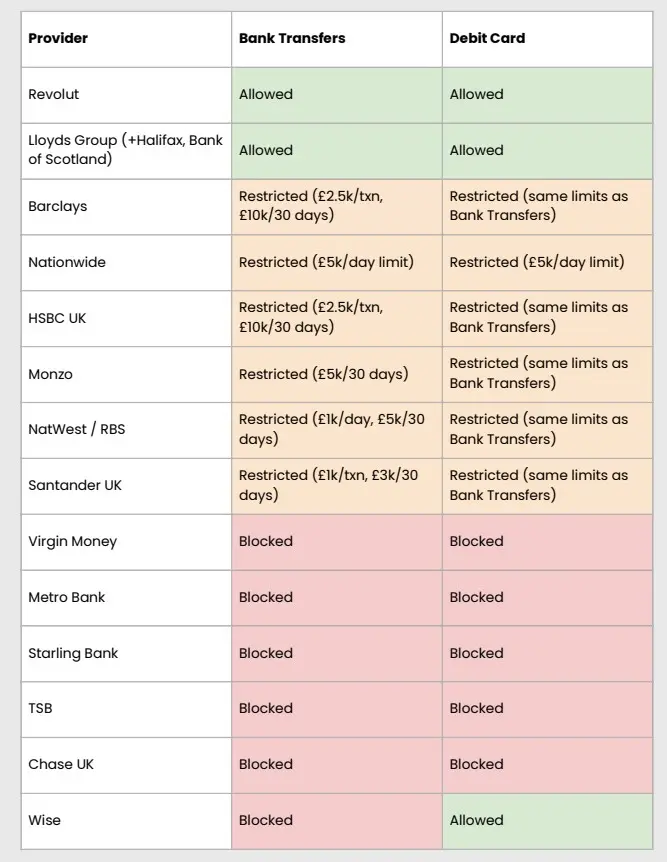

🏦BANKS STILL BLOCKING CRYPTO USERS

Even with ETFs and growing institutional adoption, investors say banks are freezing or restricting accounts for crypto activity.

As crypto goes mainstream, parts of traditional finance still aren’t on board

Even with ETFs and growing institutional adoption, investors say banks are freezing or restricting accounts for crypto activity.

As crypto goes mainstream, parts of traditional finance still aren’t on board

- Reward

- 3

- 2

- Repost

- Share

ThebeginningofLife :

:

Do your own research ( DYOR ) 🤓View More

🔥 BIG: $1T Société Générale has expanded its euro stablecoin EUR CoinVertible to the XRP Ledger.

XRP-0,69%

- Reward

- 3

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share