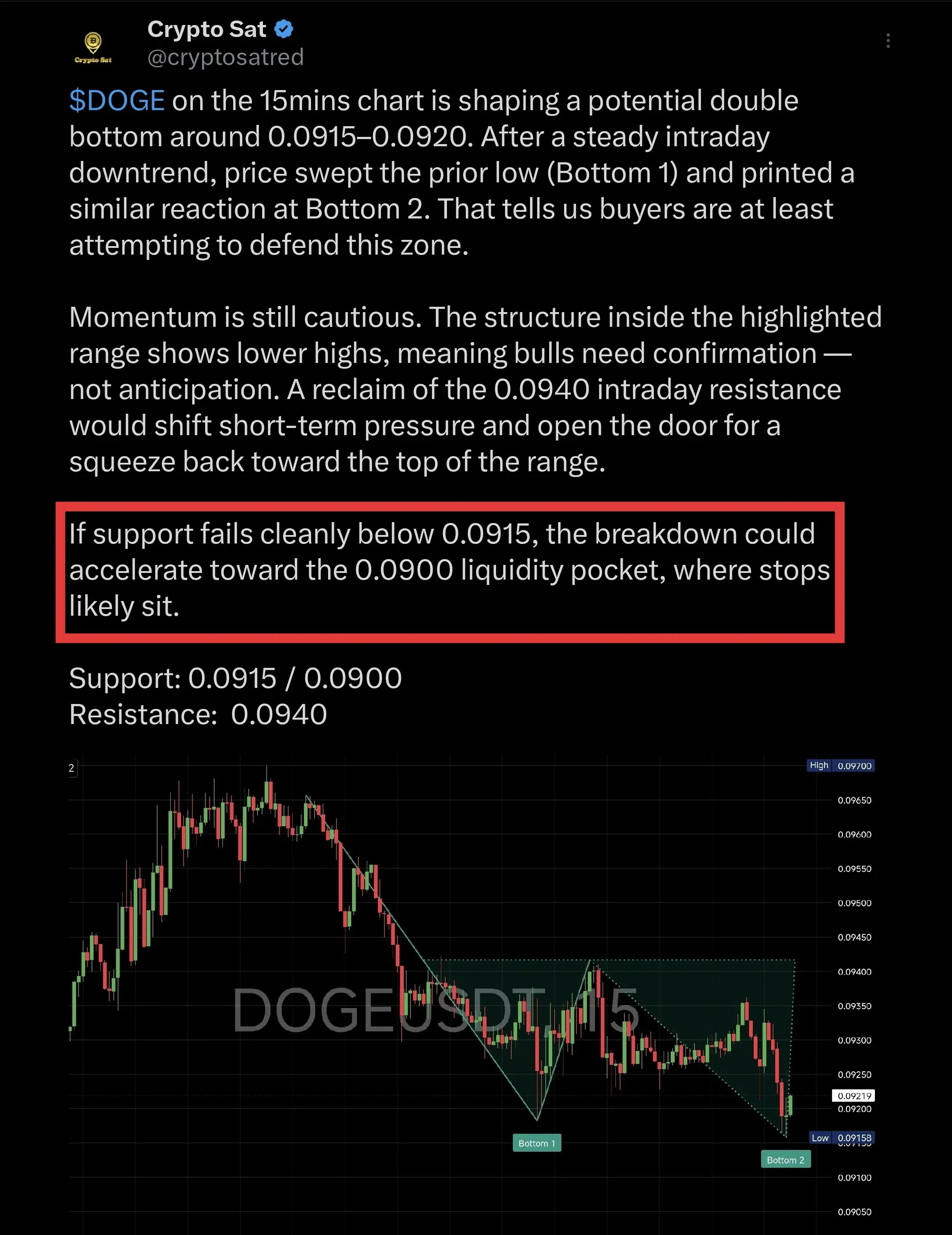

$DOGE on the 15mins chart is shaping a potential double bottom around 0.0915–0.0920. After a steady intraday downtrend, price swept the prior low (Bottom 1) and printed a similar reaction at Bottom 2. That tells us buyers are at least attempting to defend this zone.

Momentum is still cautious. The structure inside the highlighted range shows lower highs, meaning bulls need confirmation — not anticipation. A reclaim of the 0.0940 intraday resistance would shift short-term pressure and open the door for a squeeze back toward the top of the range.

If support fails cleanly below 0.0915, the breakdown could accelerate toward the 0.0900 liquidity pocket, where stops likely sit.

Support: 0.0915 / 0.0900

Resistance: 0.0940

#BuyTheDipOrWaitNow?

Momentum is still cautious. The structure inside the highlighted range shows lower highs, meaning bulls need confirmation — not anticipation. A reclaim of the 0.0940 intraday resistance would shift short-term pressure and open the door for a squeeze back toward the top of the range.

If support fails cleanly below 0.0915, the breakdown could accelerate toward the 0.0900 liquidity pocket, where stops likely sit.

Support: 0.0915 / 0.0900

Resistance: 0.0940

#BuyTheDipOrWaitNow?