# CryptoMarket

78.63K

ox_Alan

#BuyTheDipOrWaitNow? If your strategy is “buy because it dropped,” that’s not conviction — that’s emotional gambling. And if your strategy is “wait because I’m scared,” that’s not discipline — that’s paralysis.

Let’s be ruthless about it.

The market doesn’t reward hope. It rewards positioning.

Right now liquidity is selective. BTC reacts to macro pressure, ETH follows structure, and alts exaggerate both directions. Volatility is not the opportunity — structure is.

Before you scream “Buy the dip,” answer this:

• Is BTC holding a higher low on higher timeframe?

• Is volume supporting the bounce

Let’s be ruthless about it.

The market doesn’t reward hope. It rewards positioning.

Right now liquidity is selective. BTC reacts to macro pressure, ETH follows structure, and alts exaggerate both directions. Volatility is not the opportunity — structure is.

Before you scream “Buy the dip,” answer this:

• Is BTC holding a higher low on higher timeframe?

• Is volume supporting the bounce

- Reward

- like

- 2

- Repost

- Share

AnnaLinaTrader :

:

Buy To Earn 💎View More

#BuyTheDipOrWaitNow? If your strategy is “buy because it dropped,” that’s not conviction — that’s emotional gambling. And if your strategy is “wait because I’m scared,” that’s not discipline — that’s paralysis.

Let’s be ruthless about it.

The market doesn’t reward hope. It rewards positioning.

Right now liquidity is selective. BTC reacts to macro pressure, ETH follows structure, and alts exaggerate both directions. Volatility is not the opportunity — structure is.

Before you scream “Buy the dip,” answer this:

• Is BTC holding a higher low on higher timeframe?

• Is volume supporting the bounce

Let’s be ruthless about it.

The market doesn’t reward hope. It rewards positioning.

Right now liquidity is selective. BTC reacts to macro pressure, ETH follows structure, and alts exaggerate both directions. Volatility is not the opportunity — structure is.

Before you scream “Buy the dip,” answer this:

• Is BTC holding a higher low on higher timeframe?

• Is volume supporting the bounce

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

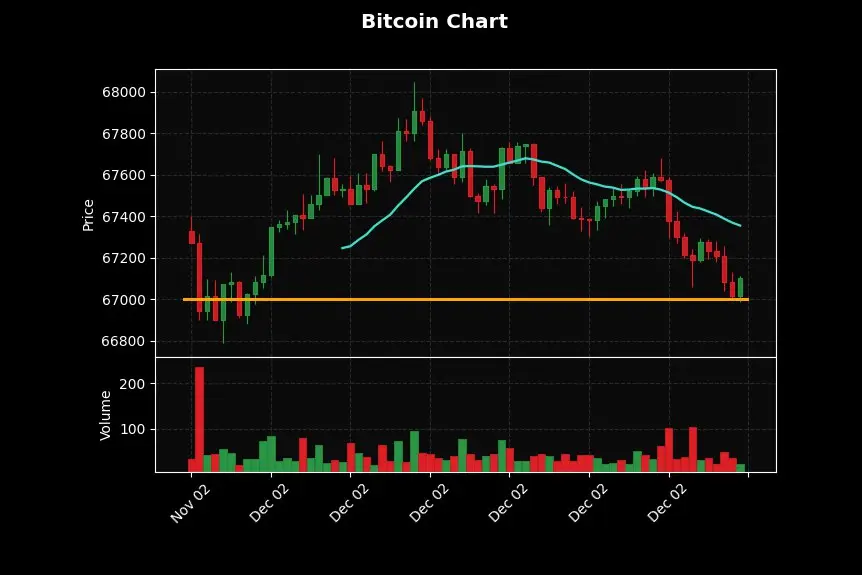

2026 GOGOGO 👊📊 #BitcoinMarketAnalysis

Bitcoin shows signs of key support and resistance levels being tested this week.

💡 Key Insights:

Price momentum could determine short-term trend direction

Watch for volume spikes and technical indicators for potential breakouts

Market sentiment remains cautious but bullish signals are emerging

Stay updated and trade smart! 🚀

#Bitcoin #BTC #CryptoMarket #TechnicalAnalysis #CryptoNews

Bitcoin shows signs of key support and resistance levels being tested this week.

💡 Key Insights:

Price momentum could determine short-term trend direction

Watch for volume spikes and technical indicators for potential breakouts

Market sentiment remains cautious but bullish signals are emerging

Stay updated and trade smart! 🚀

#Bitcoin #BTC #CryptoMarket #TechnicalAnalysis #CryptoNews

BTC0,01%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Crypto_Exper :

:

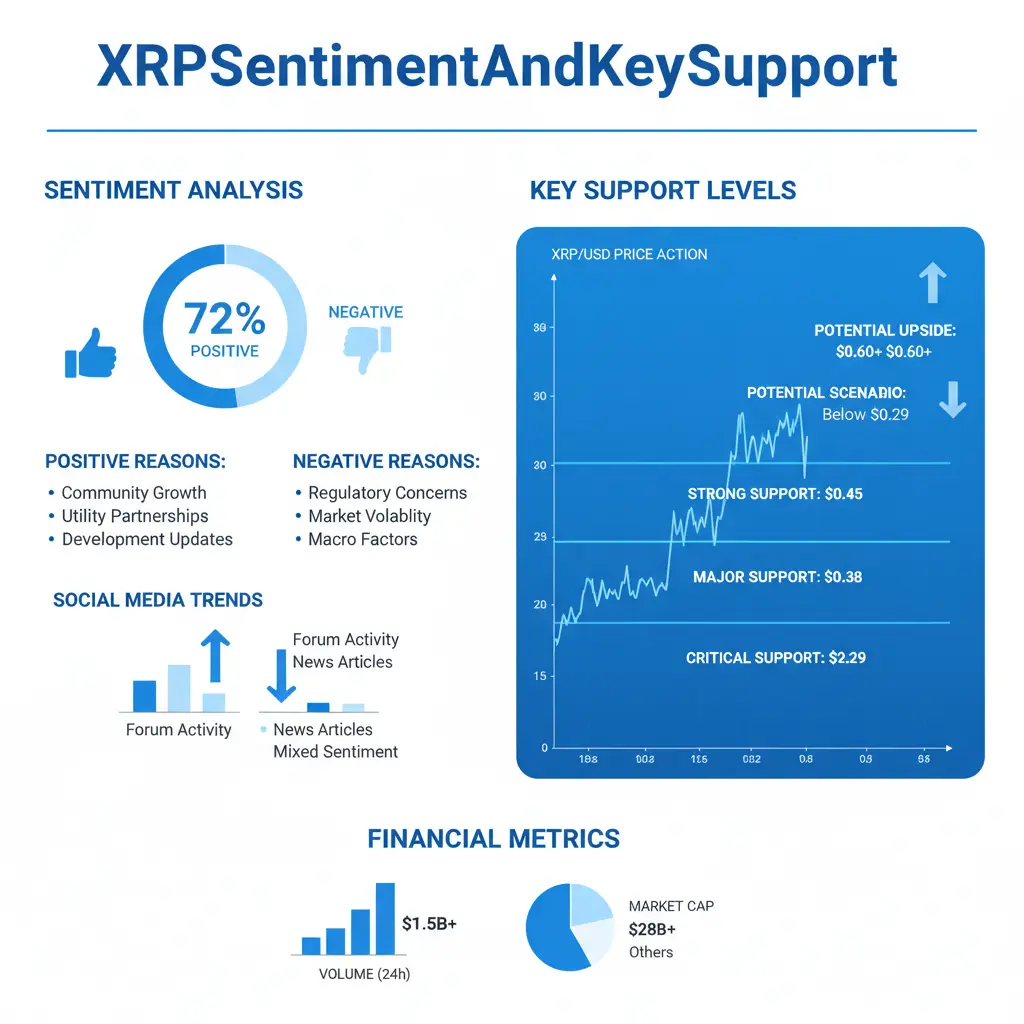

follow me brother I will follow back we should support each other 🥰✅#XRPSentimentAndKeySupport | Market Update & Trade Plan

XRP is currently trading in the $1.37–$1.41 range, down 2–4% over the last 24 hours and roughly 10–14% lower on the week, reflecting a broader crypto market pullback. This move follows a strong rejection from the $1.80–$2.00 zone earlier in 2026. Despite the decline, trading volume remains elevated, suggesting active participation rather than a lack of interest. The market is now focused on whether XRP can defend key support levels and transition from correction to stabilization.

🔍 Key Support Levels to Watch

XRP is in a corrective phase

XRP is currently trading in the $1.37–$1.41 range, down 2–4% over the last 24 hours and roughly 10–14% lower on the week, reflecting a broader crypto market pullback. This move follows a strong rejection from the $1.80–$2.00 zone earlier in 2026. Despite the decline, trading volume remains elevated, suggesting active participation rather than a lack of interest. The market is now focused on whether XRP can defend key support levels and transition from correction to stabilization.

🔍 Key Support Levels to Watch

XRP is in a corrective phase

- Reward

- 4

- 7

- Repost

- Share

CryptoEye :

:

Ape In 🚀View More

#BuyTheDipOrWaitNow? 🤔

Markets are giving mixed signals right now. Volatility is high, emotions are louder than data, and patience is becoming a real edge.

Buying the dip only works when the dip is backed by strong fundamentals, capital inflows, and market structure support — not just hope. At the same time, waiting blindly can mean missing key accumulation zones institutions are quietly building.

The smart approach?

📌 Scale entries instead of going all-in

📌 Follow spot market flows, not just price

📌 Let confirmation guide you, not FOMO

In uncertain markets, risk management is the real pro

Markets are giving mixed signals right now. Volatility is high, emotions are louder than data, and patience is becoming a real edge.

Buying the dip only works when the dip is backed by strong fundamentals, capital inflows, and market structure support — not just hope. At the same time, waiting blindly can mean missing key accumulation zones institutions are quietly building.

The smart approach?

📌 Scale entries instead of going all-in

📌 Follow spot market flows, not just price

📌 Let confirmation guide you, not FOMO

In uncertain markets, risk management is the real pro

BTC0,01%

- Reward

- 3

- 7

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#BuyTheDipOrWaitNow?

The market is testing patience again.

Prices drop… fear rises… and everyone starts asking — “Is this the bottom?”

But here’s the truth:

Not every dip is a discount. Some dips are warnings.

A real opportunity shows signs: ✔️ Price reacts at a key support zone

✔️ Sellers lose momentum

✔️ Volume increases on bullish candles

✔️ Structure starts shifting

If the chart is still making lower lows with strong selling pressure, buying blindly is not confidence — it’s hope. And hope is not a trading strategy.

Professional traders don’t chase bottoms.

They wait for confirmation or bui

The market is testing patience again.

Prices drop… fear rises… and everyone starts asking — “Is this the bottom?”

But here’s the truth:

Not every dip is a discount. Some dips are warnings.

A real opportunity shows signs: ✔️ Price reacts at a key support zone

✔️ Sellers lose momentum

✔️ Volume increases on bullish candles

✔️ Structure starts shifting

If the chart is still making lower lows with strong selling pressure, buying blindly is not confidence — it’s hope. And hope is not a trading strategy.

Professional traders don’t chase bottoms.

They wait for confirmation or bui

- Reward

- 6

- 8

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

📈 #BitcoinHitsBounceBack — Market Update (10 Feb 2026)

Bitcoin is showing signs of rebound after a sharp sell-off earlier this month, climbing back above key levels as risk assets stabilize and bargain buyers step in.

🔹 Bitcoin rebounded strongly from its recent low near $60,000, climbing back above $70,000 — a move confirmed by relief rallies in crypto, traditional stocks, and other markets.

🔹 This bounce reflects short-covering, oversold conditions, and macro stabilisation, but analysts also warn that it may be a technical rebound rather than the start of a new long-term uptrend.

🔹 Pr

Bitcoin is showing signs of rebound after a sharp sell-off earlier this month, climbing back above key levels as risk assets stabilize and bargain buyers step in.

🔹 Bitcoin rebounded strongly from its recent low near $60,000, climbing back above $70,000 — a move confirmed by relief rallies in crypto, traditional stocks, and other markets.

🔹 This bounce reflects short-covering, oversold conditions, and macro stabilisation, but analysts also warn that it may be a technical rebound rather than the start of a new long-term uptrend.

🔹 Pr

BTC0,01%

- Reward

- like

- Comment

- Repost

- Share

Market Analysis – “Reality Check”

Headline: Bitcoin at $70,000: Bear Trap or Structural Breakdown? 📉

Body:

Bitcoin has declined approximately 2.8% over the past 24 hours, while open interest has contracted from $19B to $16B, confirming a meaningful deleveraging phase.

Key levels to monitor:

$68,000: Short-term technical support

$60,000: High-conviction macro support zone

Market structure over the next few sessions will determine whether this move represents a bear trap or continuation to lower liquidity levels.

CTA:

What’s your approach here?

🟢 Scaling in

🔴 Waiting for confirmation

#CryptoM

Headline: Bitcoin at $70,000: Bear Trap or Structural Breakdown? 📉

Body:

Bitcoin has declined approximately 2.8% over the past 24 hours, while open interest has contracted from $19B to $16B, confirming a meaningful deleveraging phase.

Key levels to monitor:

$68,000: Short-term technical support

$60,000: High-conviction macro support zone

Market structure over the next few sessions will determine whether this move represents a bear trap or continuation to lower liquidity levels.

CTA:

What’s your approach here?

🟢 Scaling in

🔴 Waiting for confirmation

#CryptoM

BTC0,01%

- Reward

- like

- Comment

- Repost

- Share

🧠 💥 CRYPTO MARKET INSIGHT | GATE.IO 💥

🧠 Most traders lose money when nothing is happening.

The crypto market right now isn’t about hype.

It’s about attention, patience, and positioning.

🔹 1️⃣ WHAT EXPERIENCED TRADERS FOCUS ON:

– Sentiment shifts before price moves

– Liquidity zones instead of predictions

– Risk management over constant trading

🔹 2️⃣ WHY PATIENCE PAYS:

– Choppy markets drain emotional traders

– Sideways action builds future momentum

– Overtrading quietly destroys accounts

🔹 3️⃣ KEY TAKEAWAY:

The best opportunities usually appear after boredom, not excitement.

🔹 🛡️ PROT

🧠 Most traders lose money when nothing is happening.

The crypto market right now isn’t about hype.

It’s about attention, patience, and positioning.

🔹 1️⃣ WHAT EXPERIENCED TRADERS FOCUS ON:

– Sentiment shifts before price moves

– Liquidity zones instead of predictions

– Risk management over constant trading

🔹 2️⃣ WHY PATIENCE PAYS:

– Choppy markets drain emotional traders

– Sideways action builds future momentum

– Overtrading quietly destroys accounts

🔹 3️⃣ KEY TAKEAWAY:

The best opportunities usually appear after boredom, not excitement.

🔹 🛡️ PROT

- Reward

- 1

- 2

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

4.66K Popularity

2.28K Popularity

1.09K Popularity

31.69K Popularity

246.4K Popularity

132.07K Popularity

201 Popularity

569 Popularity

177 Popularity

96 Popularity

119.84K Popularity

23.91K Popularity

20.74K Popularity

14.21K Popularity

1.58K Popularity

News

View MorePolygon, Ethena, and Nethermind join the Enterprise Ethereum Alliance

8 m

"On-chain investors" liquidated 70 million in cryptocurrency and precious metals positions, and shorted the US stock storage sector with a scale of 17 million.

10 m

ASTER (Aster) 24-hour increase of 9.55%

11 m

XRP Price Prediction: Analysts Reveal $7 Potential Target Price Using Silver Bull Market Model

15 m

Pi Coin News: Pi Network Mainnet Nodes Mandatory Upgrade Countdown, System Update Must Be Completed by February 15

19 m

Pin