🔥 US Government Shutdown Risk — Noise or Real Market Catalyst? 🏛️⚠️

After the U.S. Senate failed to pass a funding bill on Jan 29, the risk of a partial government shutdown is back on the table. Markets are watching closely 👀

So the key questions are:

👉 Is a shutdown actually likely?

👉 And how could this impact the crypto market?

🧠 How I See It:

📌 Shutdown Probability:

Historically, shutdown threats are often used as political leverage, not an end goal. A short-term or last-minute deal remains the base case — but headline risk stays elevated ⚡

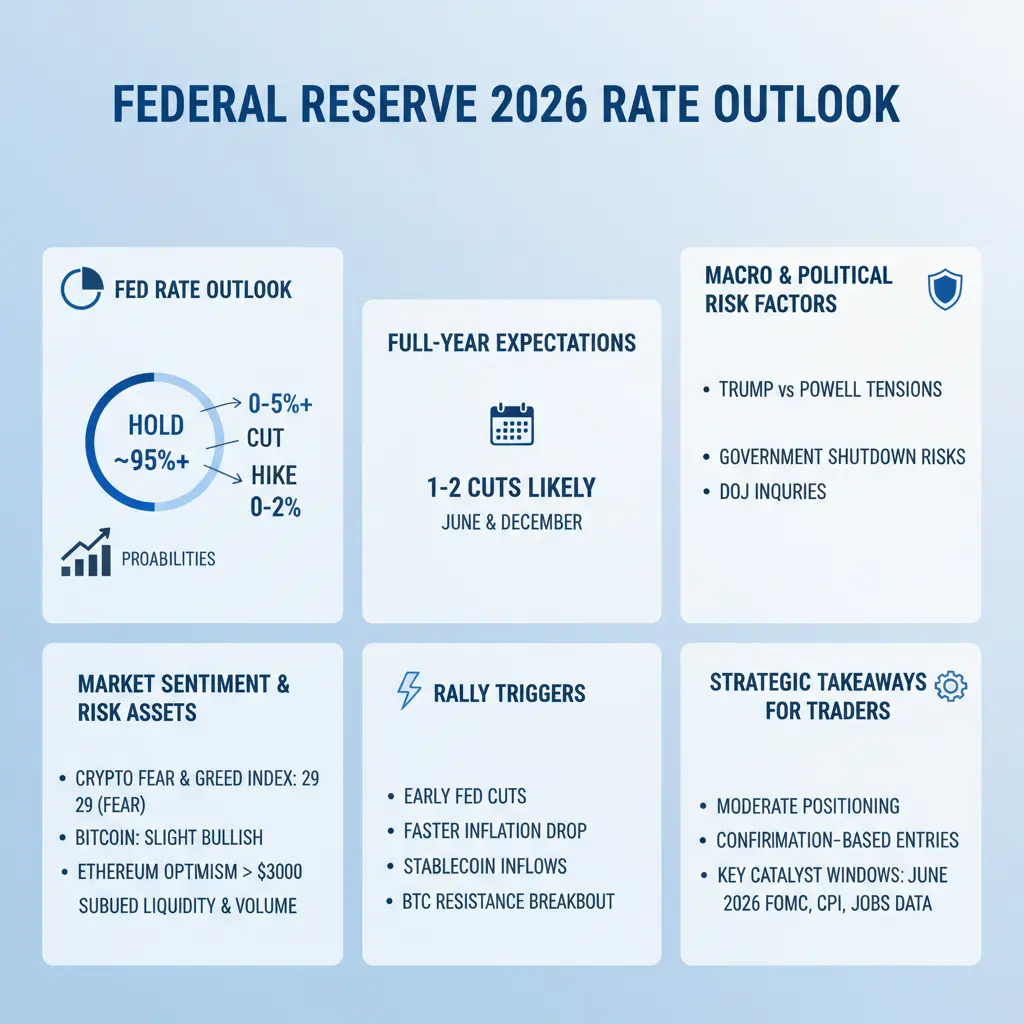

📊 Potential Impact on Crypto:

🟠 Short term:

Increased uncertainty → risk-off sentiment

BTC may see volatility spikes as a macro hedge narrative reappears

🟢 Medium term:

If shutdown pressure weakens USD confidence or delays policy clarity, BTC benefits more than altcoins

Altcoins likely stay defensive until macro visibility improves

🧩 Big Picture:

A shutdown isn’t automatically bullish or bearish — it’s a volatility catalyst.

Crypto reacts less to the event itself and more to liquidity, rates, and confidence.

💬 Do you see this shutdown risk as temporary political noise, or a real trigger for BTC volatility? Share your view 👇

⚠️ Risk Warning: Macro-driven news can cause sharp market swings. Always manage position size and risk carefully.

#USGovernmentShutdownRisk

After the U.S. Senate failed to pass a funding bill on Jan 29, the risk of a partial government shutdown is back on the table. Markets are watching closely 👀

So the key questions are:

👉 Is a shutdown actually likely?

👉 And how could this impact the crypto market?

🧠 How I See It:

📌 Shutdown Probability:

Historically, shutdown threats are often used as political leverage, not an end goal. A short-term or last-minute deal remains the base case — but headline risk stays elevated ⚡

📊 Potential Impact on Crypto:

🟠 Short term:

Increased uncertainty → risk-off sentiment

BTC may see volatility spikes as a macro hedge narrative reappears

🟢 Medium term:

If shutdown pressure weakens USD confidence or delays policy clarity, BTC benefits more than altcoins

Altcoins likely stay defensive until macro visibility improves

🧩 Big Picture:

A shutdown isn’t automatically bullish or bearish — it’s a volatility catalyst.

Crypto reacts less to the event itself and more to liquidity, rates, and confidence.

💬 Do you see this shutdown risk as temporary political noise, or a real trigger for BTC volatility? Share your view 👇

⚠️ Risk Warning: Macro-driven news can cause sharp market swings. Always manage position size and risk carefully.

#USGovernmentShutdownRisk