# BItcoin

6.65M

Crypto__iqraa

#CanBitcoinReclaim$70K? 🤔🔥

Bitcoin is consolidating…

RSI holding above 50 📊

Price hovering near resistance 🧱

Momentum building slowly ⚡

Bulls are trying to push higher 🟢

Bears are defending key levels 🔴

For $70K to be reclaimed, we need:

✅ Strong breakout above resistance

✅ High volume confirmation

✅ RSI pushing toward 60–70 zone

✅ Sustained higher highs structure

Without volume, breakouts can be fake ⚠️

With volume, momentum can explode 🚀

Right now, the market is preparing…

The pressure is building…

The real question is not if —

It’s when ⏳🔥

Are you ready for the move?

#Bitcoin #Cryp

Bitcoin is consolidating…

RSI holding above 50 📊

Price hovering near resistance 🧱

Momentum building slowly ⚡

Bulls are trying to push higher 🟢

Bears are defending key levels 🔴

For $70K to be reclaimed, we need:

✅ Strong breakout above resistance

✅ High volume confirmation

✅ RSI pushing toward 60–70 zone

✅ Sustained higher highs structure

Without volume, breakouts can be fake ⚠️

With volume, momentum can explode 🚀

Right now, the market is preparing…

The pressure is building…

The real question is not if —

It’s when ⏳🔥

Are you ready for the move?

#Bitcoin #Cryp

BTC-2,88%

- Reward

- like

- Comment

- Repost

- Share

Historically, #Bitcoin has always bottomed ~23 months after its previous all time high. We are now at 23 months since the last ATH 👀

Bullish! 🚀

#CryptoScam

$BTC

Bullish! 🚀

#CryptoScam

$BTC

BTC-2,88%

- Reward

- 2

- Comment

- Repost

- Share

#JaneStreet10AMSellOff

Market Analysis 🚨

This morning’s 10 AM sell-off driven by Jane Street flows wasn’t just a random dip — it reveals underlying market dynamics that traders need to understand.

📊 Market Breakdown:

BTC & ETH: Sharp intraday drop triggered by stop-loss cascades.

Exchange Flows: Significant outflows, indicating long-term holders are absorbing the sell pressure.

Funding Rates: Neutral to slightly negative → short squeeze potential remains intact.

💡 Insights for Traders & Creators:

Liquidity Zones: Major support levels ($65K–$66K for BTC) are key to monitor.

Institutional Ac

Market Analysis 🚨

This morning’s 10 AM sell-off driven by Jane Street flows wasn’t just a random dip — it reveals underlying market dynamics that traders need to understand.

📊 Market Breakdown:

BTC & ETH: Sharp intraday drop triggered by stop-loss cascades.

Exchange Flows: Significant outflows, indicating long-term holders are absorbing the sell pressure.

Funding Rates: Neutral to slightly negative → short squeeze potential remains intact.

💡 Insights for Traders & Creators:

Liquidity Zones: Major support levels ($65K–$66K for BTC) are key to monitor.

Institutional Ac

- Reward

- 5

- 2

- Repost

- Share

StylishKuri :

:

To The Moon 🌕View More

$BTC / $USD Update

Caught the dip before the small pump this morning — exactly as planned.

No stress here. I’m patiently waiting for better long opportunities lower if price gives us the move.

Let the market come to you.

#BTC #Bitcoin #Crypto #CanBitcoinReclaim$70K? #BuyTheDipOrWaitNow?

Caught the dip before the small pump this morning — exactly as planned.

No stress here. I’m patiently waiting for better long opportunities lower if price gives us the move.

Let the market come to you.

#BTC #Bitcoin #Crypto #CanBitcoinReclaim$70K? #BuyTheDipOrWaitNow?

BTC-2,88%

- Reward

- like

- Comment

- Repost

- Share

#BitcoinBouncesBack

February, surging from intraday lows near $62,964–$63,000 to trade firmly above $68,500–$69,000 in just 24–48 hours. The move represents a 7–11%+ rally from trough levels, liquidating more than $400–500 million in short positions in a single session and forcing a cascade of covering across perpetual futures and spot markets. This classic relief rally has shifted sentiment from capitulation fears back toward cautious optimism, though the broader cycle correction remains intact with BTC still down ~45% from late-2025 peaks above $126,000.

The rebound is driven by a combinat

February, surging from intraday lows near $62,964–$63,000 to trade firmly above $68,500–$69,000 in just 24–48 hours. The move represents a 7–11%+ rally from trough levels, liquidating more than $400–500 million in short positions in a single session and forcing a cascade of covering across perpetual futures and spot markets. This classic relief rally has shifted sentiment from capitulation fears back toward cautious optimism, though the broader cycle correction remains intact with BTC still down ~45% from late-2025 peaks above $126,000.

The rebound is driven by a combinat

- Reward

- 2

- Comment

- Repost

- Share

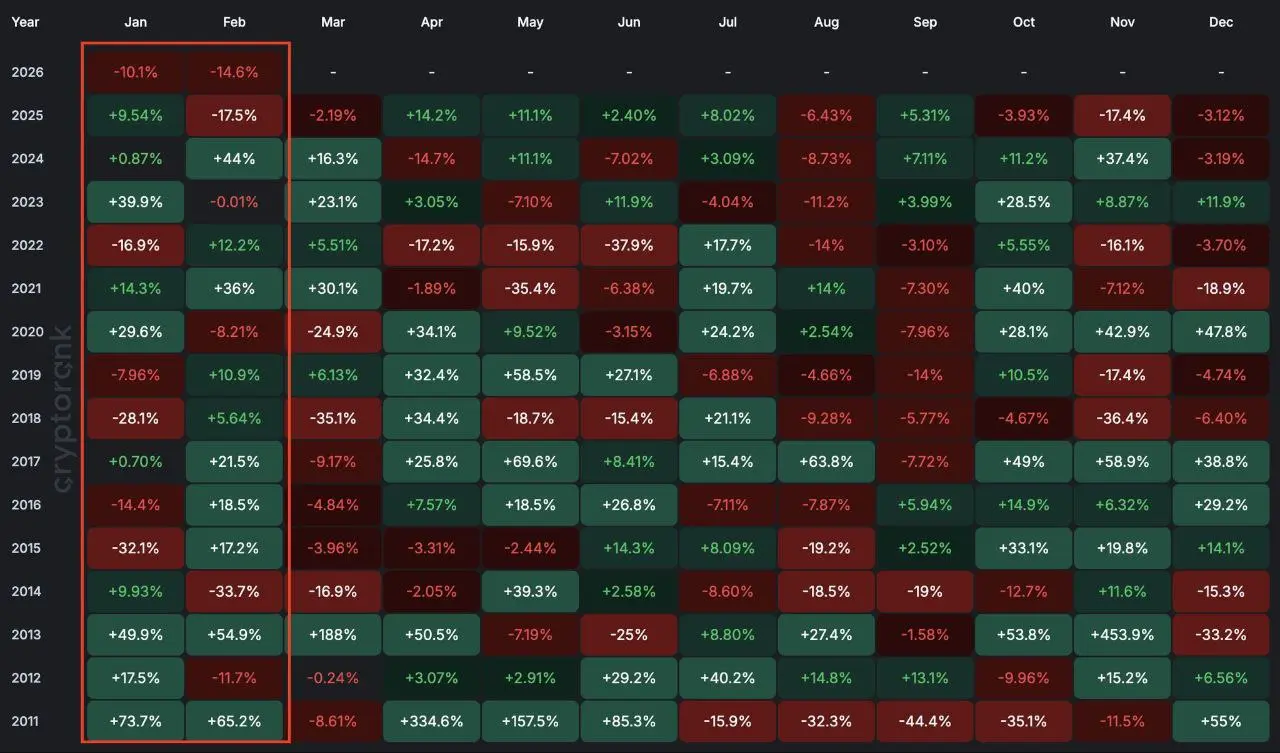

#Bitcoin has never closed both January and February in the RED in its entire history.

#bitcoin #GateSquare$50KRedPacketGiveaway #BuyTheDipOrWaitNow?

#bitcoin #GateSquare$50KRedPacketGiveaway #BuyTheDipOrWaitNow?

BTC-2,88%

- Reward

- 1

- Comment

- Repost

- Share

📊 Market Giants Focus – BTC & ETH Power Setup Guide

🚀 When the market turns uncertain, smart money often rotates into major assets — and right now, strong structure is building in both leaders: Bitcoin (BTC) and Ethereum (ETH).

---

🟠 BTC – The Liquidity King

BTC defines overall market direction.

If Bitcoin delivers a strong breakout with high volume, altcoins typically follow.

🔹 Bullish Scenario:

• Higher high with a strong daily close

• Continued institutional inflows

• Stable or rising BTC dominance

🔹 Bearish Scenario:

• Clear rejection at resistance

• Liquidity sweep below key support

🚀 When the market turns uncertain, smart money often rotates into major assets — and right now, strong structure is building in both leaders: Bitcoin (BTC) and Ethereum (ETH).

---

🟠 BTC – The Liquidity King

BTC defines overall market direction.

If Bitcoin delivers a strong breakout with high volume, altcoins typically follow.

🔹 Bullish Scenario:

• Higher high with a strong daily close

• Continued institutional inflows

• Stable or rising BTC dominance

🔹 Bearish Scenario:

• Clear rejection at resistance

• Liquidity sweep below key support

- Reward

- 2

- Comment

- Repost

- Share

Prediction: The Next 10x Won’t Be Where You’re Looking

Most traders are watching the same charts.

The same top coins.

The same influencers.

And that’s exactly why they’ll miss the next big move.

When a sector becomes “obvious”…

It’s usually crowded.

The real explosive moves start when: • Sentiment is low

• Volume is dry

• No one is talking about it

• Smart capital is accumulating quietly

By the time a narrative trends on social media, risk/reward has already shifted.

The market rewards positioning not popularity.

Ask yourself:

Are you researching where attention is going…

Or are you just follo

Most traders are watching the same charts.

The same top coins.

The same influencers.

And that’s exactly why they’ll miss the next big move.

When a sector becomes “obvious”…

It’s usually crowded.

The real explosive moves start when: • Sentiment is low

• Volume is dry

• No one is talking about it

• Smart capital is accumulating quietly

By the time a narrative trends on social media, risk/reward has already shifted.

The market rewards positioning not popularity.

Ask yourself:

Are you researching where attention is going…

Or are you just follo

BTC-2,88%

- Reward

- like

- Comment

- Repost

- Share

🚨 Market Update | February 19

BTC: ~$66,900

ETH: ~$1,980

Markets remain steady but cautious as volatility continues to influence short-term price action.

🔹 Bitcoin (BTC)

BTC is trading near the $67K level, holding within a consolidation structure after recent downside pressure.

Momentum remains balanced, with no confirmed breakout in either direction.

🔹 Ethereum (ETH)

ETH continues to fluctuate just below the $2,000 psychological level.

Price action reflects controlled movement rather than strong directional conviction.

🔹 Today’s Environment

• Elevated but controlled volatility

• Neutral s

BTC: ~$66,900

ETH: ~$1,980

Markets remain steady but cautious as volatility continues to influence short-term price action.

🔹 Bitcoin (BTC)

BTC is trading near the $67K level, holding within a consolidation structure after recent downside pressure.

Momentum remains balanced, with no confirmed breakout in either direction.

🔹 Ethereum (ETH)

ETH continues to fluctuate just below the $2,000 psychological level.

Price action reflects controlled movement rather than strong directional conviction.

🔹 Today’s Environment

• Elevated but controlled volatility

• Neutral s

- Reward

- 10

- 13

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

361.16K Popularity

22.22K Popularity

64.76K Popularity

15.74K Popularity

466.15K Popularity

3.96K Popularity

3.51K Popularity

1.86K Popularity

1.06K Popularity

80.65K Popularity

42.26K Popularity

97.54K Popularity

14.55K Popularity

67.35K Popularity

3.09K Popularity

News

View MoreTraditional Finance Alert: NFLX Increased by Over 14%

8 m

Lobster increased by 872.32% after launching Alpha, current price 0.0018772 USDT

1 h

Data: If BTC breaks through $68,773, the total liquidation strength of mainstream CEX short positions will reach $1.759 billion.

2 h

Data: If ETH breaks through $2,020, the total liquidation strength of short positions on mainstream CEXs will reach $758 million.

2 h

Traditional Finance Alert: NFLX Surges Over 12%

2 h

Pin