# SEConTokenizedSecurities

4.79K

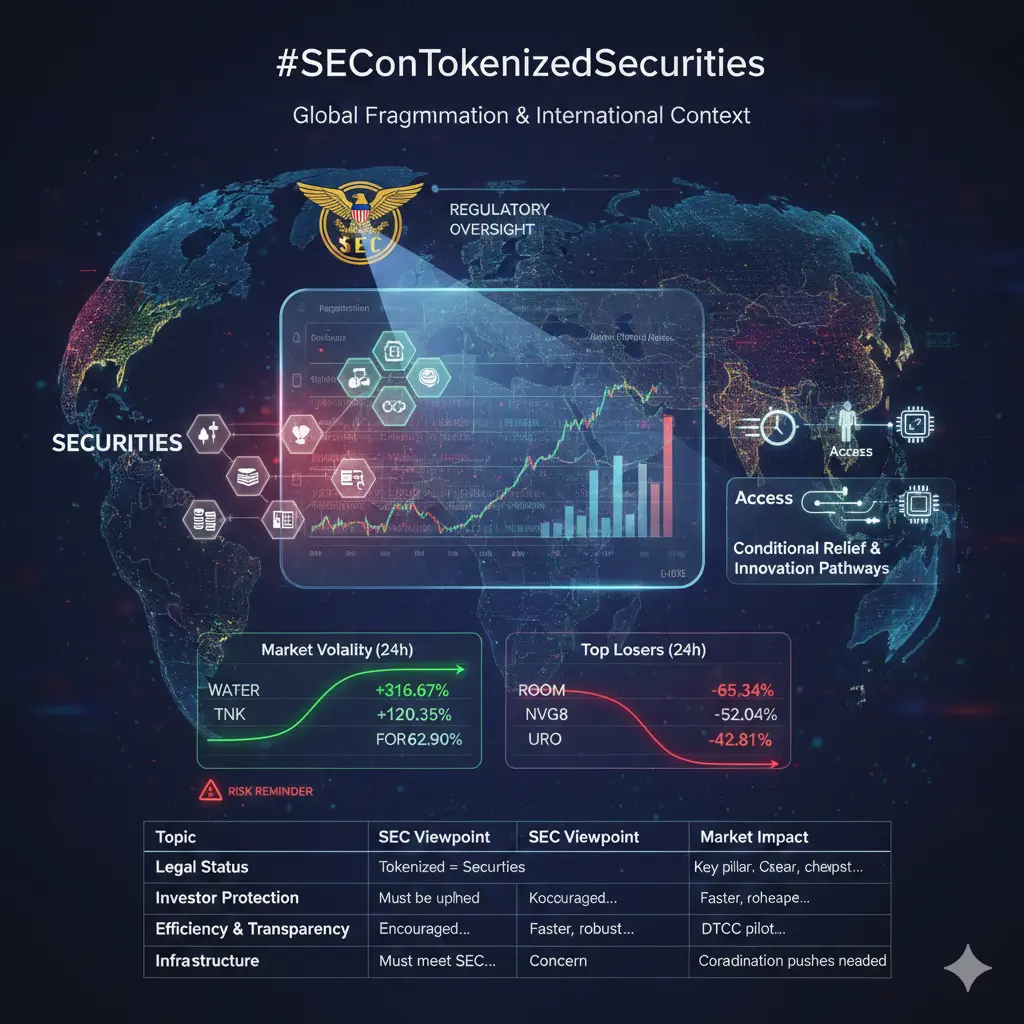

The SEC confirmed tokenization doesn’t change securities regulation. Does this signal a more institution-friendly phase for RWA, and which sectors stand to benefit first?

HighAmbition

#SEConTokenizedSecurities

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

- Reward

- 15

- 17

- Repost

- Share

xxx40xxx :

:

Buy To Earn 💎View More

#SEConTokenizedSecurities The Future Shape of Digital Finance

The evolution of tokenized securities is entering a defining phase where technology is no longer the main challenge — structure, trust, and governance are. As traditional finance and blockchain-based systems continue to intersect, markets are beginning to understand that tokenization is not about avoiding regulation, but about upgrading how regulated assets move, settle, and interact in a digital economy. This transition marks a shift from experimentation toward institutional-grade adoption.

In the coming period, the SEC’s role is e

The evolution of tokenized securities is entering a defining phase where technology is no longer the main challenge — structure, trust, and governance are. As traditional finance and blockchain-based systems continue to intersect, markets are beginning to understand that tokenization is not about avoiding regulation, but about upgrading how regulated assets move, settle, and interact in a digital economy. This transition marks a shift from experimentation toward institutional-grade adoption.

In the coming period, the SEC’s role is e

- Reward

- 1

- 3

- Repost

- Share

CryptoSelf :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities

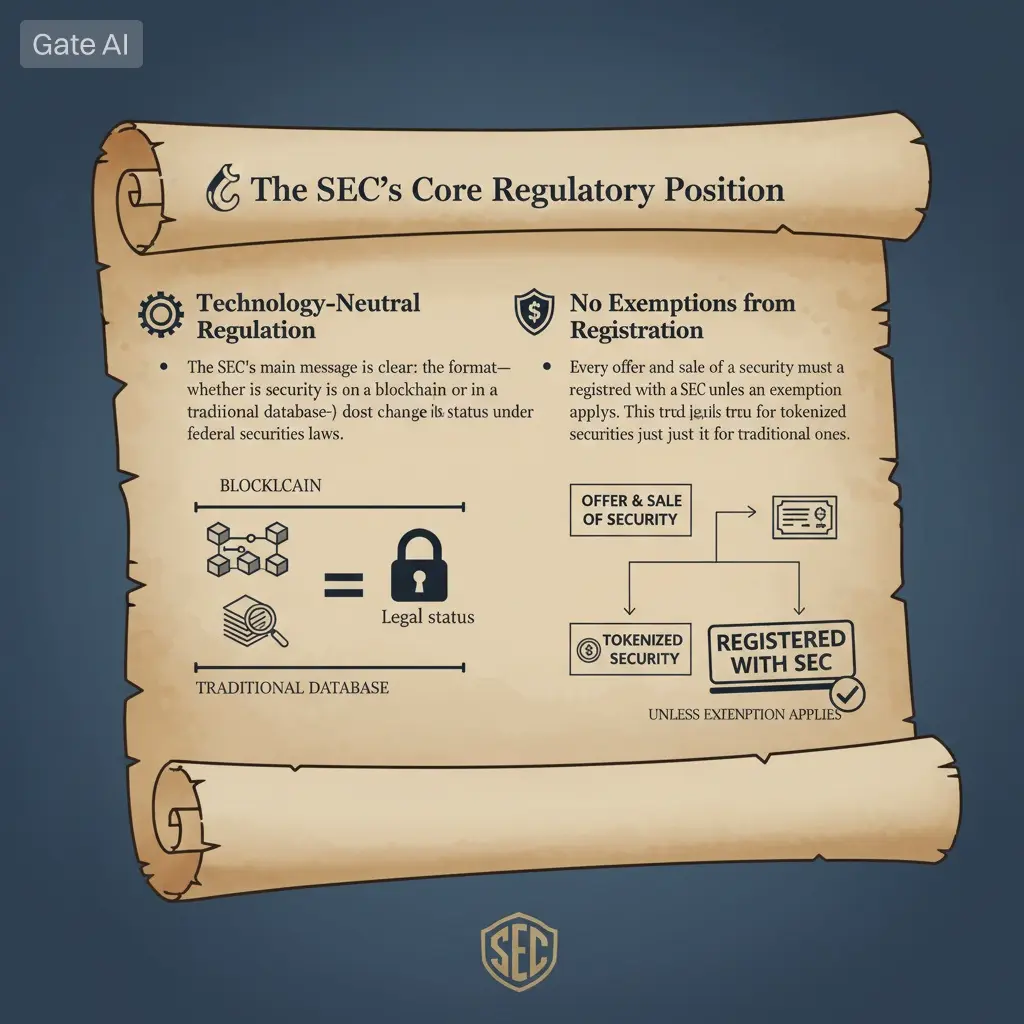

Based on the SEC's recent statement, a tokenized security is a traditional financial instrument (like a stock) that exists as a crypto asset on a blockchain. The core rule is that using blockchain does not change how securities laws apply. Below is a detailed breakdown of the key points and categories from the SEC.

📜 The SEC's Core Regulatory Position

· Technology-Neutral Regulation: The SEC's main message is clear: the format—whether a security is recorded on a blockchain or in a traditional database—does not change its legal status under federal securities laws.

·

Based on the SEC's recent statement, a tokenized security is a traditional financial instrument (like a stock) that exists as a crypto asset on a blockchain. The core rule is that using blockchain does not change how securities laws apply. Below is a detailed breakdown of the key points and categories from the SEC.

📜 The SEC's Core Regulatory Position

· Technology-Neutral Regulation: The SEC's main message is clear: the format—whether a security is recorded on a blockchain or in a traditional database—does not change its legal status under federal securities laws.

·

- Reward

- 2

- 1

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊#SEConTokenizedSecurities

Based on the SEC's recent statement, a tokenized security is a traditional financial instrument (like a stock) that exists as a crypto asset on a blockchain. The core rule is that using blockchain does not change how securities laws apply. Below is a detailed breakdown of the key points and categories from the SEC.

📜 The SEC's Core Regulatory Position

· Technology-Neutral Regulation: The SEC's main message is clear: the format—whether a security is recorded on a blockchain or in a traditional database—does not change its legal status under federal securities laws.

·

Based on the SEC's recent statement, a tokenized security is a traditional financial instrument (like a stock) that exists as a crypto asset on a blockchain. The core rule is that using blockchain does not change how securities laws apply. Below is a detailed breakdown of the key points and categories from the SEC.

📜 The SEC's Core Regulatory Position

· Technology-Neutral Regulation: The SEC's main message is clear: the format—whether a security is recorded on a blockchain or in a traditional database—does not change its legal status under federal securities laws.

·

- Reward

- 3

- 7

- Repost

- Share

GateUser-08c98d27 :

:

bzzbjaView More

#SEConTokenizedSecurities

🔍 Market Stress Test: BTC & ETH Under Pressure

The past 24 hours delivered a sharp reality check for crypto markets. BTC and ETH both saw aggressive sell-offs, rising volatility, and a clear shift toward risk-off behavior. With the Fear & Greed Index at 26 (Fear), market psychology is currently driven more by capital preservation than opportunity chasing.

📉 What’s Driving the Move?

The Fed keeping rates unchanged reinforced caution across risk assets.

Capital rotated toward safe havens like gold and silver, both hitting historic highs.

Liquidity thinned after the s

🔍 Market Stress Test: BTC & ETH Under Pressure

The past 24 hours delivered a sharp reality check for crypto markets. BTC and ETH both saw aggressive sell-offs, rising volatility, and a clear shift toward risk-off behavior. With the Fear & Greed Index at 26 (Fear), market psychology is currently driven more by capital preservation than opportunity chasing.

📉 What’s Driving the Move?

The Fed keeping rates unchanged reinforced caution across risk assets.

Capital rotated toward safe havens like gold and silver, both hitting historic highs.

Liquidity thinned after the s

- Reward

- 4

- 7

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities

The U.S. Securities and Exchange Commission (SEC) provided significant clarity on tokenized securities in a new statement issued on January 28, 2026. This decision is regarded as a critical turning point for global markets at the intersection of crypto assets and traditional finance.

Summary of the SEC’s New Guidance

Definition of Tokenized Securities: Financial instruments recorded on crypto networks that fall under the scope of federal securities laws.

Two Categories:

Issuer-Sponsored Tokens: Tokens issued directly or authorized by the company.

Third-Party "Synt

The U.S. Securities and Exchange Commission (SEC) provided significant clarity on tokenized securities in a new statement issued on January 28, 2026. This decision is regarded as a critical turning point for global markets at the intersection of crypto assets and traditional finance.

Summary of the SEC’s New Guidance

Definition of Tokenized Securities: Financial instruments recorded on crypto networks that fall under the scope of federal securities laws.

Two Categories:

Issuer-Sponsored Tokens: Tokens issued directly or authorized by the company.

Third-Party "Synt

- Reward

- 6

- 4

- Repost

- Share

CryptoSelf :

:

Buy To Earn 💎View More

🏦 #SEConTokenizedSecurities: A New Era Begins! 🚨

The SEC has finally broken its silence on tokenized securities (RWA). The line between digital assets and traditional finance is now clearer than ever. Here’s the key takeaways from today’s update:

💎 1. “Format Changed, Law Didn’t”

The SEC made it clear: if a traditional security (stocks or bonds) is tokenized on a blockchain, it still remains a security. Changing the format does not remove regulatory obligations like registration or disclosure.

🏗️ 2. Project Crypto Rollout

Under the SEC’s new Project Crypto, starting Jan 2026, an “Innovatio

The SEC has finally broken its silence on tokenized securities (RWA). The line between digital assets and traditional finance is now clearer than ever. Here’s the key takeaways from today’s update:

💎 1. “Format Changed, Law Didn’t”

The SEC made it clear: if a traditional security (stocks or bonds) is tokenized on a blockchain, it still remains a security. Changing the format does not remove regulatory obligations like registration or disclosure.

🏗️ 2. Project Crypto Rollout

Under the SEC’s new Project Crypto, starting Jan 2026, an “Innovatio

RWA-2,56%

- Reward

- 5

- 3

- Repost

- Share

EagleEye :

:

Superb work! I love how clearly and creatively this is presented.View More

#SEConTokenizedSecurities

The U.S. Securities and Exchange Commission (SEC) provided significant clarity on tokenized securities in a new statement issued on January 28, 2026. This decision is regarded as a critical turning point for global markets at the intersection of crypto assets and traditional finance.

Summary of the SEC’s New Guidance

Definition of Tokenized Securities: Financial instruments recorded on crypto networks that fall under the scope of federal securities laws.

Two Categories:

Issuer-Sponsored Tokens: Tokens issued directly or authorized by the company.

Third-Party "Synt

The U.S. Securities and Exchange Commission (SEC) provided significant clarity on tokenized securities in a new statement issued on January 28, 2026. This decision is regarded as a critical turning point for global markets at the intersection of crypto assets and traditional finance.

Summary of the SEC’s New Guidance

Definition of Tokenized Securities: Financial instruments recorded on crypto networks that fall under the scope of federal securities laws.

Two Categories:

Issuer-Sponsored Tokens: Tokens issued directly or authorized by the company.

Third-Party "Synt

- Reward

- 1

- Comment

- Repost

- Share

#SEConTokenizedSecurities The SEC Lays Down the Law for Tokenized Securities 🏛️⛓️

The regulatory fog is finally lifting. Yesterday, the SEC released a definitive statement clarifying that while the format of a security may change (from paper/digital to token), the legal obligations do not. The New Framework:

Issuer-Sponsored Tokens: These are the "gold standard." The company natively issues tokens where the blockchain is the official shareholder register.

Third-Party Tokenization: Includes custodial models (tokens representing shares held elsewhere) and synthetic models. The SEC warned these

The regulatory fog is finally lifting. Yesterday, the SEC released a definitive statement clarifying that while the format of a security may change (from paper/digital to token), the legal obligations do not. The New Framework:

Issuer-Sponsored Tokens: These are the "gold standard." The company natively issues tokens where the blockchain is the official shareholder register.

Third-Party Tokenization: Includes custodial models (tokens representing shares held elsewhere) and synthetic models. The SEC warned these

- Reward

- 4

- 3

- Repost

- Share

MoonGirl :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities

SEC Confirms Tokenized Securities Still Subject to Regulation: What It Means for RWAs and Institutional Adoption

The SEC has clarified that tokenization does not exempt securities from existing regulations. While this may initially appear restrictive, it could mark the beginning of a more institution-friendly phase for Real-World Assets (RWA) on blockchain.

Regulatory Clarity: A Double-Edged Sword

Tokenized assets remain under the same legal framework as traditional securities. This provides clear rules for issuers and investors, reducing legal uncertainty and givin

SEC Confirms Tokenized Securities Still Subject to Regulation: What It Means for RWAs and Institutional Adoption

The SEC has clarified that tokenization does not exempt securities from existing regulations. While this may initially appear restrictive, it could mark the beginning of a more institution-friendly phase for Real-World Assets (RWA) on blockchain.

Regulatory Clarity: A Double-Edged Sword

Tokenized assets remain under the same legal framework as traditional securities. This provides clear rules for issuers and investors, reducing legal uncertainty and givin

RWA-2,56%

- Reward

- 10

- 12

- Repost

- Share

Discovery :

:

Thank you for the helpful information and sharing!View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

15.55K Popularity

13.71K Popularity

11.87K Popularity

4.79K Popularity

46.36K Popularity

3.07K Popularity

16.8K Popularity

3.22K Popularity

80.78K Popularity

27.87K Popularity

87.27K Popularity

23.76K Popularity

17.48K Popularity

14.02K Popularity

202.69K Popularity

News

View MoreTrump threatened to impose a 50% tariff on Canadian aircraft

2 m

Trump declared a national emergency and imposed tariffs on countries that send oil to Cuba

14 m

Data: 700 BTC were transferred out of an anonymous address and transferred to another anonymous address after the transfer

14 m

UBS maintained its bullish stance on gold and raised its target price to $6,200

17 m

The CLARITY bill passed with partisan voting, and the bipartisan divide is getting worse

30 m

Pin