Significant progress has been made in the US regarding cryptocurrency market structure legislation, but the bill has not yet been enacted. Here is the most accurate and up-to-date information:

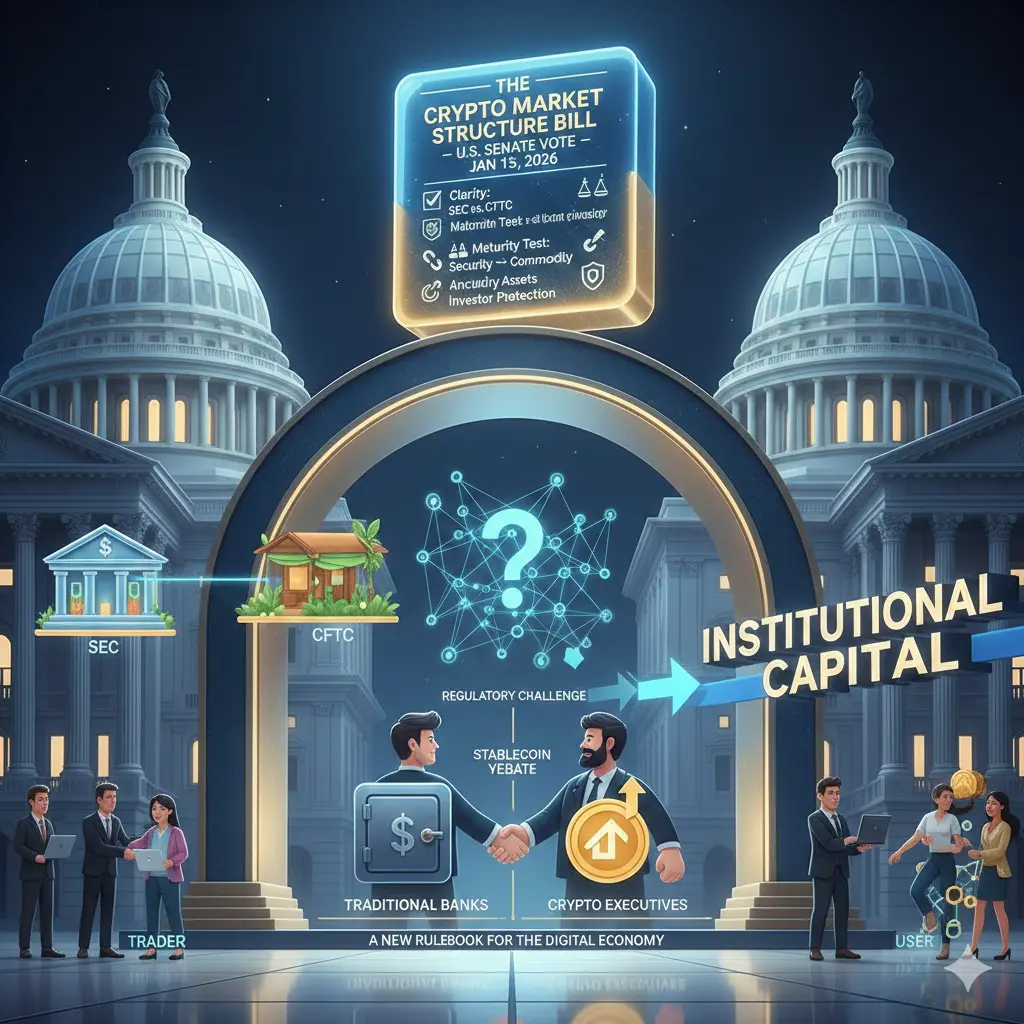

House of Representatives: In July 2025, the Digital Asset Market Clarity Act (CLARITY Act) passed with bipartisan support. This was a major success for the industry and aimed to clarify the separation of powers between the CFTC and the SEC, and to define most crypto assets as “digital commodities.”

Senate: It has not yet reached a full Senate vote. Current situation:

Senate Agriculture Committee: On January 29, 2026, it passed its own version, the Digital Commodity Intermediaries Act, with a bipartisan vote (12 Republicans yes – 11 Democrats no). This was the first time in Senate history that a crypto market structure bill passed a committee.

Senate Banking Committee: It prepared its own version, but the markup process was delayed. Issues such as stablecoin yields, the dispute between banks and crypto companies, and how DeFi will be regulated remain unresolved. General process: The texts from the two committees will be combined, voted on in the Senate plenary session (since 60 votes are needed to overcome the filibuster), reached an agreement with the House, and then sent to the President for signature. Currently, none of these stages are complete.

SEC & CFTC's stance: On January 29, 2026, SEC Chairman Paul Atkins and CFTC Chairman Mike Selig appeared on a joint CNBC program, conveying the message that "we can codify sensible rules," and "we can make the US a leader in crypto." They announced the launch of a joint "Project Crypto" initiative. However, neither used phrases like "House passed, Senate is moving forward, we are eagerly awaiting." Instead, they emphasized that the law is still in Congress and that the institutions are preparing to implement it.

House of Representatives: In July 2025, the Digital Asset Market Clarity Act (CLARITY Act) passed with bipartisan support. This was a major success for the industry and aimed to clarify the separation of powers between the CFTC and the SEC, and to define most crypto assets as “digital commodities.”

Senate: It has not yet reached a full Senate vote. Current situation:

Senate Agriculture Committee: On January 29, 2026, it passed its own version, the Digital Commodity Intermediaries Act, with a bipartisan vote (12 Republicans yes – 11 Democrats no). This was the first time in Senate history that a crypto market structure bill passed a committee.

Senate Banking Committee: It prepared its own version, but the markup process was delayed. Issues such as stablecoin yields, the dispute between banks and crypto companies, and how DeFi will be regulated remain unresolved. General process: The texts from the two committees will be combined, voted on in the Senate plenary session (since 60 votes are needed to overcome the filibuster), reached an agreement with the House, and then sent to the President for signature. Currently, none of these stages are complete.

SEC & CFTC's stance: On January 29, 2026, SEC Chairman Paul Atkins and CFTC Chairman Mike Selig appeared on a joint CNBC program, conveying the message that "we can codify sensible rules," and "we can make the US a leader in crypto." They announced the launch of a joint "Project Crypto" initiative. However, neither used phrases like "House passed, Senate is moving forward, we are eagerly awaiting." Instead, they emphasized that the law is still in Congress and that the institutions are preparing to implement it.