# BiggestCryptoOutflowsSince2022

51.41K

neesa04

🔍 #BiggestCryptoOutflowsSince2022 — What It Means for Investors

Since 2022, the crypto market has experienced some of the largest outflows in history — signaling major shifts in investor sentiment and market dynamics.

📉 What Are Crypto Outflows?

Outflows occur when more investors withdraw funds from crypto funds and exchanges than they deposit. Large outflows often reflect fear, profit-taking, or risk aversion.

📊 Why It Matters:

• Indicates weakening confidence in certain assets

• Can put selling pressure on prices

• Reveals capital rotation into safer or alternative investments

🧠 Key Take

Since 2022, the crypto market has experienced some of the largest outflows in history — signaling major shifts in investor sentiment and market dynamics.

📉 What Are Crypto Outflows?

Outflows occur when more investors withdraw funds from crypto funds and exchanges than they deposit. Large outflows often reflect fear, profit-taking, or risk aversion.

📊 Why It Matters:

• Indicates weakening confidence in certain assets

• Can put selling pressure on prices

• Reveals capital rotation into safer or alternative investments

🧠 Key Take

- Reward

- 1

- Comment

- Repost

- Share

#BiggestCryptoOutflowsSince2022

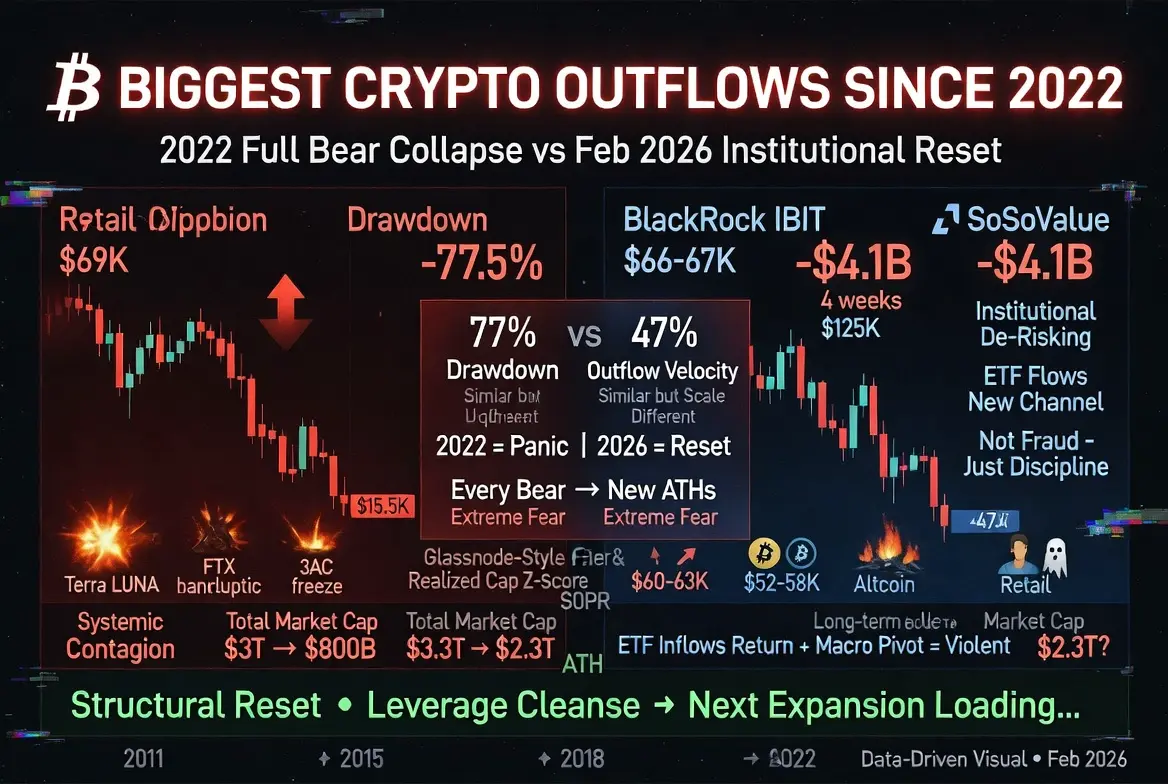

As of mid-February 2026, with Bitcoin hovering around $66,000–$67,000, the crypto market is experiencing the most aggressive capital outflow phase since the 2022 bear market collapse. According to on-chain data from Glassnode (highlighted by analyst Chris Beamish), the 30-day aggregate realized market value capital flow has turned sharply negative — the fastest outflow velocity recorded since the Terra/FTX/3AC contagion cycle.

But here’s the real question:

Is this a full 2022 repeat… or a structurally different correction in a more mature, institutional market?

As of mid-February 2026, with Bitcoin hovering around $66,000–$67,000, the crypto market is experiencing the most aggressive capital outflow phase since the 2022 bear market collapse. According to on-chain data from Glassnode (highlighted by analyst Chris Beamish), the 30-day aggregate realized market value capital flow has turned sharply negative — the fastest outflow velocity recorded since the Terra/FTX/3AC contagion cycle.

But here’s the real question:

Is this a full 2022 repeat… or a structurally different correction in a more mature, institutional market?

- Reward

- 8

- 8

- Repost

- Share

Yunna :

:

To The Moon 🌕View More

🔍 **#BiggestCryptoOutflowsSince2022 — What Investors Should Know**

The crypto market has seen some of its largest outflows since 2022 — signaling shifts in sentiment, strategy, and opportunity.

📊 **Top 5 Key Takeaways:**

1. **Short-term caution, long-term potential** — Outflows may reflect fear, but not necessarily market collapse.

2. **Profit-taking & rebalancing** — Capital moves toward stable assets, emerging sectors, or institutional strategies.

3. **Market sentiment insights** — Large outflows reveal investor confidence levels and risk appetite.

4. **Focus on fundamentals** — Track proj

The crypto market has seen some of its largest outflows since 2022 — signaling shifts in sentiment, strategy, and opportunity.

📊 **Top 5 Key Takeaways:**

1. **Short-term caution, long-term potential** — Outflows may reflect fear, but not necessarily market collapse.

2. **Profit-taking & rebalancing** — Capital moves toward stable assets, emerging sectors, or institutional strategies.

3. **Market sentiment insights** — Large outflows reveal investor confidence levels and risk appetite.

4. **Focus on fundamentals** — Track proj

- Reward

- 3

- Comment

- Repost

- Share

#BiggestCryptoOutflowsSince2022 📉 Market Snapshot

Current Price: Bitcoin is hovering around $66,500, struggling to find a solid floor after dropping nearly 47% from its October 2025 all-time high of ~$126,000.

Fear & Greed Index: Currently sitting at a dismal 8–9, confirming the "Extreme Fear" you mentioned.

Weekly Performance: The 22.2% drop over the last week is indeed one of the most aggressive technical breakdowns in Bitcoin's history.🛡️ Critical Levels to Watch

Primary Support ($60,000 – $62,000): This is the "must-hold" zone. A break below this could psychologically open the door to th

Current Price: Bitcoin is hovering around $66,500, struggling to find a solid floor after dropping nearly 47% from its October 2025 all-time high of ~$126,000.

Fear & Greed Index: Currently sitting at a dismal 8–9, confirming the "Extreme Fear" you mentioned.

Weekly Performance: The 22.2% drop over the last week is indeed one of the most aggressive technical breakdowns in Bitcoin's history.🛡️ Critical Levels to Watch

Primary Support ($60,000 – $62,000): This is the "must-hold" zone. A break below this could psychologically open the door to th

BTC-1,88%

- Reward

- 6

- 8

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Wishing you abundant wealth and great success in the Year of the Horse 🐴✨View More

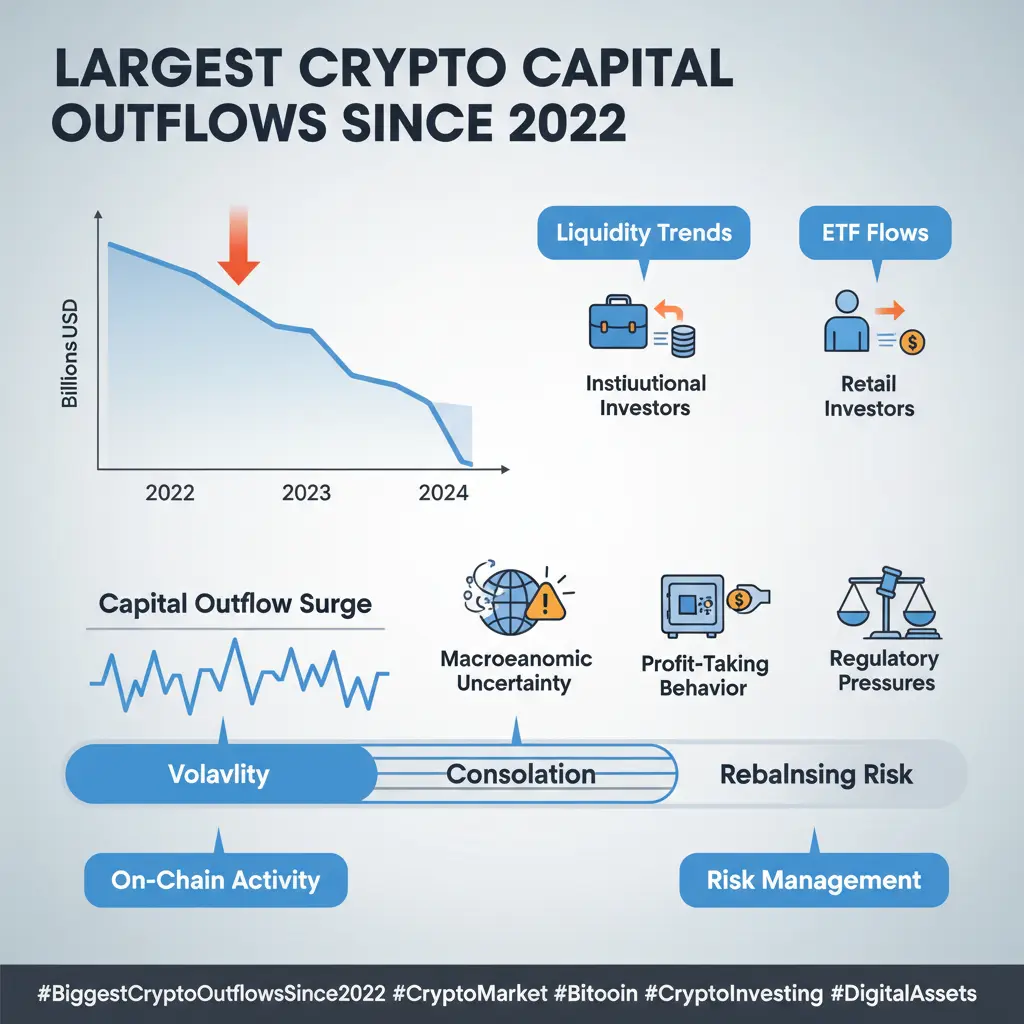

The crypto market is witnessing its largest wave of capital outflows since 2022, signaling a cautious shift in investor sentiment across digital assets. Recent data shows that institutional and retail investors alike are pulling funds from crypto investment products amid macroeconomic uncertainty, profit-taking behavior, and evolving regulatory pressures. While such outflows often create short-term volatility, they also reflect a natural market cycle where participants rebalance risk exposure after strong rallies.

Historically, periods of significant outflows have not always indicated long-ter

Historically, periods of significant outflows have not always indicated long-ter

BTC-1,88%

- Reward

- 4

- 2

- Repost

- Share

HighAmbition :

:

good information about cryptoView More

#BiggestCryptoOutflowsSince2022 Biggest Crypto Outflows Since 2022 💸📉

Crypto investors are moving their funds faster than ever. Data shows that since 2022, the crypto market has witnessed some of the largest outflows in history, reflecting a mix of profit-taking, market uncertainty, and regulatory pressures.

🔹 Key Highlights:

Institutional wallets are shifting funds away from major exchanges.

Stablecoins and Bitcoin saw significant net outflows in 2025.

Investor sentiment is cautious, awaiting macroeconomic clarity.

💡 What This Means:

Potential short-term volatility in crypto prices.

Oppor

Crypto investors are moving their funds faster than ever. Data shows that since 2022, the crypto market has witnessed some of the largest outflows in history, reflecting a mix of profit-taking, market uncertainty, and regulatory pressures.

🔹 Key Highlights:

Institutional wallets are shifting funds away from major exchanges.

Stablecoins and Bitcoin saw significant net outflows in 2025.

Investor sentiment is cautious, awaiting macroeconomic clarity.

💡 What This Means:

Potential short-term volatility in crypto prices.

Oppor

- Reward

- 3

- 1

- Repost

- Share

Yunna :

:

To The Moon 🌕#BiggestCryptoOutflowsSince2022

#BiggestCryptoOutflowsSince2022

The cryptocurrency markets in February 2026 are witnessing one of the deepest institutional capital withdrawals in recent years. Reaching an intensity not seen since the systemic shocks of 2022, these fund outflows signal a new search for equilibrium within the digital asset ecosystem.

A Historic Fracture in Capital Flows

As of mid-February, outflows from crypto investment products have closed their fourth consecutive week in negative territory, reaching a staggering total volume of $3.8 billion. This data clearly demonstrates th

#BiggestCryptoOutflowsSince2022

The cryptocurrency markets in February 2026 are witnessing one of the deepest institutional capital withdrawals in recent years. Reaching an intensity not seen since the systemic shocks of 2022, these fund outflows signal a new search for equilibrium within the digital asset ecosystem.

A Historic Fracture in Capital Flows

As of mid-February, outflows from crypto investment products have closed their fourth consecutive week in negative territory, reaching a staggering total volume of $3.8 billion. This data clearly demonstrates th

BTC-1,88%

- Reward

- 12

- 20

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

#BiggestCryptoOutflowsSince2022

The appearance of the largest crypto outflows since 2022 is not a random or isolated event; it is the result of multiple forces converging at the same time. Markets move in cycles, and capital flows are the clearest reflection of where risk appetite stands within those cycles. When outflows reach historical extremes, it usually means that positioning has become one-sided, expectations are being reset, and participants are reassessing their exposure to uncertainty. Rather than signaling collapse, these moments often mark transition phases where excess optimism i

The appearance of the largest crypto outflows since 2022 is not a random or isolated event; it is the result of multiple forces converging at the same time. Markets move in cycles, and capital flows are the clearest reflection of where risk appetite stands within those cycles. When outflows reach historical extremes, it usually means that positioning has become one-sided, expectations are being reset, and participants are reassessing their exposure to uncertainty. Rather than signaling collapse, these moments often mark transition phases where excess optimism i

- Reward

- 6

- 5

- Repost

- Share

Yunna :

:

To The Moon 🌕View More

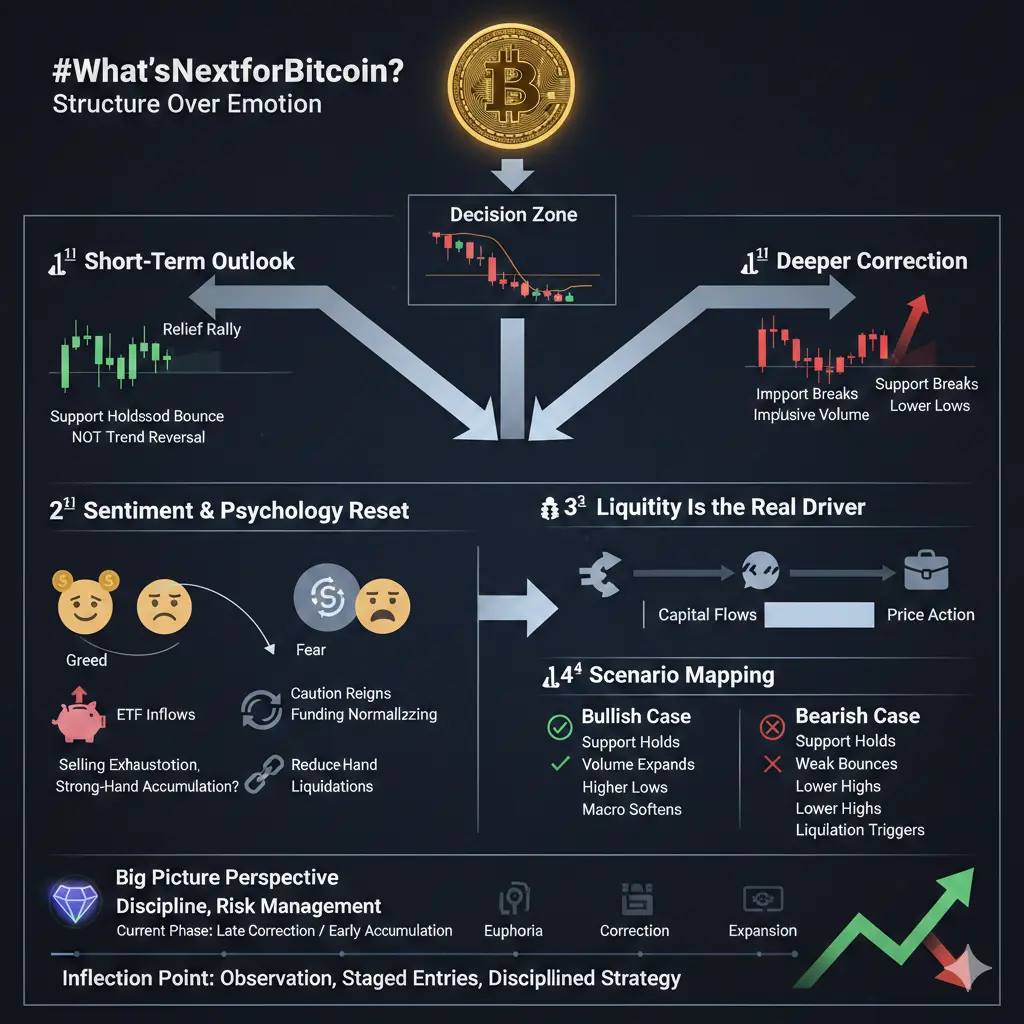

#What’sNextforBitcoin? What’sNextforBitcoin? Structural Crossroads for BTC

Bitcoin is currently at a critical juncture. Headlines, social chatter, or sudden macro developments may sway short-term sentiment, but true directional moves are determined by positioning, liquidity, and conviction. BTC is compressing near key support zones—a classic inflection point where the next major move will be dictated by how buyers and sellers interact rather than speculation or emotion.

📉 1️⃣ Short-Term Technical Outlook

If support levels hold, BTC may see a technical relief rally. Oversold conditions often t

Bitcoin is currently at a critical juncture. Headlines, social chatter, or sudden macro developments may sway short-term sentiment, but true directional moves are determined by positioning, liquidity, and conviction. BTC is compressing near key support zones—a classic inflection point where the next major move will be dictated by how buyers and sellers interact rather than speculation or emotion.

📉 1️⃣ Short-Term Technical Outlook

If support levels hold, BTC may see a technical relief rally. Oversold conditions often t

BTC-1,88%

- Reward

- 3

- 1

- Repost

- Share

Yunna :

:

To The Moon 🌕#What’sNextforBitcoin? Bitcoin (BTC) is at a structural crossroads. Headlines, social media hype, or sudden macro news may sway short-term sentiment, but true market direction is dictated by positioning, liquidity, and conviction. Currently, BTC is compressing near key support zones, a classic decision point where the next major move will be defined by how buyers and sellers interact — not by speculation or emotional reactions.

📉 1️⃣ Short-Term Technical Outlook

If major support levels hold, we can expect a technical relief rally. Oversold conditions often trigger short-term bounces as short

📉 1️⃣ Short-Term Technical Outlook

If major support levels hold, we can expect a technical relief rally. Oversold conditions often trigger short-term bounces as short

BTC-1,88%

- Reward

- 11

- 17

- Repost

- Share

Yunna :

:

To The Moon 🌕View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

219.63K Popularity

856.99K Popularity

51.41K Popularity

90.54K Popularity

465.38K Popularity

290.62K Popularity

60.45K Popularity

36.05K Popularity

23.79K Popularity

22.89K Popularity

23.16K Popularity

20.25K Popularity

22.14K Popularity

49.68K Popularity

News

View MoreStablecoin settlement company Ubyx is invested in by AB Xelerate, an accelerator under Arab Bank.

3 m

OpenEden: DNS hijacking issue has been resolved; smart contracts and reserve assets remain unaffected

17 m

Analyst: Weak institutional demand combined with CEX inflow pressure, Bitcoin market faces dual selling pressure

24 m

Data: The notional value of $40,000 put options expiring on February 27 has approached $500 million, indicating increased hedging demand.

29 m

ARTX increased by 51.54% after launching on Alpha, current price is 0.1946888198412952 USDT

29 m

Pin