# BTCVolatility

4.39K

MissCrypto

#BitcoinPriceWatch — Navigating Volatility & Understanding the Road Ahead 🚀

The Bitcoin market continues to capture attention with sharp movements, macro-driven reactions, and liquidity shifts. To succeed in this dynamic environment, it’s crucial to understand what’s happening behind the charts, not just the price on your screen.

🔍 Current Market Momentum

Bitcoin’s latest volatility—sudden dips, followed by swift recoveries—is shaped by real forces:

✔️ Macroeconomic Pressure

Interest rate decisions, inflation data, and geopolitical uncertainty continue to influence risk assets, including Bit

The Bitcoin market continues to capture attention with sharp movements, macro-driven reactions, and liquidity shifts. To succeed in this dynamic environment, it’s crucial to understand what’s happening behind the charts, not just the price on your screen.

🔍 Current Market Momentum

Bitcoin’s latest volatility—sudden dips, followed by swift recoveries—is shaped by real forces:

✔️ Macroeconomic Pressure

Interest rate decisions, inflation data, and geopolitical uncertainty continue to influence risk assets, including Bit

BTC-1,36%

- Reward

- 12

- 6

- Repost

- Share

Crypto_Teacher :

:

HODL Tight 💪View More

🔥 Trump just dropped a bold prediction and markets are reacting already.

Speaking to reporters, President Trump said he expects the U.S. economy to “boom in the next 5 to 6 months,” hinting at a wave of growth, stimulus, and policy moves that could shake every major market.

If he’s right, risk assets especially crypto could catch fire fast.

And if he's wrong volatility will explode.

Boom incoming? Or political overconfidence?

$SOL $XRP $BNB

#BTCVolatility #USStocksForecast2026 #WriteToEarnUpgrade #CPIWatch #CryptoIn401k

Speaking to reporters, President Trump said he expects the U.S. economy to “boom in the next 5 to 6 months,” hinting at a wave of growth, stimulus, and policy moves that could shake every major market.

If he’s right, risk assets especially crypto could catch fire fast.

And if he's wrong volatility will explode.

Boom incoming? Or political overconfidence?

$SOL $XRP $BNB

#BTCVolatility #USStocksForecast2026 #WriteToEarnUpgrade #CPIWatch #CryptoIn401k

- Reward

- 1

- Comment

- Repost

- Share

🚨🚨 MicroStrategy and digital investment funds are facing a problem.

At $126,000, MicroStrategy's position in #Bitcoin increased by 70%. #بيتكوين is now only 7% away from MicroStrategy's average purchase price.

⚠️ On January 15, 2026, MSCI will remove these funds and many other funds from all major stock indices, as currency treasury companies are no longer classified as stocks but are treated as investment funds. The funds do not belong to the S&P 500 or any other major index.

MicroStrategy and other companies are under severe pressure to sell their assets if this rule does not change.

Jan

At $126,000, MicroStrategy's position in #Bitcoin increased by 70%. #بيتكوين is now only 7% away from MicroStrategy's average purchase price.

⚠️ On January 15, 2026, MSCI will remove these funds and many other funds from all major stock indices, as currency treasury companies are no longer classified as stocks but are treated as investment funds. The funds do not belong to the S&P 500 or any other major index.

MicroStrategy and other companies are under severe pressure to sell their assets if this rule does not change.

Jan

- Reward

- like

- Comment

- Repost

- Share

🚨 $BTC Enters Fastest Bear Market Ever — But a Big Reversal Could Be Next! 🚀

Bitcoin just crashed into its fastest bear market on record:

💥 Price dropped to $80,600

💥 Over $1B in futures liquidated

💥 Crypto market cap down 33%

💥 ETFs bleeding, BlackRock ETF on track for record outflows

$BTC But here’s the twist… 📊

The National Financial Conditions Index (NFCI) is falling — and historically, that triggers BTC rallies within 4–6 weeks. December could bring a liquidity boost, similar to 2019’s “not-QE” event that sparked a 40% BTC rally.✅ Key Takeaway: This brutal sell-off may actually

Bitcoin just crashed into its fastest bear market on record:

💥 Price dropped to $80,600

💥 Over $1B in futures liquidated

💥 Crypto market cap down 33%

💥 ETFs bleeding, BlackRock ETF on track for record outflows

$BTC But here’s the twist… 📊

The National Financial Conditions Index (NFCI) is falling — and historically, that triggers BTC rallies within 4–6 weeks. December could bring a liquidity boost, similar to 2019’s “not-QE” event that sparked a 40% BTC rally.✅ Key Takeaway: This brutal sell-off may actually

BTC-1,36%

- Reward

- like

- 3

- Repost

- Share

BublooUK :

:

1000x Vibes 🤑View More

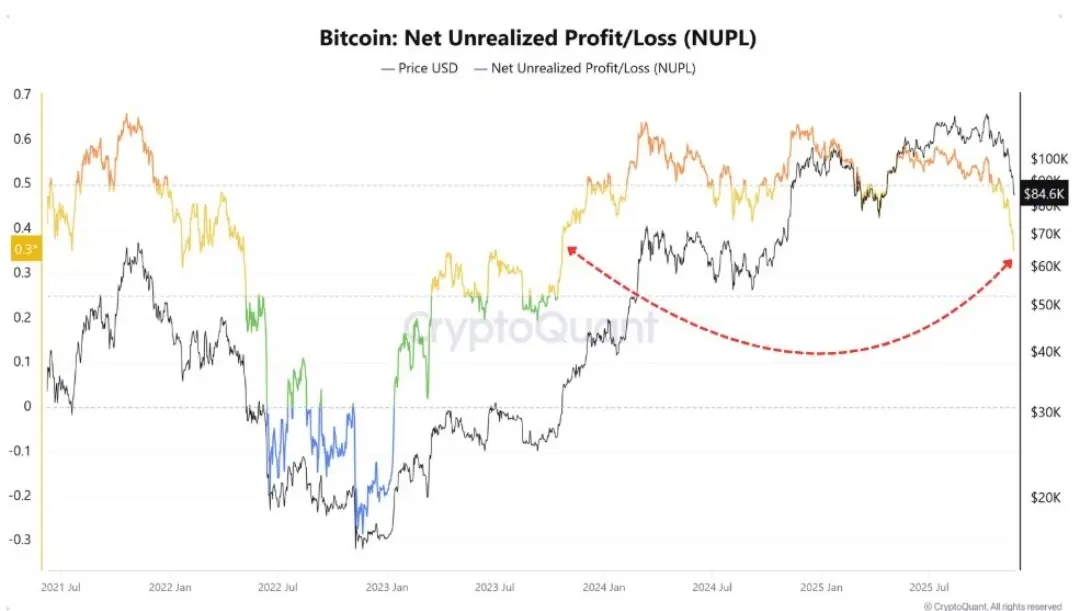

#بيتكوين just entered a high sensitivity zone.

The drop in the price of the share #NUPL to around 0.35 - the lowest level since 2023 - indicates that the market may have exited the zone of comfort. Unrealized profits have quickly shrunk, which always raises concerns about sentiment.

But here is the positive side:

This is the same zone where previous cycles settled before recovering. When the NUPL share price reaches this low level during an upward trend, it usually indicates the waning of excessive enthusiasm and a return of the market to a healthier state.

Wallets have become closer to neut

View OriginalThe drop in the price of the share #NUPL to around 0.35 - the lowest level since 2023 - indicates that the market may have exited the zone of comfort. Unrealized profits have quickly shrunk, which always raises concerns about sentiment.

But here is the positive side:

This is the same zone where previous cycles settled before recovering. When the NUPL share price reaches this low level during an upward trend, it usually indicates the waning of excessive enthusiasm and a return of the market to a healthier state.

Wallets have become closer to neut

- Reward

- 5

- 2

- Repost

- Share

Selmus :

:

BTC ETH BTC ETH BTC ETH BTC ETH BTC ETH BTCView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

216K Popularity

9.33K Popularity

12.36K Popularity

12K Popularity

6.19K Popularity

70.33K Popularity

4.53K Popularity

6.15K Popularity

59.63K Popularity

2.81K Popularity

3.65K Popularity

13.51K Popularity

3.6K Popularity

19.99K Popularity

12.43K Popularity

News

View MoreThe Russian State Duma passes the cryptocurrency confiscation bill, establishing its property status

1 m

Data: In the past 24 hours, the entire network has liquidated $214 million, with long positions liquidated at $150 million and short positions at $64.2606 million.

3 m

An entity minted 376 million BUIDL on Solana early this morning

12 m

Multiple traditional financial asset prices fluctuate, with gold and Brent crude oil experiencing slight increases.

30 m

The USD/JPY falls below 154, with a intraday decline of 0.25%

39 m

Pin