Post content & earn content mining yield

placeholder

十一

【$API3 Signal】Short | Massive Volume Surge Followed by Distribution Pattern

$API3 On the 4-hour chart, a typical massive volume rally was completed, followed by consecutive bearish candles indicating distribution by the main players. The price has broken below the midpoint of the massive volume candlestick, and Taker sell orders are dominant. The funding rate remains negative, signaling the establishment of a bearish structure.

🎯Direction: Short

🎯Entry: 0.332 - 0.335

🛑Stop Loss: 0.345 (Rigid Stop Loss)

🚀Target 1: 0.315

🚀Target 2: 0.303

Hardcore Logic: The 4-hour chart shows a huge bullish

View Original$API3 On the 4-hour chart, a typical massive volume rally was completed, followed by consecutive bearish candles indicating distribution by the main players. The price has broken below the midpoint of the massive volume candlestick, and Taker sell orders are dominant. The funding rate remains negative, signaling the establishment of a bearish structure.

🎯Direction: Short

🎯Entry: 0.332 - 0.335

🛑Stop Loss: 0.345 (Rigid Stop Loss)

🚀Target 1: 0.315

🚀Target 2: 0.303

Hardcore Logic: The 4-hour chart shows a huge bullish

- Reward

- like

- Comment

- Repost

- Share

$Bigtrout Big Entry here for easy 20x to 30x

- Reward

- like

- Comment

- Repost

- Share

Trend Research lost approximately $686 million after leveraged positions of nearly $2 billion were liquidated due to the price of #Ethereum giảm mạnh. Công ty này từng vay #stablecoin on #Aave, dùng $ETH thế chấp để “loop” long. Sự việc cho thấy rủi ro đòn bẩy cao trong thị trường crypto biến động mạnh.#nghiencrypto #crypto #trading

View Original

- Reward

- like

- Comment

- Repost

- Share

星星之火

星星之火

Created By@gatefunuser_936d

Listing Progress

100.00%

MC:

$2.16K

Create My Token

UK Regulators Launch Scale-up Unit with Six Firms Joining First Cohort - - #pra #sec #uk

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4-gold-lucky-draw?ref=VVNDAQHEUQ&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

WEF is a terrorist organization

- Reward

- like

- Comment

- Repost

- Share

Who can explain to me how a "benign deal like Nexstar-Tegna" is related to the cryptocurrency world?

View Original

- Reward

- like

- Comment

- Repost

- Share

#雪球 #Xueqiu Community

The first offline promotion salon of the year kicked off in Jiangmen,

The second one is in Xiamen.

Double happiness, marking the first shot.

After the New Year, it will explode across the country.

View OriginalThe first offline promotion salon of the year kicked off in Jiangmen,

The second one is in Xiamen.

Double happiness, marking the first shot.

After the New Year, it will explode across the country.

- Reward

- like

- 1

- Repost

- Share

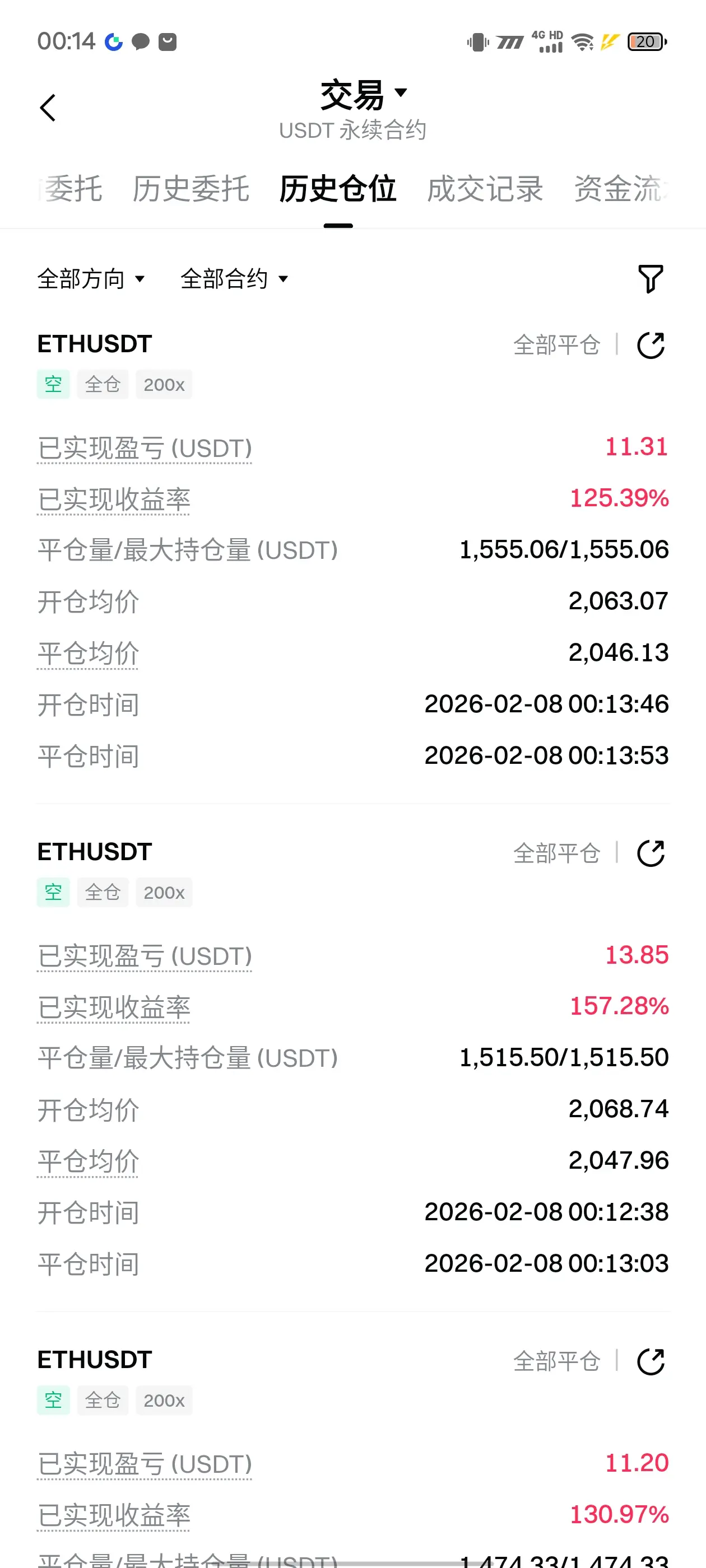

Don'tBeTemptedAgain :

:

Are children also participating?What’s going on with ETH? Dropping down to 2000 and then rising back to 2150—are the bulls and bears just calling each other fools? Or did some DeFi or big leverage players get forced to liquidate?

ETH-0,05%

- Reward

- like

- 3

- Repost

- Share

Spade_K :

:

Hold on tight, we're about to take off 🛫View More

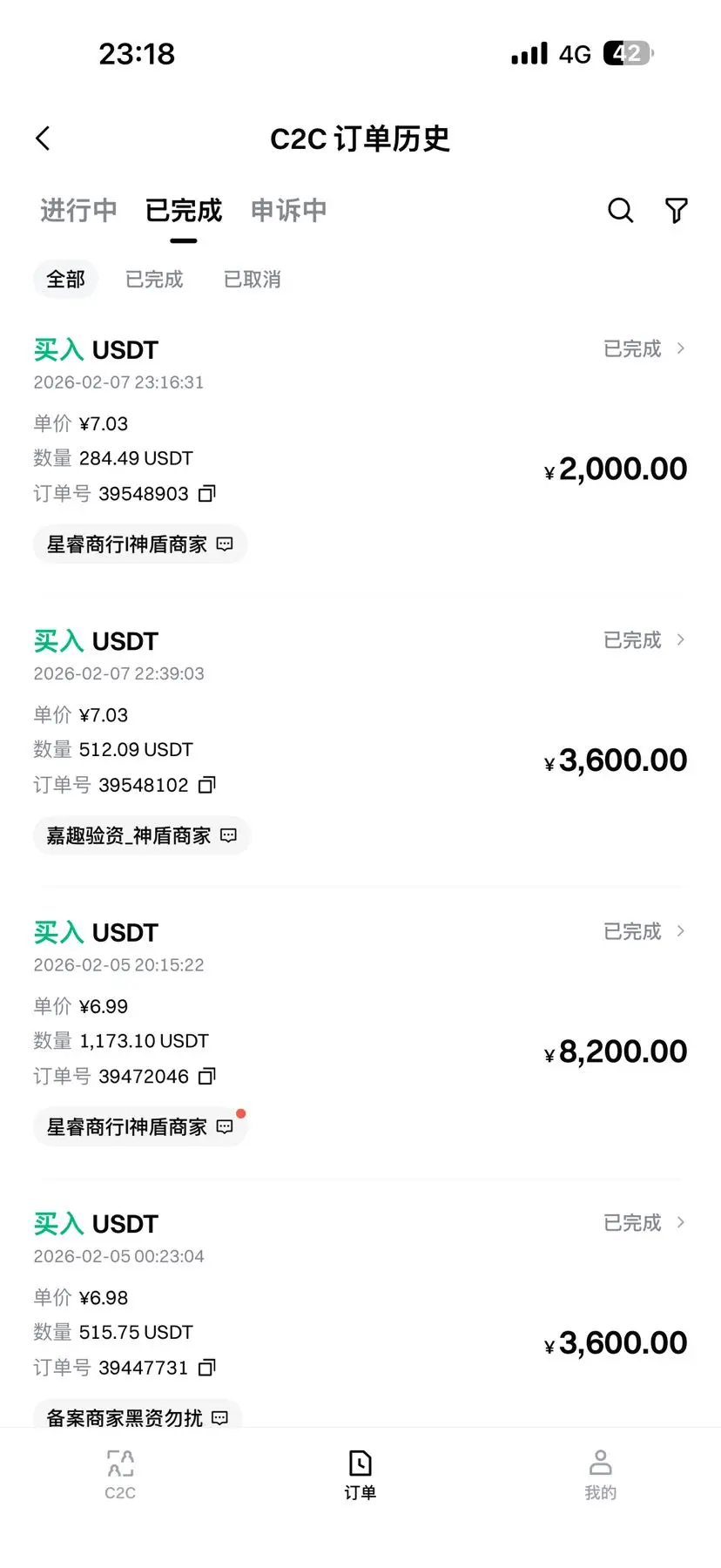

#资产分析# https://www.gate.com/wallet/assetsAnalysis From 3u in less than a week, reached 700u with 80u withdrawn. Keep pushing to hit the new user protection period. Come on!

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Li-jian

工机

Created By@GateUser-e65975dc

Listing Progress

0.00%

MC:

$2.43K

Create My Token

#CMEGroupPlansCMEToken

CME Group Plans CME Token: Wall Street Giant Eyes Proprietary Digital Asset for Tokenized Collateral and 24/7 Crypto Trading

In a significant step bridging traditional finance and blockchain technology, CME Group—the world's leading derivatives marketplace—has signaled its intent to explore launching its own proprietary digital token, often referred to in media as "CME Coin." The revelation came from Chairman and CEO Terrence Duffy during the company's Q4 2025 earnings call in early February 2026, amid surging interest in tokenized assets and institutional crypto adopti

CME Group Plans CME Token: Wall Street Giant Eyes Proprietary Digital Asset for Tokenized Collateral and 24/7 Crypto Trading

In a significant step bridging traditional finance and blockchain technology, CME Group—the world's leading derivatives marketplace—has signaled its intent to explore launching its own proprietary digital token, often referred to in media as "CME Coin." The revelation came from Chairman and CEO Terrence Duffy during the company's Q4 2025 earnings call in early February 2026, amid surging interest in tokenized assets and institutional crypto adopti

- Reward

- 2

- Comment

- Repost

- Share

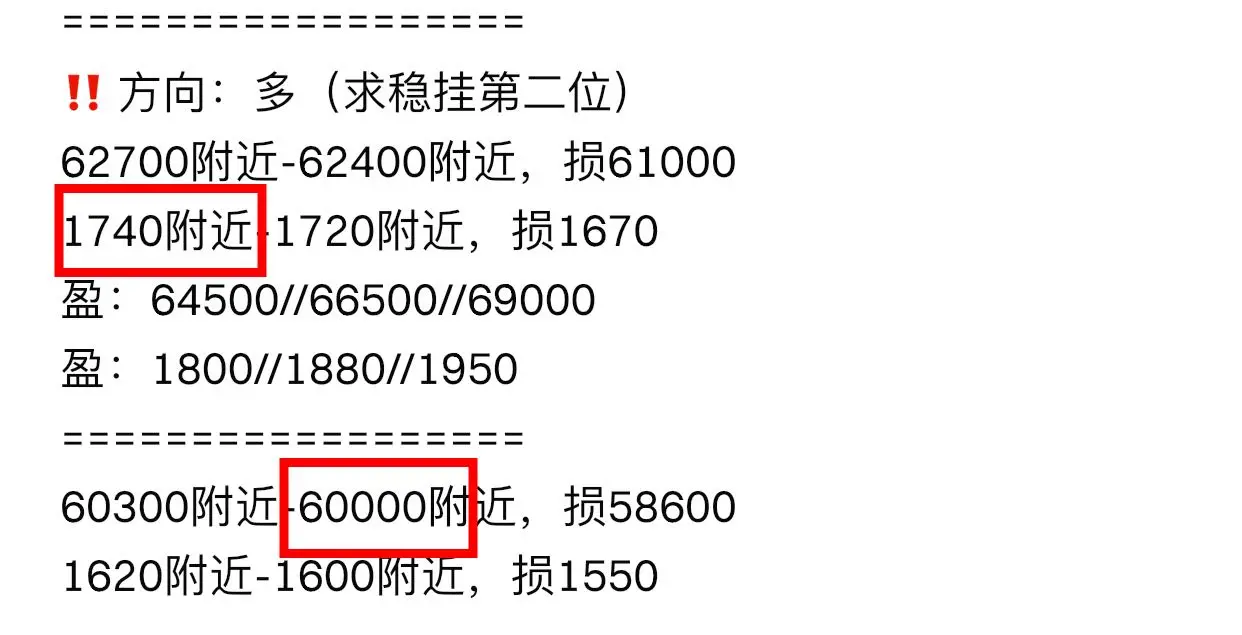

‼️Second order⬇️

‼️Direction: Long (prefer stability, second priority)

Around 67,300 - 67,000, stop loss at 65,600

Around 1,970 - 1,950, stop loss at 1,900

Profit: 69,000 // 70,500 // 72,200

Profit: 2,030 // 2,100 // 2,190

#Gate1月透明度报告

View Original‼️Direction: Long (prefer stability, second priority)

Around 67,300 - 67,000, stop loss at 65,600

Around 1,970 - 1,950, stop loss at 1,900

Profit: 69,000 // 70,500 // 72,200

Profit: 2,030 // 2,100 // 2,190

#Gate1月透明度报告

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 9

- Repost

- Share

DeadAirForce :

:

Keep going, anyway I’m not afraid of losing more than 100,000 yuan. No matter what, I’ll keep pushing forward and face whatever comes, because losing that much money isn’t the end of the world.View More

$BTC is reacting after a sharp liquidation sweep and panic-driven selloff, and I’m seeing signs that smart money is no longer pressing shorts aggressively.

Reason / Market read

I’m looking at this move as a post-crash stabilization phase. Price wicked deep into the high-liquidity zone near 60K, cleared late longs and weak hands, and then quickly reclaimed higher levels. That tells me sellers are losing momentum and buyers are stepping in selectively, not emotionally.

Structure & context

I’m seeing a higher low forming on the intraday structure after a strong impulsive bounce. Volatility exp

Reason / Market read

I’m looking at this move as a post-crash stabilization phase. Price wicked deep into the high-liquidity zone near 60K, cleared late longs and weak hands, and then quickly reclaimed higher levels. That tells me sellers are losing momentum and buyers are stepping in selectively, not emotionally.

Structure & context

I’m seeing a higher low forming on the intraday structure after a strong impulsive bounce. Volatility exp

BTC-2,09%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin extends its rally, briefly breaking above $70,000 overnight — How will the weeke

- Reward

- like

- Comment

- Repost

- Share

#CryptoSurvivalGuide

#CryptoSurvivalGuide

Building a Financial Fortress: Deepening Risk Control

Severe market fluctuations (volatility) represent chaos for the unprepared investor, yet for the disciplined one, they are merely a "data set." In the tense atmosphere of February 2026, it is vital to activate these three core mechanisms to protect your portfolio:

1. Asymmetric Risk and Loss Management

A common mistake made by market analysts is focusing solely on profit targets. Professionals, however, prioritize calculating the "risk/reward ratio."

The Psychology of Stop-Loss: When determining yo

#CryptoSurvivalGuide

Building a Financial Fortress: Deepening Risk Control

Severe market fluctuations (volatility) represent chaos for the unprepared investor, yet for the disciplined one, they are merely a "data set." In the tense atmosphere of February 2026, it is vital to activate these three core mechanisms to protect your portfolio:

1. Asymmetric Risk and Loss Management

A common mistake made by market analysts is focusing solely on profit targets. Professionals, however, prioritize calculating the "risk/reward ratio."

The Psychology of Stop-Loss: When determining yo

BTC-2,09%

- Reward

- 6

- 13

- Repost

- Share

AylaShinex :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More138.57K Popularity

30.74K Popularity

391.8K Popularity

13K Popularity

11.83K Popularity

News

View MoreMarket maker grid strategy anomaly has caused fluctuations in ETH prices, leading to abnormal market conditions and increased volatility.

1 h

A newly created wallet withdraws 60,000 ETH from CEX and then deposits it into Aave V3.

1 h

ETH drops below 2050 USDT

1 h

ETH Breaks Through 2100 USDT

1 h

ETH drops below 2050 USDT

1 h

Pin