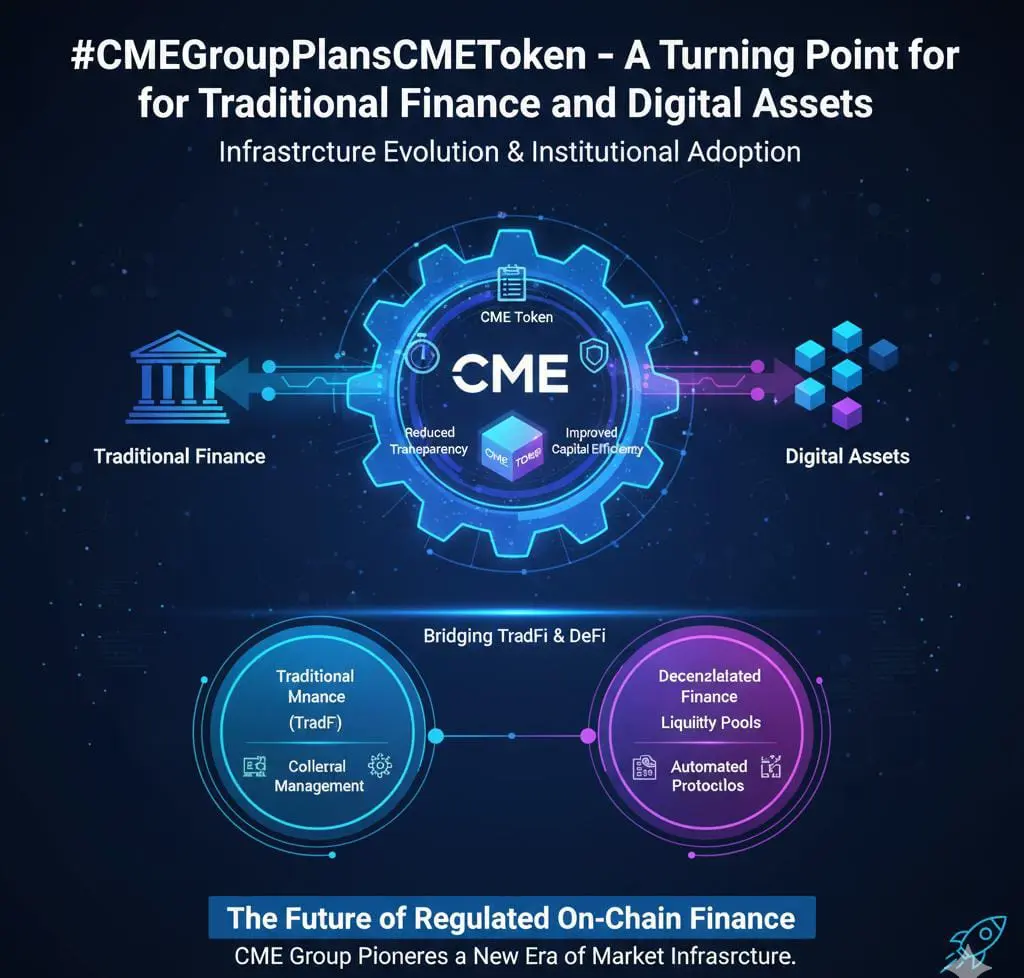

#CMEGroupPlansCMEToken .

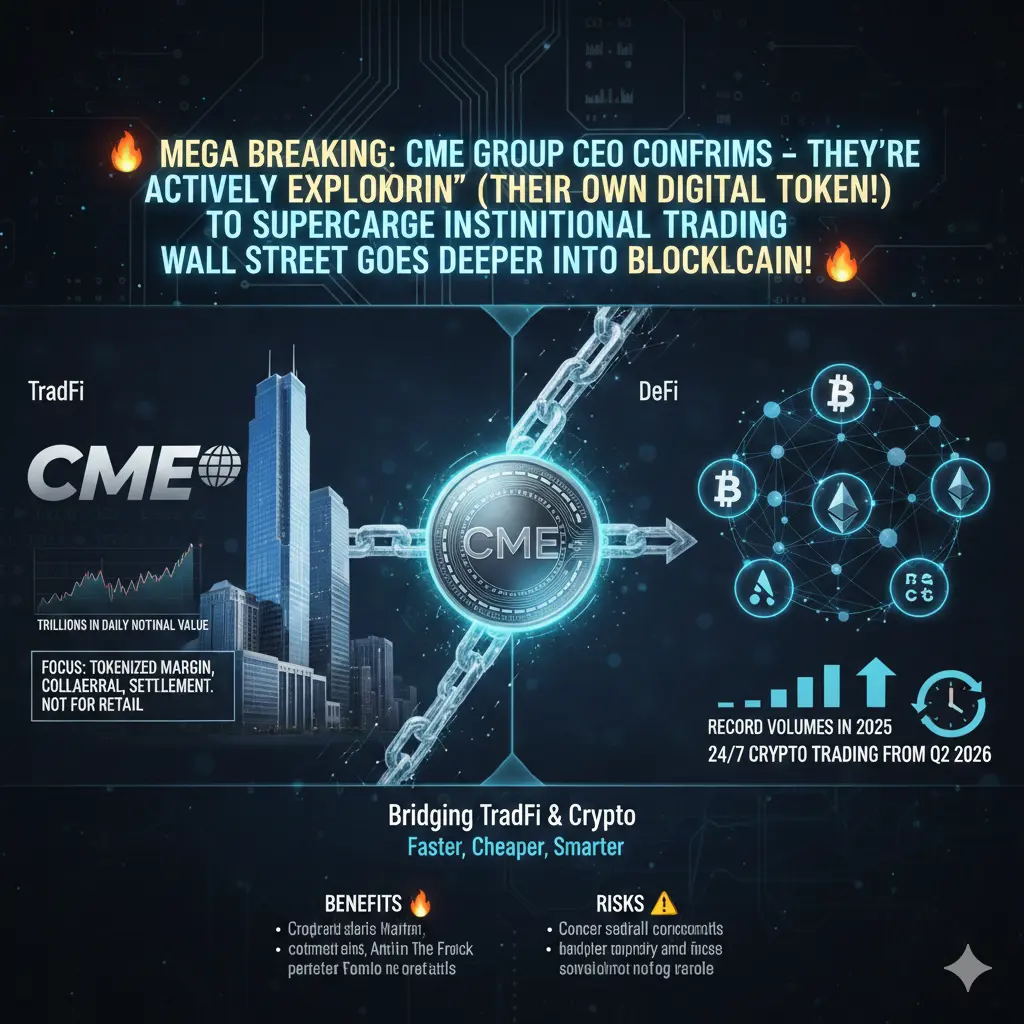

🚨 MEGA BREAKING: CME Group CEO Confirms – They're Actively Exploring “CME Coin” (Their OWN Digital Token!) on a Decentralized Network to Supercharge Institutional Trading & Margin! Wall Street's Biggest Derivatives Giant Goes Deeper into Blockchain! 🚨

Topic in Plain English:

CME Group (the world's #1 regulated futures/options exchange, handling TRILLIONS in daily notional value) is seriously considering launching its own proprietary digital token — often nicknamed “CME Coin” or “CME Token” in media coverage. This isn't a retail crypto like Bitcoin or a stablecoin for everyday payments. Instead, it's aimed at institutional use only: tokenized margin, collateral, and settlement for derivatives trading. CEO Terry Duffy revealed this on their Q4 2025 earnings call (February 4, 2026), saying they're looking at “initiatives with our own coin that we could potentially put on a decentralized network for other industry participants to use.”

This comes alongside:

A separate “tokenized cash” project with Google Cloud (launching later in 2026) for faster digital settlements.

Explosive growth in their crypto products → record volumes in 2025 (up 92% in Q4 to ~379K contracts/day, $13B+ notional).

Big expansion: New futures for Cardano, Chainlink, Stellar (launched Feb 9, 2026), and full 24/7 trading for their entire crypto suite (Bitcoin, Ether, Solana, XRP, etc.) rolling out in Q2 2026 (early next quarter from now) to match nonstop crypto cash markets.

Why This Is a Potential Game-Changer 🔥

Faster & Cheaper Efficiency: Tokenized collateral on blockchain could slash settlement times, free up capital for institutions, and reduce counterparty risks — all under CME's ultra-regulated umbrella (systemically important player).

Bridging TradFi & Crypto: A CME-issued token for margin/settlement could bring massive institutional liquidity into tokenized assets, making regulated crypto derivatives even more attractive vs. spot exchanges.

24/7 Crypto Futures/Options: CME is syncing traditional finance with crypto's always-on nature — no more weekend gaps for hedging. This could explode volumes further.

Credibility Boost: Coming from CME (not a startup), this signals mainstream adoption of blockchain for real financial plumbing, not just speculation.

But Let's Be Real – Risks & Caveats ⚠️

Still early/exploratory — no launch date, no final design, pending regulatory approval.

Focus is institutional collateral, not public trading or DeFi-style usage.

Duffy stressed avoiding extra risk — any token would prioritize safety over hype.

Competition from other tokenized efforts (banks, stablecoins, etc.) could slow it down.

This is Wall Street finally building real blockchain infrastructure from the inside. If CME launches a token for margin/settlement, it could dwarf many existing stablecoins in practical importance for global finance. TradFi + DeFi convergence just leveled up!

🚨 MEGA BREAKING: CME Group CEO Confirms – They're Actively Exploring “CME Coin” (Their OWN Digital Token!) on a Decentralized Network to Supercharge Institutional Trading & Margin! Wall Street's Biggest Derivatives Giant Goes Deeper into Blockchain! 🚨

Topic in Plain English:

CME Group (the world's #1 regulated futures/options exchange, handling TRILLIONS in daily notional value) is seriously considering launching its own proprietary digital token — often nicknamed “CME Coin” or “CME Token” in media coverage. This isn't a retail crypto like Bitcoin or a stablecoin for everyday payments. Instead, it's aimed at institutional use only: tokenized margin, collateral, and settlement for derivatives trading. CEO Terry Duffy revealed this on their Q4 2025 earnings call (February 4, 2026), saying they're looking at “initiatives with our own coin that we could potentially put on a decentralized network for other industry participants to use.”

This comes alongside:

A separate “tokenized cash” project with Google Cloud (launching later in 2026) for faster digital settlements.

Explosive growth in their crypto products → record volumes in 2025 (up 92% in Q4 to ~379K contracts/day, $13B+ notional).

Big expansion: New futures for Cardano, Chainlink, Stellar (launched Feb 9, 2026), and full 24/7 trading for their entire crypto suite (Bitcoin, Ether, Solana, XRP, etc.) rolling out in Q2 2026 (early next quarter from now) to match nonstop crypto cash markets.

Why This Is a Potential Game-Changer 🔥

Faster & Cheaper Efficiency: Tokenized collateral on blockchain could slash settlement times, free up capital for institutions, and reduce counterparty risks — all under CME's ultra-regulated umbrella (systemically important player).

Bridging TradFi & Crypto: A CME-issued token for margin/settlement could bring massive institutional liquidity into tokenized assets, making regulated crypto derivatives even more attractive vs. spot exchanges.

24/7 Crypto Futures/Options: CME is syncing traditional finance with crypto's always-on nature — no more weekend gaps for hedging. This could explode volumes further.

Credibility Boost: Coming from CME (not a startup), this signals mainstream adoption of blockchain for real financial plumbing, not just speculation.

But Let's Be Real – Risks & Caveats ⚠️

Still early/exploratory — no launch date, no final design, pending regulatory approval.

Focus is institutional collateral, not public trading or DeFi-style usage.

Duffy stressed avoiding extra risk — any token would prioritize safety over hype.

Competition from other tokenized efforts (banks, stablecoins, etc.) could slow it down.

This is Wall Street finally building real blockchain infrastructure from the inside. If CME launches a token for margin/settlement, it could dwarf many existing stablecoins in practical importance for global finance. TradFi + DeFi convergence just leveled up!