#BuyTheDipOrWaitNow? — Ethereum L2 Power Shift & Market Positioning (2026 Outlook)

The Ethereum Layer 2 ecosystem in 2026 is no longer defined by experimentation or speculative growth. It is now shaped by distribution power, institutional infrastructure, and settlement-layer efficiency. For investors and traders, this shift reframes the core question: Is this a dip worth buying, or a phase that requires patience and structural confirmation?

Understanding the evolving L2 hierarchy is essential before making allocation decisions.

1. The “Base” Takeover — When Distribution Wins

While Arbitrum and Optimism spent years cultivating crypto-native communities, Base leveraged Coinbase’s global user base to dominate retail adoption and revenue generation.

As of early 2026:

Market Share: ~47.6% of L2 TVL, peaking near $4.39B

Revenue Dominance: 70% of total L2 fee revenue ($147K daily)

Utility Evolution: Transitioned from a meme-driven ecosystem to a “super-app” environment supporting payments, trading, gaming, and consumer apps

Base’s success demonstrates a structural truth: in mature markets, distribution often outperforms pure technical superiority. Access to millions of verified users has translated directly into sustainable fee generation and ecosystem stickiness.

For market participants, Base represents the strongest example of retail-driven network effects in crypto today.

2. Arbitrum and Optimism — The Institutional Pivot

The former leaders of the L2 race are no longer competing for mass-market volume. Instead, they are positioning themselves as the backbone of institutional-grade decentralized finance.

Arbitrum One

Maintains roughly 27% market share

Hosts the deepest liquidity pools in DeFi

Processes transaction volumes rivaling or exceeding Ethereum mainnet

Serves as the default venue for large-scale trading, derivatives, and structured products

Arbitrum’s strength lies in its reliability and liquidity depth, making it the preferred venue for professional capital.

Optimism (OP Mainnet & Superchain)

Individual TVL: ~$6B

Focuses on the Superchain thesis

Multiple OP Stack chains share security, tooling, and liquidity

Rather than competing as a single chain, Optimism is building a network of interoperable chains, creating a federated liquidity layer. This model prioritizes scalability, modularity, and enterprise partnerships.

Together, Arbitrum and Optimism represent the “institutional layer” of Ethereum’s L2 economy.

3. ZK-Rollups — The Long-Term “Slow Burn”

Zero-Knowledge rollups remain the most technically advanced L2 architecture, offering superior security and near-instant finality. However, complexity has slowed mainstream adoption.

zkSync Era

Leads the ZK sector

Operates an “Elastic Network” of 19+ chains

Favored for gaming, private transactions, and high-frequency apps

Market Position

Collective ZK TVL: ~$3.5B–$5B

Smaller than optimistic rollups

Viewed as long-term infrastructure for mission-critical applications

ZK rollups are currently sacrificing short-term growth for architectural resilience. As tooling improves and onboarding friction declines, they are positioned to capture future demand in AI, payments, and enterprise systems.

For long-term investors, ZK represents optionality on the next technological wave.

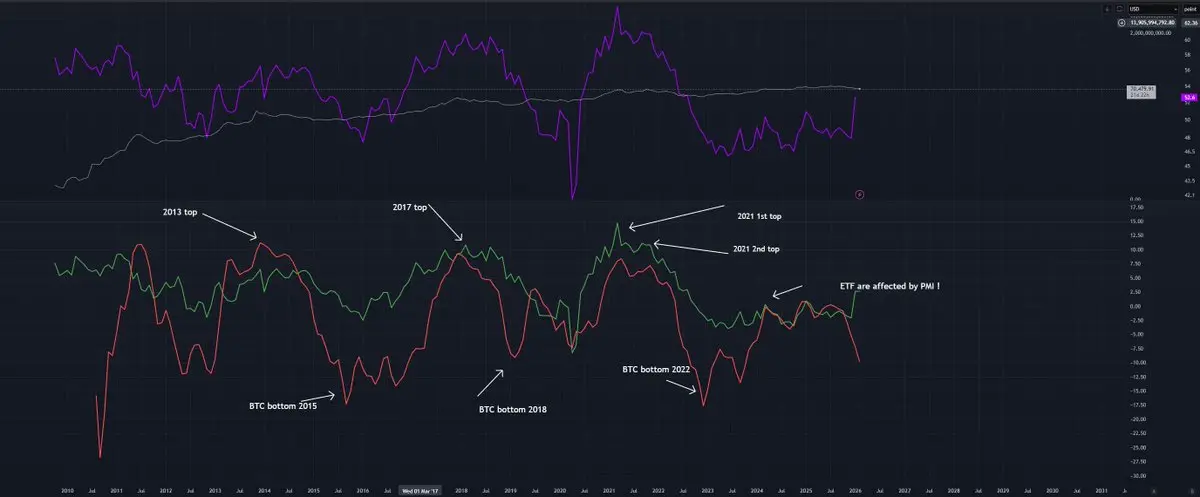

4. The Macro Shift — Ethereum as a Settlement Layer

The most important structural development in 2026 is the functional separation between Ethereum L1 and L2 activity.

Ethereum is evolving into a global settlement and security layer, while execution migrates to rollups.

Key indicators:

L2 Share of Activity: Over 95% of Ethereum-related transactions

System-Wide TPS: From ~50 in 2023 to 325+ today

Fee Compression: Mainnet fees remain low due to rollup offloading

This architecture mirrors traditional financial systems, where settlement and execution are separated. Ethereum now resembles a digital clearinghouse rather than a retail transaction network.

This shift enhances scalability while preserving decentralization and security.

5. Buy the Dip or Wait? Strategic Implications

Given the current structure, the answer depends on positioning and time horizon.

📈 When “Buying the Dip” Makes Sense

Strong Base, Arbitrum, OP, and ZK ecosystems hold key support

L2 revenues remain stable

ETH settlement demand stays consistent

Macro conditions stabilize

In this scenario, dips represent structural accumulation zones.

⏳ When Patience Is Wiser

L2 revenue declines

TVL migrates away from major chains

Ethereum settlement fees weaken

Macro liquidity tightens

Here, capital preservation becomes the priority.

Key Takeaways

📌 Base dominates through distribution and retail adoption

📌 Arbitrum and Optimism serve institutional and modular finance

📌 ZK rollups represent long-term technical infrastructure

📌 Ethereum is consolidating its role as a settlement layer

📌 L2 fundamentals now matter more than narratives

Conclusion

The 2026 L2 landscape is defined by specialization, revenue generation, and structural maturity.

This is no longer a speculative playground. It is an emerging financial infrastructure stack.

For traders and investors, success now depends on understanding where value is created, where liquidity concentrates, and how execution layers interact with settlement security.

Buy blindly, and you follow hype.

Buy strategically, and you follow structure.

The Ethereum Layer 2 ecosystem in 2026 is no longer defined by experimentation or speculative growth. It is now shaped by distribution power, institutional infrastructure, and settlement-layer efficiency. For investors and traders, this shift reframes the core question: Is this a dip worth buying, or a phase that requires patience and structural confirmation?

Understanding the evolving L2 hierarchy is essential before making allocation decisions.

1. The “Base” Takeover — When Distribution Wins

While Arbitrum and Optimism spent years cultivating crypto-native communities, Base leveraged Coinbase’s global user base to dominate retail adoption and revenue generation.

As of early 2026:

Market Share: ~47.6% of L2 TVL, peaking near $4.39B

Revenue Dominance: 70% of total L2 fee revenue ($147K daily)

Utility Evolution: Transitioned from a meme-driven ecosystem to a “super-app” environment supporting payments, trading, gaming, and consumer apps

Base’s success demonstrates a structural truth: in mature markets, distribution often outperforms pure technical superiority. Access to millions of verified users has translated directly into sustainable fee generation and ecosystem stickiness.

For market participants, Base represents the strongest example of retail-driven network effects in crypto today.

2. Arbitrum and Optimism — The Institutional Pivot

The former leaders of the L2 race are no longer competing for mass-market volume. Instead, they are positioning themselves as the backbone of institutional-grade decentralized finance.

Arbitrum One

Maintains roughly 27% market share

Hosts the deepest liquidity pools in DeFi

Processes transaction volumes rivaling or exceeding Ethereum mainnet

Serves as the default venue for large-scale trading, derivatives, and structured products

Arbitrum’s strength lies in its reliability and liquidity depth, making it the preferred venue for professional capital.

Optimism (OP Mainnet & Superchain)

Individual TVL: ~$6B

Focuses on the Superchain thesis

Multiple OP Stack chains share security, tooling, and liquidity

Rather than competing as a single chain, Optimism is building a network of interoperable chains, creating a federated liquidity layer. This model prioritizes scalability, modularity, and enterprise partnerships.

Together, Arbitrum and Optimism represent the “institutional layer” of Ethereum’s L2 economy.

3. ZK-Rollups — The Long-Term “Slow Burn”

Zero-Knowledge rollups remain the most technically advanced L2 architecture, offering superior security and near-instant finality. However, complexity has slowed mainstream adoption.

zkSync Era

Leads the ZK sector

Operates an “Elastic Network” of 19+ chains

Favored for gaming, private transactions, and high-frequency apps

Market Position

Collective ZK TVL: ~$3.5B–$5B

Smaller than optimistic rollups

Viewed as long-term infrastructure for mission-critical applications

ZK rollups are currently sacrificing short-term growth for architectural resilience. As tooling improves and onboarding friction declines, they are positioned to capture future demand in AI, payments, and enterprise systems.

For long-term investors, ZK represents optionality on the next technological wave.

4. The Macro Shift — Ethereum as a Settlement Layer

The most important structural development in 2026 is the functional separation between Ethereum L1 and L2 activity.

Ethereum is evolving into a global settlement and security layer, while execution migrates to rollups.

Key indicators:

L2 Share of Activity: Over 95% of Ethereum-related transactions

System-Wide TPS: From ~50 in 2023 to 325+ today

Fee Compression: Mainnet fees remain low due to rollup offloading

This architecture mirrors traditional financial systems, where settlement and execution are separated. Ethereum now resembles a digital clearinghouse rather than a retail transaction network.

This shift enhances scalability while preserving decentralization and security.

5. Buy the Dip or Wait? Strategic Implications

Given the current structure, the answer depends on positioning and time horizon.

📈 When “Buying the Dip” Makes Sense

Strong Base, Arbitrum, OP, and ZK ecosystems hold key support

L2 revenues remain stable

ETH settlement demand stays consistent

Macro conditions stabilize

In this scenario, dips represent structural accumulation zones.

⏳ When Patience Is Wiser

L2 revenue declines

TVL migrates away from major chains

Ethereum settlement fees weaken

Macro liquidity tightens

Here, capital preservation becomes the priority.

Key Takeaways

📌 Base dominates through distribution and retail adoption

📌 Arbitrum and Optimism serve institutional and modular finance

📌 ZK rollups represent long-term technical infrastructure

📌 Ethereum is consolidating its role as a settlement layer

📌 L2 fundamentals now matter more than narratives

Conclusion

The 2026 L2 landscape is defined by specialization, revenue generation, and structural maturity.

This is no longer a speculative playground. It is an emerging financial infrastructure stack.

For traders and investors, success now depends on understanding where value is created, where liquidity concentrates, and how execution layers interact with settlement security.

Buy blindly, and you follow hype.

Buy strategically, and you follow structure.