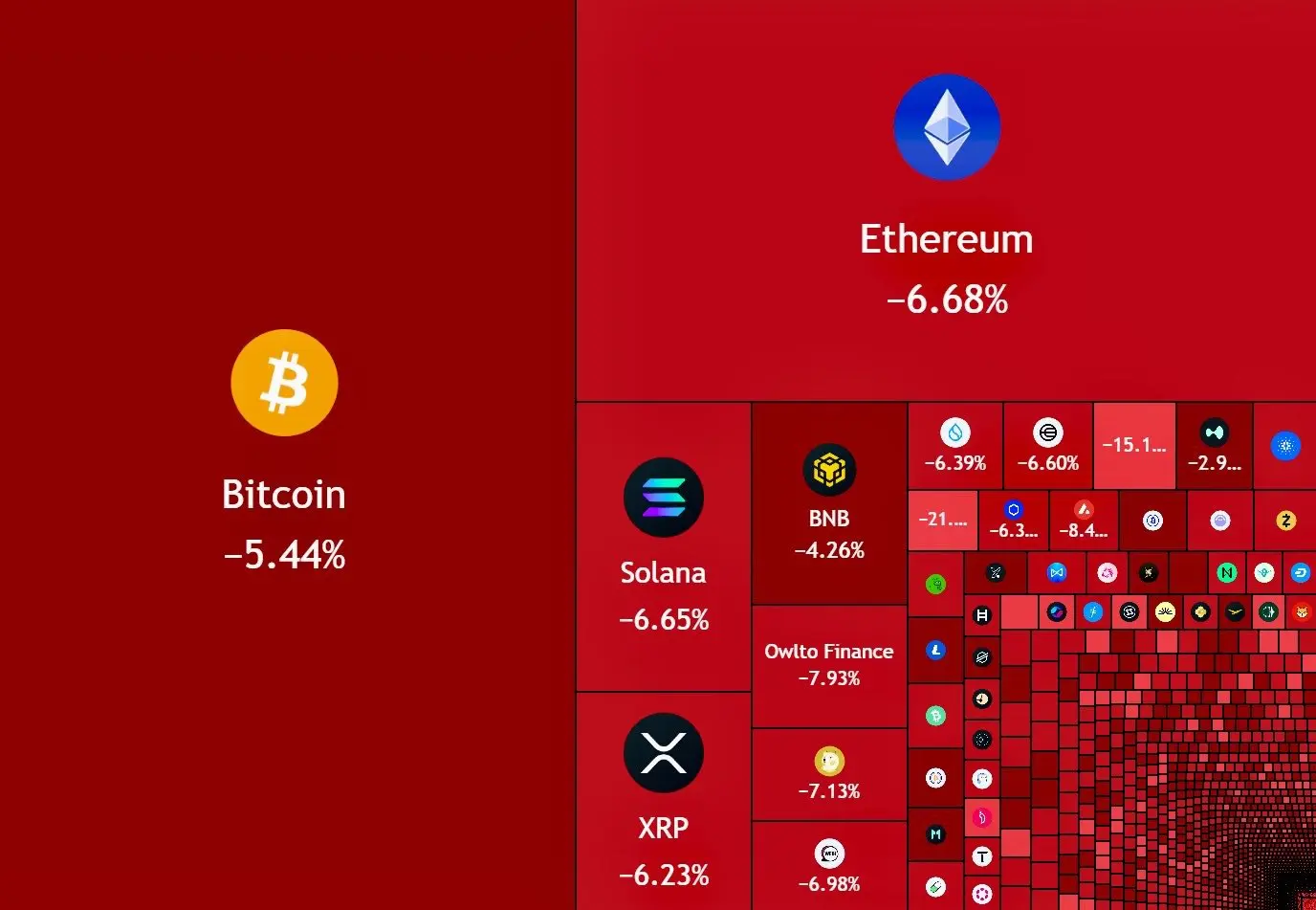

BTC Technical Outlook: Breakdown From Local Range, Retesting Macro Demand

Bitcoin remains within a broader corrective structure after the rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by a strong bearish continuation into late Q4.

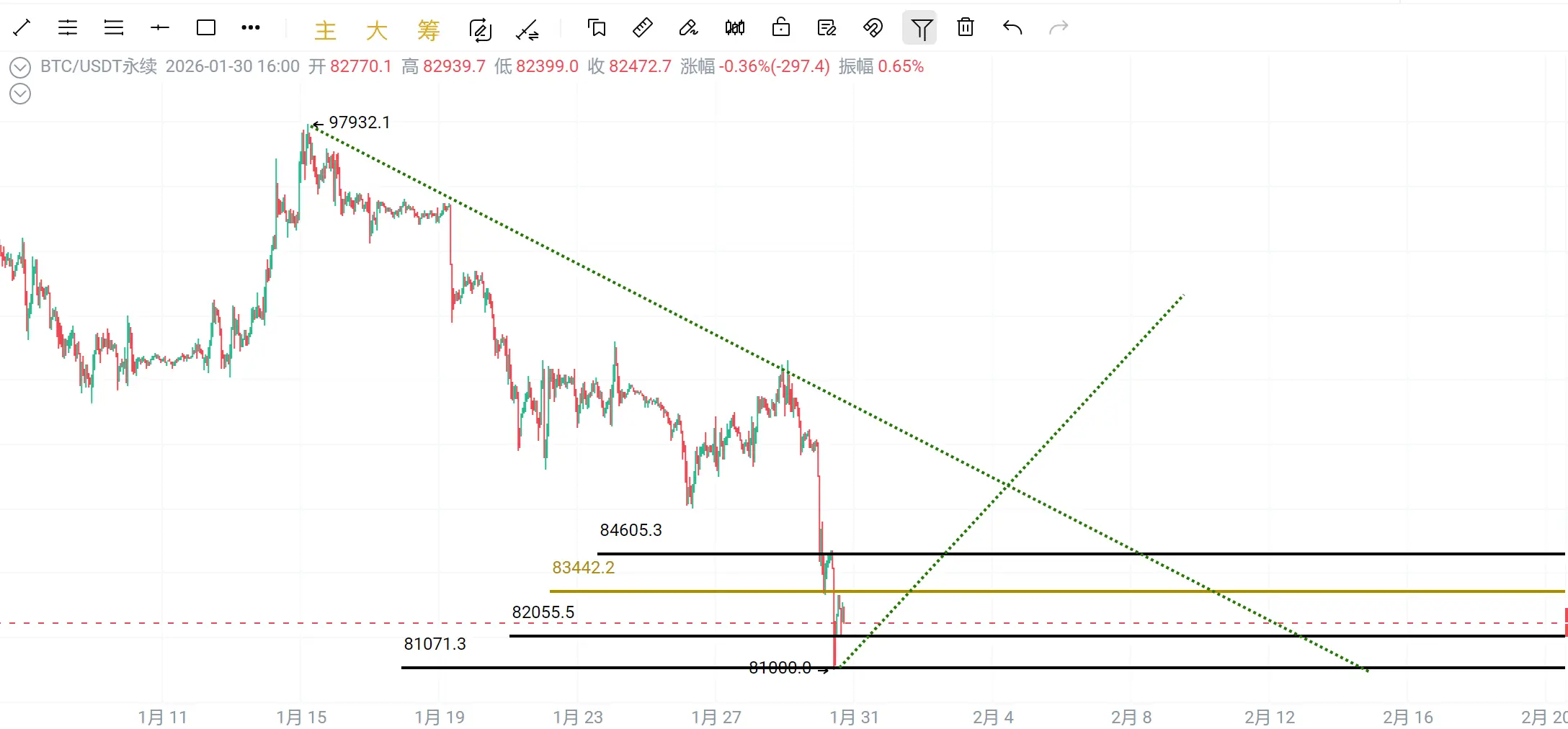

Recent price action shows BTC losing the $88K–$90K range base and now moving lower into the $83K–$80K macro demand zone, where buyers previously stepped in aggressively. Momentum has weakened again, and the higher-timeframe trend remains bearish.

EMA Structure (Bearish Bias, Breakdown Phase)

20 EMA: $89,173

50 EMA: $90,745

100 EMA: $94,295

200 EMA: $98,158

BTC is trading below all major EMAs, confirming bearish medium- and long-term structure. The failed reclaim of the 0.236 Fib + EMA zone (~$91K–$92K) triggered renewed downside pressure.

The $94K–$98K zone remains a major dynamic resistance band.

Fibonacci & Price Structure

1 Fib: $126,123

0.786 Fib: $116,399

0.618 Fib: $108,766

0.5 Fib: $103,405

0.382 Fib: $98,043

0.236 Fib: $91,410

Fib 0: $80,687

BTC has now lost the 0.236 Fib ($91,410) and is moving toward the Fib 0 macro base ($80,687). This keeps price in a corrective continuation phase, not a recovery structure.

A reclaim of $91K–$94K is required to re-enter the prior rrange.

Structural Context

The rounded accumulation attempt near $88K failed, leading to a range breakdown. Current structure suggests price is seeking liquidity inside the $83K–$80K demand block, which aligns with the Fib 0 level and historical support.

Only a decisive daily close back above $91K–$94K would shift structure away from bearish continuation.

RSI Momentum

RSI (14): 31–44

RSI has slipped back toward the lower zone, reflecting renewed bearish momentum and a lack of strong bullish participation. This supports continuation risk before any sustainable bounce.

📊 Key Levels

Resistance

• $91K–$94K (0.236 Fib / EMA zone)

• $98K (0.382 Fib)

• $103K (0.5 Fib)

Support

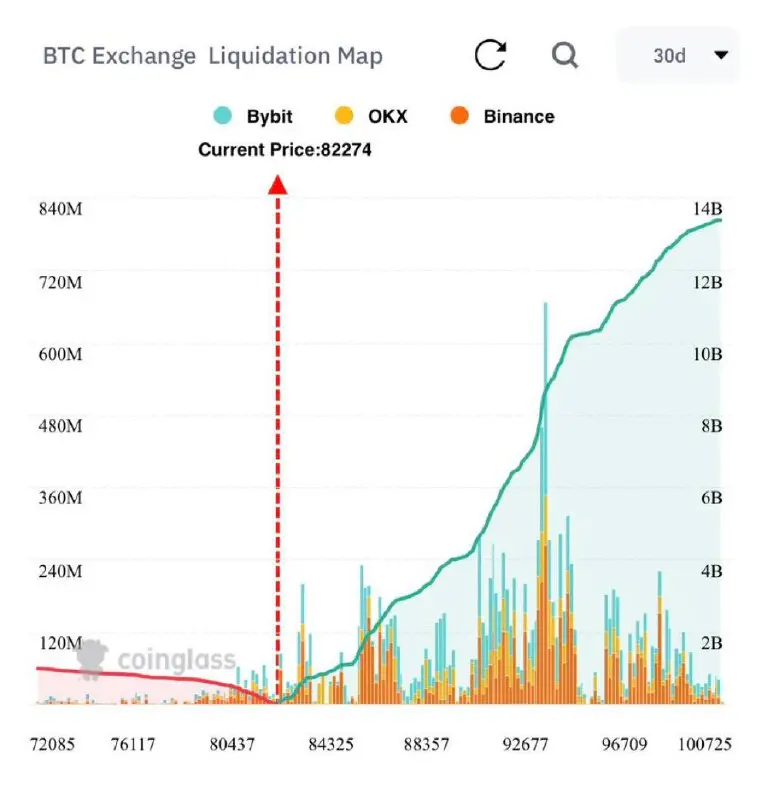

• $83K–$82K (local demand)

• $80.7K (Fib 0 / macro demand)

• $76K–$75K (last HTF support below)

📌 Summary

BTC has failed to hold the $88K–$90K base and is now rotating into the $83K–$80K macro demand zone. While this area may attract buyers for a technical bounce, the broader structure remains bearish and corrective unless BTC can reclaim $91K–$94K with strength. Until then, downside risk and range expansion remain active.

$BTC

Bitcoin remains within a broader corrective structure after the rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by a strong bearish continuation into late Q4.

Recent price action shows BTC losing the $88K–$90K range base and now moving lower into the $83K–$80K macro demand zone, where buyers previously stepped in aggressively. Momentum has weakened again, and the higher-timeframe trend remains bearish.

EMA Structure (Bearish Bias, Breakdown Phase)

20 EMA: $89,173

50 EMA: $90,745

100 EMA: $94,295

200 EMA: $98,158

BTC is trading below all major EMAs, confirming bearish medium- and long-term structure. The failed reclaim of the 0.236 Fib + EMA zone (~$91K–$92K) triggered renewed downside pressure.

The $94K–$98K zone remains a major dynamic resistance band.

Fibonacci & Price Structure

1 Fib: $126,123

0.786 Fib: $116,399

0.618 Fib: $108,766

0.5 Fib: $103,405

0.382 Fib: $98,043

0.236 Fib: $91,410

Fib 0: $80,687

BTC has now lost the 0.236 Fib ($91,410) and is moving toward the Fib 0 macro base ($80,687). This keeps price in a corrective continuation phase, not a recovery structure.

A reclaim of $91K–$94K is required to re-enter the prior rrange.

Structural Context

The rounded accumulation attempt near $88K failed, leading to a range breakdown. Current structure suggests price is seeking liquidity inside the $83K–$80K demand block, which aligns with the Fib 0 level and historical support.

Only a decisive daily close back above $91K–$94K would shift structure away from bearish continuation.

RSI Momentum

RSI (14): 31–44

RSI has slipped back toward the lower zone, reflecting renewed bearish momentum and a lack of strong bullish participation. This supports continuation risk before any sustainable bounce.

📊 Key Levels

Resistance

• $91K–$94K (0.236 Fib / EMA zone)

• $98K (0.382 Fib)

• $103K (0.5 Fib)

Support

• $83K–$82K (local demand)

• $80.7K (Fib 0 / macro demand)

• $76K–$75K (last HTF support below)

📌 Summary

BTC has failed to hold the $88K–$90K base and is now rotating into the $83K–$80K macro demand zone. While this area may attract buyers for a technical bounce, the broader structure remains bearish and corrective unless BTC can reclaim $91K–$94K with strength. Until then, downside risk and range expansion remain active.

$BTC