Post content & earn content mining yield

placeholder

The₿itcoinTherapist

🚨JUST IN: Tether reports to own $23 billion dollars in gold stored in a nuclear bunker in Switzerland at a location “guarded by multiple thick steel doors” and resembles a “James Bond kind of place.” 👀

- Reward

- like

- Comment

- Repost

- Share

#FedRateDecisionApproaches 🚨

Bitcoin vs. The Fed: Tone Over Rates

The Fed’s upcoming meeting isn’t about cuts—it’s about what Powell says.

🔹 Hawkish tone → tighter liquidity → BTC under pressure

🔹 Dovish cues → improved risk appetite → potential BTC rally

Bitcoin reacts sharply to Fed signals due to institutional flows, derivatives, and retail sentiment. Liquidity, dollar strength, and macro risk appetite will also drive short-term moves.

💡 Takeaway: Traders should brace for volatility; long-term investors watch adoption and macro trends. Powell’s words could move Bitcoin as much as policy

Bitcoin vs. The Fed: Tone Over Rates

The Fed’s upcoming meeting isn’t about cuts—it’s about what Powell says.

🔹 Hawkish tone → tighter liquidity → BTC under pressure

🔹 Dovish cues → improved risk appetite → potential BTC rally

Bitcoin reacts sharply to Fed signals due to institutional flows, derivatives, and retail sentiment. Liquidity, dollar strength, and macro risk appetite will also drive short-term moves.

💡 Takeaway: Traders should brace for volatility; long-term investors watch adoption and macro trends. Powell’s words could move Bitcoin as much as policy

BTC0,79%

- Reward

- like

- Comment

- Repost

- Share

Today, January 28, 2026, Gold (XAUUSD) is exhibiting historic bullish momentum, trading near record highs around $5,230 - $5,245. The primary driver is a weakening US Dollar and heightened safe-haven demand ahead of the Federal Reserve’s policy meeting later today. While technically "overbought" on the RSI, the trend remains firmly upward. The possible next move is a push toward $5,300 if the Fed maintains a neutral-to-dovish tone. Conversely, expect a minor corrective dip toward $5,160 if profit-taking occurs, though buyers are currently aggressive on any slight retracement.

Professional Trad

Professional Trad

- Reward

- like

- Comment

- Repost

- Share

泓一说缠

泓一说缠

Created By@ChineseMemeGlobalAmbassador

Listing Progress

0.00%

MC:

$3.46K

Create My Token

【$SPACE Signal】Empty Position Observation — Holding Volume Battle After Downward Volume Surge

$SPACE After experiencing a -14.52% sharp decline, the price action shows a volume-driven drop, which requires combining with holding volume to determine whether it is a long liquidation or main force distribution. Currently, it is not an obvious counter-trend entry point.

🎯Direction: Empty Position (NoPosition)

🎯Entry: None

🛑Stop Loss: Not applicable

🚀Target 1: Not applicable

🚀Target 2: Not applicable

Market Logic: A trading volume of 74.47M accompanied by a sharp price decline indicates a high-

$SPACE After experiencing a -14.52% sharp decline, the price action shows a volume-driven drop, which requires combining with holding volume to determine whether it is a long liquidation or main force distribution. Currently, it is not an obvious counter-trend entry point.

🎯Direction: Empty Position (NoPosition)

🎯Entry: None

🛑Stop Loss: Not applicable

🚀Target 1: Not applicable

🚀Target 2: Not applicable

Market Logic: A trading volume of 74.47M accompanied by a sharp price decline indicates a high-

View Original

- Reward

- like

- Comment

- Repost

- Share

As of January 28, 2026, Solana (SOL) is navigating a consolidation phase, currently trading around $124-$126. While the long-term outlook remains bullish due to steady ETF inflows and ecosystem growth, the short-term chart shows a battle between a triangle structure reversal and persistent EMA resistance.

Possible Next Move

Market indicators suggest a breakout attempt is imminent. If SOL can decisively close a 4-hour candle above the $128.50 pivot, it is expected to rally toward $132–$144. However, failure to flip this resistance could lead to another rotation back to the psychological support

Possible Next Move

Market indicators suggest a breakout attempt is imminent. If SOL can decisively close a 4-hour candle above the $128.50 pivot, it is expected to rally toward $132–$144. However, failure to flip this resistance could lead to another rotation back to the psychological support

SOL2,01%

- Reward

- 1

- 2

- Repost

- Share

laniakea :

:

vfrtijjfffghkknbgfguokkkgfdddddjkjnbfgyjjjjggggggyuijhggtffgggggjjjjhhhhggfffView More

On-Chain Lunar New Year · Market Never Closes https://www.gate.com/campaigns/3937?ref=SEVENCYJ&ref_type=132

View Original

- Reward

- like

- Comment

- Repost

- Share

Marquee Coin holders are community governors who decide the project's development direction through voting, sharing the benefits of ecosystem construction. Join us to become decision-makers in the digital currency era and collaboratively build a decentralized future!

View Original

MC:$19.16KHolders:29

50.49%

- Reward

- 4

- Comment

- Repost

- Share

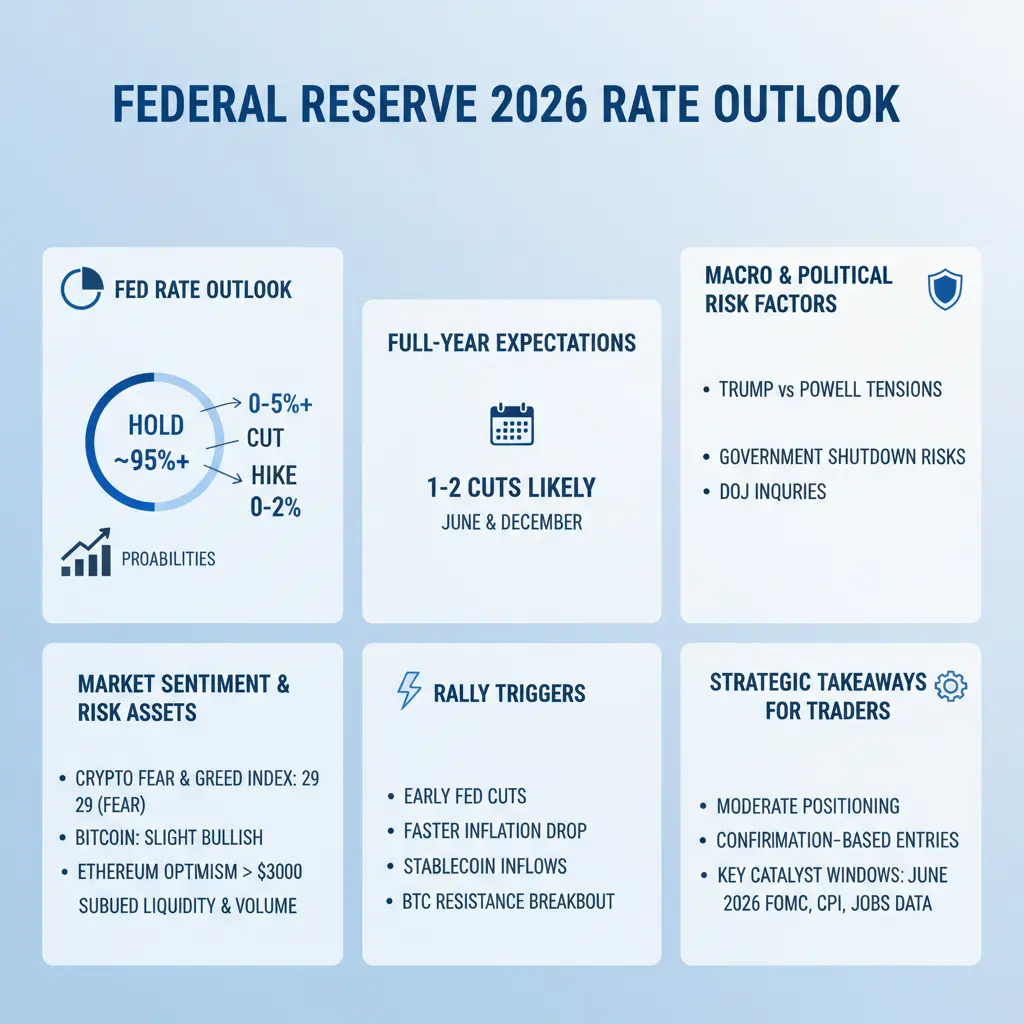

#FedRateDecisionApproaches 🚨

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 3

- 8

- Repost

- Share

CryptoChampion :

:

DYOR 🤓View More

This liquidity, the only remaining certainty is BSC watching over, SOL watching over, moonshot

View Original

- Reward

- like

- Comment

- Repost

- Share

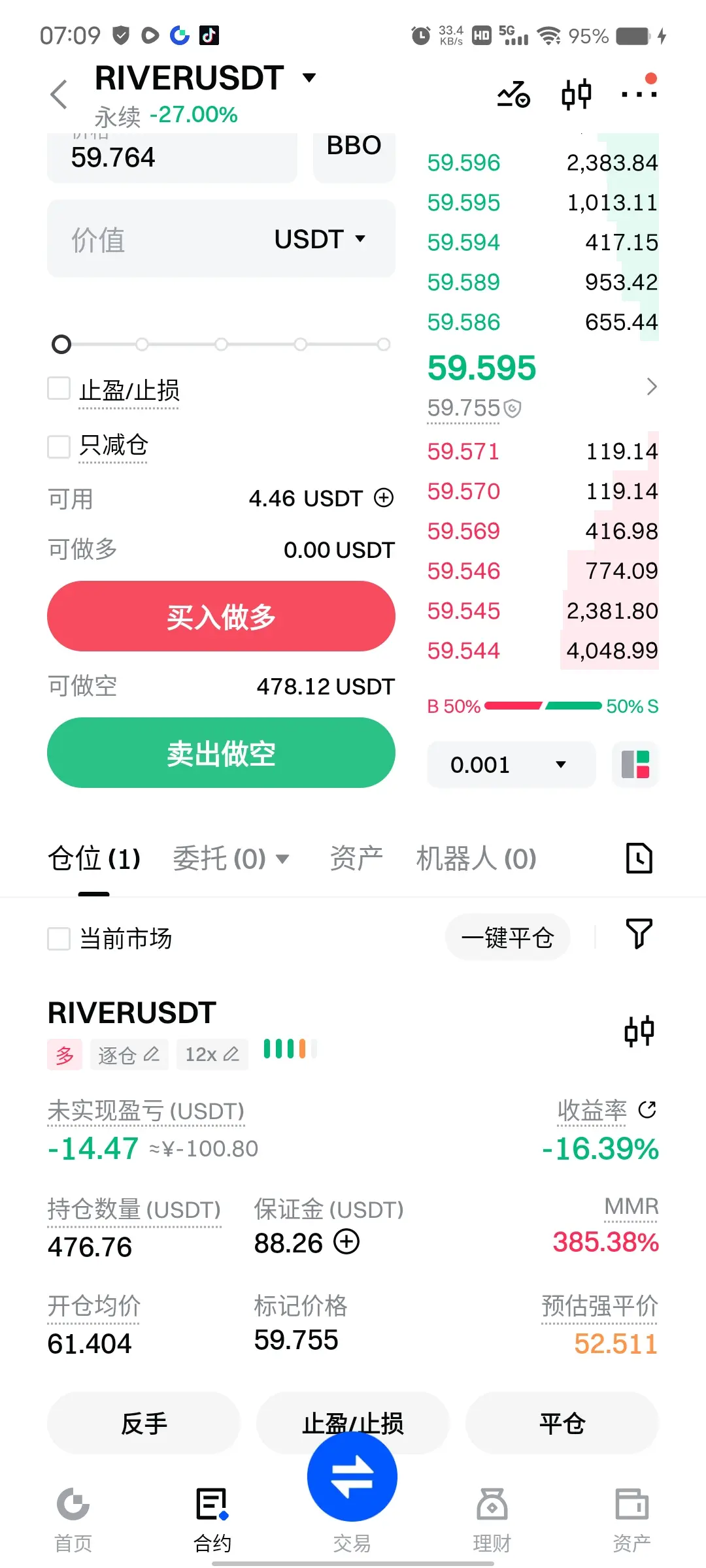

$RIVER 72 degrees of emptiness. 71 running. Almost liquidated at 80. Now telling me it dropped to 68. Truly unbelievable.

View Original

- Reward

- like

- 3

- Repost

- Share

KKK5546A :

:

Already 59View More

Mu Feng's Trend Analysis: 1.28 Bitcoin/Ethereum Consolidation and Trading Suggestions

Looking at the daily chart of Bitcoin/Ethereum, today’s KDJ and MACD show a synchronized upward momentum. The BOLL indicator’s upper band is opening up, and on the main chart, the three moving averages are resonating upward with different amplitudes, breaking through and stabilizing to confirm a short-term reversal and open up upward space. On the 12-hour chart, KDJ, MACD, and BOLL are resonating bullishly, indicating a rebound momentum recovery. RSI is not overbought, MACD shows a golden cross, which is favo

View OriginalLooking at the daily chart of Bitcoin/Ethereum, today’s KDJ and MACD show a synchronized upward momentum. The BOLL indicator’s upper band is opening up, and on the main chart, the three moving averages are resonating upward with different amplitudes, breaking through and stabilizing to confirm a short-term reversal and open up upward space. On the 12-hour chart, KDJ, MACD, and BOLL are resonating bullishly, indicating a rebound momentum recovery. RSI is not overbought, MACD shows a golden cross, which is favo

- Reward

- 1

- Comment

- Repost

- Share

We Talk Abot Bull Market vs Bear Market

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$27.06K

Create My Token

GM CTBuild a good Habit!

- Reward

- like

- Comment

- Repost

- Share

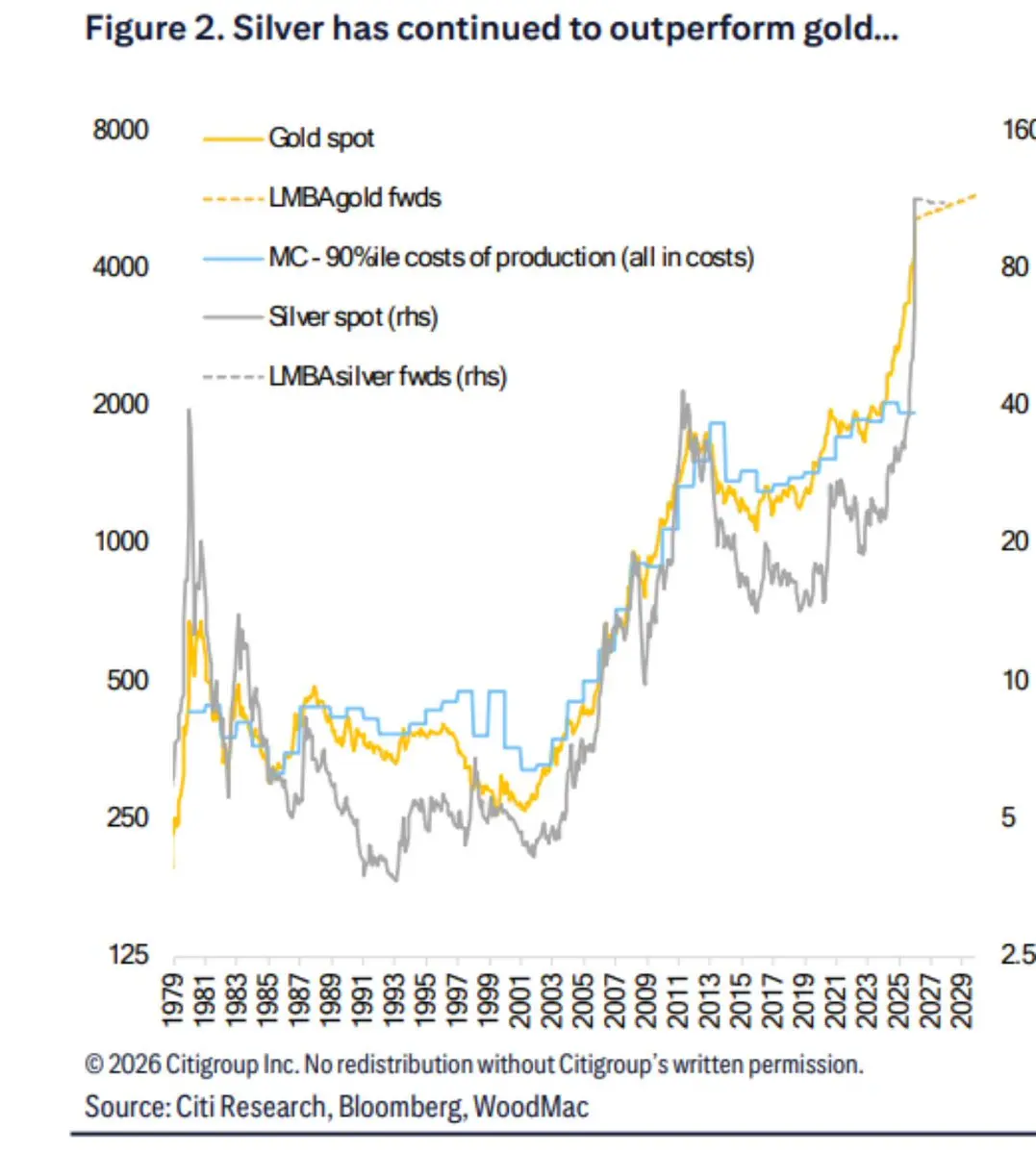

⚡️Citigroup updates research report, predicting silver to rally to $150 in the coming weeks — the most incredible part is that the sharp rise in silver prices occurs against the backdrop of multiple traditional bearish indicators simultaneously: 1⃣ COMEX silver inventories have decreased by about 100 million ounces since October last year. 2⃣ Global (excluding China) silver ETF holdings have net outflows of approximately 270 million ounces since December. 3⃣ CFTC data shows some managed funds taking profits during the rally. Under the influence of macro risk premiums and China's crazy retail d

View Original

- Reward

- like

- Comment

- Repost

- Share

Gold prices are at their highest level in history! 💰 Gram gold has reached 7,336.60 TRY, and ounce gold has hit 5,257.19 USD. This rise has been influenced by the Fed's interest rate cut expectations, a sharp decline in the Japanese yen, and the US government shutdown risk.

*Factors Affecting Gold Prices:*

- *Fed's Interest Rate Decisions*: Rate cuts make gold more attractive.

- *Dollar Value*: A weakening dollar increases gold demand.

- *Geopolitical Risks*: During periods of uncertainty, gold is preferred as a safe haven.

- *Inflation Expectations*: High inflation makes gold a protective as

View Original*Factors Affecting Gold Prices:*

- *Fed's Interest Rate Decisions*: Rate cuts make gold more attractive.

- *Dollar Value*: A weakening dollar increases gold demand.

- *Geopolitical Risks*: During periods of uncertainty, gold is preferred as a safe haven.

- *Inflation Expectations*: High inflation makes gold a protective as

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Marquee Coin, stable consolidation, never dump the market, let's promote it together!!

View Original

MC:$19.16KHolders:29

50.49%

- Reward

- 7

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More1.75K Popularity

65.11K Popularity

23.76K Popularity

8.32K Popularity

7.33K Popularity

Hot Gate Fun

View More- MC:$3.44KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

News

View MoreA certain whale liquidated a long position on HYPE, earning $1.86 million in 3 days

7 m

BNB rises and breaks through 900 USDT

22 m

Daiwa Securities: Japan's fiscal expansion and yen weakness may prompt the central bank to raise interest rates again

24 m

Gate Contract Index Zone will launch the BVIX and EVIX volatility index perpetual contracts on January 28th, supporting 1-50x leverage.

35 m

Gate SOL staking total surpasses 513,900 tokens, reaching a new high, with an annualized yield of 16%

42 m

Pin