Post content & earn content mining yield

placeholder

Rising military risks under Trump: Funds may flow into crypto and gold as safe havens

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

嫣然天使

嫣然天使

Created By@Goodbyeto

Listing Progress

2.90%

MC:

$4.01K

Create My Token

#WeekendMarketAnalysis

$ETH For the asset, it is now important to break through the key resistance level at 3100 and hold above it. Otherwise, a retest and further price decline may occur at this level. Indicators on the 2H timeframe signal a reversal to LONG.

$ETH For the asset, it is now important to break through the key resistance level at 3100 and hold above it. Otherwise, a retest and further price decline may occur at this level. Indicators on the 2H timeframe signal a reversal to LONG.

ETH1,46%

- Reward

- like

- Comment

- Repost

- Share

I have been securely trading digital currencies on the 12-year-old established exchange Gate. Join me now in participating in the hottest activity! https://www.gate.com/campaigns/4-gold-lucky-draw?ref=VLUSUAPDVG&ref_type=132

View Original

- Reward

- like

- Comment

- Repost

- Share

Clock in

Because most ordinary people are stubborn, ignorant, selfish, and self-centered. They are either fence-sitters, like floating duckweed with no roots or opinions, let alone cognition. Human nature is very complex and changeable.

The greed, anger, ignorance, shortsightedness, arrogance, and reckless commands of ordinary people are all too common. When others succeed, they think it's just good luck. When I encounter or succeed, I believe I can do it too. They even criticize those who don't understand or are professionals.

View OriginalBecause most ordinary people are stubborn, ignorant, selfish, and self-centered. They are either fence-sitters, like floating duckweed with no roots or opinions, let alone cognition. Human nature is very complex and changeable.

The greed, anger, ignorance, shortsightedness, arrogance, and reckless commands of ordinary people are all too common. When others succeed, they think it's just good luck. When I encounter or succeed, I believe I can do it too. They even criticize those who don't understand or are professionals.

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

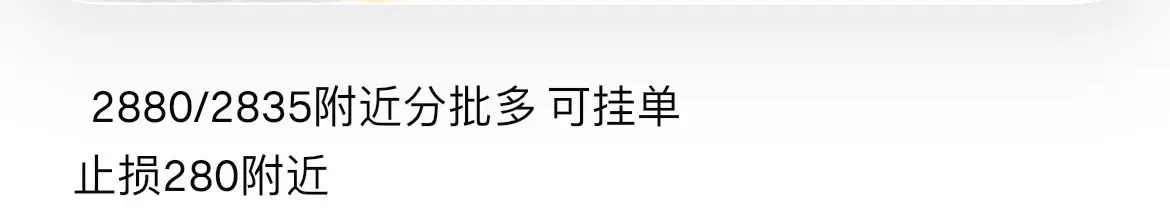

Over 2,880 subscription updates, 3,065 short positions, done!

View Original

- Reward

- 5

- 8

- Repost

- Share

Sixflowers :

:

😴😴😴View More

$BTC

Quotation!

BREAKING: Gold and silver prices fall sharply as President Trump announces he is no longer imposing new 10% tariffs on the EU.

This is the most tradable and profitable market of all time.

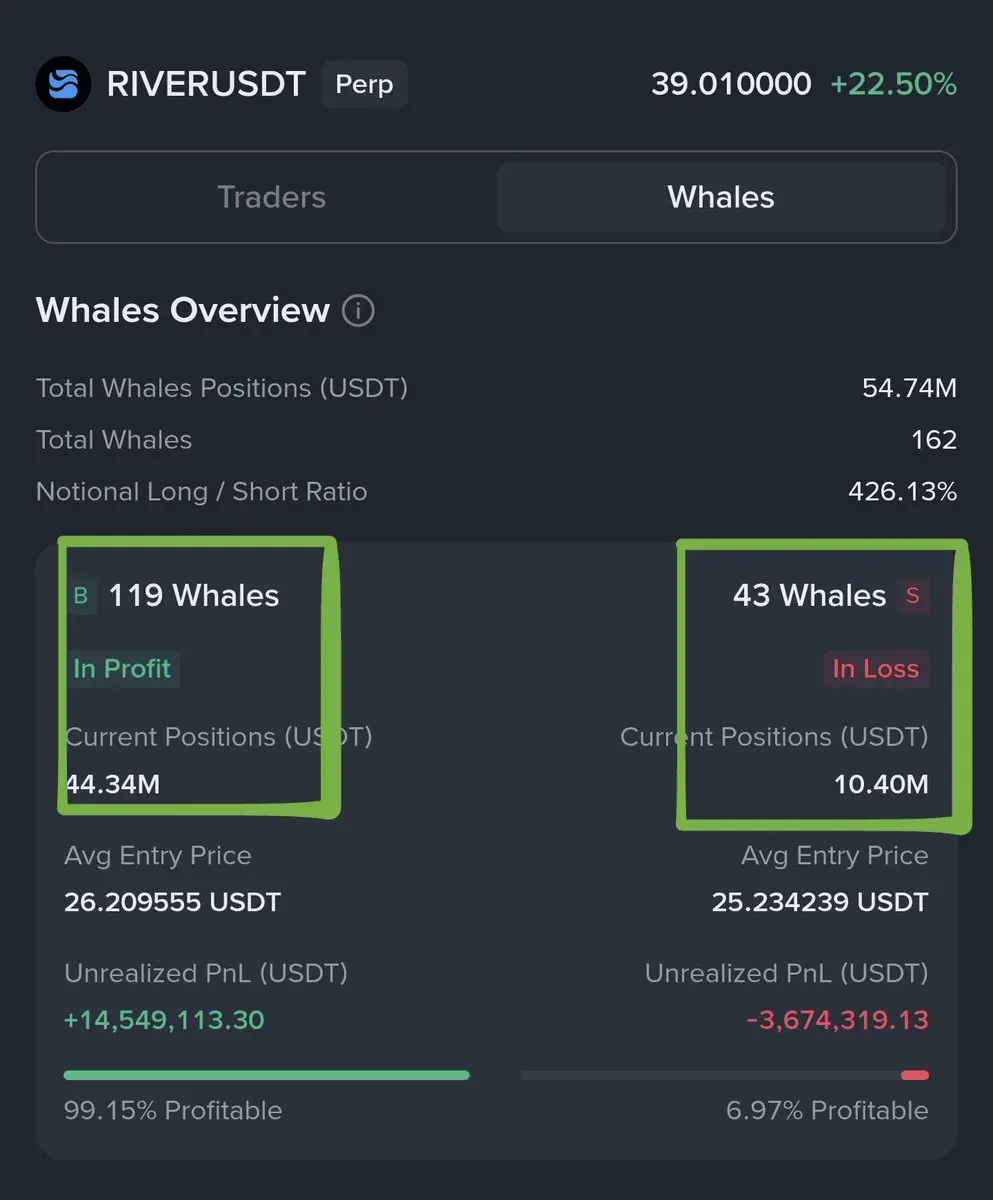

Breaking news is starting to surface, what's going on? Does someone want the donkeys to walk?

Quotation!

BREAKING: Gold and silver prices fall sharply as President Trump announces he is no longer imposing new 10% tariffs on the EU.

This is the most tradable and profitable market of all time.

Breaking news is starting to surface, what's going on? Does someone want the donkeys to walk?

BTC0,68%

- Reward

- like

- Comment

- Repost

- Share

If you don't get caught in a set, don't get hit and damaged, you'll never be able to break out. Today, the total position is close to flipping the account, and tomorrow you'll flip one more position.

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

【$HANA Signal】Long + Breakout with High Volume

$HANA Strong breakout after a 72.85% surge in volume, indicating this is a trend initiation driven by major players rather than mere short covering.

🎯 Direction: Long

🎯 Entry: 0.0218 - 0.0225

🛑 Stop Loss: 0.0205 ( Rigid Stop Loss )

🚀 Target 1: 0.0260

🚀 Target 2: 0.0295

$HANA ’s massive increase in price accompanied by a surge in open interest is a typical sign of capital inflow. The price did not quickly retrace after breaking out, indicating strong buying absorption and a market psychology shifting from hesitation to FOMO. There is no obvi

$HANA Strong breakout after a 72.85% surge in volume, indicating this is a trend initiation driven by major players rather than mere short covering.

🎯 Direction: Long

🎯 Entry: 0.0218 - 0.0225

🛑 Stop Loss: 0.0205 ( Rigid Stop Loss )

🚀 Target 1: 0.0260

🚀 Target 2: 0.0295

$HANA ’s massive increase in price accompanied by a surge in open interest is a typical sign of capital inflow. The price did not quickly retrace after breaking out, indicating strong buying absorption and a market psychology shifting from hesitation to FOMO. There is no obvi

View Original

- Reward

- like

- Comment

- Repost

- Share

#Show my holdings profit #交易就是如此简单 Keep sticking to my trading style Every day I can make steady profits I can do it for sure Keep going, keep going, keep going, keep going Making a hundred U per day and calling it a day, not greedy for more Stability is what matters

View Original

- Reward

- like

- 1

- Repost

- Share

EatHamburgersAndDrinkCola :

:

666 the 20th century is the computer department likes a lot, a lot of words, absolutely, absolutely, absolutely, absolutely willFUNKY

FunkyCat

Created By@BitBirdMemeTradeMaster

Listing Progress

0.00%

MC:

$3.37K

Create My Token

Update #BNBUSDT ⚖️ The price is in a critical zone.

From here, the market structure will determine whether we head towards the top of the range or start breaking through the lows. This is the preparation phase, where we monitor the price and get ready for the next move.

#BNB

$BNB

From here, the market structure will determine whether we head towards the top of the range or start breaking through the lows. This is the preparation phase, where we monitor the price and get ready for the next move.

#BNB

$BNB

BNB-0,51%

- Reward

- 1

- Comment

- Repost

- Share

Many of Elon musk acquisitions have started as a joke. \n\nRemember about this one.\n\n\n\nGrab your ticket or get left behind $XAir.

- Reward

- like

- Comment

- Repost

- Share

Gold crashing after Trump cancels EU tariffs and announces framework for Greenland deal

- Reward

- like

- Comment

- Repost

- Share

#GrowthPointsDrawRound16

🇮🇷 JUST IN: Blockchain analysis firm Elliptic reports that the Central Bank of Iran accumulated at least $507 million in Tether’s USDT to bypass sanctions and support the rial, with on-chain flows later traced through exchanges and cross-chain bridges.

$BTC $GT

🇮🇷 JUST IN: Blockchain analysis firm Elliptic reports that the Central Bank of Iran accumulated at least $507 million in Tether’s USDT to bypass sanctions and support the rial, with on-chain flows later traced through exchanges and cross-chain bridges.

$BTC $GT

- Reward

- like

- Comment

- Repost

- Share

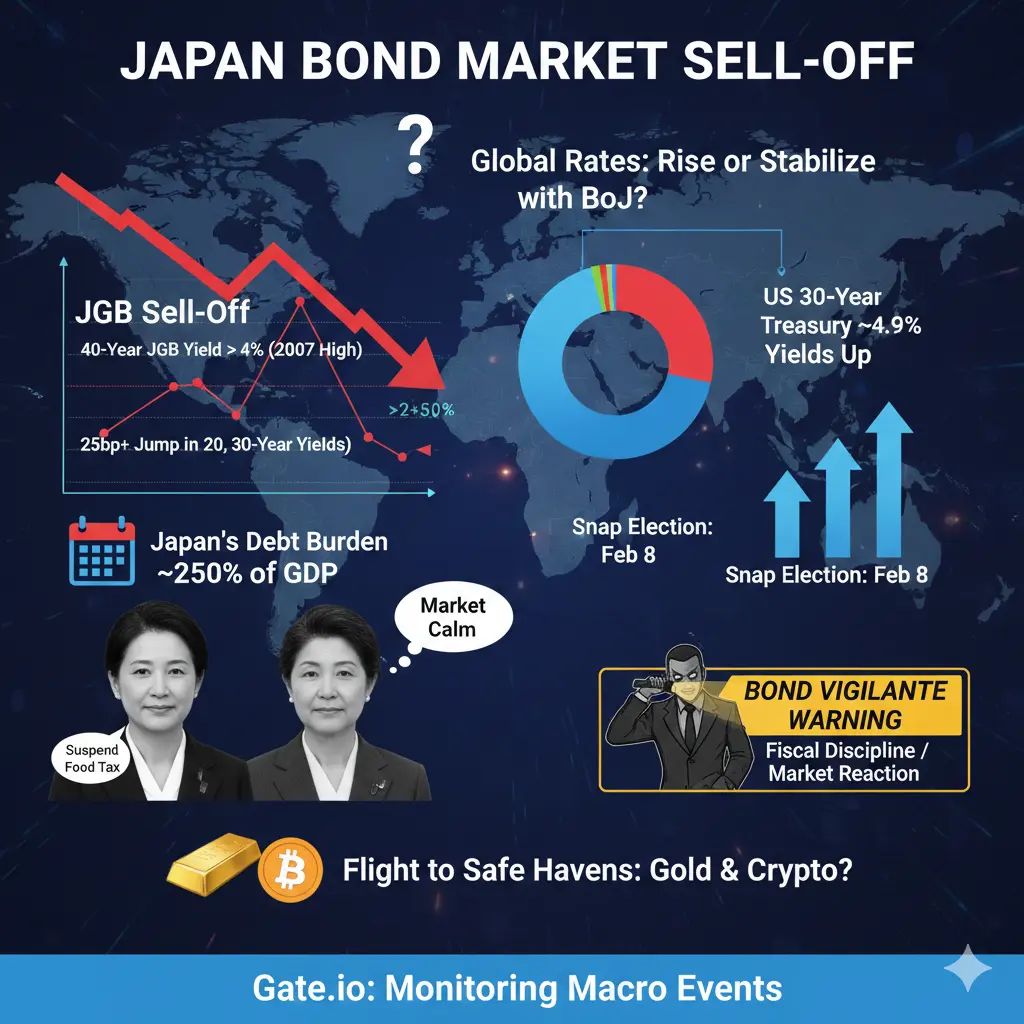

#JapanBondMarketSell-Off The recent sharp sell-off in Japan’s bond market is sending ripples across global financial markets. 📉🇯🇵 Long-term Japanese Government Bonds (JGBs) have experienced unprecedented movements, with the 40-year bond yield exceeding 4% for the first time, marking its highest level since 2007. Meanwhile, 30- and 20-year yields surged by more than 25 basis points, highlighting investor concern over Japan’s fiscal trajectory.

The sell-off was triggered by a combination of political and economic factors. Prime Minister Sanae Takaichi’s announcement to suspend the food consum

The sell-off was triggered by a combination of political and economic factors. Prime Minister Sanae Takaichi’s announcement to suspend the food consum

BTC0,68%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More38.26K Popularity

20.75K Popularity

8.08K Popularity

54.64K Popularity

343.55K Popularity

News

View MoreUS stocks close with the three major indices up over 1%, Trump’s post boosts the market

44 m

Trump: Hopes Hasset remains in office; the Federal Reserve Chair candidates have been narrowed down to two or three.

1 h

Data: In the past 24 hours, the total liquidation across the network was $1.005 billion, with long positions liquidated at $670 million and short positions at $335 million.

1 h

ETH breaks through 3050 USDT

2 h

The US Dollar Index rose to 98.8, and the Euro against the US Dollar briefly fell to 1.1685.

2 h

Pin