# JapanBondMarketSell-Off

20.29K

Japan’s bond market saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after plans to end fiscal tightening and boost spending. Will this impact global rates and risk assets?

YingYue

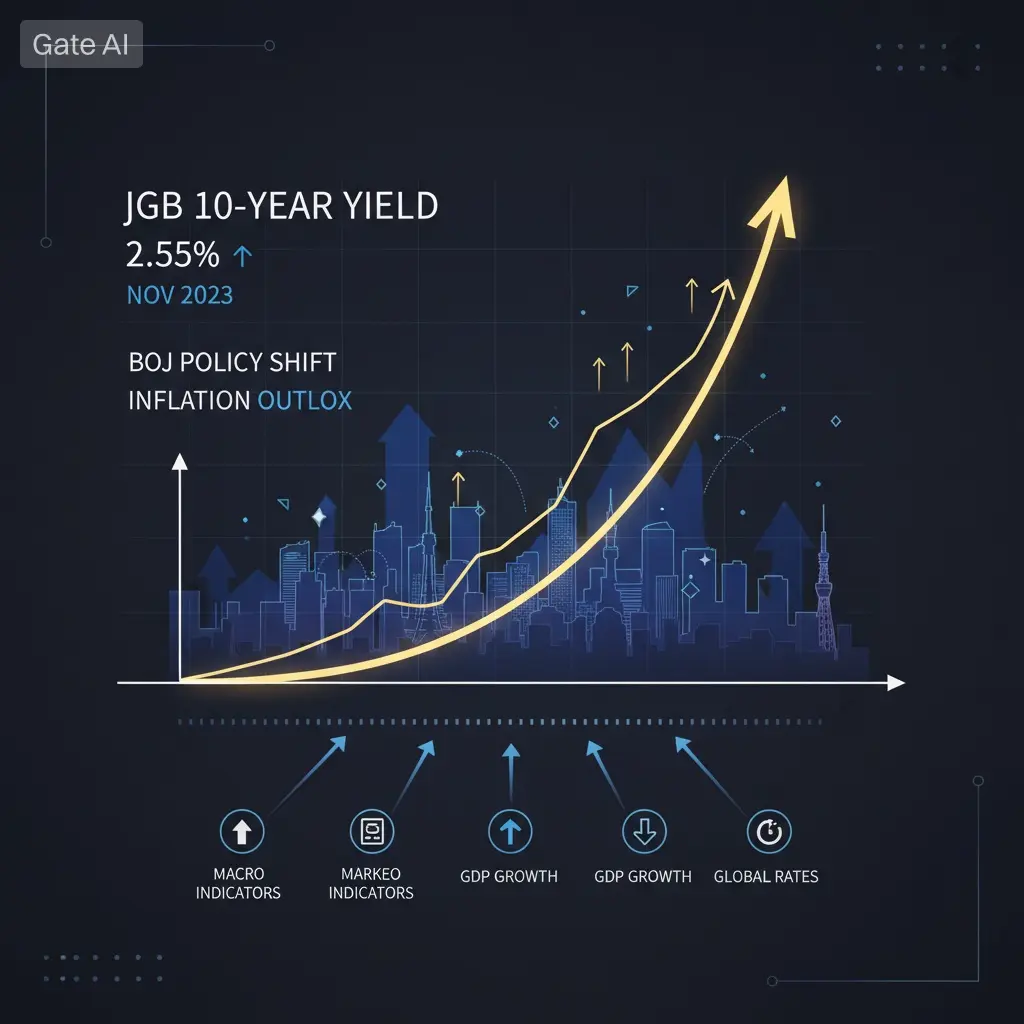

#JapanBondMarketSell-Off The recent surge in Japanese government bond yields — with 30-year and 40-year maturities jumping over 25 basis points — has captured the attention of global macro observers. This move follows Japan’s plans to ease fiscal tightening and increase government spending, signaling a potential shift in the ultra-low-yield environment that has dominated the country for decades.

Japan’s bond market has historically been a cornerstone of global capital flows, offering stable, near-zero yields that influence international rate expectations. A sudden spike in long-dated yields is

Japan’s bond market has historically been a cornerstone of global capital flows, offering stable, near-zero yields that influence international rate expectations. A sudden spike in long-dated yields is

- Reward

- 1

- 11

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

🇯🇵 Japan Bond Market Shock: A Liquidity Event With Global Consequences

Japan’s government bond market has just experienced an extraordinary shock.

Long-term Japanese Government Bond (JGB) yields surged at a pace not seen since 2003.

The 30-year yield jumped more than 30 basis points to ~3.9%, marking a 27-year high — a move so extreme that officials described it as a six-standard-deviation event.

This was not a routine sell-off.

It was a liquidity breakdown.

📉 What Happened

The disruption began around January 20–21

Buyers stepped aside, causing bond prices to collapse

Liquidity dried up com

Japan’s government bond market has just experienced an extraordinary shock.

Long-term Japanese Government Bond (JGB) yields surged at a pace not seen since 2003.

The 30-year yield jumped more than 30 basis points to ~3.9%, marking a 27-year high — a move so extreme that officials described it as a six-standard-deviation event.

This was not a routine sell-off.

It was a liquidity breakdown.

📉 What Happened

The disruption began around January 20–21

Buyers stepped aside, causing bond prices to collapse

Liquidity dried up com

- Reward

- 37

- 48

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

Japan Bond Market Sell-Off: Rising Yields, Fiscal Shift, and Global Implications

Japan’s bond market experienced a sharp sell-off, with 30-year and 40-year government bond yields jumping over 25 basis points following the government’s announcement to end fiscal tightening and increase spending. This dramatic move has raised questions about the impact on global rates, risk assets, and investor positioning.

What Happened

The Japanese government signaled a shift toward expansionary fiscal policy, aiming to boost economic growth through increased public spending.

In respo

Japan Bond Market Sell-Off: Rising Yields, Fiscal Shift, and Global Implications

Japan’s bond market experienced a sharp sell-off, with 30-year and 40-year government bond yields jumping over 25 basis points following the government’s announcement to end fiscal tightening and increase spending. This dramatic move has raised questions about the impact on global rates, risk assets, and investor positioning.

What Happened

The Japanese government signaled a shift toward expansionary fiscal policy, aiming to boost economic growth through increased public spending.

In respo

- Reward

- 9

- 11

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off is a macro development that could quietly influence global markets.

A sharp rise of over 25 bps in 30Y and 40Y Japanese bond yields signals a shift after plans to ease fiscal tightening and boost spending.

Japan has long been associated with ultra-low yields, so moves like this can affect global capital flows and rate expectations.

If higher yields persist, risk assets worldwide — including crypto — may start feeling the pressure.

The question is whether this is a temporary reaction or the start of broader repricing in global bond markets.

Ma

#JapanBondMarketSell-Off is a macro development that could quietly influence global markets.

A sharp rise of over 25 bps in 30Y and 40Y Japanese bond yields signals a shift after plans to ease fiscal tightening and boost spending.

Japan has long been associated with ultra-low yields, so moves like this can affect global capital flows and rate expectations.

If higher yields persist, risk assets worldwide — including crypto — may start feeling the pressure.

The question is whether this is a temporary reaction or the start of broader repricing in global bond markets.

Ma

- Reward

- 14

- 26

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#JapanBondMarketSell-Off Global Ripple Effects from Japan’s Bond Turmoil 🇯🇵📉

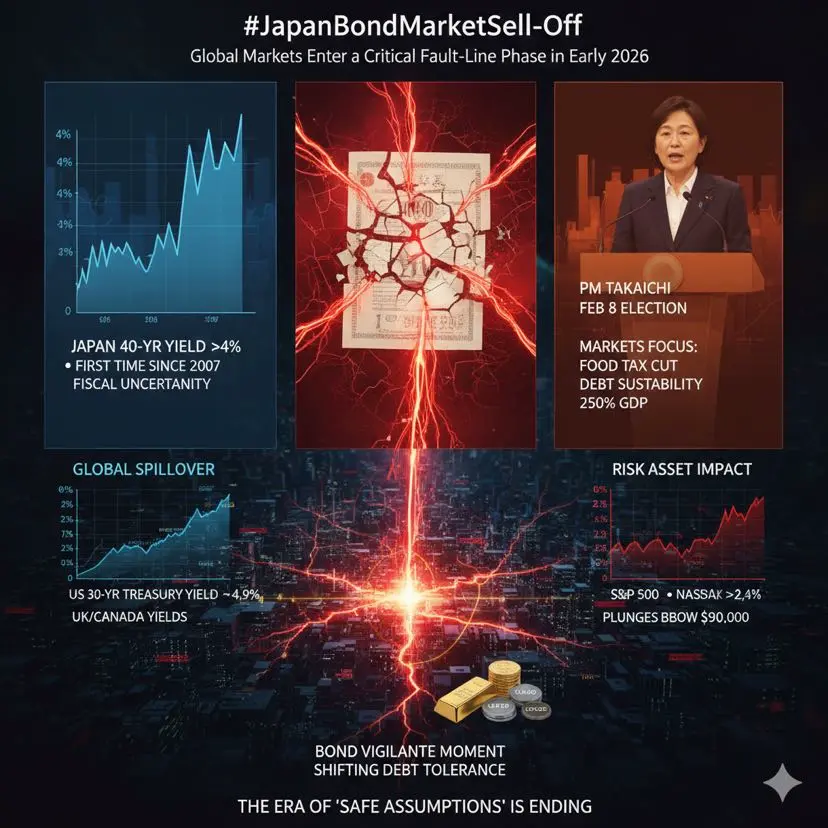

The recent sharp sell-off in Japan’s government bond market is sending tremors through global financial systems. Long-term yields surged as investors reacted to expansionary fiscal policies and political announcements ahead of Japan’s snap elections on February 8. This movement highlights how quickly debt markets can transmit local policy risks into global capital flows.

📊 Key Market Moves

Yesterday, Japanese government bonds experienced record selling, particularly in the long-term segment. The 40-year bond yield

The recent sharp sell-off in Japan’s government bond market is sending tremors through global financial systems. Long-term yields surged as investors reacted to expansionary fiscal policies and political announcements ahead of Japan’s snap elections on February 8. This movement highlights how quickly debt markets can transmit local policy risks into global capital flows.

📊 Key Market Moves

Yesterday, Japanese government bonds experienced record selling, particularly in the long-term segment. The 40-year bond yield

- Reward

- 5

- 9

- Repost

- Share

LittleQueen :

:

Buy To Earn 💎View More

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off

As of January 22, 2026, the Japanese government bond market has erupted into one of the most significant fixed-income sell-offs seen in decades, sparking marketwide volatility and capturing the attention of global investors. What was once considered one of the world’s safest and most stable bond markets has suddenly turned into a barometer of risk-on/risk-off sentiment across financial assets, as record surges in yields have alarmed portfolio managers, central bankers, and policymakers alike. On Tuesday, yields on long-dated Japanese Governmen

#JapanBondMarketSell-Off

As of January 22, 2026, the Japanese government bond market has erupted into one of the most significant fixed-income sell-offs seen in decades, sparking marketwide volatility and capturing the attention of global investors. What was once considered one of the world’s safest and most stable bond markets has suddenly turned into a barometer of risk-on/risk-off sentiment across financial assets, as record surges in yields have alarmed portfolio managers, central bankers, and policymakers alike. On Tuesday, yields on long-dated Japanese Governmen

- Reward

- 6

- 11

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

#JapanBondMarketSell-Off

📈 Japan Bonds Surge — Global Ripples Incoming?

Japan’s bond market just saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after the government signaled an end to fiscal tightening and plans to boost spending. This is a big move in a market that’s long been ultra-stable.

🔍 Key Implications

1️⃣ Global rate influence

Japan’s long-term yields often anchor Asian and global bond markets. A surge here could push US and European yields higher, especially in longer maturities.

2️⃣ Risk asset sentiment

Rising yields = higher discount rates = potential pressure

📈 Japan Bonds Surge — Global Ripples Incoming?

Japan’s bond market just saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after the government signaled an end to fiscal tightening and plans to boost spending. This is a big move in a market that’s long been ultra-stable.

🔍 Key Implications

1️⃣ Global rate influence

Japan’s long-term yields often anchor Asian and global bond markets. A surge here could push US and European yields higher, especially in longer maturities.

2️⃣ Risk asset sentiment

Rising yields = higher discount rates = potential pressure

- Reward

- 11

- 11

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#JapanBondMarketSell-Off

Forcing a Global Repricing of Risk in 2026

The recent disruption in Japan’s government bond market is no longer being viewed as a local anomaly but as a structural signal for the global financial system. For decades, Japan functioned as the world’s yield suppressor, exporting cheap capital and anchoring global interest rate expectations. That role is now under pressure as long-dated Japanese Government Bond yields push into territory unseen in nearly two decades, signaling that one of the last pillars of ultra-low rates is weakening. The sharp rise in 40-year JGB yiel

Forcing a Global Repricing of Risk in 2026

The recent disruption in Japan’s government bond market is no longer being viewed as a local anomaly but as a structural signal for the global financial system. For decades, Japan functioned as the world’s yield suppressor, exporting cheap capital and anchoring global interest rate expectations. That role is now under pressure as long-dated Japanese Government Bond yields push into territory unseen in nearly two decades, signaling that one of the last pillars of ultra-low rates is weakening. The sharp rise in 40-year JGB yiel

- Reward

- 4

- 7

- Repost

- Share

Peacefulheart :

:

Watching Closely 🔍️View More

#JapanBondMarketSell-Off

Long-Term Yields Surge as Fiscal Policy Shifts: Global Rate Shock or Regional Adjustment?

Japan’s bond market recently experienced a sharp sell-off, with 30-year and 40-year yields jumping over 25 basis points after the government announced plans to end fiscal tightening and increase spending. This sudden move is significant because Japan’s long-dated government bonds have long been considered ultra-stable and a cornerstone of global fixed-income markets. The rapid repricing signals that investors are adjusting to higher perceived duration and inflation risk, and it r

Long-Term Yields Surge as Fiscal Policy Shifts: Global Rate Shock or Regional Adjustment?

Japan’s bond market recently experienced a sharp sell-off, with 30-year and 40-year yields jumping over 25 basis points after the government announced plans to end fiscal tightening and increase spending. This sudden move is significant because Japan’s long-dated government bonds have long been considered ultra-stable and a cornerstone of global fixed-income markets. The rapid repricing signals that investors are adjusting to higher perceived duration and inflation risk, and it r

- Reward

- 19

- 26

- Repost

- Share

GateUser-e7fbb675 :

:

Buy To Earn 💎View More

#JapanBondMarketSell-Off Global Ripples from Tokyo

The recent sharp sell-off in Japan’s bond market is sending shockwaves across global financial markets. Yesterday, Japanese government bonds (JGBs), especially long-term maturities, experienced record-high selling. The 40-year bond yield exceeded 4% for the first time, marking its highest level since 2007, while the 30- and 20-year yields jumped by more than 25 basis points.

This sell-off is primarily driven by Prime Minister Sanae Takaichi’s promise to suspend the food consumption tax for two years, combined with rising concerns over increase

The recent sharp sell-off in Japan’s bond market is sending shockwaves across global financial markets. Yesterday, Japanese government bonds (JGBs), especially long-term maturities, experienced record-high selling. The 40-year bond yield exceeded 4% for the first time, marking its highest level since 2007, while the 30- and 20-year yields jumped by more than 25 basis points.

This sell-off is primarily driven by Prime Minister Sanae Takaichi’s promise to suspend the food consumption tax for two years, combined with rising concerns over increase

- Reward

- 6

- 10

- Repost

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

35.97K Popularity

19.36K Popularity

13.99K Popularity

3.55K Popularity

10.41K Popularity

9.6K Popularity

8.25K Popularity

75.98K Popularity

36.68K Popularity

20.29K Popularity

7.21K Popularity

109.15K Popularity

254.34K Popularity

20.41K Popularity

179.48K Popularity

News

View MoreUS XRP spot ETF saw a total net inflow of $3.43 million in a single day

13 m

Money laundering suspect Sen Hok Ling in the Zhimin Bitcoin case must return $7.6 million, or face an additional 8-year prison sentence

18 m

Data: 137.22 BTC transferred from an anonymous address, worth approximately $12.3 million

19 m

Data: 699.83 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

29 m

Analyst: SLV's increase is "exaggerated," and Bitcoin ETF attracting funds during a headwind period is more valuable.

30 m

Pin