Search results for "NET"

XRP Breaking News: Veteran Transition, ETF Progress, Policy Catalysts, Is the $3 Target in Place?

At the beginning of 2026, the XRP ecosystem ushered in a dual key catalyst. On the technical front, David Schwartz, the Chief Technology Officer of Ripple and co-creator of the XRP Ledger, who has served for over 13 years, officially stepped down, transitioning to Honorary CTO and remaining on the board, marking a smooth transition of an era. On the market front, the XRP spot ETF has accumulated a net inflow of $1.18 billion since its launch, defying market pressure in December 2025 to attract $499.9 million, forming a stark contrast to the outflows from Bitcoin and Ethereum ETFs.

Meanwhile, the U.S. Senate Banking Committee will review the key "Market Structure Act" on January 15, paving the way for clearer regulation of digital assets. The strategic handover of technical veterans, surging institutional funds, and potential regulatory benefits have collectively brought XRP into the market spotlight, with analysts generally optimistic about a mid-term price increase to $3.

MarketWhisper·10h ago

Solana RWA market capitalization soars by 325%, aiming for the billion-dollar mark, ETF attracts $765 million in funds to help SOL target $140

At the beginning of 2026, Solana delivered an impressive performance in the Real World Assets (RWA) sector. Data shows that its on-chain RWA total value soared to $873.3 million in January, a 325% increase compared to a year ago, firmly ranking third in the global blockchain RWA ecosystem. Meanwhile, the spot Solana ETF approved and launched in mid-December 2025 has attracted a net inflow of over $765 million.

The strong fundamental growth and continuous influx of institutional funds resonate, driving SOL prices to consolidate above key technical levels. Analysts are generally optimistic about its potential to reach $140 or even higher in the first quarter of 2026. This marks Solana's transformation from a high-performance public chain to an institutional-grade infrastructure that integrates traditional financial assets with crypto liquidity.

MarketWhisper·11h ago

Raoul Pal Net Worth: How Crypto Built a $350M Fortune

Raoul Pal, the former Goldman Sachs hedge fund manager turned crypto media mogul, has amassed a fortune estimated between \$40 million and \$350 million, with the upper range gaining significant credence in 2025. The architect of Raoul Pal's net worth is a bold, all-in bet on digital assets, which he has publicly stated constitute nearly 100% of his liquid portfolio.

PAL11,79%

MarketWhisper·11h ago

In 2025, global ETF growth "attracts $1.5 trillion," with BlackRock Bitcoin IBIT being the only one among the top 15 to incur losses.

In 2025, global ETF net inflows surged to $1.49 trillion, led by US stocks and gold. BlackRock's IBIT became the only product among the top 15 with negative returns, highlighting a trend of capital withdrawal from Bitcoin and shifting toward the stock market.

(Background: Fidelity's 2026 Crypto Market Outlook Report: More countries may establish Bitcoin reserves, and long-term holding of BTC remains profitable)

(Additional context: Bitcoin reaches $90,000, so why do meme coins PEPE and DOGE always rally at the peak?)

Table of Contents

Capital favors stocks, ETF net inflows set records

IBIT changes from star to drag

Policy and market psychology exert dual pressure

Bloomberg analyst Eric Balchunas compiled the 2025 global ETF performance on the X platform, with total net inflows reaching 1.4

動區BlockTempo·11h ago

The biggest IPO wealth creation movement in history is about to begin: SpaceX, OpenAI, and Anthropic lead the way

SpaceX, OpenAI, and Anthropic are set to go public collectively in 2026, with a total valuation reaching up to 2.5 trillion USD, marking an unprecedented stress test for market funding.

(Background recap: Musk's net worth approaches 750 billion USD, the first in history! Court restores sky-high salaries, SpaceX IPO sparks imagination)

(Additional background: Tether reiterates: We will return to the US market! Targeting institutional clients, but not following Circle's IPO approach)

Table of Contents

Timeline and valuation of three super IPOs

SpaceX: Physical revenue as a backing

OpenAI, Anthropic: AGI valuation undergoes its first public scrutiny

Is the market capable of absorbing this?

2026 is just beginning, Financial Times reports that SpaceX, OpenA

動區BlockTempo·12h ago

Bitcoin returns to $90,000! ETF attracts $459 million in a single week, ending two weeks of outflows

Bitcoin first returned to $90,000 on December 12 and rose to $91,518 on January 4. As of the week ending January 2, the US spot ETF saw a net inflow of $459 million, ending two weeks of outflows. The decline in the 10-year Japanese government bond yield has driven an influx of yen arbitrage trading. Despite the fear index dropping to 25, technical and fundamental divergences suggest a short-term target of $95,000.

BTC1,45%

MarketWhisper·12h ago

XRP Today's News: Senate to review Market Bill on January 15, bullish challenge to $3

The U.S. Senate Banking Committee will review the "Market Structure Act" on January 15, which, together with the XRP spot ETF's cumulative net inflow of $1.18 billion, forms a double positive. In December, XRP ETF net inflows were nearly $500 million, while Bitcoin and Ethereum ETFs saw outflows of $1.09 billion and $617 million respectively, indicating a possible decoupling. Analysts expect XRP bulls to challenge $3.00 in the medium term.

MarketWhisper·12h ago

$670 million New Year’s kickoff: TradFi massively increases positions, crypto ETFs fire the first shot in "decoupling"

The first trading day of 2026 saw a long-awaited "capital feast" in the US spot crypto ETF market. According to the latest data, on January 2nd, these funds experienced a single-day net inflow of up to $669 million, not only sweeping away the net outflows at the end of 2025 but also hitting the highest single-day inflow record in nearly two months.

Among them, Bitcoin ETFs dominated with a $471 million inflow, while Ethereum ETFs also recorded a strong net inflow of $174 million. This robust buying force was not limited to leading assets; ETFs for small-cap assets like Solana and XRP also attracted capital. Analysts pointed out that this indicates TradFi institutions may be rebalancing crypto assets with unprecedented strength at the start of the new fiscal year, shifting the logic from pure speculation to strategic positioning based on the unique fundamentals of crypto assets.

MarketWhisper·13h ago

MicroStrategy's persistent struggles: Why does the Bitcoin whale holding $59 billion get rejected by the S&P 500?

Despite holding Bitcoin worth up to $59 billion, far exceeding its $4.5 billion market capitalization, MicroStrategy's stock plummeted nearly 50% in 2025, making it the worst-performing component of the Nasdaq 100 index. This brutal decline not only triggered fierce criticism of its "Bitcoin-backed" corporate strategy from economists including Peter Schiff but also clearly highlighted the "high wall" between MicroStrategy and the S&P 500 index.

This article delves into the underlying reasons for the severe divergence between MicroStrategy's stock price and its Bitcoin assets, revealing the essence of its business model as a "Bitcoin proxy" and the perilous situation where its market value-to-net asset ratio falls below 1.0, providing a comprehensive perspective on the unique position of this world's largest publicly listed Bitcoin holder.

BTC1,45%

MarketWhisper·14h ago

Why hasn't the $1 billion USD ETF XRP yet made a breakthrough for the market?

The XRP spot ETF funds have surpassed the $1 billion USD assets under management (AUM), with a total of approximately $1.14 billion USD allocated across 5 issuing organizations. The total net capital flow since November 14th is currently around $423.27 million USD.

On the same CoinGlass data table, XRP is trading around $1.88 USD, with a market capitalization reaching a...

TapChiBitcoin·14h ago

In 2025, crypto phishing losses plummeted by 83%, but attackers are shifting towards a "scattergun" approach.

According to the latest report from the Web3 security platform Scam Sniffer, cryptocurrency phishing losses related to wallet stealers plummeted by 83% in 2025, down to $83.85 million. However, the decline in total losses masks a more covert trend: attackers are abandoning "whale hunting" and shifting to a "broad net" strategy targeting retail users.

The report points out that the ecosystem remains active, with new attack vectors emerging alongside Ethereum upgrades, indicating that security offense and defense will enter a more complex new stage. Meanwhile, although overall hacker losses in December decreased by 60% month-on-month, phishing attacks, as a persistent threat, warrant increased vigilance from ordinary investors regarding their evolving tactics.

MarketWhisper·15h ago

Can MSTR's deep discount be reversed? Wall Street outlines the 2026 Strategy stock price surge roadmap to $500

Senior Wall Street analysts have outlined a valuation blueprint for Strategy stock reaching up to $500 by 2026. The core logic is based on the significant discount between the company's Bitcoin assets valued at approximately $59 billion on its balance sheet and its current market capitalization of about $46 billion. This forecast is not blind optimism but is grounded in mathematical calculations assuming Bitcoin prices stabilize and the net asset value discount converges.

However, the road ahead is not smooth. The upcoming MSCI classification decision on January 15 presents significant uncertainty, potentially leading to massive outflows of index funds. Meanwhile, MSTR's stock price has initially stabilized near the critical support level of $150 after a 66% plunge. Technical indicators show weakening selling pressure, providing a structural basis for a subsequent rebound. Recent data released by founder Michael Saylor shows that his stock trading activity far exceeds that of tech giants, highlighting the market's high attention and strategic play surrounding this unique "Bitcoin proxy stock."

BTC1,45%

MarketWhisper·15h ago

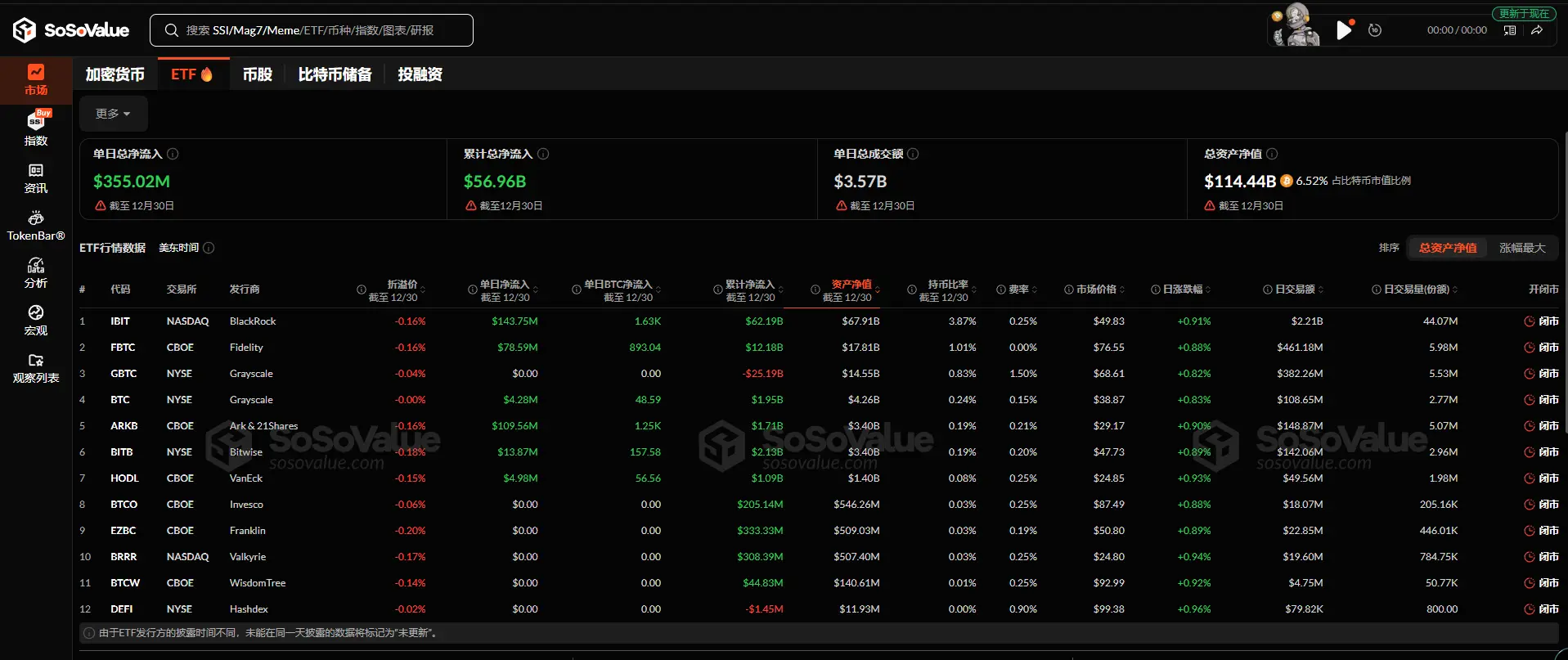

Cryptocurrency ETF trading volume exceeds 2 trillion, with BlackRock taking 70% of the trading volume

U.S. cryptocurrency ETF trading volume surpasses $2 trillion, doubling from $1 trillion to $2 trillion in just 8 months, doubling the previous pace. BlackRock IBIT accounts for 70%, with assets under management exceeding $66 billion. The first-day net inflow in 2026 is $645.6 million, with institutional demand continuing to expand.

MarketWhisper·15h ago

Bitcoin whale hoarding is a false illusion! Internal exchange maintenance was misinterpreted; December was actually a net sell-off.

CryptoQuant Research Director Julio Moreno revealed on January 2nd that recent on-chain signals interpreted as "Bitcoin whale" buying are actually internal maintenance related to exchange asset integration. Excluding technical transfers, whales were net sellers in December, reducing their holdings from 3.2 million to 2.9 million. Glassnode confirmed that net fund flow has turned negative, ending two years of positive inflows.

BTC1,45%

MarketWhisper·15h ago

Only took 8 months! Cryptocurrency ETF trading volume surpasses $2 trillion. Why has the speed doubled?

The US spot cryptocurrency ETF market has ushered in a landmark moment. According to The Block data, by January 2, 2026, its cumulative trading volume has surpassed the $2 trillion mark. It took only about 8 months to go from $1 trillion to $2 trillion, twice as fast as reaching the first trillion milestone, clearly revealing that institutional funds are pouring into this compliant channel at an accelerated pace.

On the first trading day of the year, the net inflow of Bitcoin and Ethereum spot ETFs combined reached $645.6 million, sweeping away the last year's outflow gloom, with BlackRock's IBIT fund maintaining dominance with approximately 70% of trading volume share. Market analysts believe that as more asset class ETFs are approved, competition will intensify, and the industry may face a process of consolidation through winners and losers in the future.

MarketWhisper·16h ago

First day institutional rush in 2026! Cryptocurrency ETF attracts $670 million

U.S. cryptocurrency ETFs recorded a net inflow of $669 million on their first day in 2026, reversing the trend of fund withdrawals at the end of the year. BlackRock's IBIT led with a single-day inflow of $287 million, while Bitcoin products saw a total inflow of $471 million, and Ethereum funds grew by $174 million. The capital inflow extended to smaller asset ETFs such as Solana, XRP, and Dogecoin, indicating that institutions are positioning for the 2026 crypto cycle.

MarketWhisper·17h ago

XRP Flips BNB as Spot ETFs and Institutional Demand Spark 2026 Bull Run

XRP jumped about 9% in 24 hours, briefly topping $2 and flipping BNB to rank as the fourth-largest crypto by market value.

Spot XRP ETFs added $13.59 million on Jan 2, 2026; net inflows since Nov 2025 reached $1.18 billion, with AUM near $1.37 billion.

XRP price climbed 9% over the

CryptoNewsFlash·21h ago

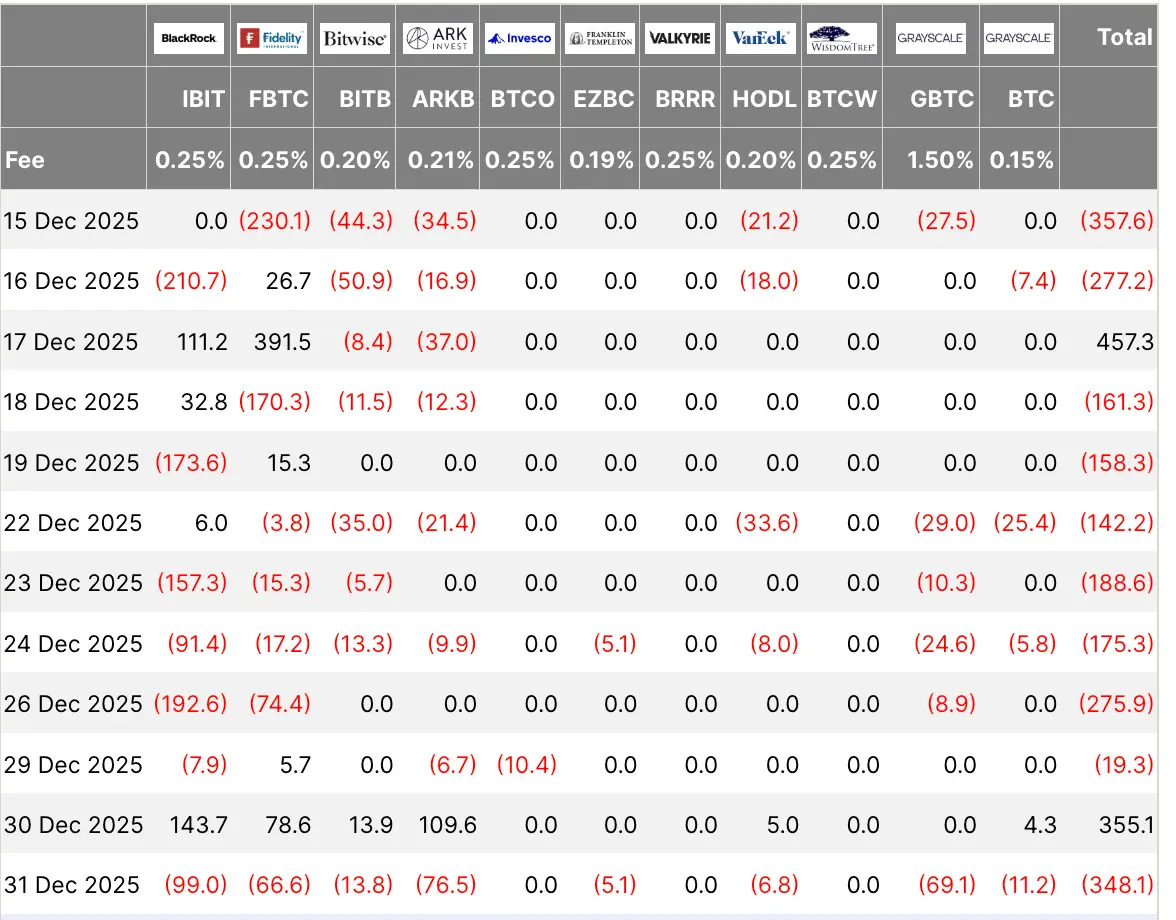

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

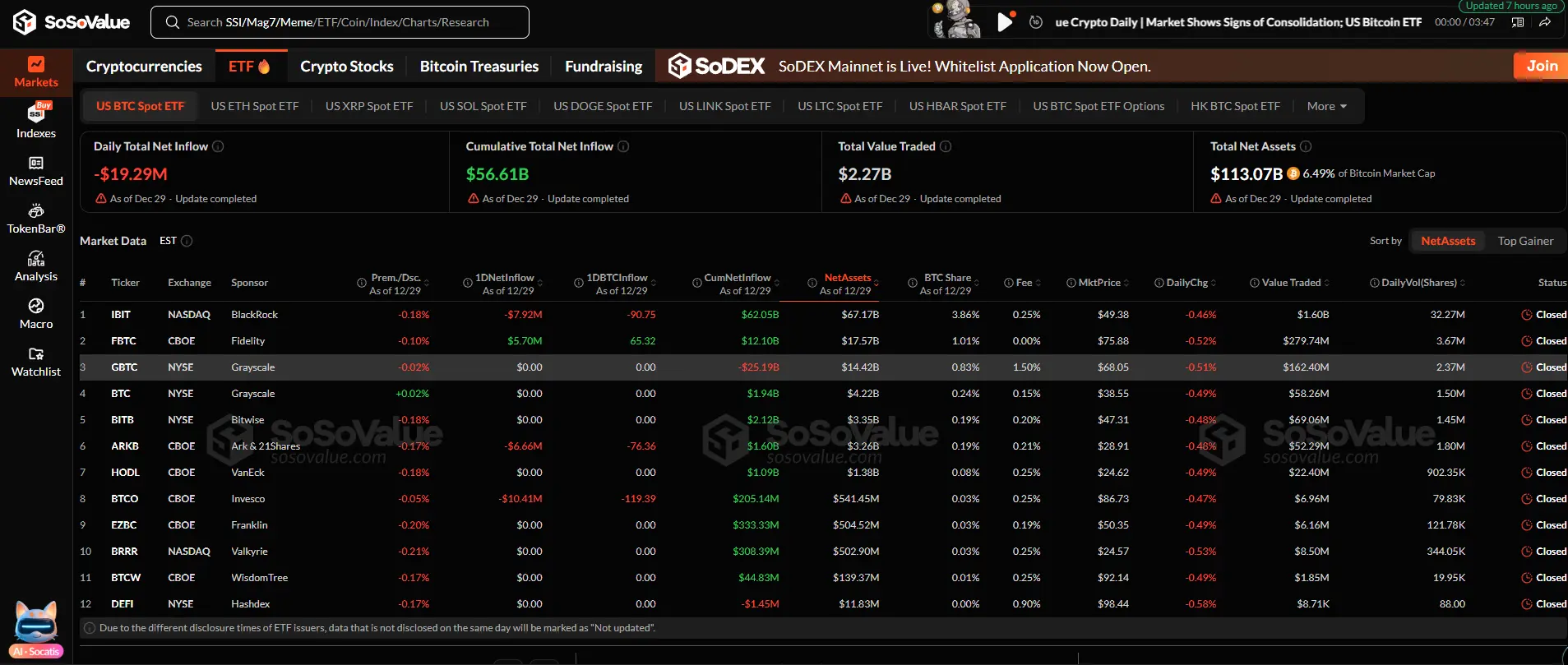

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC1,45%

区块客·01-03 12:18

ETF Bitcoin fails the test as $1.29 billion is withdrawn from the market due to "strategic" positions

The US-based spot Bitcoin ETF funds recorded a total net outflow of approximately $1.29 billion USD over 12 trading sessions, from December 15 to December 31.

This quiet holiday period has become one of the clearest tests of the "stickiness" of the spot Bitcoin ETF group, amid the discussions

BTC1,45%

TapChiBitcoin·01-03 05:08

Weekly Podcast for the First Week of January — Is the Rebound Just an Illusion? ETF Capital Outflows and Worsening Market Imbalance

[1] Introduction: Bitcoin breaks through $90,000, and the atmosphere is filled with calls of "Uptober" driven by quantitative algorithms. However, ETF funds are shifting to net outflows, and liquidity is clearly flowing into derivatives.

&39;Is this rebound a recovery based on actual demand, or an illusion caused by liquidity reallocation?&39; Exploring the essence of the rebound is the core focus of this week's market analysis.

[2] Internal Market Analysis ① (Price and Asset Structure): Bitcoin(+1.91%) and Ethereum(+4.43%) are leading the market with strong performance, but this is accompanied by an increase in Ethereum's market share and a decrease in Bitcoin's share. Altcoins are performing even more strongly. Dogecoin(+10.96%), Cardano(+8.91%), Ripple(+6.46%), and others have seen significant gains far exceeding Bitcoin. However, this rally is not based on technological or ecological expansion, but is heavily influenced by leveraged trading dominated by derivatives, which means it is not a fundamental...

TechubNews·01-03 04:43

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC1,45%

区块客·01-02 12:13

MICA Daily|Binance ETH inflow volume increases significantly, indicating potential selling pressure

The net inflow of Ethereum on Binance Exchange surged to 245,000 ETH after Christmas, reaching a new high since July, indicating a large amount of ETH moving from cold wallets to the exchange. This increase may suggest that holders are preparing to sell or hedge derivative positions.

ETH0,99%

区块客·01-02 05:06

Meme coin Broccoli surges 1000%! The founder of Equation News makes a move, earning millions on the first day of 2026

New Year's Day BROCCOLI714 Surges Over 10 Times, Vida Detects Abnormal Operations with Precise Entry and Exit, and Reverse Short Selling, Achieving a Profit of 1 Million USD on the First Day of the New Year.

In the early hours of New Year's Day 2026, BROCCOLI714 was suspected to have been violently pumped over 10 times due to a hacker attack or abnormal market maker activity. Vida, the founder of Formula News, was alerted by the surge alarm, quickly identified the abnormality by observing the order book, and decisively executed a precise strategy of "closing hedge positions, waiting for circuit breaker buy-ins, withdrawing orders at high levels to escape the top, and reverse short selling to harvest." On the first day of the new year, this strategy successfully earned a net profit of 1 million USD.

CZ's Dog-Name Coin Broccoli Price Surges Abnormally

------------------------

On 2/13, CZ shared on Twitter that his beloved dog’s name is Cauliflower (Bro

CryptoCity·01-02 04:40

[Domestic Stock Market Opening行情] The domestic stock market is showing a sideways trend... The exchange rate and gold prices are declining, accompanied by a personal buying trend

The Korean stock market was flat today, with both the KOSPI and KOSDAQ indices showing no change. Retail investors net bought funds on both the main board and KOSDAQ markets, while foreign investors and institutions both showed net selling. The Korean won weakened slightly against the US dollar, and gold prices also declined.

TechubNews·01-02 00:46

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·01-01 14:36

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC1,45%

区块客·01-01 12:13

Tron Sees Historic Stablecoin Inflows as Capital Accelerates Onchain

Tron has captured market attention after recording the largest stablecoin supply increase within a single day. Artemis data shows the network added $1.4 billion in stablecoins during the last 24 hours. This surge places Tron ahead of every major blockchain in daily net inflows. The movement

TRX0,76%

Coinfomania·01-01 08:42

[Domestic Stock Market Opening] Domestic stock market closed lower... KOSPI index down 0.15%, KOSDAQ index down 0.76%, retail investors net bought

According to the Korea Exchange News, the KOSPI index fell 6.39 points(-0.15%) from the previous trading day, closing at 4,214.17 points; the KOSDAQ index dropped 7.12 points(-0.76%), closing at 925.47 points.

In the main board market, retail investors net bought 8,448 billion KRW, while foreign investors and institutional investors net sold 4,768 billion KRW and 3,763 billion KRW respectively.

Top market cap stocks on the KOSPI include: Samsung Electronics(+0.33%), SK Hynix(+1.72%), LG Energy Solution(-3.03%), Samsung Biologics(-0.64%), Samsung Electronics preferred stock(-0.67%), Hyundai Motor(+1.02%), KB Financial(-0.72%), Kia(+0.58%), Celltrion(-0.17%), Samsung C&T(-0.83%).

In the KOSDAQ market

TechubNews·01-01 00:46

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-31 14:34

Bitcoin Spot ETFs Reverse Outflows With $355M Inflow; Ethereum and Solana See Gains

On December 30, institutional money returned to crypto exchange-traded products, with Bitcoin spot ETFs logging a collective net inflow of about $355 million, a sharp reversal after seven consecutive days of outflows. The day’s buying was led by BlackRock’s IBIT, which alone accounted for

BlockChainReporter·2025-12-31 13:03

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC1,45%

区块客·2025-12-31 12:12

PA Daily | Bitcoin ETF shifts from 7 days of net outflows to net inflows; Bitwise submits applications for 11 crypto ETFs

Today's News Highlights:

Trump Mobile, a subsidiary of the Trump Group, delays the launch of the gold-colored smart phone originally scheduled for this year.

Delin Holdings: Delin Securities approved to provide virtual asset trading services, upgraded to a Category 1 license.

Bitcoin spot ETF saw a total net inflow of $355 million yesterday, switching from seven consecutive days of net outflows to net inflows.

NEO's two founders publicly split: Da Hongfei and Zhang Zhengwen accuse each other of monopolizing financial control and lacking transparency.

Bitwise submits applications to the US SEC for 11 new cryptocurrency ETFs, including tokens like AAVE and UNI.

Macro

Trump Mobile, a subsidiary of the Trump Group, delays the launch of the gold-colored smart phone originally scheduled for this year.

According to Jin10 citing the Financial Times, Trump Mobile, a mobile phone company launched by the Trump Group, has postponed its plan to deliver the gold-colored smart phone originally scheduled for the end of this year. The company

PANews·2025-12-31 10:06

Bitcoin loses $2 trillion liquidity safety net! Federal Reserve reverse repurchase agreement zero alert

The Federal Reserve's reverse repurchase mechanism has decreased from over $2 trillion to nearly zero, eliminating the liquidity safety net that Bitcoin was hiding behind. Although global liquidity reached a new high of $187.3 trillion, it has fallen back by $1.8 trillion since November. U.S. net liquidity stabilized in the fourth quarter, and Bitcoin lost its mechanical boost. The trend in 2026 will depend on interest rate cuts, the dollar, and Chinese policies.

MarketWhisper·2025-12-31 08:47

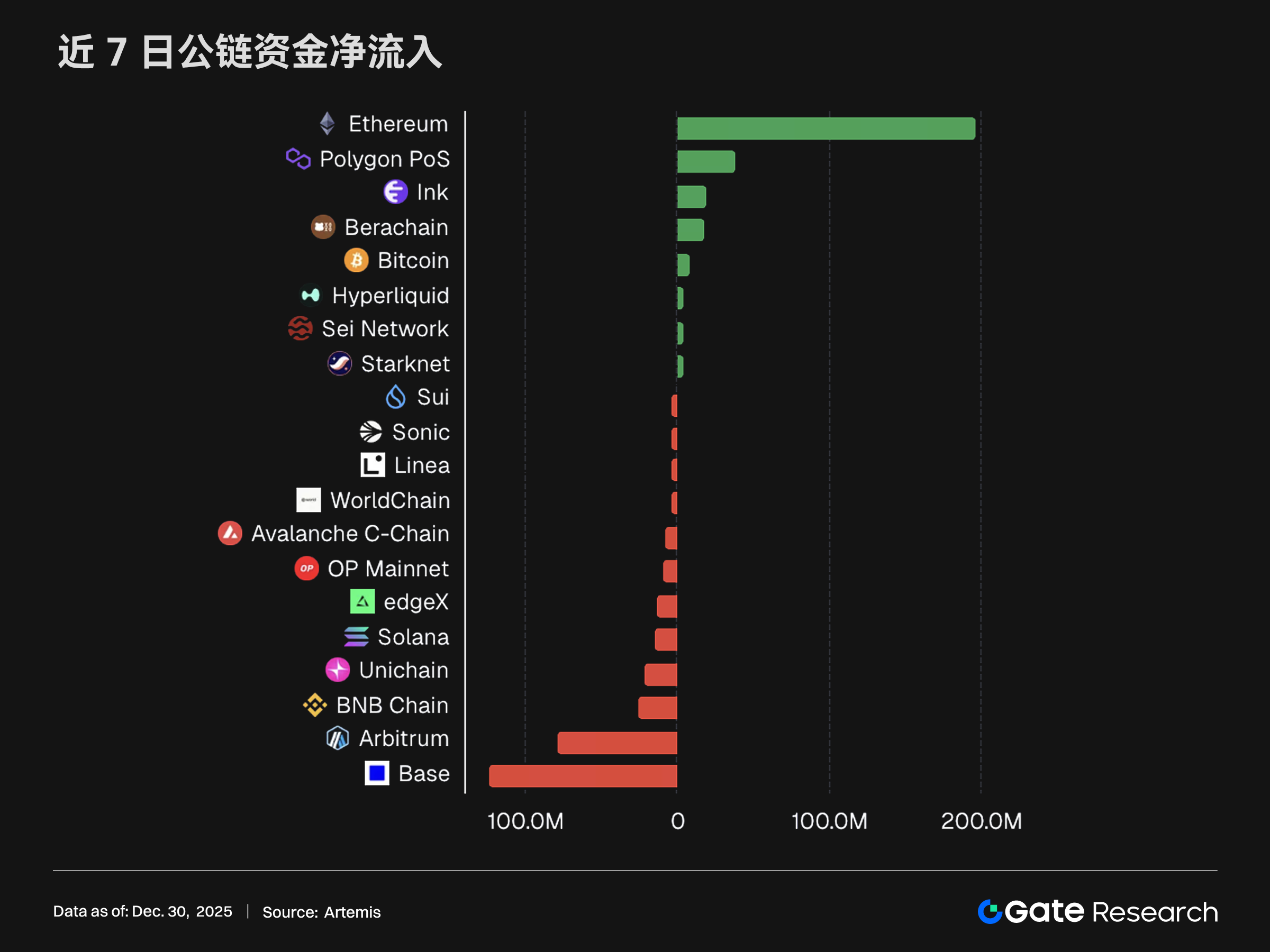

[Chain Flow] Ethereum bridge fund net inflow of $46.47 million within 7 days… Arbitrum now has the largest net outflow

In the past seven days, Ethereum has performed prominently in bridge asset flows, with a net inflow of $46.47 million, while Arbitrum experienced a net outflow of $75.73 million, indicating a clear trend of fund transfer. Other chains such as Hyperliquid and Polygon PoS also showed additional inflow and outflow activities.

TechubNews·2025-12-31 08:18

The biggest IPO in history! Elon Musk's 1.5 trillion unicorn controls 2/3 of the world's satellites

SpaceX's largest IPO in history, raising over $30 billion, with a valuation of $1.5 trillion, twice that of Tencent, topping the list as the world's largest unicorn. Celestrak data shows SpaceX controls nearly 2/3 of active satellites worldwide. Musk's wealth soars to $752 billion, earning approximately $7.85 billion daily, becoming the first billionaire in history with a net worth exceeding $5 trillion.

MarketWhisper·2025-12-31 06:59

The spot Bitcoin ETF recorded a total net inflow of $355 million yesterday.

In a recent report, data from SoSoValue reveals that Bitcoin spot ETFs attracted a net inflow of $355 million on December 30. BlackRock's IBIT led with $144 million, while ARKB from Ark Invest received $110 million. Total assets for spot ETFs reached $114.439 billion.

BTC1,45%

TapChiBitcoin·2025-12-31 06:07

2026 Yen Crisis: Bank of Japan Raises Interest Rates but Depreciates, 3 Trillion Capital Fleeing to Gold and US Stocks

The Bank of Japan plans to raise interest rates to 0.75% in 2025, reaching a 30-year high. However, the Japanese yen has not appreciated as theoretically expected; instead, it continues to depreciate. CFTC data shows that global leveraged funds' net short positions on the yen have reached a new high since July 2024. The main reason is the substantial real interest rate differential between the US and Japan, which is as high as 3.2%, coupled with Japan's government debt exceeding 250% of GDP. Fiscal dominance forces the central bank to sacrifice exchange rates to preserve debt sustainability.

MarketWhisper·2025-12-31 05:24

Ten billionaires make a net profit of 730 billion USD in one year: Elon Musk, Sanders, and the century-long debate on wealth inequality

2025 is coming to an end, and the extreme concentration of global wealth has once again sparked political and social debates. According to Forbes statistics, just ten billionaires have collectively gained up to $730 billion in wealth within a year, and this staggering figure has prompted long-time advocate for income inequality, Senator Bernie Sanders, to issue a strong condemnation, claiming that the United States is sliding toward "oligarchy." On the other side, Elon Musk, the world's richest person, countered, insisting that this wealth comes from substantive innovation and production, criticizing politicians as "not creators, only takers." This debate of "creation vs redistribution" has become one of the most representative economic issues of 2025.

Sanders angrily criticizes: 10 billionaires earned $730 billion in one year, "This is extremely immoral"

In late December, Bernie Sanders on social media

ChainNewsAbmedia·2025-12-31 05:14

XRP Today's News: ETF Flows Against the Trend and Decoupling from Bitcoin, Target Price of $8 in 2026

U.S. XRP Spot ETF has experienced eight consecutive weeks of capital inflows, with a total net inflow of $1.16 billion, in stark contrast to the $2.74 billion net outflow from Bitcoin spot ETFs during the same period. Geoffrey Kendrick, Head of Global Digital Asset Research at Standard Chartered Bank, predicts that XRP will reach $8 by the end of 2026, representing a 327% increase from the current price of $1.87.

XRP4,44%

MarketWhisper·2025-12-31 02:54

2025 Crypto ETF Review: Bitcoin, Ethereum Flourish, and More Coins Like XRP Join the Feast

Article by: André Beganski

Translation by: Block unicorn

Although asset management firms have previously strived to launch products tracking the spot prices of Bitcoin and Ethereum, the regulatory environment began to shift as President Trump returned to the White House in January. Many anticipate new opportunities in 2025.

According to Farside Investors data, as of December 15, since the historic launch of the spot Bitcoin ETF in January 2024, it has accumulated a net inflow of $57.7 billion. Compared to $36.2 billion at the beginning of this year, this represents a 59% increase. However, the capital inflow has not been consistently stable.

For example, according to CoinGlass data, on October 6, Bitcoin's price approached a historical high of $126,000.

TechubNews·2025-12-31 02:45

Metaplanet increases its Bitcoin holdings by 4,000 coins after three months, with the stock price sluggish and facing challenges from MNAV

Japanese listed company Metaplanet announced a large-scale accumulation action at the end of 2025, after a three-month hiatus, investing nearly 70 billion yen to purchase 4,279 Bitcoins, solidifying its position as the fourth-largest Bitcoin reserve publicly traded company globally. The acquisition was mainly financed through Bitcoin-backed loans and the issuance of preferred shares, demonstrating the company's continued commitment to a "Bitcoin-backed" financial strategy. However, the purchase cost significantly differs from the current market price, and coupled with a substantial correction in the company's stock price from its peak, the market is closely watching its financial leverage and asset net value ratio (mNAV) for stability.

Metaplanet Buys Bitcoin Again After Three Months

Japanese microstrategy Metaplanet, after a three-month break, finally announced at the end of the year that it has repurchased Bitcoin. Metaplanet purchased 4,279 Bitcoins this time, totaling

BTC1,45%

ChainNewsAbmedia·2025-12-31 02:34

DOGE Year-End Review: Has Elon Musk's 100-Day Innovation Made an Impact?

An experiment cut short

Federal employees successfully reduced by 271,000, a 9% decrease, setting the record for the largest layoffs during peacetime. However, at the same time, federal total spending did not decrease but instead surged from $6.75-7.135 trillion in 2024 to $7.01-7.6 trillion, a net increase of $248 billion to $480 billion. This phenomenon of "shrinking but gaining weight" is at the core of the DOGE (Department of Government Efficiency) reform's contradictions.

Initially led by Elon Musk and Vivek Ramaswamy, this "external advisory" agency promised to dismantle the government bureaucracy using commercial methods, cut unnecessary regulations, and reduce wasteful spending, ultimately saving $2 trillion to balance the federal budget. This ambitious plan was expected to last until July 2026, giving them 18 months to transform the government. However, reality proved far more brutal than expected: Musk resigned hastily in May, having only fulfilled 13

PANews·2025-12-31 00:10

Bitcoin breaks through 128 million KRW... ETH, XRP, SOL year-end market analysis

The flagship cryptocurrency in the market, Bitcoin, continues its year-end upward trend, breaking through 128 million Korean Won. Bitcoin, which has risen 1.5% in 24 hours and broke out of the range in mid-December, has gained upward momentum.

Despite decreased trading volume and reduced volatility, Bitcoin remains stable. Dragonfly's Hashib Kureši predicts that Bitcoin's price could rise above 150 million Korean Won by the end of 2026, but also notes that its market dominance may weaken.

Spot Bitcoin ETF experienced an outflow of approximately 1.1 trillion Korean Won, and experts analyze that the end-of-year tax optimization strategies for loss realization are the reasons for the capital withdrawal.

Ethereum rebounded from the $2800 support level, breaking through 4.3 million Korean Won, with a 1.8% increase in 24 hours. Over the past month, spot Ethereum ETFs saw an outflow of about 612 billion Korean Won, with a single-day net outflow of 9.6 billion Korean Won on December 29.

TechubNews·2025-12-30 16:11

XRP ETF Retains 29-Day Inflow Streak

Key Notes

US spot XRP ETFs recorded $8.44 million in daily total net inflows on December 29.

Its cumulative net inflows have now surged to $1.15 billion.

XRP price is still struggling to hit $2 despite the ETF outperformance.

A turbulent December was not strong enough to disrupt the

Coinspeaker·2025-12-30 14:43

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-30 14:26

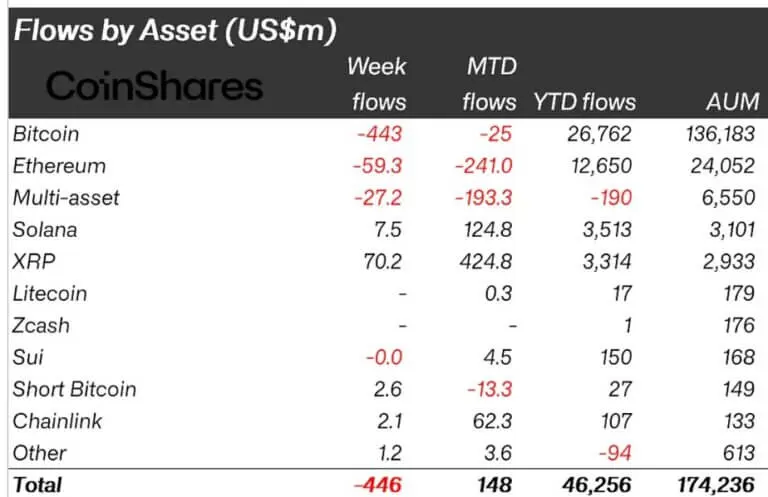

Crypto ETPs Face $446M Outflows as Year-End Sentiment Dives

Crypto ETPs Witness Continued Outflows Amid Market Caution

Recent data indicates that crypto exchange-traded products (ETPs) experienced net outflows of $446 million last week, extending a trend of cautious investor activity that has persisted since the sharp market correction in October. Despite s

CryptoBreaking·2025-12-30 12:10

Gate Research Institute: CC increased over 43% last week, Ethereum had the largest net inflow | Gate VIP Weekly Report

Last week in the market, BTC and ETH stabilized amid fluctuations, with ETH's rebound being stronger than BTC. On-chain capital inflow was primarily into Ethereum, while L2 networks experienced net outflows. The growth in crypto payment card transactions reflects application trends amid market caution. The report will provide an in-depth analysis of these market dynamics.

GateResearch·2025-12-30 09:45

New Year's Day is approaching, and the crypto market continues to consolidate. What potential "catalysts" could exist in the market in 2026?

Article by: Glendon, Techub News

After briefly climbing above $90,000 yesterday, Bitcoin fell below $87,000 again today, with a intraday decline of 3.76%. Meanwhile, the crypto market has once again experienced a broad decline. According to SoSoValue data, no major sector in the market was spared, with 24-hour declines generally exceeding 3%. Among them, SocialFi, Layer2, AI, RWA, and NFT sectors were hit hardest, each dropping more than 5%.

In terms of institutional investment, CoinShares' latest data shows that digital asset investment products saw a net outflow of approximately $446 million last week, bringing the total outflow since October 10 to $3.2 billion. Additionally, last week, Bitcoin spot

TechubNews·2025-12-30 09:19

Cryptocurrency ETF capital flow on 12/29: Bitcoin and Ethereum experience outflows, Solana and XRP attract funds back

According to data from SoSoValue, on December 29th, US-based spot Bitcoin ETFs recorded a total net outflow of $19.29 million, reflecting investors' cautious sentiment as the market enters the end-of-year period. Notably, the Fidelity Bitcoin ETF (FBTC) still led in inflows for the day, with

TapChiBitcoin·2025-12-30 07:11

XRP Spring Supply Trap! Institutions lock in $1 billion, while retail investors panic sell

XRP Shows Contradictory Trends: In December, ETF net inflows reached $424 million, but the price dropped 15%, making it one of the bottom ten. Institutions locked hundreds of millions of coins into cold wallets, reducing circulation and creating a "spring-like" supply mechanism. Retail investor sentiment is pessimistic, but the Canary XRP ETF has raised $300 million, with institutions mechanically increasing holdings. Once the supply black hole encounters renewed demand, prices may rebound sharply.

MarketWhisper·2025-12-30 06:33

Load More