Sonic's Key Features and Tokenomics

In this module, we dive into Sonic’s technological edge and economic structure. You’ll explore what makes Sonic fast (400,000 TPS!), how sub-second finality works, and how SonicVM powers smart contract execution. You’ll also understand the core utility of the S token, Sonic’s native currency, and how programs like Fee Monetization (FeeM) incentivize developers directly. It’s all about usability, efficiency, and a token model built for sustainability—not speculation.

Core Features of Sonic

High Throughput and Sub-Second Finality

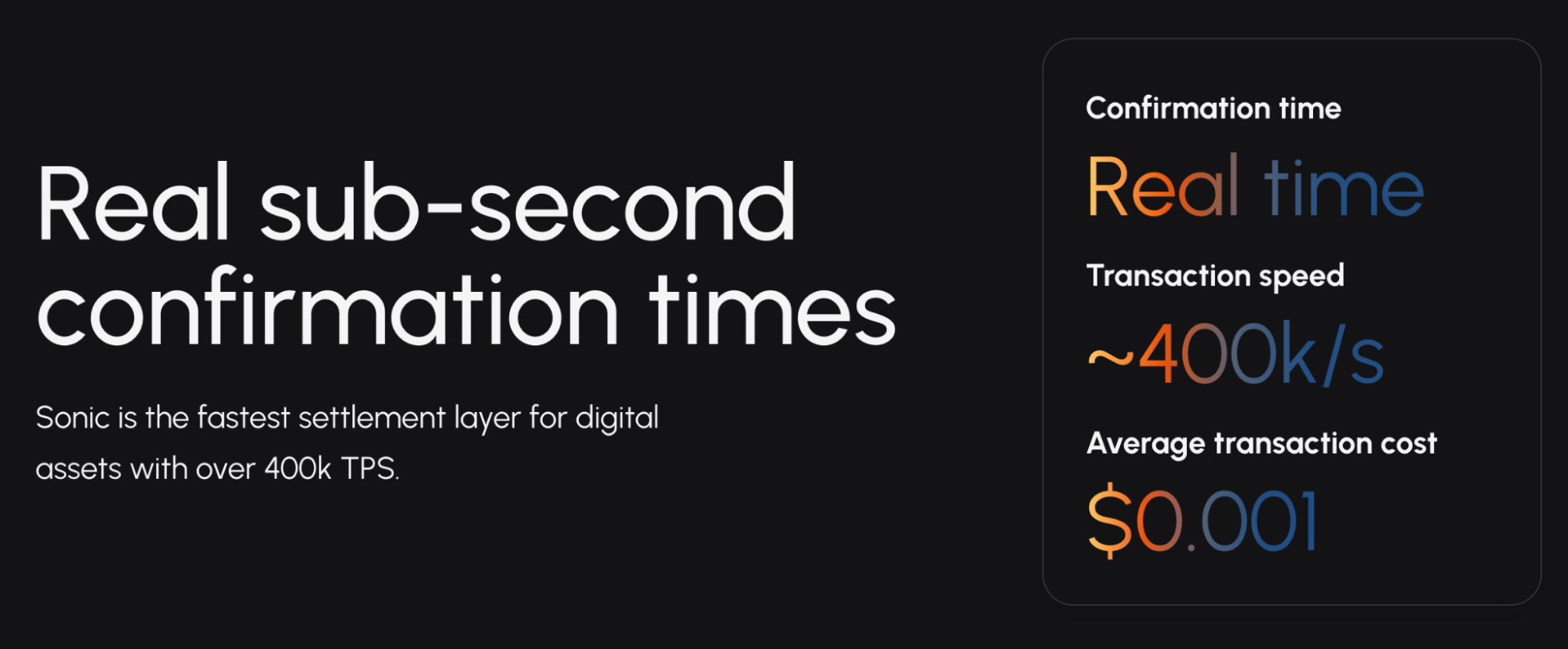

Sonic’s most defining feature is its ability to process an exceptional volume of transactions without sacrificing speed or reliability. Benchmarked at up to 400,000 transactions per second (TPS), Sonic significantly outpaces most Layer-1 and Layer-2 solutions in the industry. This performance is made possible by a highly efficient consensus mechanism and network architecture specifically designed for scale.

What makes Sonic even more impactful is its sub-second finality. Unlike traditional blockchains that may take several blocks or confirmations to finalize a transaction, Sonic settles them in under one second. This ensures that transactions are not just fast — they’re immediately irreversible. Such capabilities open new possibilities for real-time use cases like payments, high-frequency trading, gaming, and global settlements.

SonicVM: Execution at Scale

Sonic’s virtual machine, known as SonicVM, is a purpose-built engine designed for executing smart contracts at lightning speed. Unlike standard EVM implementations that inherit legacy constraints, SonicVM is optimized from the ground up for efficiency, stability, and scalability. It maintains full EVM compatibility, which means developers can deploy existing Ethereum contracts on Sonic without modification.

The result is a significantly improved environment for smart contracts — fewer crashes, lower resource consumption, and much faster execution. For both developers and users, this translates into smoother dApp performance and more predictable network behavior.

EVM Compatibility and Developer Tooling

Sonic is fully Ethereum Virtual Machine-compatible, allowing developers to build with familiar tools and programming languages like Solidity and Vyper. This compatibility ensures that projects from the Ethereum ecosystem can be easily ported to Sonic, reducing onboarding time and effort.

Toolkits like Hardhat, Truffle, and Foundry work out-of-the-box, and Sonic also supports major wallets and SDKs. This seamless integration makes Sonic immediately accessible to Ethereum developers while delivering the performance gains of a next-gen Layer-1 chain.

Sonic Gateway: Native Ethereum Bridge

Interoperability is essential in a multi-chain world, and Sonic addresses this with its native bridge — the Sonic Gateway. Designed for secure, permissionless transfers between Sonic and Ethereum, the Gateway allows users to move assets across chains with ease.

Unlike third-party bridges that often present security risks, Sonic Gateway is natively integrated into the protocol. It includes fail-safe protections in case of network failures or extended downtime. This makes cross-chain liquidity, yield farming, or dApp interoperability not just possible, but safe and efficient.

Modular Architecture and Composability

Sonic’s design supports modular composability, allowing dApps and protocols to interact as building blocks within the same ecosystem. This is especially vital for DeFi, where “money legos” — the stacking of interoperable protocols — are core to innovation.

Sonic’s infrastructure ensures these interactions occur without delay or conflict, even under heavy traffic. Developers are encouraged to build interoperable dApps thanks to the network’s reliable execution and consistent transaction finality, making Sonic ideal for large, complex application ecosystems.

Fee Monetization (FeeM): Incentivizing Builders

To support long-term sustainability, Sonic introduces Fee Monetization (FeeM) — a mechanism that rewards developers based on usage. Up to 90% of transaction fees generated by a dApp are redistributed directly to the developers behind it.

This changes the typical incentive model seen in many blockchains. Instead of value flowing primarily to validators or token holders, Sonic shares that value with the builders who drive actual network activity. This model encourages the creation of high-quality, user-centric applications and fosters a more equitable economy of innovation.

The S Token

The S token is the native asset of the Sonic blockchain. It powers every layer of the protocol — from paying transaction fees to enabling governance, staking, and rewards. It’s not just a currency within the system; it’s a fundamental part of how Sonic operates, scales, and sustains itself.

While it succeeds Fantom’s FTM token in terms of community and legacy, the S token represents a clean economic reset, aligned with Sonic’s performance-first philosophy and developer-friendly design.

Utility Across the Network

Every on-chain interaction — whether deploying a smart contract, swapping tokens, or staking — requires S tokens. Because Sonic offers fast finality and low gas fees, these interactions remain cheap and accessible even as network usage grows.

The S token is also used to power the FeeM program, serving as the currency through which developer rewards are distributed. As more dApps launch and usage increases, demand for S grows — creating a usage-driven value cycle rather than one based purely on speculation.

Proof-of-Stake, Validators, and Delegation

Sonic uses a proof-of-stake (PoS) model for consensus. Validators stake S tokens to participate in block production and transaction validation. This economic stake aligns validator behavior with network health — any attempt to act maliciously could result in slashing or penalties.

For users who don’t run validator nodes, delegation is an option. They can stake their S tokens with trusted validators and earn a portion of the staking rewards in return. This helps decentralize the network and makes staking more accessible to everyday users.

Governance with Staked S

Staking isn’t just about security — it’s also about governance. Holders of staked S tokens gain the right to vote on protocol upgrades, network parameters, and other key proposals. This decentralized governance model ensures that power within the Sonic ecosystem remains in the hands of its community.

As Sonic matures, governance will likely evolve to include more granular decision-making around treasury use, development funding, and ecosystem initiatives — with the S token at the center of it all.

Migration from FTM to S

The Sonic network was designed as the evolutionary successor to Fantom, and with that came a carefully planned migration path. Existing holders of FTM were offered a 1:1 upgrade to the S token via an official portal, giving them a straightforward path into the new ecosystem.

This user-initiated migration allowed participants to choose when and how to transition, while ensuring that only migrated tokens interact with the new infrastructure. Post-migration, FTM and S are completely separate assets — with S being native only to the Sonic blockchain.

This migration allowed Sonic to launch with an established community while avoiding the bloat of a legacy chain. It also marked a symbolic and structural departure — an upgrade in both technology and tokenomics.

Real-World Utility and Future Growth

The S token is designed to function as more than just a speculative asset. It’s the engine that powers the Sonic ecosystem — from securing the network and executing contracts to rewarding builders and enabling governance.

Looking forward, the utility of S is expected to grow. Upcoming initiatives include advanced governance modules, cross-chain staking, and deeper integrations with partner applications and ecosystems. As Sonic expands, so will the ways S is used — reinforcing its role as the central asset in a fast, fair, and scalable blockchain.