Introduction to Kyber Network

This module introduces KyberDAO and its governance role in the Kyber Network. It covers the staking process of KNC tokens, how staking confers voting rights, and the details of the voting process for governance proposals, as well as explains the reward system, how rewards are determined based on participation, and options for reinvesting rewards to increase future influence within the network.

What is Kyber Network?

Kyber Network is a blockchain-based liquidity protocol that allows decentralized token swaps to be integrated into any application. This enables easy exchange of assets without a central order book or operator. It has the ability to aggregate liquidity from different sources to provide secure and instant transactions on any decentralized application (DApp).

This protocol is built on the Ethereum blockchain and supports different ERC-20 tokens. Users can interact with smart contracts directly to perform instant token trades at competitive rates. The platform is designed to be secure, with all operations performed on the blockchain, ensuring transparency and resistibility to censorship.

Kyber Network’s operation is unique because it pools liquidity from various sources including liquidity pools, market makers, and other decentralized exchanges (DEXs), providing users with the best rates they are able to offer.

This aggregation mechanism ensures liquidity and helps to minimize slippage on large orders, enhancing the overall efficiency of the network.

Advanced Trading on KyberSwap

Customizing the Trading Interface

KyberSwap allows users to personalize their trading interface. This customization includes layout adjustments and visual preferences, enhancing user experience and interaction efficiency.

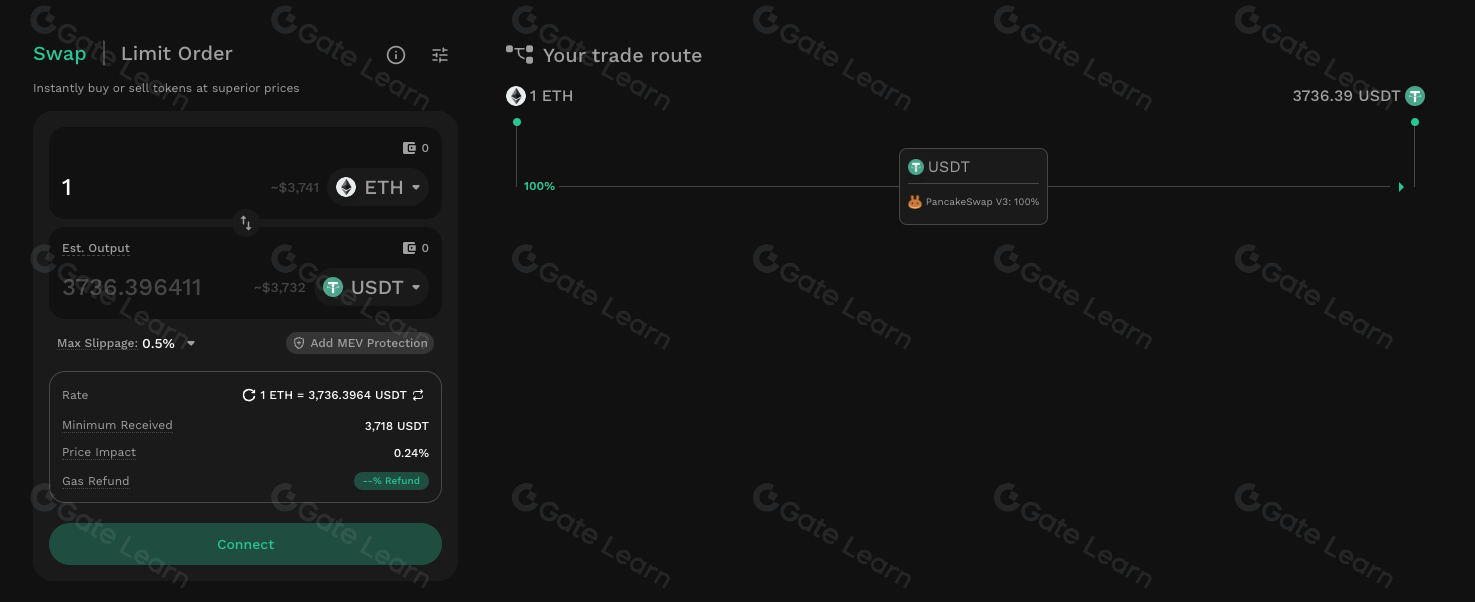

Executing Limit Orders and Other Trading Options

Users can set limit orders on KyberSwap. This feature enables them to specify the price at which they wish to buy or sell a token, automating the trade execution when the market meets their conditions.

KyberSwap also supports bridging tokens and purchasing cryptocurrencies with different payment methods.

Earning through Liquidity Provision and Farming

KyberSwap offers opportunities to earn passive income by providing liquidity to different pools. Participants in these liquidity pools collect fees from the trades that occur within the pool, proportional to their share of the total liquidity. There are also farming options where users can stake their tokens to earn rewards.

Staking and Voting

Staking KNC Tokens

KyberDAO allows KNC token holders to stake their tokens as a way to contribute to the network’s governance. Staking involves locking up KNC tokens in the governance contract. This action grants the holder voting rights, which are proportional to the amount of KNC staked. Then, the staked tokens are not only a means to vote but also a way to secure the network by aligning the interests of KNC holders with the network’s health and success.

Voting on Proposals

Token holders participate in KyberDAO by voting on various proposals that shape the future of the Kyber Network. These proposals may involve changes to protocol parameters, updates to the system, or decisions on funding for future development. The voting process is conducted entirely on-chain, ensuring transparency and that all votes are verifiable and tamper-proof.

Each stakeholder’s voting power is directly linked to the number of tokens they have staked, and the outcomes directly influence the operation and strategic direction of the network. This decentralized governance model empowers token holders to steer the development in a direction the majority believes will benefit the network most. By participating in governance, stakeholders can help ensure that the network remains responsive to the needs of its users and adaptable to changing market conditions.

Earning Rewards

Participants in KyberDAO are able to earn rewards for their active involvement in governance.

These rewards are distributed in KNC, which can either be reinvested into the staking pool to increase one’s voting power and potential rewards or can be traded on the open market. The system is designed to incentivize continuous participation and engagement with the network’s governance.

The amount of rewards each participant can receive is calculated based on the proportion of the total staked tokens that their stake represents. Additionally, rewards are influenced by the frequency and consistency of a user’s participation in votes. Regular participation increases the reward potential for each stakeholder, promoting a governance model that rewards consistent engagement over passive staking.

Stakers have the option to reinvest their earned rewards to compound their gains, enhancing their influence in future votes and increasing their potential rewards. This compounding effect encourages long-term commitment to the network’s governance and growth, as larger stakes translate into greater decision-making power and financial incentives.

Highlights

- KyberDAO Governance: KNC token holders can stake their tokens to participate in governance, gaining voting rights proportional to the amount staked, which influences Kyber Network’s operational and strategic decisions.

- Voting System: Voting on proposals within KyberDAO is conducted on-chain, ensuring transparency and security, with each token staked granting a vote to influence decisions such as protocol changes and development directions.

- Reward Mechanism: Active participants in KyberDAO receive rewards in KNC for voting on proposals, incentivizing continuous engagement and decision-making in the network’s governance.

- Reward Calculation and Reinvestment: Rewards are calculated based on the amount of KNC staked and voting participation. Stakers can reinvest their rewards to compound their stakes, increasing their voting power and potential future rewards.

- Decentralized Influence: KyberDAO allows stakeholders to directly impact the network’s growth and responsiveness to market conditions, promoting a decentralized governance model that aligns stakeholder interests with the network’s success.