Why Bitcoin Yield Now?

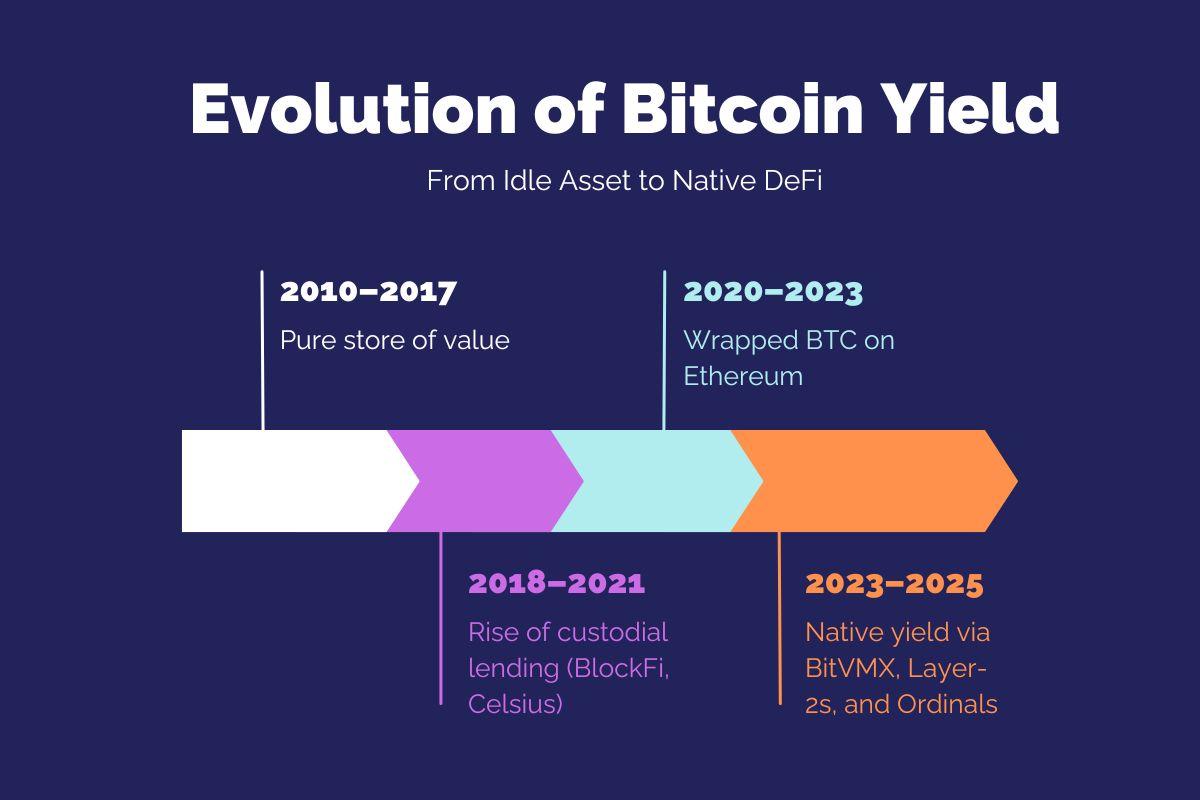

Bitcoin has historically been perceived as a “store of value” asset, comparable to digital gold. While this narrative has supported its rise as a macro hedge, it has also limited its functionality within decentralized finance (DeFi). Unlike Ethereum or newer chains designed for composability and on-chain programmability, Bitcoin remained siloed, i.e. its liquidity largely idle unless exported through wrapped representations like WBTC. However, the emergence of Bitcoin-native programmability frameworks such as BitVM and its extension BitVMX has triggered a shift. In 2025, Bitcoin-native yield is becoming both technically feasible and economically relevant. This module explores the reasons behind this transition, the historical constraints that shaped it, and the structural forces driving its adoption now.

Bitcoin as a Store of Value and Its Inherent Inertia

In crypto, “yield” refers to passive income generated by deploying your digital assets, rather than just holding them and waiting for the price to go up. Yield can come from lending coins to borrowers, staking them to help secure a network, or providing liquidity to decentralized exchanges. On blockchains like Ethereum, these opportunities have become common thanks to programmable smart contracts and composable DeFi protocols.

Bitcoin, however, has historically lacked this kind of financial utility. While it remains the most secure and decentralized asset in the crypto ecosystem, it has offered few ways for holders to generate on-chain yield. The reason lies in Bitcoin’s design choices: a deliberately limited scripting language, an account model that resists complex interactions, and a culture that prioritizes security over experimentation.

Bitcoin’s limited scripting capabilities, UTXO-based accounting model, and rigid consensus design made it robust but inflexible. This inflexibility, while central to its security model, imposed hard boundaries on the types of financial applications that could be built directly on the base layer. As a result, for most of Bitcoin’s history, yield-bearing applications such as lending, borrowing, or liquidity provision were either impossible or required off-chain intermediaries and custodians. Solutions like BlockFi, Celsius, and Genesis filled this gap but eventually collapsed, reinforcing skepticism around centralized yield mechanisms.

Even Ethereum-based DeFi protocols could not natively integrate Bitcoin. Instead, they required wrapped representations or collateralized versions of BTC (such as WBTC, renBTC, or tBTC) issued by custodians or through complex bridging mechanisms. This introduced custodial risk, cross-chain friction, and additional trust assumptions that Bitcoin purists generally avoided. Despite Bitcoin representing over 50% of the total crypto market cap in many periods, its on-chain utility remained minimal outside of settlement and speculative trading.

The Rise of Wrapped Bitcoin and Its Limitations

Wrapped Bitcoin played a significant role in enabling yield exposure during the DeFi boom of 2020–2022. WBTC, the most widely adopted variant, reached over $4 billion in total value locked at its peak. However, its design required users to give up their Bitcoin to a centralized custodian (BitGo) in exchange for an ERC-20 token. This process, while functional, conflicted with Bitcoin’s core principles of trust-minimization and self-custody.

Moreover, the inability to audit or independently verify the reserves backing wrapped assets led to growing concerns. The Tornado Cash sanctions, bridge hacks (e.g., Wormhole, Nomad), and DeFi protocol exploits added to the narrative that moving Bitcoin into Ethereum’s domain involved disproportionate risk. Users were left with few alternatives: either forego yield entirely or expose themselves to custodial or smart-contract risk in foreign ecosystems.

Why DeFi Skipped Bitcoin (Until Now)

Bitcoin was not designed for Turing-complete execution. Its scripting language, Script, is deliberately limited to avoid the possibility of infinite loops, contract bloat, and vulnerabilities like those seen in early Ethereum contracts. These limitations made it nearly impossible to write expressive smart contracts directly on Bitcoin. While Bitcoin Script supports multi-signature transactions and basic time-locking features, it lacks key primitives such as programmatic state transitions, composable contract calls, and gas-based execution metering.

Additionally, Bitcoin’s conservative culture and ossified governance model meant that protocol-level upgrades were slow and controversial. Proposals such as Taproot, which added Schnorr signatures and support for Merkelized Abstract Syntax Trees (MAST), took years to activate despite broad support. As a result, Bitcoin was left behind in the programmable asset race.

Meanwhile, Ethereum and newer chains like Solana, Avalanche, and Arbitrum created thriving ecosystems with hundreds of protocols, composable standards (ERC-20, ERC-4626), and integrated tooling. These environments enabled DeFi to flourish without Bitcoin’s direct involvement, further marginalizing it from on-chain finance.

2023–2025: Catalysts for Bitcoin-Native Yield

Starting in late 2023, several developments challenged the notion that Bitcoin could not support native yield. The rise of Ordinals and inscriptions introduced the concept of Bitcoin NFTs, showing that arbitrary metadata could be embedded in Bitcoin transactions. This triggered both a cultural and technical shift. It proved that Bitcoin users were willing to pay for non-monetary functionality and that protocol developers could leverage existing primitives in novel ways.

Parallel to this, the introduction of BitVM in October 2023 provided a new framework for building off-chain programs that could be verified on-chain using Bitcoin’s existing opcodes. BitVM did not require consensus changes or soft forks. Instead, it used challenge-response protocols and hashed pre-image verification to prove the correctness of computations off-chain. This approach opened the door to building rollups, bridges, and programmable financial contracts without modifying Bitcoin’s base layer.

By 2024, extensions like BitVMX began to appear, offering more scalable and modular implementations of BitVM principles. BitVMX integrated virtual CPU models (e.g., RISC-V) and optimistic rollup logic, allowing complex programs to execute off-chain with periodic proofs enforced through Bitcoin’s scripting language. This made it possible to create Bitcoin-native lending protocols, automated market makers, and staking modules that settled in real BTC, without needing to wrap or bridge to other chains.

Market Dynamics and Institutional Interest in 2025

In 2025, Bitcoin-native yield is not just a technical experiment—it is a market imperative. With Bitcoin trading above $120,000 and institutional holdings rising through ETFs and custodial platforms, the opportunity cost of holding idle BTC has become significant. Asset managers, pension funds, and crypto treasuries are increasingly exploring low-risk, yield-bearing strategies that retain exposure to native BTC. The emergence of Bitcoin Layer-2s with programmable capabilities has created a new asset class: yield-generating Bitcoin that does not compromise custody or consensus integrity.

Projects like Citrea, Bitlayer, and LayerBTC have attracted venture funding and institutional pilots. Citrea, the first ZK-rollup for Bitcoin, launched on testnet with support for native settlement. Bitlayer, an optimistic rollup secured via BitVMX, raised funding from Franklin Templeton and is now onboarding DeFi apps that operate without wrapped tokens. These projects exemplify how the Bitcoin-native yield landscape is moving from proof-of-concept to production.