Introdução ao Liquidswap

Introdução do módulo: O Módulo 9 apresenta o Liquidswap, um aplicativo DeFi chave no Aptos, explorando seu papel como um Fabricante de Mercado Automatizado (AMM) e seu impacto na liquidez e capacidades de negociação do ecossistema. Abordaremos as características, funcionalidades e a importância do Liquidswap para promover um cenário DeFi vibrante no Aptos. Este módulo tem como objetivo ilustrar a contribuição de aplicativos DeFi como o Liquidswap para o crescimento e adoção geral da blockchain Aptos.

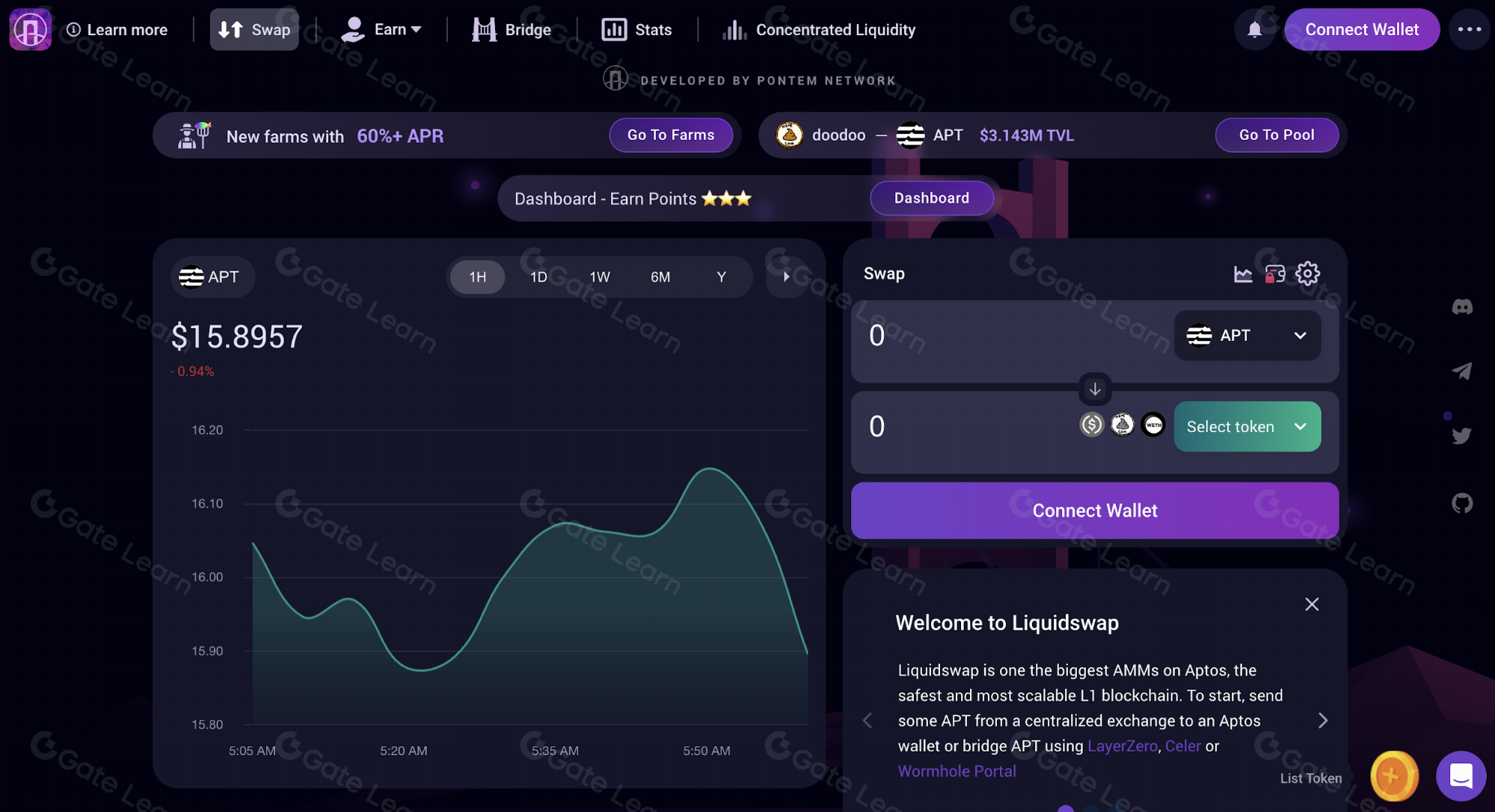

Visão geral do Liquidswap como um AMM no Aptos

Liquidswap é uma troca descentralizada (DEX) construída na blockchain Aptos, utilizando um modelo de Automated Market Maker (AMM) para facilitar trocas de tokens. Como um dos primeiros DEXs na Aptos, Liquidswap desempenha um papel crucial no ecossistema, fornecendo liquidez e possibilitando negociações de tokens sem problemas, sem a necessidade de market makers tradicionais.

O modelo AMM permite aos usuários negociar ativos digitais diretamente dos pools de liquidez, em vez de através de um livro de ordens tradicional. Essa abordagem não só simplifica o processo de negociação, mas também fornece liquidez contínua para uma ampla gama de tokens. A integração do Liquidswap com o Aptos aproveita a alta capacidade e escalabilidade do blockchain, garantindo transações rápidas e eficientes.

Liquidswap foi projetado para suportar uma variedade de tokens na blockchain Aptos, incluindo ativos nativos e inter-cadeias. Essa inclusividade amplia o escopo de pares de negociação disponíveis na plataforma, tornando-a um hub versátil para traders e provedores de liquidez.

A plataforma possui uma interface amigável, reduzindo a barreira de entrada para usuários novos em DeFi e negociação de criptomoedas. Ao focar na simplicidade e acessibilidade, a Liquidswap visa atrair uma base diversificada de usuários, desde traders experientes até aqueles que estão começando sua jornada DeFi.

O papel da Liquidswap no ecossistema Aptos vai além da troca de tokens. Também serve como um serviço DeFi fundamental, permitindo que outros DApps construam sobre sua infraestrutura e contribuam para um cenário de finanças descentralizadas próspero no Aptos.

Recursos e Funcionalidades

Liquidswap oferece vários recursos e funcionalidades que atendem às necessidades dos usuários DeFi. A principal delas é a provisão de pools de liquidez, onde os usuários podem fornecer tokens para ganhar taxas de negociação como provedores de liquidez. Isso incentiva os detentores de tokens a contribuírem para a liquidez do ecossistema, essencial para o funcionamento da plataforma.

A plataforma incorpora oportunidades de fazenda de rendimento, permitindo que os usuários apostem seus tokens de provedor de liquidez (LP) para ganhar recompensas adicionais. Esse mecanismo incentiva a provisão de liquidez a longo prazo e promove um ambiente DeFi mais estável na Aptos.

Liquidswap também implementa controle de deslizamento e recursos de impacto de preço, permitindo que os usuários gerenciem suas negociações de forma mais eficaz e minimizem as perdas potenciais devido a grandes pedidos. Essas ferramentas de gerenciamento de risco são cruciais para manter a confiança do usuário e garantir uma experiência de negociação justa.

Para uma segurança aprimorada, o Liquidswap integra auditorias de contratos inteligentes e protocolos de avaliação de riscos, garantindo a resiliência da plataforma contra vulnerabilidades e promovendo a confiança entre seus usuários. Esse foco na segurança está alinhado com o compromisso abrangente da Aptos em criar um ecossistema DeFi seguro.

O DEX foi projetado para ser interoperável com outros protocolos DeFi e serviços na Aptos, facilitando um fluxo contínuo de ativos e informações em todo o ecossistema. Essa interoperabilidade é fundamental para a construção de um cenário abrangente e interconectado de DeFi na blockchain.

Importância no Ecossistema Aptos DeFi

A importância do Liquidswap no ecossistema DeFi da Aptos não pode ser exagerada. Como uma das plataformas DeFi inaugurais na Aptos, ela prepara o terreno para o desenvolvimento e adoção das finanças descentralizadas na blockchain, atuando como uma pedra angular para a expansão do ecossistema.

O modelo AMM da plataforma democratiza o acesso à liquidez e à negociação, removendo barreiras que normalmente existem na finança tradicional. Essa inclusividade é fundamental para fomentar uma comunidade DeFi diversificada e vibrante no Aptos, incentivando a participação de um amplo espectro de usuários.

Ao fornecer uma plataforma de negociação confiável e eficiente, a Liquidswap atrai tanto provedores de liquidez quanto traders, criando um ciclo de feedback positivo que aprimora a liquidez e a utilidade da plataforma. Essa liquidez é crucial para o sucesso de outros projetos DeFi na Aptos, pois garante que os ativos possam ser facilmente negociados e utilizados em todo o ecossistema.

A inovação do Liquidswap e a integração com a blockchain Aptos contribuem para a escalabilidade e desempenho geral do ecossistema DeFi. Sua capacidade de lidar com grandes volumes de transações com mínimo deslizamento e baixas taxas exemplifica o potencial do DeFi na Aptos, mostrando o que é possível com a tecnologia avançada de blockchain.

A plataforma também desempenha um papel fundamental na economia de tokens da Aptos, possibilitando a descoberta de preços e a distribuição de novos e existentes tokens. Essa função é essencial para o crescimento e estabilidade do ecossistema de DeFi da Aptos, fornecendo um mecanismo transparente e eficiente para a valoração de ativos.

Destaques

- Liquidswap é uma exchange descentralizada (DEX) pioneira na blockchain Aptos, utilizando um Automated Market Maker (AMM) para facilitar trocas de tokens sem os tradicionais market makers.

- Ele emprega pools de liquidez para negociação de ativos, permitindo liquidez contínua para uma ampla gama de tokens e apoiando ativos nativos e de cadeia cruzada dentro do ecossistema Aptos.

- A plataforma é projetada com foco na facilidade de uso, com o objetivo de reduzir a barreira de entrada para pessoas novas no setor de finanças descentralizadas (DeFi) e negociação de criptomoedas.

- Liquidswap oferece recursos adicionais DeFi, como agricultura de rendimento, onde os usuários podem apostar seus tokens de provedor de liquidez para ganhar recompensas, aumentando o incentivo para a provisão de liquidez.

- Ele incorpora ferramentas essenciais de gerenciamento de risco como controle de deslizamento e recursos de impacto de preço, ajudando os usuários a executar negociações de forma mais eficaz e proteger seus investimentos.

- Medidas de segurança, incluindo auditorias de contratos inteligentes, são parte integrante da operação da Liquidswap, alinhando-se com o compromisso da Aptos de criar um ecossistema DeFi seguro.

- Como um serviço DeFi fundamental na Aptos, a Liquidswap desempenha um papel crucial na paisagem DeFi da blockchain, preparando o terreno para o desenvolvimento e a adoção contínuos de aplicativos de finanças descentralizadas.