Ferramentas de análise de dados DeFi

1

As ferramentas de análise DeFi (finanças descentralizadas) são usadas para analisar e monitorar o mercado e o ecossistema DeFi. DeFi é um serviço financeiro baseado em blockchain projetado para eliminar autoridades centrais no sistema financeiro tradicional e fornecer serviços financeiros mais seguros, transparentes e descentralizados. As ferramentas de análise DeFi visam ajudar os usuários a entender as últimas tendências do mercado DeFi para apoiá-los na tomada de melhores decisões de investimento e negociação.

As ferramentas de análise DeFi geralmente incluem os seguintes recursos:

Monitoramento de dados de mercado: essas ferramentas fornecem várias métricas e dados, como volume de negociação, liquidez, capitalização de mercado, preço e rendimento para ajudar os usuários a entender as últimas tendências do mercado. As métricas podem ajudar os usuários a avaliar o valor de investimento de um projeto ou ativo, tomando decisões mais informadas.

Análise de liquidez: as ferramentas de análise DeFi fornecem detalhes sobre pools de liquidez, como os ativos fornecidos, taxas de transação e derrapagem, para facilitar que os usuários entendam a estabilidade e a lucratividade do pool de liquidez e decidam se devem investir nele.

Visão geral do projeto: as ferramentas podem fornecer detalhes e estatísticas sobre projetos DeFi, como histórico do projeto, capitalização de mercado, rendimento, membros da equipe etc., permitindo que os usuários entendam o histórico e os riscos potenciais de um projeto para tomar decisões de investimento mais informadas.

Avaliação de riscos: as ferramentas de análise DeFi podem ser usadas para conduzir análises e avaliações de riscos para ajudar os usuários a avaliar os riscos e retornos potenciais de um projeto. Essas ferramentas podem realizar análises com base em diferentes indicadores e dados, como volatilidade do mercado, mudanças de preços, riscos de liquidez, etc.

Gerenciamento de ativos: algumas ferramentas de análise DeFi fornecem recursos de gerenciamento de ativos, como rastreamento de portfólio, taxa de retorno e ajuste de portfólio, permitindo que os usuários gerenciem melhor seus portfólios de investimento e tomem decisões de investimento mais informadas.

Em conclusão, as ferramentas de análise DeFi são usadas para analisar e monitorar o mercado e o ecossistema DeFi. Eles fornecem vários indicadores e dados para ajudar os usuários a entender as últimas tendências do mercado e apoiá-los na tomada de melhores decisões de investimento e negociação. Essas ferramentas são muito úteis no mercado DeFi e podem facilitar aos usuários a utilização desse serviço financeiro emergente.

DefiLlama é uma das ferramentas de análise DeFi mais populares:

DefiLlama (https://defillama.com/)

DeFiLlama é uma plataforma que agrega pools de liquidez e protocolos no ecossistema DeFi, fornecendo aos usuários dados em tempo real sobre liquidez e pools de financiamento. Ele permite que os usuários entendam e acompanhem melhor o desenvolvimento do mercado e ecossistema DeFi.

O DeFiLlama rastreia várias trocas descentralizadas (DEXs), protocolos de empréstimo, pools de liquidez, protocolos de stablecoin e outros projetos DeFi. Ele fornece dados em tempo real sobre valor total bloqueado (TVL), liquidez, volume de negociação, rendimento, APR e mais desses projetos. Ele ajuda os usuários a entender o desempenho histórico, as tendências e os riscos dos projetos e os apóia na tomada de decisões sábias de investimento e negociação.

DeFiLlama fornece os seguintes recursos principais:

Desempenho histórico: o DeFiLlama fornece dados históricos de desempenho para vários projetos DeFi, incluindo TVL, volume de transações, rendimento, APR e muito mais. Os dados podem ajudar os usuários a entender as tendências e o desempenho do projeto e apoiá-los na tomada de decisões melhores.

Valor total bloqueado (TVL): DeFiLlama fornece dados sobre valor total bloqueado (TVL) para vários projetos DeFi, ajudando os usuários a entender o tamanho e as tendências do mercado geral de DeFi, bem como a participação de cada projeto no mercado.

Análise de liquidez: DeFiLlama fornece dados e análises em tempo real sobre pools de liquidez e pares de negociação, ajudando os usuários a entender a liquidez e a estabilidade do mercado, bem como os retornos e riscos de pools de liquidez e pares de negociação.

Avaliação de risco: o DeFiLlama pode ajudar os usuários a avaliar os riscos potenciais dos projetos DeFi e fornecer dados e insights sobre o histórico do projeto, tendências de mercado, comportamento comercial e muito mais. Esses dados podem ajudar os usuários a entender os riscos e retornos potenciais de um projeto para melhor gerenciar seus portfólios de investimentos.

Em poucas palavras, DeFiLlama é uma plataforma que agrega dados sobre pools de liquidez e protocolos no ecossistema DeFi, com o objetivo de fornecer aos usuários dados e insights precisos e em tempo real. Ele pode ajudar os usuários a entender as últimas tendências do mercado DeFi e apoiá-los na tomada de melhores decisões de investimento e negociação.

Recurso:

Na página inicial do DeFiLlama, você pode ver o TVL do mercado DeFi e o projeto DeFi com o maior TVL. Os usuários podem visualizar diretamente os rankings TVL de todos os projetos no mercado DeFi.

Fonte: https://defillama.com

DeFiLlama usa gráficos visuais para exibir o TVL de vários projetos DeFi em diferentes blockchains e fornece uma classificação detalhada. Os usuários podem baixar os dados de origem em .csv de graça.

Fonte: https://defillama.com/chains

Para protocolos DeFi que ainda não emitiram seus próprios tokens, o DeFiLlama fornece uma lista detalhada para fornecer aos usuários interessados oportunidades de obter airdrops.

Fonte: https://defillama.com/airdrops

Além disso, para projetos DeFi relacionados a Oracles e Forks, DeFiLlama fornece dados detalhados de TVS (Total Value Secured) e TVL.

Fonte: https://defillama.com/forks

A fim de facilitar a compreensão do TVL de diferentes protocolos, o DeFiLlama fornece um recurso de comparação de protocolos, permitindo que os usuários selecionem aleatoriamente vários protocolos para comparação de TVL, com resultados exibidos como um gráfico de linha visual. Isso permite que os usuários obtenham uma compreensão abrangente de vários protocolos DeFi.

Fonte: https://defillama.com/comparison?protocol=MakerDAO&protocol=Curve&protocol=Lido

Além disso, o DeFiLlama também fornece classificações de rendimento para vários projetos DeFi. Os usuários podem personalizar seus filtros, com resultados de comparação listando a cadeia à qual cada projeto DeFi pertence, TVL, APY, Base APY e Reward APY. Isso permite que os usuários visualizem as classificações de rendimento de forma mais conveniente.

Fonte: https://defillama.com/yields

Além disso, DeFiLlama também fornece dados sobre desbloqueios de token, transparência CEX, liquidações, etc. Ele ajuda os usuários a entender as tendências e o movimento no mercado DeFi, facilitando a tomada de melhores decisões de investimento e negociação.

Fonte: https://defillama.com/

Dune (dune.com)

Dune Analytics é uma plataforma de análise de dados blockchain que se concentra em fornecer visualização de dados e insights relacionados a Ethereum e DeFi. Ele fornece informações detalhadas sobre a atividade da cadeia Ethereum, uso do projeto DeFi e outras métricas relevantes por meio de painéis pré-criados.

O Dune Analytics permite que os usuários criem e compartilhem painéis personalizados, extraiam dados no Ethereum escrevendo consultas SQL e visualizem os dados em tabelas e gráficos. Isso torna o Dune Analytics uma ferramenta poderosa para monitorar e analisar vários projetos e métricas no ecossistema DeFi. Além disso, a plataforma também oferece aos usuários a oportunidade de colaborar e aprender, pois possui uma comunidade ativa onde os usuários podem compartilhar e discutir suas análises e visualizações de dados livremente.

No geral, o Dune Analytics é uma poderosa ferramenta de análise de dados blockchain que fornece informações valiosas sobre o espaço DeFi. Ele permite que os usuários entendam e monitorem melhor as atividades no Ethereum, fornecendo suporte de dados significativo para os participantes do ecossistema DeFi. Ao mesmo tempo, também fornece uma plataforma para os membros da comunidade compartilharem e aprenderem, o que promove ainda mais o desenvolvimento e a inovação do espaço DeFi.

https://dune.com/browse/dashboards

Ao passar o mouse sobre a barra de pesquisa, você pode ver estatísticas sobre trocas descentralizadas, Opensea e NFTs. Os usuários podem simplesmente clicar nos títulos correspondentes para entrar na página de detalhes.

Fonte: https://dune.com/hagaetc/dex-metrics

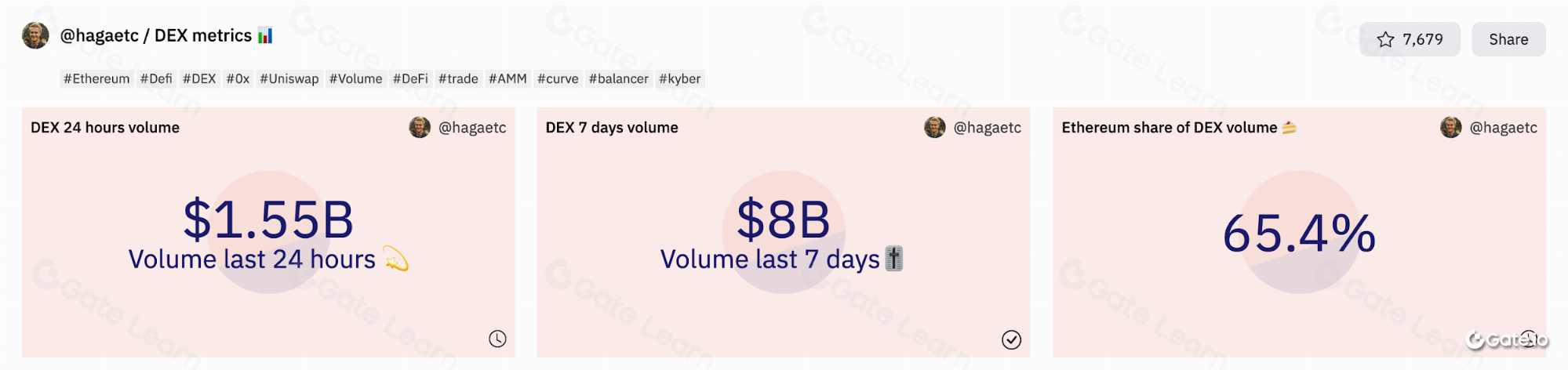

Na seção de métricas DEX, você pode ver o volume de negociação DEX nas últimas 24 horas e 7 dias, bem como a participação da Ethereum no volume DEX.

Fonte: https://dune.com/hagaetc/dex-metrics

Ao rolar a página, você também verá a classificação das exchanges descentralizadas por volume, bem como o gráfico de pizza e o gráfico de barras da classificação. Há também uma participação de mercado do volume de negociação de trocas descentralizadas em cada blockchain principal.

Fonte: https://dune.com/hagaetc/dex-metrics

Fonte: https://dune.com/hagaetc/dex-metrics

Dune Analytics também fornece volume DEX semanal e participação de mercado.

No geral, Dune.com é uma plataforma descentralizada de análise e visualização de dados que fornece uma maneira fácil de usar para projetos e usuários no ecossistema blockchain rastrear, analisar e entender os dados.

Etherscan (etherscan.io)

O Etherscan.io fornece uma maneira de consultar e analisar dados no blockchain Ethereum em tempo real. Ele permite que os usuários rastreiem transações, endereços, tokens, contratos inteligentes e outras informações relacionadas de maneira mais fácil. O Etherscan.io é um dos exploradores de blockchain mais populares e amplamente utilizados no ecossistema Ethereum. Goza das seguintes características principais:

Dados em tempo real: Etherscan.io fornece dados em tempo real sobre o blockchain Ethereum, incluindo suas transações, blocos, tokens e contratos inteligentes, permitindo que os usuários consultem as informações mais recentes do blockchain a qualquer momento, rastreando assim o status de suas transações ou monitorando seus ativos.

Consultas de transações: os usuários podem consultar os detalhes de uma transação específica no Etherscan.io, como hash da transação, remetente, destinatário, valor da transação, taxa, altura do bloco e muito mais. Isso permite que os usuários rastreiem e verifiquem as transações, garantindo assim a segurança de seus fundos.

Análise de endereço: o Etherscan.io permite que os usuários visualizem informações de ativos para endereços específicos, incluindo saldo de ETH, saldo de token, histórico de transações, etc. Os usuários também podem consultar contratos inteligentes e transações internas relacionadas a um endereço.

Verificação de contrato inteligente: o Etherscan.io oferece suporte à verificação de código-fonte de contratos inteligentes, permitindo que os desenvolvedores carreguem e verifiquem códigos de contrato. Isso ajuda a melhorar a transparência dos contratos inteligentes e aumenta a confiança do usuário neles.

Rastreador de token: Etherscan.io suporta tokens ERC-20 e ERC-721, permitindo que os usuários visualizem detalhes de um token específico, como fornecimento total, número de titulares, histórico de transações, etc. Isso é útil para analisar e rastrear o mercado de tokens.

API do desenvolvedor: Etherscan.io fornece uma API versátil, permitindo que os desenvolvedores acessem os dados da blockchain Ethereum programaticamente. Isso permite que os desenvolvedores integrem facilmente o Etherscan.io dados em seus aplicativos e serviços.

Em uma palavra, o Etherscan.io é um poderoso explorador de blockchain Ethereum que fornece aos usuários ferramentas convenientes de consulta e análise. Por meio de uma variedade de recursos exclusivos, incluindo dados em tempo real, consultas de transações, análise de endereço, verificação de contrato inteligente etc., o Etherscan.io desempenha um papel essencial no ecossistema Ethereum.

Fonte: https://etherscan.io/

Primeiro, o Etherscan Blockchain Explorer permite que os usuários pesquisem por endereço, Txn hash, bloco, token e nome de domínio.

Fonte: https://etherscan.io/

Em segundo lugar, o Etherscan exibe dados em tempo real sobre o Ether, incluindo seu preço, total de transações, capitalização de mercado, último bloco finalizado e histórico de transações em 14 dias.

Fonte: https://etherscan.io/

Em conclusão, o Etherscan é um poderoso navegador de blockchain Ethereum que fornece uma maneira de consultar e analisar dados no blockchain Ethereum em tempo real. Ele permite que os usuários rastreiem facilmente transações, endereços, tokens, contratos inteligentes e outras informações relacionadas. O Etherscan.io é um dos navegadores blockchain mais populares e amplamente utilizados no ecossistema Ethereum, que desempenha um papel importante lá.

Fonte: https://etherscan.io/