SergioTesla

Aún no hay contenido

SergioTesla

$BTC

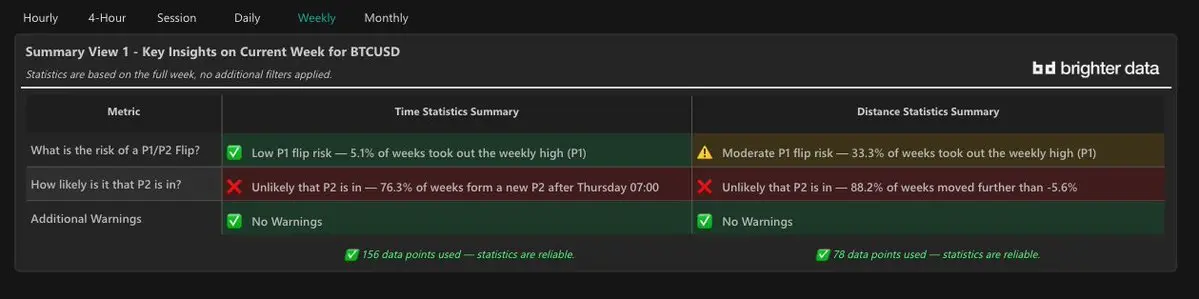

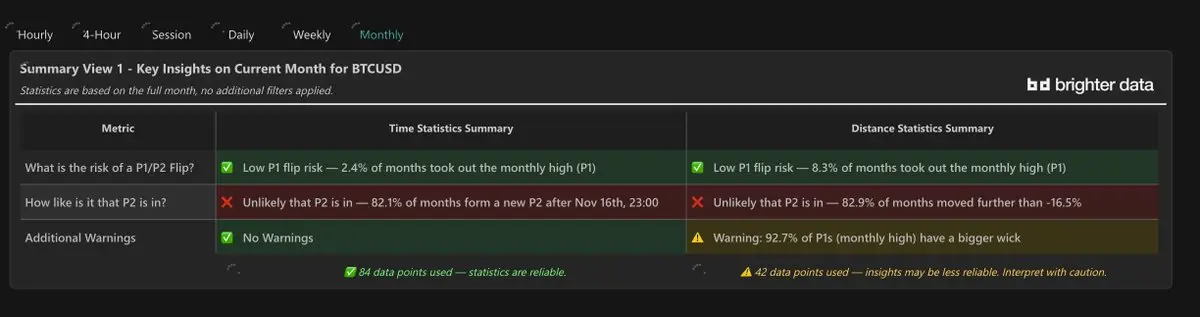

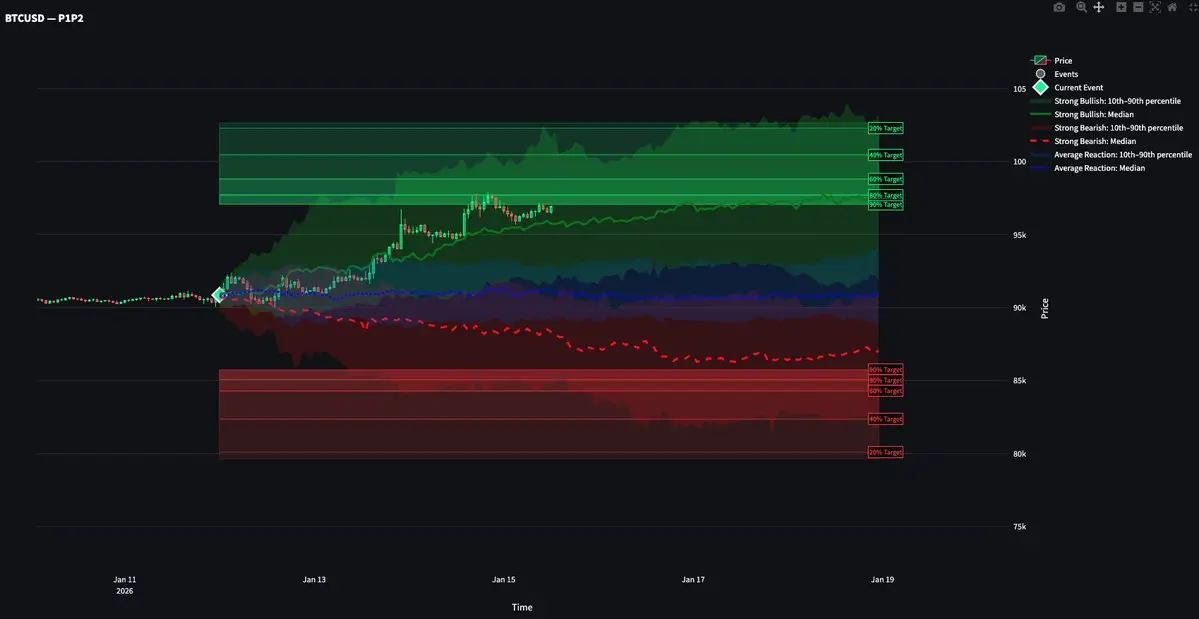

Objetivos de confianza mensual actuales:

- Si el mínimo mensual se mantiene, el 90% de los meses en la historia muestran suficiente desplazamiento desde el mínimo hasta el máximo para alcanzar aproximadamente 98.9k

- Si el máximo mensual se mantiene, el 90% de los meses en la historia muestran suficiente desplazamiento a la baja desde el máximo hasta el mínimo para alcanzar aproximadamente 84.5k

- Solo el 4.5% de los meses en la historia no logran desplazarse más, lo que significa que tanto el máximo como el mínimo ya estaban en su lugar

Objetivos de confianza mensual actuales:

- Si el mínimo mensual se mantiene, el 90% de los meses en la historia muestran suficiente desplazamiento desde el mínimo hasta el máximo para alcanzar aproximadamente 98.9k

- Si el máximo mensual se mantiene, el 90% de los meses en la historia muestran suficiente desplazamiento a la baja desde el máximo hasta el mínimo para alcanzar aproximadamente 84.5k

- Solo el 4.5% de los meses en la historia no logran desplazarse más, lo que significa que tanto el máximo como el mínimo ya estaban en su lugar

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

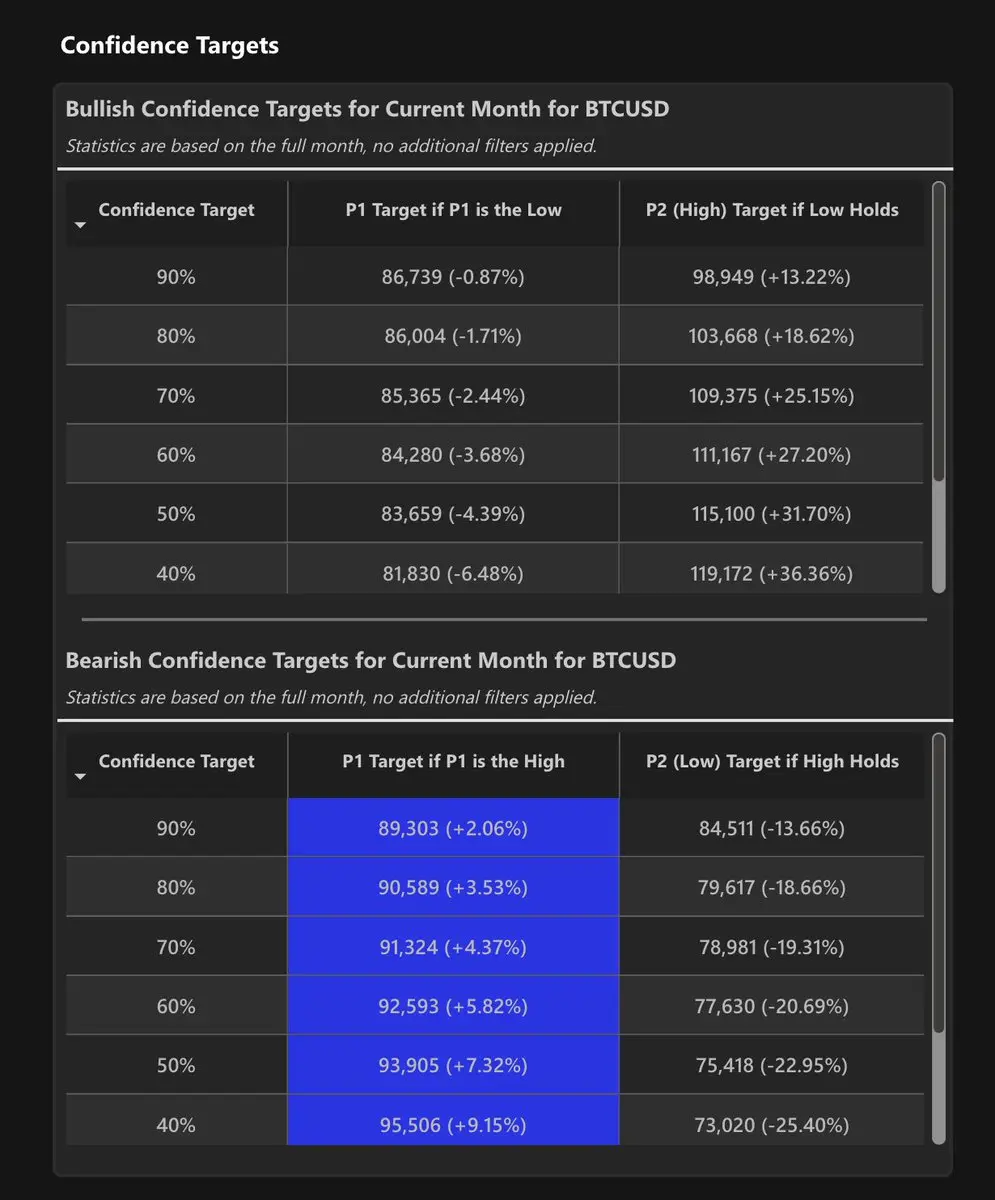

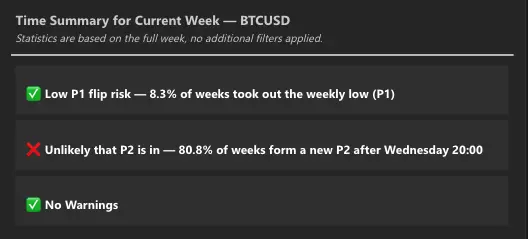

En el gráfico de abajo, he trazado la acción del precio intra-semanal de los últimos tres años y agrupado las semanas en:

•las 33% más alcistas

•las 33% medias (semanas promedio)

•las 33% más bajistas

Por ejemplo, la banda verde muestra dónde ocurrieron el 80% de los cierres durante las semanas más alcistas.

Ahora mismo, el precio está claramente siguiendo el perfil alcista. Una primera conclusión: las semanas alcistas tienden a avanzar lentamente hacia arriba durante toda la semana.

¿Hasta qué punto más alto? Ahí entran en juego los objetivos de confianza. Su trazado resalta los niveles

En el gráfico de abajo, he trazado la acción del precio intra-semanal de los últimos tres años y agrupado las semanas en:

•las 33% más alcistas

•las 33% medias (semanas promedio)

•las 33% más bajistas

Por ejemplo, la banda verde muestra dónde ocurrieron el 80% de los cierres durante las semanas más alcistas.

Ahora mismo, el precio está claramente siguiendo el perfil alcista. Una primera conclusión: las semanas alcistas tienden a avanzar lentamente hacia arriba durante toda la semana.

¿Hasta qué punto más alto? Ahí entran en juego los objetivos de confianza. Su trazado resalta los niveles

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

En el gráfico a continuación, he trazado la acción del precio intrasemana de los últimos tres años y agrupado las semanas en:

•las 33% más alcistas

•las 33% medias (semanas promedio)

•las 33% más bajistas

Por ejemplo, la banda verde muestra dónde ocurrieron el 80% de los cierres durante las semanas más alcistas.

Actualmente, el precio está claramente siguiendo el perfil alcista. Una conclusión temprana: las semanas alcistas tienden a avanzar lentamente hacia arriba durante toda la semana.

¿Hasta qué punto más alto? Ahí es donde entran en juego los objetivos de confianza. Su trazado resalt

En el gráfico a continuación, he trazado la acción del precio intrasemana de los últimos tres años y agrupado las semanas en:

•las 33% más alcistas

•las 33% medias (semanas promedio)

•las 33% más bajistas

Por ejemplo, la banda verde muestra dónde ocurrieron el 80% de los cierres durante las semanas más alcistas.

Actualmente, el precio está claramente siguiendo el perfil alcista. Una conclusión temprana: las semanas alcistas tienden a avanzar lentamente hacia arriba durante toda la semana.

¿Hasta qué punto más alto? Ahí es donde entran en juego los objetivos de confianza. Su trazado resalt

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

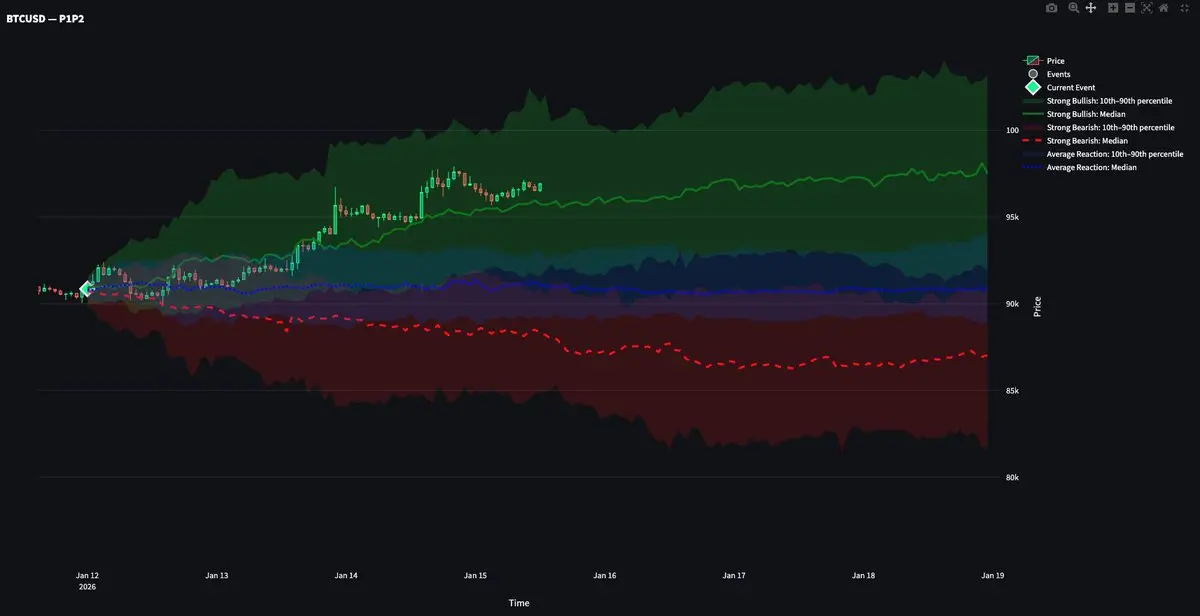

$BTC

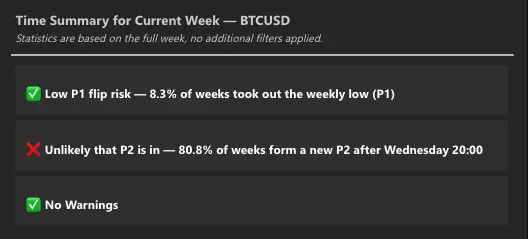

Por qué el PA mensual abierto es estadísticamente bajista ( en el corto plazo), respaldado por datos.

Comenzamos el mes de enero con un impulso alcista, pero ¿durará? Podemos analizar la calidad estadística del mínimo mensual para tener una idea.

@BrighterData está señalando 2 advertencias para el mínimo mensual:

- El 90.7% de los meses colocan el primer extremo (máximo o mínimo mensual) después de la cuarta hora de negociación del mes

- El 97.1% de los meses tienen una mecha más grande en el mínimo mensual cuando este es el primero

Esto significa que el mínimo mensual es inusualmente tem

Por qué el PA mensual abierto es estadísticamente bajista ( en el corto plazo), respaldado por datos.

Comenzamos el mes de enero con un impulso alcista, pero ¿durará? Podemos analizar la calidad estadística del mínimo mensual para tener una idea.

@BrighterData está señalando 2 advertencias para el mínimo mensual:

- El 90.7% de los meses colocan el primer extremo (máximo o mínimo mensual) después de la cuarta hora de negociación del mes

- El 97.1% de los meses tienen una mecha más grande en el mínimo mensual cuando este es el primero

Esto significa que el mínimo mensual es inusualmente tem

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

No soy muy de resoluciones de Año Nuevo. Pero el fin de año es un buen momento para hacer una pausa.

Revisa qué salió bien. Sé honesto sobre lo que no.

Eso te da una base real para establecer tus metas y dirección para el año que viene.

El éxito no consiste en alcanzar el 100% de tus metas. Si lo haces, tus metas eran demasiado conservadoras.

Normalmente alcanzo aproximadamente el 60%. Otro ~20% me acerco, en la dirección correcta. Y ~20% las fallo completamente.

Algunas metas son demasiado ambiciosas. Otras pierden prioridad a medida que la realidad se desarrolla.

Esta reflexión anual importa

Ver originalesRevisa qué salió bien. Sé honesto sobre lo que no.

Eso te da una base real para establecer tus metas y dirección para el año que viene.

El éxito no consiste en alcanzar el 100% de tus metas. Si lo haces, tus metas eran demasiado conservadoras.

Normalmente alcanzo aproximadamente el 60%. Otro ~20% me acerco, en la dirección correcta. Y ~20% las fallo completamente.

Algunas metas son demasiado ambiciosas. Otras pierden prioridad a medida que la realidad se desarrolla.

Esta reflexión anual importa

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

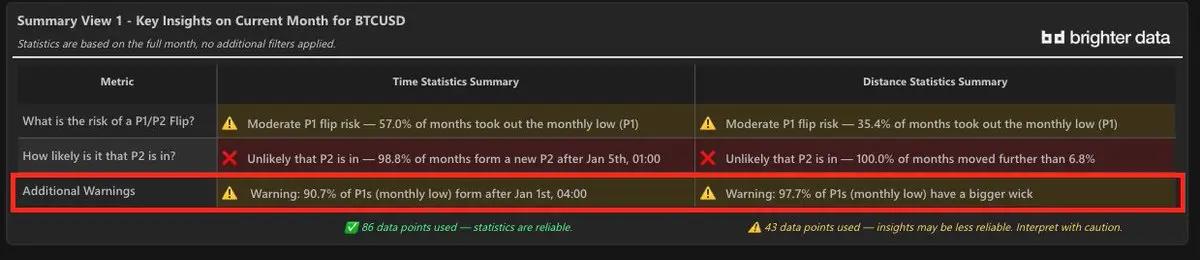

$BTC

Terminar este mes con el máximo mensual actual Y el mínimo mensual intactos sería un acontecimiento muy raro:

- El 93% de los meses presentan más desplazamiento entre el mínimo mensual y el máximo mensual

- El 92.9% de los meses se sitúan en el segundo extremo del mes después del noveno día de negociación a las 17:00 UTC

Terminar este mes con el máximo mensual actual Y el mínimo mensual intactos sería un acontecimiento muy raro:

- El 93% de los meses presentan más desplazamiento entre el mínimo mensual y el máximo mensual

- El 92.9% de los meses se sitúan en el segundo extremo del mes después del noveno día de negociación a las 17:00 UTC

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

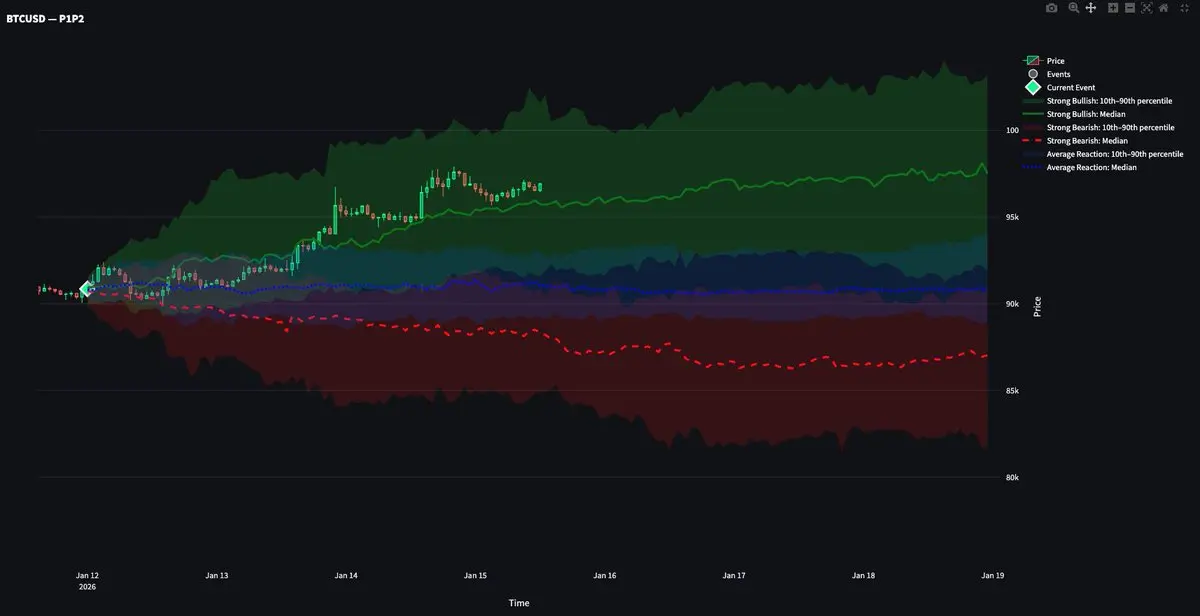

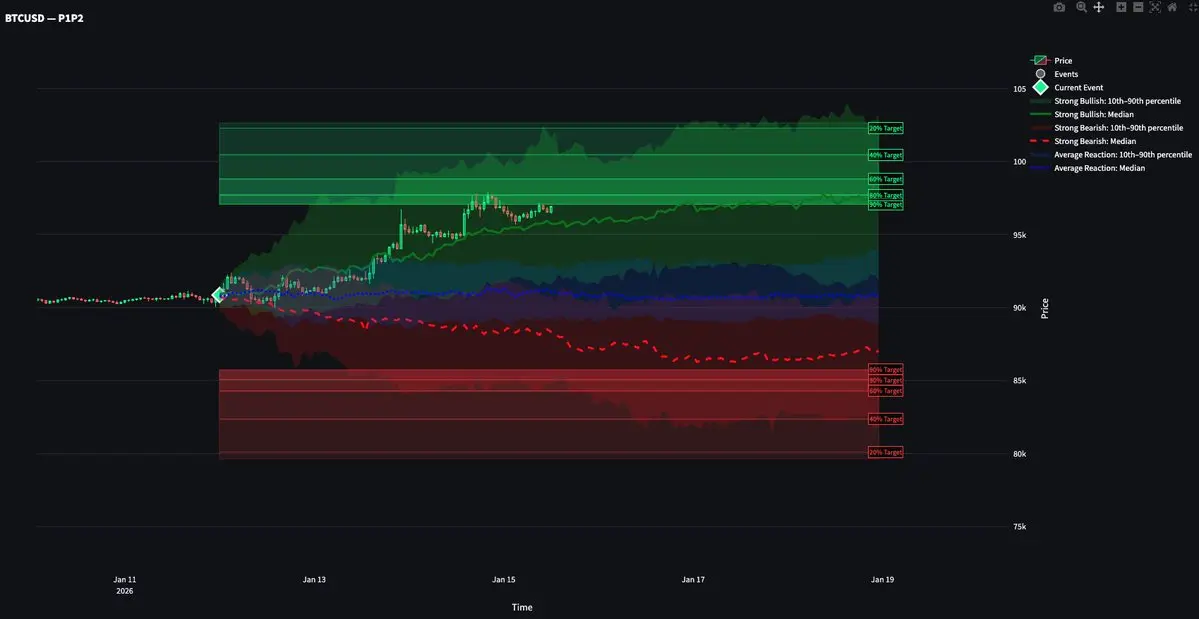

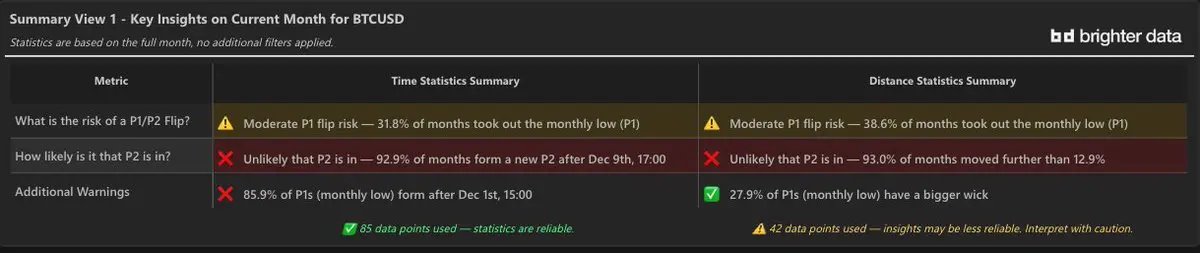

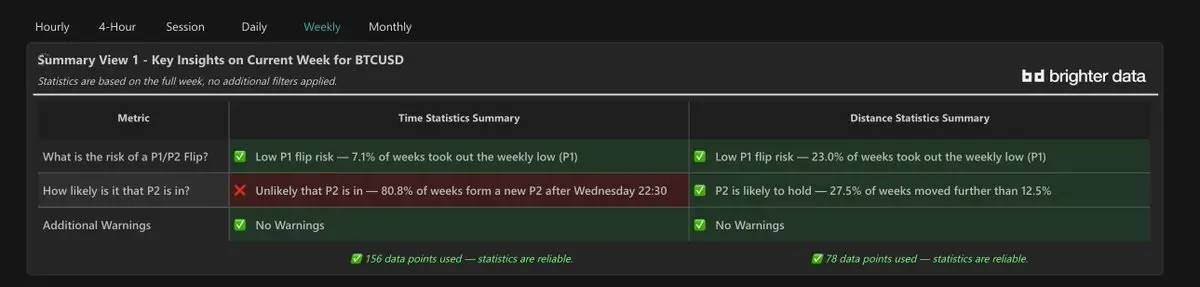

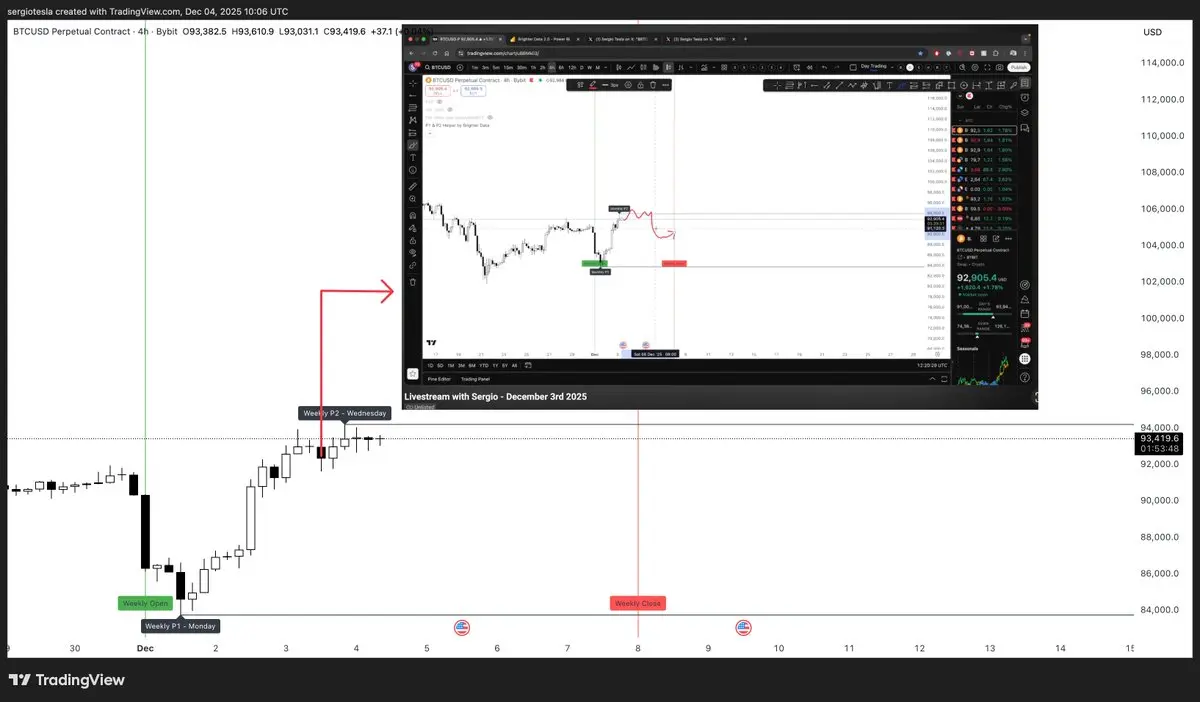

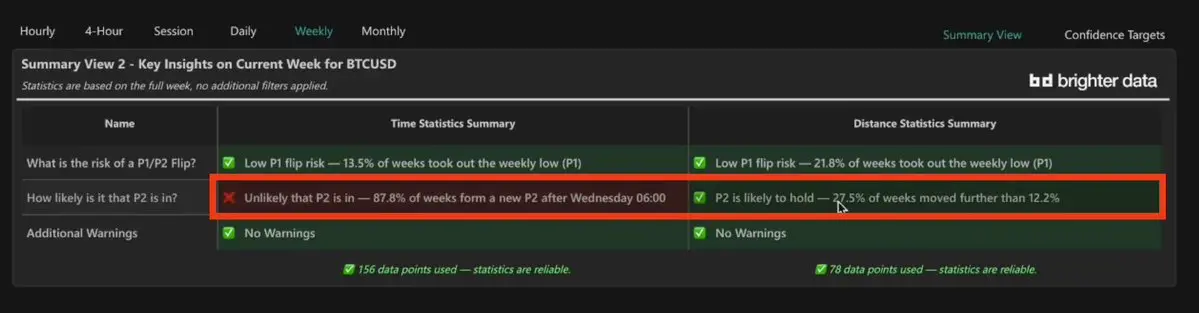

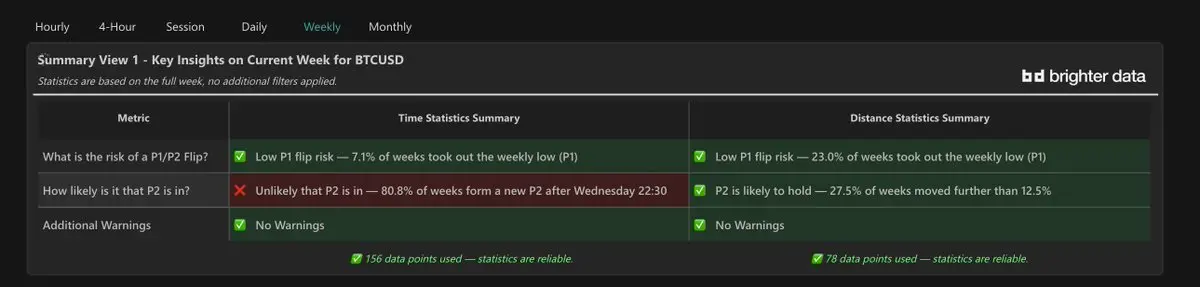

Durante mi retransmisión pública de ayer expliqué que:

1. Esperaba que el máximo semanal aún no estuviera marcado.

2. Sin embargo, pensaba que los máximos se marcarían no muy lejos del (entonces) máximo semanal actual.

En otras palabras: cada ruptura del máximo semanal probablemente sería poco profunda. Esta sigue siendo mi postura:

La razón son las estadísticas de tiempo y distancia de @BrighterData. Ayer, en el momento de la retransmisión, eran las siguientes:

- El 87,8% de los P2s (máximo semanal) se marcaron más tarde.

- El 27,5% de las semanas alcistas ven un mayor desplazamiento des

Durante mi retransmisión pública de ayer expliqué que:

1. Esperaba que el máximo semanal aún no estuviera marcado.

2. Sin embargo, pensaba que los máximos se marcarían no muy lejos del (entonces) máximo semanal actual.

En otras palabras: cada ruptura del máximo semanal probablemente sería poco profunda. Esta sigue siendo mi postura:

La razón son las estadísticas de tiempo y distancia de @BrighterData. Ayer, en el momento de la retransmisión, eran las siguientes:

- El 87,8% de los P2s (máximo semanal) se marcaron más tarde.

- El 27,5% de las semanas alcistas ven un mayor desplazamiento des

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

Durante mi retransmisión pública de ayer expliqué que:

1. Esperaba que el máximo semanal aún no estuviera marcado.

2. Sin embargo, pensaba que los máximos se pondrían no muy lejos del (entonces) máximo semanal actual.

En otras palabras: es probable que cada ruptura del máximo semanal sea poco profunda. Esta sigue siendo mi postura:

La razón es la estadística de tiempo y distancia de @BrighterData. Ayer, en el momento de la retransmisión, eran las siguientes:

- El 87,8% de los P2s (máximo semanal) se marcaron más tarde.

- El 27,5% de las semanas alcistas ven más desplazamiento del mínimo a

Durante mi retransmisión pública de ayer expliqué que:

1. Esperaba que el máximo semanal aún no estuviera marcado.

2. Sin embargo, pensaba que los máximos se pondrían no muy lejos del (entonces) máximo semanal actual.

En otras palabras: es probable que cada ruptura del máximo semanal sea poco profunda. Esta sigue siendo mi postura:

La razón es la estadística de tiempo y distancia de @BrighterData. Ayer, en el momento de la retransmisión, eran las siguientes:

- El 87,8% de los P2s (máximo semanal) se marcaron más tarde.

- El 27,5% de las semanas alcistas ven más desplazamiento del mínimo a

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

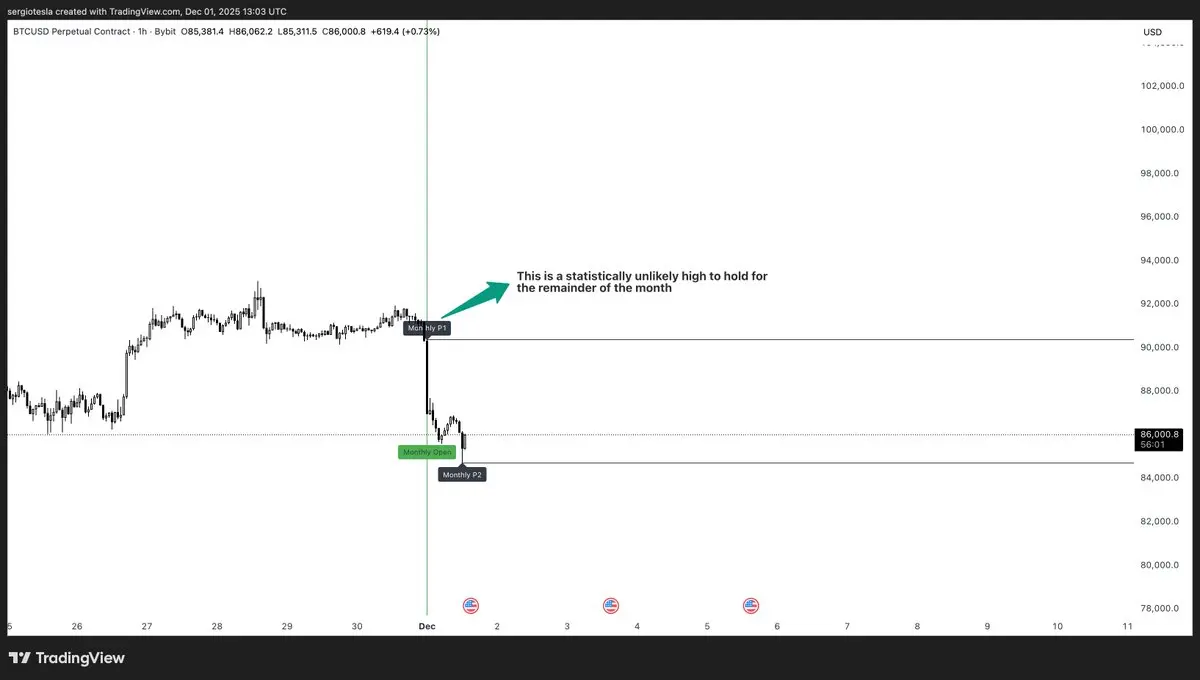

$BTC

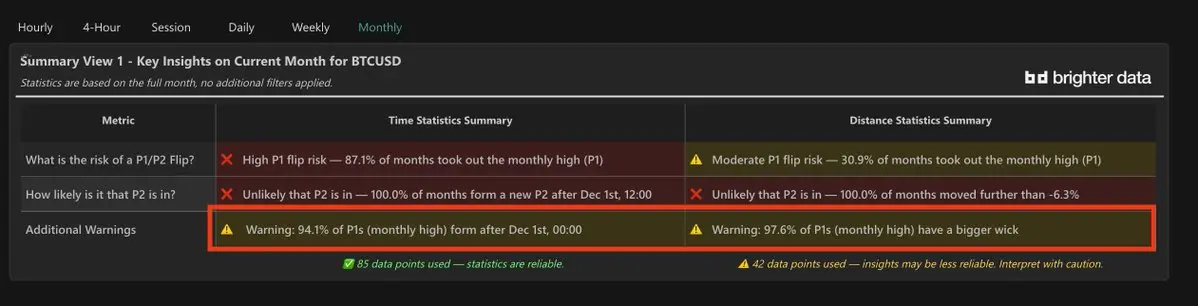

Por qué este vertido de apertura mensual es alcista - respaldado por datos.

El precio acaba de caer un impresionante 5.5% en la apertura del mes, lo que da más razones para buscar posiciones largas que para no hacerlo.

El máximo mensual es actualmente P1, de lo cual podemos decir lo siguiente:

- 94.1% de los P1s mensuales se forman más tarde

- El 97.6% de los P1 mensuales tienen una mecha más grande

En términos simples: si el máximo mensual actual se mantuviera, entonces se colocaría inusualmente temprano y inusualmente cerca de la apertura mensual.

Si no sabes qué es P1, comenta P1 y te

Por qué este vertido de apertura mensual es alcista - respaldado por datos.

El precio acaba de caer un impresionante 5.5% en la apertura del mes, lo que da más razones para buscar posiciones largas que para no hacerlo.

El máximo mensual es actualmente P1, de lo cual podemos decir lo siguiente:

- 94.1% de los P1s mensuales se forman más tarde

- El 97.6% de los P1 mensuales tienen una mecha más grande

En términos simples: si el máximo mensual actual se mantuviera, entonces se colocaría inusualmente temprano y inusualmente cerca de la apertura mensual.

Si no sabes qué es P1, comenta P1 y te

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

Por qué este volcado de apertura mensual es alcista - respaldado por datos.

El precio acaba de caer un asombroso 5.5% en la apertura del mes, lo que da más razones para buscar posiciones largas que para no hacerlo.

El máximo mensual es actualmente P1, de lo cual podemos decir lo siguiente:

- El 94.1% de los P1s mensuales se forman más tarde

- El 97.6% de los P1 mensuales tienen una mecha más grande

En términos simples: si el máximo mensual actual se mantiene, entonces se establecería inusualmente temprano y inusualmente cerca de la apertura mensual.

Si no sabes qué es P1, comenta 'P1&

Por qué este volcado de apertura mensual es alcista - respaldado por datos.

El precio acaba de caer un asombroso 5.5% en la apertura del mes, lo que da más razones para buscar posiciones largas que para no hacerlo.

El máximo mensual es actualmente P1, de lo cual podemos decir lo siguiente:

- El 94.1% de los P1s mensuales se forman más tarde

- El 97.6% de los P1 mensuales tienen una mecha más grande

En términos simples: si el máximo mensual actual se mantiene, entonces se establecería inusualmente temprano y inusualmente cerca de la apertura mensual.

Si no sabes qué es P1, comenta 'P1&

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

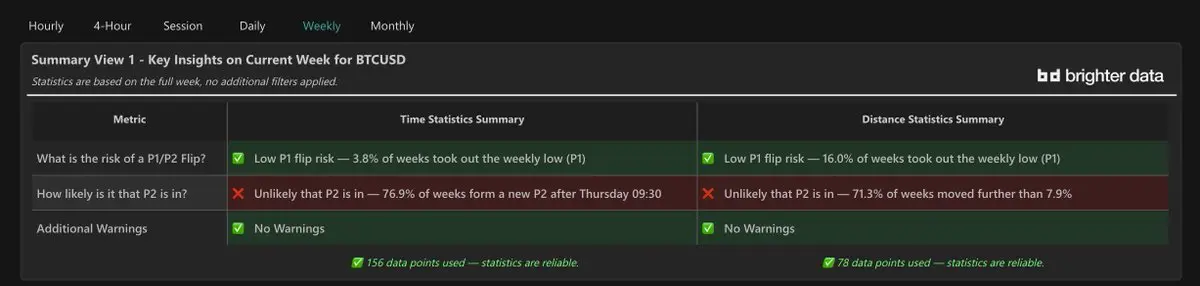

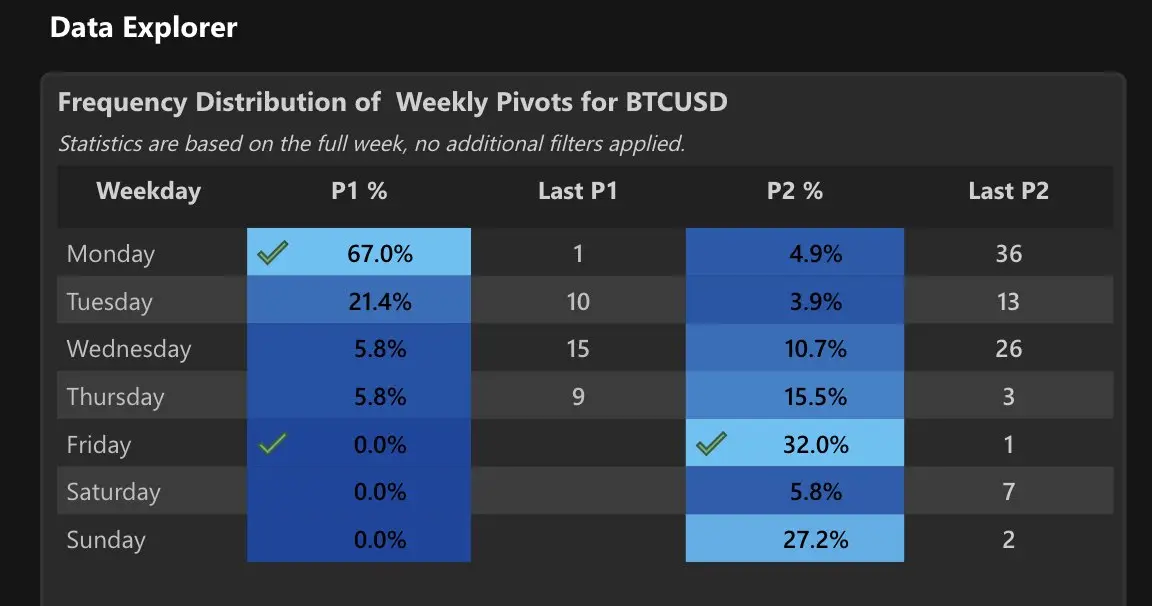

$BTC

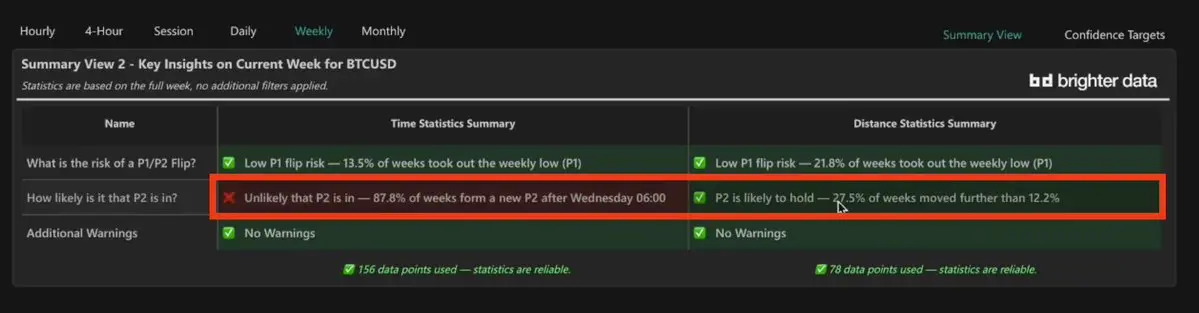

Probablemente aún queda un poco de potencial alcista en la semanal para Bitcoin:

- P2 semanal actual el jueves a las 09:30 AM, 7.9% por encima del mínimo semanal

- 76.9% de las semanas se ponen en un P2 más tarde

- El 71.3% de las semanas alcistas ven más desplazamiento

Así que, aunque la parte principal del movimiento semanal ya sucedió, vender en corto aquí ya no parece una jugada de alta probabilidad.

Probablemente aún queda un poco de potencial alcista en la semanal para Bitcoin:

- P2 semanal actual el jueves a las 09:30 AM, 7.9% por encima del mínimo semanal

- 76.9% de las semanas se ponen en un P2 más tarde

- El 71.3% de las semanas alcistas ven más desplazamiento

Así que, aunque la parte principal del movimiento semanal ya sucedió, vender en corto aquí ya no parece una jugada de alta probabilidad.

BTC1,38%

- Recompensa

- 1

- 1

- Republicar

- Compartir

Betterforever :

:

$BTC Bitcoin puede tener un poco más de espacio para subir en el gráfico semanal:

- Actualmente, el P2 semanal está a las 09:30 del jueves, un 7.9% por encima del punto más bajo de la semana.

- El 76.9% de las semanas invirtieron en el P2 posterior.

- El 71.3% de las semanas alcistas vieron más desplazamiento.

Así que, aunque ya ha habido fluctuaciones semanales, hacer short aquí no parece ser una operación de alta probabilidad.

He estado un poco más tranquilo últimamente. Cuando el mercado no ofrece nada significativo, vuelvo a centrar mi atención en construir.

En este momento estoy inmerso en el diseño de la próxima versión de @BrighterData. Es más complejo que cualquier cosa que hayamos hecho hasta ahora, y una vez que me enfrento a un problema difícil, no puedo soltarlo hasta que lo resuelva.

No estoy comprando en estos niveles, tampoco estoy vendiendo. Solo estoy esperando. Mientras tanto, construir la próxima evolución de BD es el mejor uso de mi atención.

La dirección es clara y estoy emocionado por a dónde se

Ver originalesEn este momento estoy inmerso en el diseño de la próxima versión de @BrighterData. Es más complejo que cualquier cosa que hayamos hecho hasta ahora, y una vez que me enfrento a un problema difícil, no puedo soltarlo hasta que lo resuelva.

No estoy comprando en estos niveles, tampoco estoy vendiendo. Solo estoy esperando. Mientras tanto, construir la próxima evolución de BD es el mejor uso de mi atención.

La dirección es clara y estoy emocionado por a dónde se

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Recientemente publicamos una vacante para @BrighterData y recibimos 40 solicitudes. Lo divertido es que las que NO estaban escritas con IA destacaron instantáneamente.

La mayoría de las solicitudes parecían la presentación perfecta de hace cinco años. Largas, pulidas, con cada habilidad ordenada de manera impecable, el CV parecía que toda la carrera del solicitante había sido diseñada exactamente para lo que necesitábamos.

El problema era que tenía 30 de esos. Ninguno de ellos destacaba. Eran demasiado perfectos y demasiado artificiales. Al final elegimos las aplicaciones "menos perfectas" que

Ver originalesLa mayoría de las solicitudes parecían la presentación perfecta de hace cinco años. Largas, pulidas, con cada habilidad ordenada de manera impecable, el CV parecía que toda la carrera del solicitante había sido diseñada exactamente para lo que necesitábamos.

El problema era que tenía 30 de esos. Ninguno de ellos destacaba. Eran demasiado perfectos y demasiado artificiales. Al final elegimos las aplicaciones "menos perfectas" que

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

Hasta ahora no veo ninguna razón para decir que Bitcoin está tocando fondo todavía. La acción del precio parece débil.

Si el mes actual será bajista, entonces el 80% de los meses bajistas mostrarían un desplazamiento bajista suficiente para llegar a 90k.

Dado el historial en los momentos de los mínimos y máximos mensuales, querrías que la próxima semana fuera alcista para mantener una buena probabilidad de no formar esa vela mensual bajista.

Hasta ahora no veo ninguna razón para decir que Bitcoin está tocando fondo todavía. La acción del precio parece débil.

Si el mes actual será bajista, entonces el 80% de los meses bajistas mostrarían un desplazamiento bajista suficiente para llegar a 90k.

Dado el historial en los momentos de los mínimos y máximos mensuales, querrías que la próxima semana fuera alcista para mantener una buena probabilidad de no formar esa vela mensual bajista.

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

He estado en la carretera desde el jueves y tengo poco tiempo para actualizar los gráficos, pero para quienes preguntan, mi sesgo sigue siendo el mismo que en los últimos meses:

La invalidación que di hace un tiempo no ha sido alcanzada y, por lo tanto, nada ha cambiado: sigo siendo alcista en HTF hasta que perdamos de manera decisiva 104k (los movimientos no sostenidos a 100k están bien).

El precio sigue dentro del mismo rango local que los últimos meses y por lo tanto continuaré asumiendo un rango hasta que rompa.

Si el rango local se rompe, mi invalidación seguramente se activará, pero hast

Ver originalesLa invalidación que di hace un tiempo no ha sido alcanzada y, por lo tanto, nada ha cambiado: sigo siendo alcista en HTF hasta que perdamos de manera decisiva 104k (los movimientos no sostenidos a 100k están bien).

El precio sigue dentro del mismo rango local que los últimos meses y por lo tanto continuaré asumiendo un rango hasta que rompa.

Si el rango local se rompe, mi invalidación seguramente se activará, pero hast

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Como era de esperar, el feed está comenzando a llenarse de publicaciones de personas que están cortas desde ATH después de que el precio ha bajado 20k desde el máximo.

Cuando estemos de vuelta en ATH en un par de semanas, las mismas personas publicarán por qué están largos desde el último fondo de HTF.

No se puede vencer al Capitán Retrospectiva.

Ver originalesCuando estemos de vuelta en ATH en un par de semanas, las mismas personas publicarán por qué están largos desde el último fondo de HTF.

No se puede vencer al Capitán Retrospectiva.

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

Niveles muy interesantes ahora. Sin embargo, no hay necesidad de empezar a atrapar cuchillos aquí, voy a dejar que esta semana transcurra.

Pero si la próxima semana comenzamos a ver estadísticas semanales alcistas, eso creará un gran potencial para una configuración de compra.

88%(!) de las semanas alcanzaron el máximo/mínimo semanal el martes en los últimos 2 años, por lo que estaremos buscando un buen potencial mínimo semanal el lunes/martes.

Dejaremos que los datos nos guíen.

Niveles muy interesantes ahora. Sin embargo, no hay necesidad de empezar a atrapar cuchillos aquí, voy a dejar que esta semana transcurra.

Pero si la próxima semana comenzamos a ver estadísticas semanales alcistas, eso creará un gran potencial para una configuración de compra.

88%(!) de las semanas alcanzaron el máximo/mínimo semanal el martes en los últimos 2 años, por lo que estaremos buscando un buen potencial mínimo semanal el lunes/martes.

Dejaremos que los datos nos guíen.

BTC1,38%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

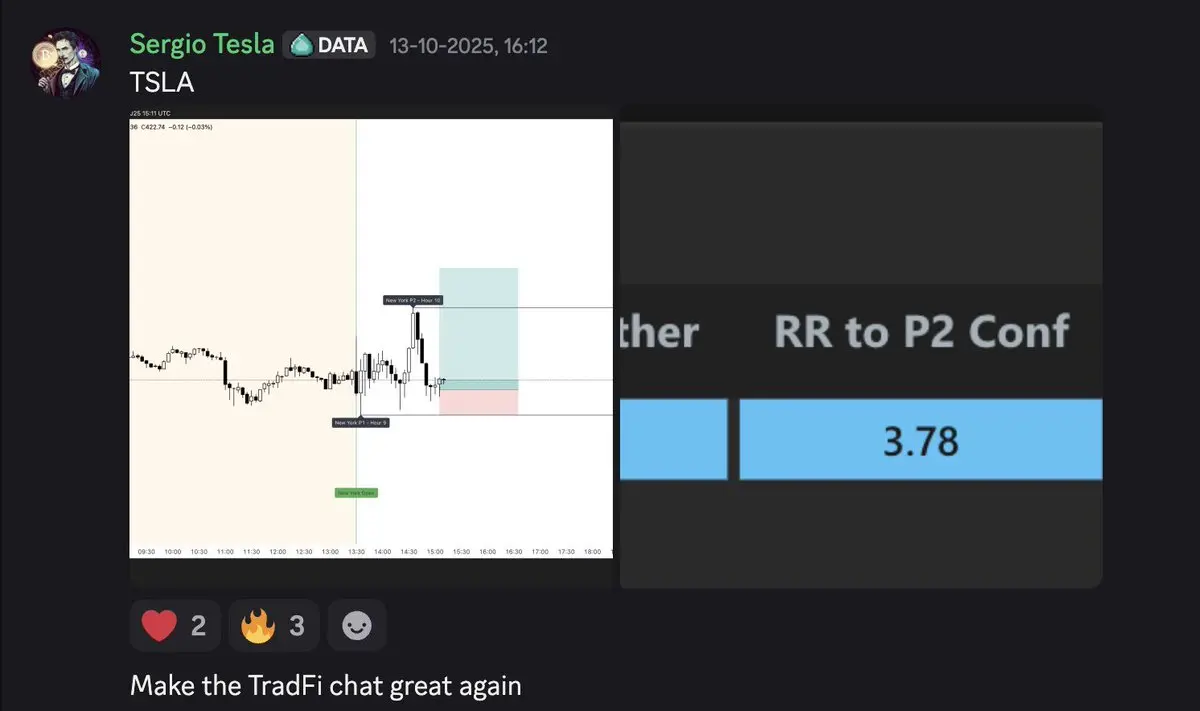

Publiqué esta configuración en $TSLA el otro día. La parte interesante de esto: fue 100% basada en estadísticas de @BrighterData

Literalmenta no se usó TA. Ni siquiera miré el gráfico para detectarlo.

Lentamente pero con seguridad, me acerco a mi objetivo de un enfoque completamente basado en datos que no requerirá gráficos.

Seguimos construyendo.

Ver originalesLiteralmenta no se usó TA. Ni siquiera miré el gráfico para detectarlo.

Lentamente pero con seguridad, me acerco a mi objetivo de un enfoque completamente basado en datos que no requerirá gráficos.

Seguimos construyendo.

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

Temas de actualidad

Ver más39.6K Popularidad

22.04K Popularidad

9.29K Popularidad

58.8K Popularidad

343.94K Popularidad

Anclado