Post content & earn content mining yield

placeholder

Dyme

The more people get mad at me, the more I know I\'m right.

- Reward

- like

- Comment

- Repost

- Share

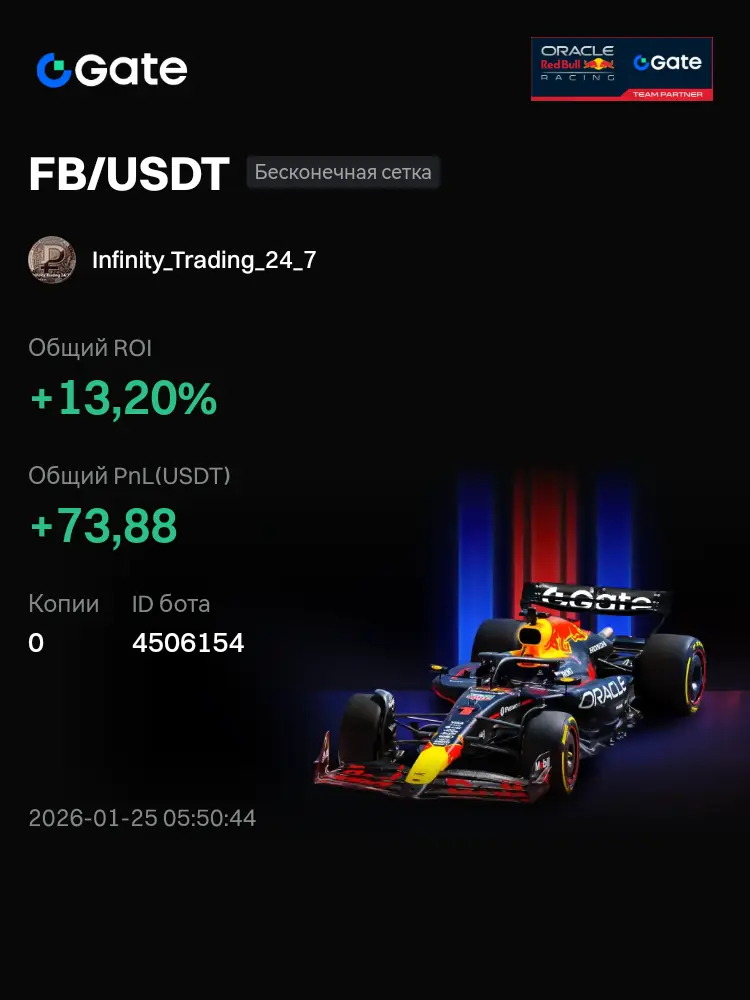

The market trend is unexpected.

- Reward

- like

- 1

- Repost

- Share

YearOfTheHorseWealthExplosion :

:

New Year Wealth Explosion 🤑Let's Go hope to see an increase in the future🙏

- Reward

- like

- Comment

- Repost

- Share

DD

呆呆

Created By@DreamsComeTrueInLife.

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- like

- Comment

- Repost

- Share

【$ACU Signal】Short + Volume Breakout

$ACU Forms a cliff-like decline amid massive selling, with a 40% drop accompanied by record-breaking trading volume. This is a typical panic sell-off combined with long liquidation. The chart shows clear signs of main force distribution, with no effective support below.

🎯 Direction: Short (Short)

🎯 Entry: 0.185 - 0.192

🛑 Stop Loss: 0.205 (Rigid Stop Loss)

🚀 Target 1: 0.165

🚀 Target 2: 0.145

The decline of $ACU is driven by record volume, and the data on open interest suggests that longs are being systematically cleaned out. The price has broken away

$ACU Forms a cliff-like decline amid massive selling, with a 40% drop accompanied by record-breaking trading volume. This is a typical panic sell-off combined with long liquidation. The chart shows clear signs of main force distribution, with no effective support below.

🎯 Direction: Short (Short)

🎯 Entry: 0.185 - 0.192

🛑 Stop Loss: 0.205 (Rigid Stop Loss)

🚀 Target 1: 0.165

🚀 Target 2: 0.145

The decline of $ACU is driven by record volume, and the data on open interest suggests that longs are being systematically cleaned out. The price has broken away

ACU-21.51%

- Reward

- 1

- Comment

- Repost

- Share

They're all watching the pump, but the real move is the other way. $PUMP /USDT

$PUMP - 🔴 Risk 8/10 (SHORT)

Trade Plan:

Entry: 0.002697 – 0.002725

SL: 0.002796

TP1: 0.002625

TP2: 0.002597

TP3: 0.00254

Why this setup?

SHORT bias is armed. The 4H setup is live with entry near 0.002711. RSI on lower timeframes shows no bullish strength, and the 1D trend is ranging, suggesting limited upside momentum. Key levels to watch: TP1 at 0.002625, with SL at 0.002796.

Debate:

Is this range about to break down, or will the bulls stage a surprise reversal from here?

Trade here 👇#PUMP

$PUMP - 🔴 Risk 8/10 (SHORT)

Trade Plan:

Entry: 0.002697 – 0.002725

SL: 0.002796

TP1: 0.002625

TP2: 0.002597

TP3: 0.00254

Why this setup?

SHORT bias is armed. The 4H setup is live with entry near 0.002711. RSI on lower timeframes shows no bullish strength, and the 1D trend is ranging, suggesting limited upside momentum. Key levels to watch: TP1 at 0.002625, with SL at 0.002796.

Debate:

Is this range about to break down, or will the bulls stage a surprise reversal from here?

Trade here 👇#PUMP

PUMP11.53%

- Reward

- like

- Comment

- Repost

- Share

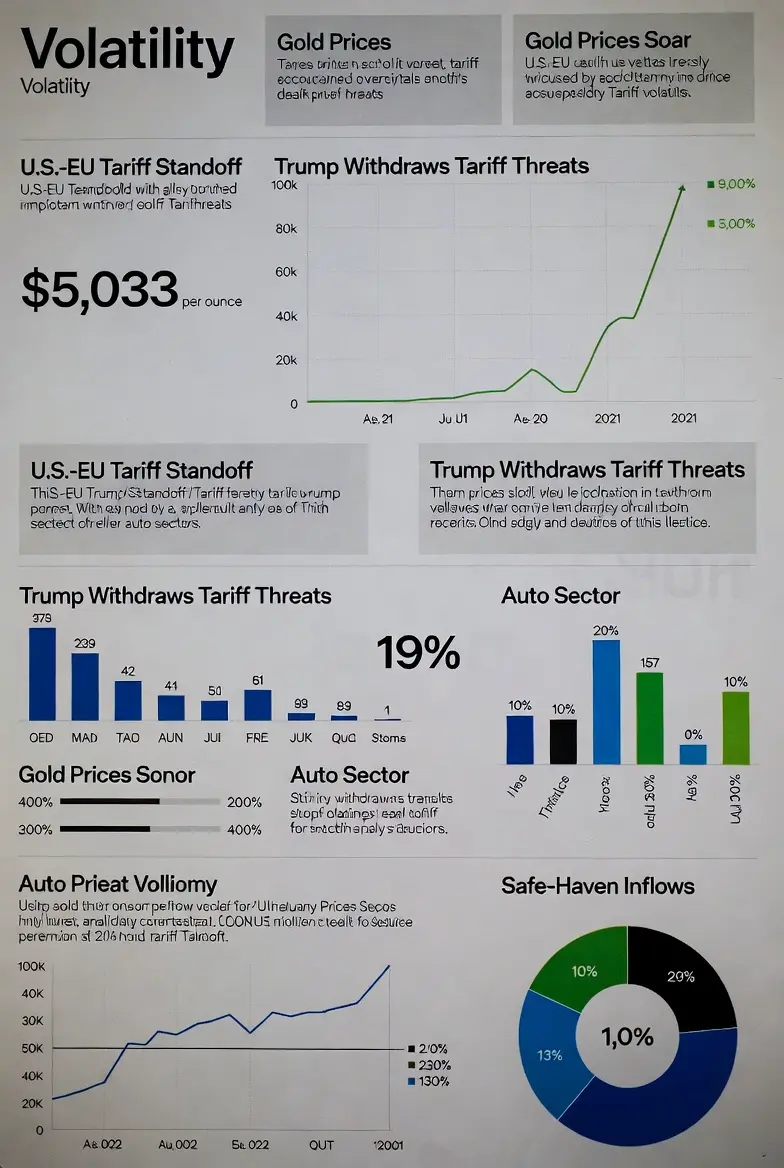

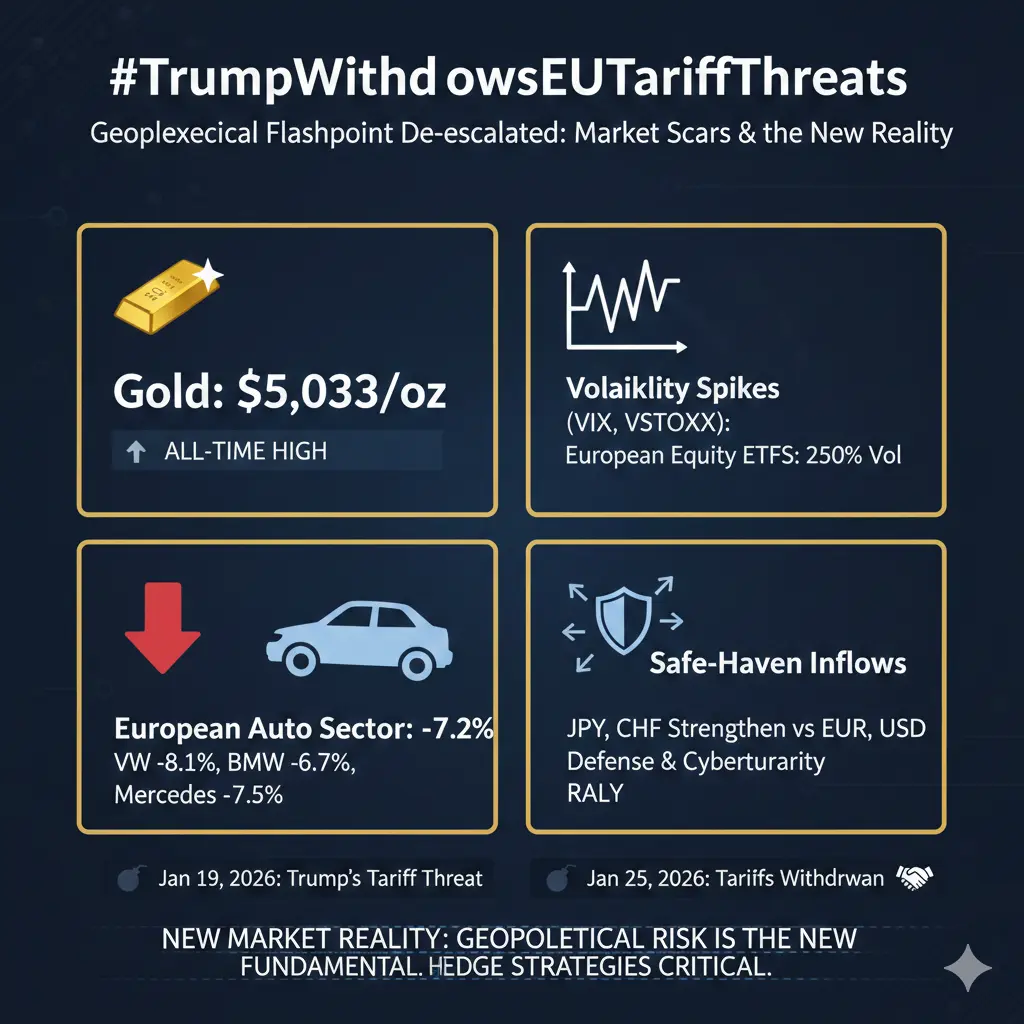

#TrumpWithdrawsEUTariffThreats

Geopolitical Flashpoint De-escalated: A Deep Dive into the U.S.-EU Tariff Standoff and Its Lasting Market Scars

The recent withdrawal of tariff threats by the Trump administration against eight European nations has provided a moment of respite for global markets. However, this de-escalation does not signify a return to the pre-2020 status quo. Instead, it formalizes a new, more volatile geopolitical reality, where financial markets have become the primary battlefield.

The episode began with President Trump's threat on January 19, 2026, to impose a 50% tariff on

Geopolitical Flashpoint De-escalated: A Deep Dive into the U.S.-EU Tariff Standoff and Its Lasting Market Scars

The recent withdrawal of tariff threats by the Trump administration against eight European nations has provided a moment of respite for global markets. However, this de-escalation does not signify a return to the pre-2020 status quo. Instead, it formalizes a new, more volatile geopolitical reality, where financial markets have become the primary battlefield.

The episode began with President Trump's threat on January 19, 2026, to impose a 50% tariff on

- Reward

- 5

- 8

- Repost

- Share

Korean_Girl :

:

Happy New Year! 🤑View More

Come on! Buddy, let's go. Let's see how big your ideals and vision are.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#TheWorldEconomicForum

The 56th World Economic Forum (WEF 2026) An Analytical Perspective and Emerging Trends

The 56th Annual Meeting of the World Economic Forum (WEF), held in Davos, Switzerland, from January 19 to 23, 2026, once again brought together global leaders from politics, business, civil society, and academia. The official theme, “A Spirit of Dialogue,” reflected a world at a crossroads, where technological disruption, economic competition, climate challenges, and geopolitical tensions intersect. In my assessment, this meeting illustrated both the opportunities and constraints of

The 56th World Economic Forum (WEF 2026) An Analytical Perspective and Emerging Trends

The 56th Annual Meeting of the World Economic Forum (WEF), held in Davos, Switzerland, from January 19 to 23, 2026, once again brought together global leaders from politics, business, civil society, and academia. The official theme, “A Spirit of Dialogue,” reflected a world at a crossroads, where technological disruption, economic competition, climate challenges, and geopolitical tensions intersect. In my assessment, this meeting illustrated both the opportunities and constraints of

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

🚨 Kevin O’Leary Streamlines Crypto Portfolio

Shark Tank’s Kevin O’Leary is selling 27 crypto positions, narrowing his bets exclusively to Bitcoin and Ethereum.

💡 What this signals: Even high-profile investors are focusing on blue-chip cryptos, prioritizing liquidity, market dominance, and long-term viability over speculative altcoins.

👀 Takeaway: In a volatile market, quality > quantity. O’Leary’s move highlights a growing trend: institutions and seasoned investors are doubling down on BTC & ETH as the pillars of the crypto ecosystem.

💬 Your thoughts — is this a smart consolidation or play

Shark Tank’s Kevin O’Leary is selling 27 crypto positions, narrowing his bets exclusively to Bitcoin and Ethereum.

💡 What this signals: Even high-profile investors are focusing on blue-chip cryptos, prioritizing liquidity, market dominance, and long-term viability over speculative altcoins.

👀 Takeaway: In a volatile market, quality > quantity. O’Leary’s move highlights a growing trend: institutions and seasoned investors are doubling down on BTC & ETH as the pillars of the crypto ecosystem.

💬 Your thoughts — is this a smart consolidation or play

- Reward

- like

- Comment

- Repost

- Share

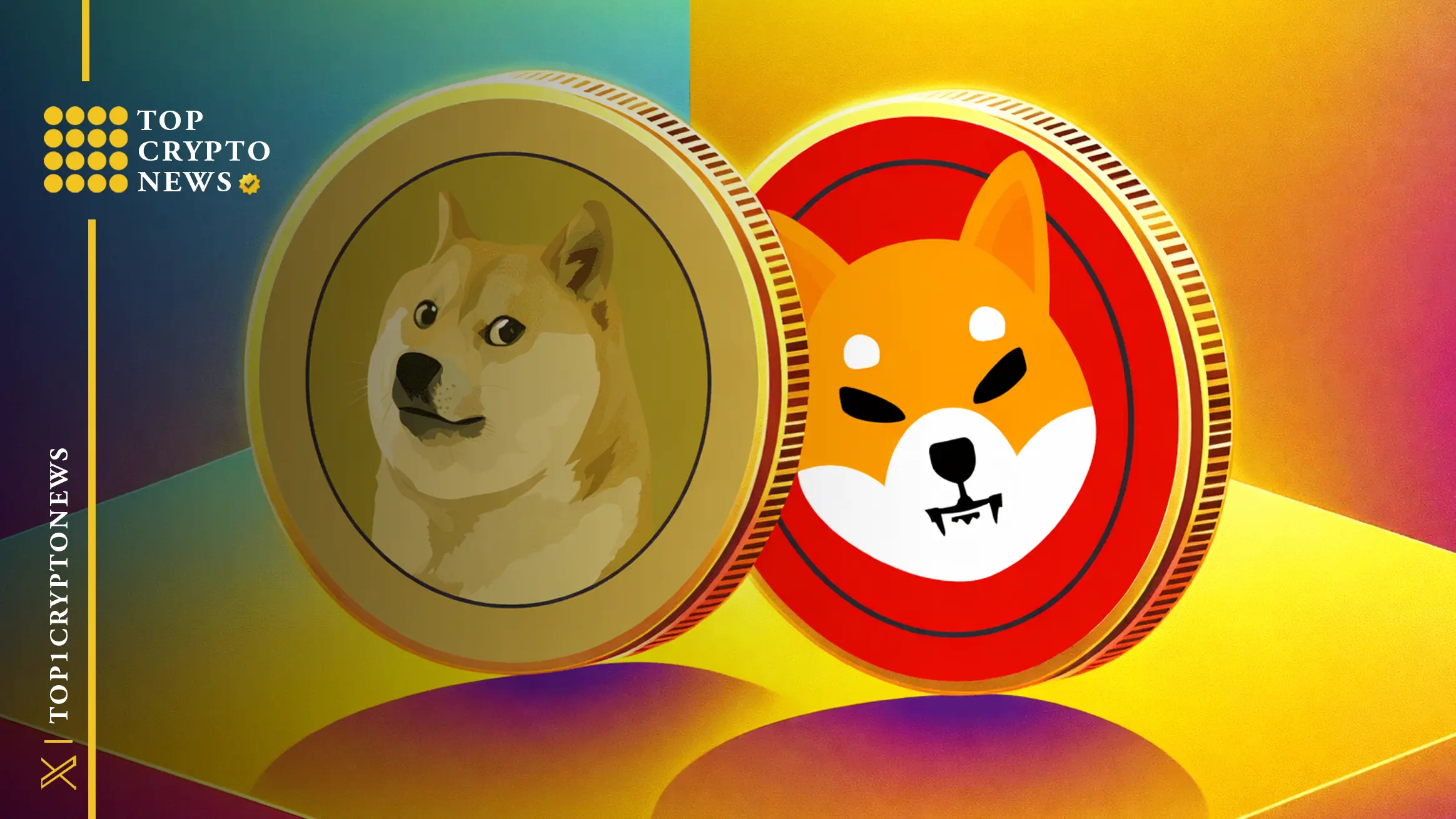

📣 Dogecoin Leaves Shiba Inu Behind in Spot ETF Race After SEC Approval

Dogecoin pulls ahead of Shiba Inu after its spot ETF gains SEC approval and begins trading, highlighting a growing gap in meme coin ETFs.

🔸 Dogecoin Secures First SEC-Approved Meme Coin ETF

Dogecoin strengthened its position after a spot ETF tied to the token received approval from the U.S. Securities and Exchange Commission. Earlier this week, the 21Shares Dogecoin ETF began trading on Nasdaq under the ticker TDOG, according to regulatory filings. The approval makes Dogecoin the first and only meme coin with a standalone

Dogecoin pulls ahead of Shiba Inu after its spot ETF gains SEC approval and begins trading, highlighting a growing gap in meme coin ETFs.

🔸 Dogecoin Secures First SEC-Approved Meme Coin ETF

Dogecoin strengthened its position after a spot ETF tied to the token received approval from the U.S. Securities and Exchange Commission. Earlier this week, the 21Shares Dogecoin ETF began trading on Nasdaq under the ticker TDOG, according to regulatory filings. The approval makes Dogecoin the first and only meme coin with a standalone

- Reward

- like

- Comment

- Repost

- Share

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$2.77K

Create My Token

#NextFedChairPredictions

The Federal Reserve is at a crossroads. Jerome Powell’s term ends in May 2026, and the question of who will lead the U.S. central bank next is no longer a matter of speculation it is a question that will determine the trajectory of global markets, interest rates, and economic confidence for years. The next Fed Chair will face a volatile economic environment, with inflation still above target, market expectations of rate cuts, geopolitical uncertainty, and mounting political pressure. This is not a routine succession; this is a defining moment for monetary policy in t

The Federal Reserve is at a crossroads. Jerome Powell’s term ends in May 2026, and the question of who will lead the U.S. central bank next is no longer a matter of speculation it is a question that will determine the trajectory of global markets, interest rates, and economic confidence for years. The next Fed Chair will face a volatile economic environment, with inflation still above target, market expectations of rate cuts, geopolitical uncertainty, and mounting political pressure. This is not a routine succession; this is a defining moment for monetary policy in t

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

📊 SOL/USDT Daily K Analysis - 【Weak Rebound, Continuing Bearishness】

1. Trend Structure and Moving Average Patterns

The price has been declining unilaterally from the previous high of 205.25 USDT, finding support at 116.78 USDT and entering a correction phase. Currently, the price has dipped to the 127.01 USDT level. The short-term MA5 and MA10 are showing a death cross pattern, with the price breaking below short-term moving averages, indicating that short-term bearish momentum is temporarily dominant; medium- and long-term moving averages (MA20, MA30, MA50, MA100) remain in a bearish arrang

1. Trend Structure and Moving Average Patterns

The price has been declining unilaterally from the previous high of 205.25 USDT, finding support at 116.78 USDT and entering a correction phase. Currently, the price has dipped to the 127.01 USDT level. The short-term MA5 and MA10 are showing a death cross pattern, with the price breaking below short-term moving averages, indicating that short-term bearish momentum is temporarily dominant; medium- and long-term moving averages (MA20, MA30, MA50, MA100) remain in a bearish arrang

SOL-0.52%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 5

- Repost

- Share

CaiDi :

:

Keep funding and keep going.View More

#TrumpWithdrawsEUTariffThreats Trump Withdraws EU Tariff Threats, Markets React with Relief

The decision by former US President Donald Trump to withdraw tariff threats against the European Union has injected a wave of relief into global financial markets. After weeks of heightened uncertainty surrounding potential trade escalation, this move signals a temporary easing of transatlantic trade tensions. Investors interpreted the announcement as a step toward stabilizing global trade flows at a time when markets are already dealing with slowing growth and geopolitical risks.

Background of the Tari

The decision by former US President Donald Trump to withdraw tariff threats against the European Union has injected a wave of relief into global financial markets. After weeks of heightened uncertainty surrounding potential trade escalation, this move signals a temporary easing of transatlantic trade tensions. Investors interpreted the announcement as a step toward stabilizing global trade flows at a time when markets are already dealing with slowing growth and geopolitical risks.

Background of the Tari

- Reward

- 4

- 5

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

🌈 #GateLiveStreamingInspiration - Jan. 25

Go live with the following topics now to receive extra official support and promotional exposure!

🔹 Coinbase CEO at Davos: banks now see crypto as a top priority, with tokenization in focus

🔹 Meme sector surges, market cap briefly up 80% in 24 hours

🔹 Whale scoops PENGUIN with 20,575 SOL, pushing market cap above $130M

🔹 Crypto Fear Index stays at 25, market remains in extreme fear

🔹 Key crypto market structure hearing coming next week

🔹 Large Bitcoin whale wallets add over 100,000 BTC

🔹 Tax policy criticized for limiting Bitcoin’s use as a pay

Go live with the following topics now to receive extra official support and promotional exposure!

🔹 Coinbase CEO at Davos: banks now see crypto as a top priority, with tokenization in focus

🔹 Meme sector surges, market cap briefly up 80% in 24 hours

🔹 Whale scoops PENGUIN with 20,575 SOL, pushing market cap above $130M

🔹 Crypto Fear Index stays at 25, market remains in extreme fear

🔹 Key crypto market structure hearing coming next week

🔹 Large Bitcoin whale wallets add over 100,000 BTC

🔹 Tax policy criticized for limiting Bitcoin’s use as a pay

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊#IranTradeSanctions Global markets are reacting to renewed geopolitical pressure after former U.S. President Donald Trump announced a 25% tariff on countries trading with Iran. While headlines highlight uncertainty, experienced investors know that volatility often creates opportunity — if approached strategically.

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More58.62K Popularity

34.31K Popularity

28.5K Popularity

10.3K Popularity

21.9K Popularity

News

View MoreRootData: EIGEN will unlock tokens worth approximately $12.91 million in one week

28 m

RootData: BEAT will unlock tokens worth approximately $6.02 million in one week.

28 m

Overview of popular cryptocurrencies on January 25, 2026, with the top three in popularity being: PENGUIN, FIGHT, ENSO

28 m

RootData: ZETA will unlock tokens worth approximately $3.19 million in one week

28 m

Brazil Central Bank: Banks and brokerages must hire independent third-party compliance certification to conduct cryptocurrency business

29 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889