Token lain di Jupiter: JUPSOL dan wSOL

JUPSOL dan wSOL adalah token penting dalam ekosistem Jupiter, meningkatkan likuiditas dan utilitas untuk SOL dalam keuangan terdesentralisasi (DeFi). JUPSOL mewakili SOL yang dipatok likuid, memungkinkan pengguna untuk mendapatkan imbal hasil staking sambil tetap dapat menggunakan aset mereka dalam perdagangan, peminjaman, dan penyediaan likuiditas. Hal ini meningkatkan efisiensi modal dan desentralisasi dalam jaringan validator Solana. wSOL mengstandarisasi SOL untuk kompatibilitas dengan protokol DeFi, memastikan integrasi yang mulus dengan kontrak pintar, pertukaran terdesentralisasi (DEXs), dan platform peminjaman.

JupSOL

JUPSOL adalah token staking likuid yang mewakili SOL yang dipertaruhkan dalam ekosistem Jupiter. Alih-alih mengunci SOL dalam kontrak staking di mana menjadi tidak likuid, JUPSOL memungkinkan pengguna untuk terus menggunakan aset yang dipertaruhkan mereka untuk perdagangan, peminjaman, dan penyediaan likuiditas. Ini memungkinkan pengguna untuk memaksimalkan efisiensi modal sambil tetap mendapatkan imbalan staking.

Penerbitan JUPSOL dirancang untuk terintegrasi secara mulus dengan agregasi pertukaran terdesentralisasi (DEX) Jupiter dan kolam likuiditas. Pengguna yang melakukan staking SOL melalui Jupiter menerima JUPSOL sebagai imbalan, yang dapat diperdagangkan secara bebas atau digunakan sebagai agunan dalam aplikasi DeFi. Nilai JUPSOL tetap terikat pada SOL, menyesuaikan secara dinamis untuk mencerminkan hadiah staking yang terakumulasi dari waktu ke waktu.

JUPSOL meningkatkan likuiditas di seluruh ekosistem Solana DeFi dengan memungkinkan aset yang dipatok untuk digunakan dalam pasangan perdagangan dan protokol peminjaman. Hal ini meningkatkan kedalaman kolam likuiditas sambil memastikan bahwa pengguna tetap memiliki akses ke dana yang dipatok. Selain itu, mekanisme routing Jupiter mengoptimalkan pertukaran JUPSOL dengan mendapatkan likuiditas dari beberapa pertukaran terdesentralisasi (DEX), mengurangi slippage dan meningkatkan eksekusi harga.

Dengan mengaktifkan staking likuid, JUPSOL turut berkontribusi pada desentralisasi jaringan validator Solana. Pengguna yang melakukan staking SOL melalui Jupiter membantu mendistribusikan kekuatan staking secara lebih merata di antara validator, memperkuat keamanan dan ketahanan jaringan. Berbeda dengan staking tradisional, di mana dana dikunci untuk jangka waktu tertentu, JUPSOL memberikan fleksibilitas, memungkinkan pengguna untuk melepas staking atau menukar token mereka kapan saja.

SOL Terbungkus (wSOL)

Wrapped SOL (wSOL) adalah representasi tokenisasi dari token SOL asli Solana, dirancang untuk kompatibilitas dengan kontrak pintar berbasis Solana dan aplikasi terdesentralisasi (dApps). Berbeda dengan SOL asli, yang digunakan untuk biaya transaksi dan operasi jaringan, wSOL berfungsi sebagai aset mirip ERC-20 dalam blockchain Solana, memungkinkan integrasi yang mulus dengan protokol DeFi.

Saat pengguna membungkus SOL, mereka menukar token asli mereka dengan wSOL dalam rasio 1:1. Proses konversi ini memastikan bahwa wSOL tetap memiliki nilai yang sama dengan SOL sambil memudahkan penggunaannya dalam aplikasi keuangan terdesentralisasi. Tujuan utama wSOL adalah untuk menstandarisasi SOL untuk digunakan dalam kontrak pintar, di mana format token tetap diperlukan untuk interoperabilitas.

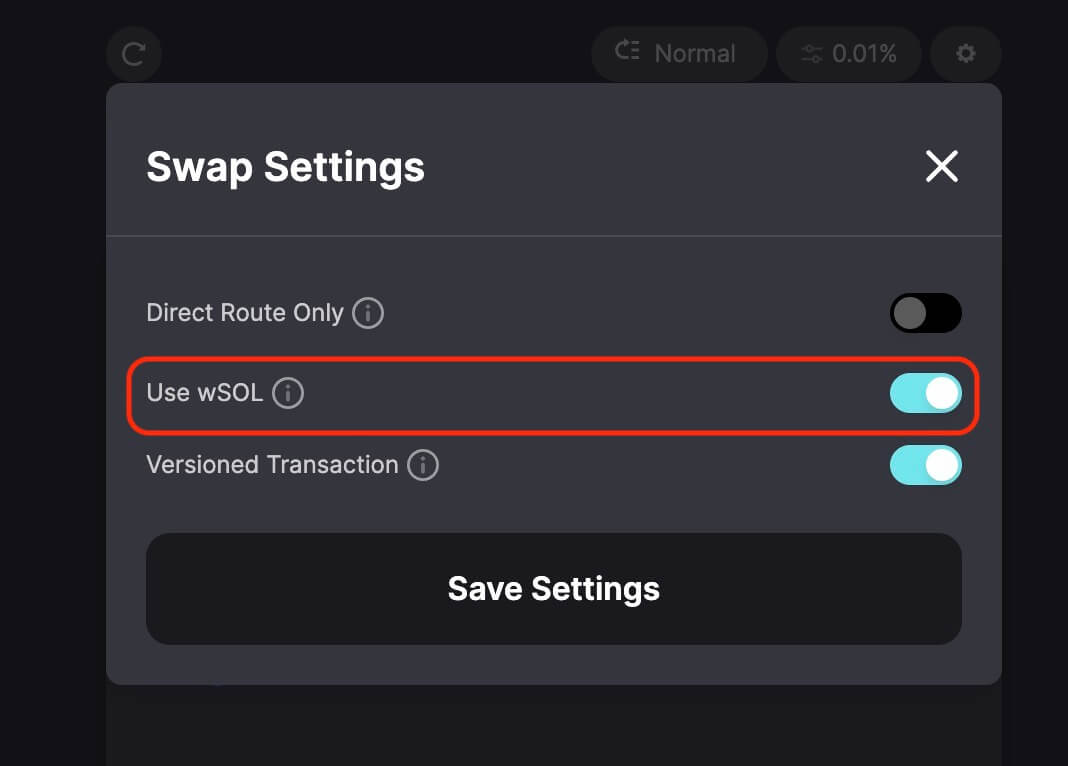

Jupiter menggunakan wSOL di seluruh ekosistem perdagangannya, memastikan pengguna dapat mengakses kolam likuiditas yang dalam dan routing yang efisien untuk aset yang dibungkus. Banyak bursa terdesentralisasi dan pembuat pasar otomatis (AMM) memerlukan format token seragam untuk memfasilitasi perdagangan, dan wSOL berfungsi sebagai jembatan yang memungkinkan SOL ditukar dengan lancar di berbagai platform.

Dan, wSOL banyak digunakan dalam protokol peminjaman dan pinjaman. Platform-platform yang mendukung wSOL memungkinkan pengguna untuk mendepositkan aset terbungkus mereka sebagai jaminan, meminjam dari aset tersebut, atau mendapatkan bunga melalui kolam staking. Hal ini meningkatkan kegunaan SOL dengan memungkinkan pengguna untuk terlibat dalam strategi DeFi tanpa membuka aset token mereka.

Sorotan

- JUPSOL Memungkinkan Staking Likuid - Pengguna dapat melakukan staking SOL dan menerima JUPSOL, yang mempertahankan nilainya sambil memungkinkan partisipasi dalam aktivitas DeFi seperti perdagangan dan peminjaman.

- Efisiensi Modal dan Optimisasi Likuiditas – JUPSOL memungkinkan pengguna untuk menjaga likuiditas sambil mendapatkan imbalan staking, meningkatkan efisiensi pasar secara keseluruhan.

- wSOL Standarisasi SOL untuk DeFi - Wrapped SOL memastikan bahwa SOL kompatibel dengan kontrak pintar dan aplikasi DeFi, memungkinkan transaksi tanpa hambatan di seluruh DEX dan platform peminjaman.

- Utilitas Perdagangan dan Peminjaman – Baik JUPSOL maupun wSOL dapat digunakan dalam kolam likuiditas, protokol peminjaman, dan mekanisme tata kelola, memperluas peran mereka di luar penyimpanan aset yang sederhana.

- Interoperabilitas dan Kedalaman Pasar – Jupiter menyediakan likuiditas untuk JUPSOL dan wSOL di berbagai platform terdesentralisasi, meminimalkan slippage dan meningkatkan eksekusi perdagangan.