Proyecto y economía de Token de Ethena

Este módulo se centra en Ethena como un protocolo de dólar sintético, explicando cómo utiliza la tecnología blockchain para mantener una moneda estable y descentralizada, USDe. Se discute la tokenómica de ENA (token nativo de Ethena), su papel en la gobernanza y staking, y cómo soporta reducciones en las tarifas de transacción y alinea los incentivos de los titulares de participaciones. El módulo desarrolla estrategias tecnológicas como el delta hedging que ayudan a mantener la paridad con el dólar de USDe.

Descripción general de Ethena como protocolo de dólar sintético

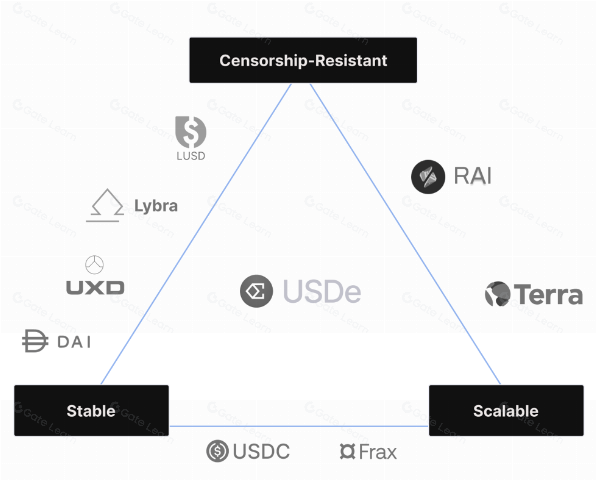

Ethena opera como un protocolo de dólar sintético diseñado para proporcionar una solución financiera estable, escalable y descentralizada. A diferencia de las stablecoins tradicionales que a menudo están vinculadas a monedas fiduciarias a través de colaterales mantenidos en cuentas bancarias o respaldadas por otros activos criptográficos, Ethena introduce un enfoque novedoso al aprovechar la tecnología blockchain inherente a Ethereum. Este enfoque posiciona a USDe, el dólar sintético de Ethena, como un componente crítico dentro del ecosistema de finanzas descentralizadas (DeFi), sirviendo como un medio de intercambio estable pero flexible y como reserva de valor. La base de la estabilidad y funcionalidad de USDe es su naturaleza sintética, lograda a través de sofisticadas técnicas de ingeniería financiera que incluyen el delta hedging. Así es como funciona:

Colateralización:Los usuarios depositan Ethereum con participación (stETH) en el protocolo Ethena. Este stETH sirve como garantía principal. A diferencia de la garantía tradicional, que respalda directamente la creación de stablecoins con activos tangibles, Ethena utiliza estos activos criptográficos como parte dinámica de su mecanismo de estabilidad.

Cobertura delta:Para mantener su anclaje al dólar y gestionar la volatilidad inherente a su garantía (stETH), Ethena emplea estrategias de cobertura delta. Esto implica abrir posiciones cortas en mercados de derivados equivalentes al valor de stETH depositado. Esta estrategia ayuda a neutralizar el riesgo financiero planteado por las fluctuaciones en el precio de Ethereum, asegurando que el valor de USDe permanezca estable en relación con el dólar estadounidense.

Acuñación y Redención:Los usuarios emiten USDe depositando garantías, y el mismo mecanismo funciona en sentido contrario para la redención. Cuando se redime USDe, la cantidad correspondiente de stETH se devuelve al usuario y las posiciones derivadas se cierran, manteniendo el equilibrio del protocolo.

Ventajas del Dólar Sintético

El dólar sintético de Ethena ofrece varias ventajas sobre las monedas estables tradicionales:

Descentralización: Al no depender de los sistemas financieros tradicionales para sus operaciones, USDe mejora la resistencia a la censura y la eficiencia de capital del protocolo.

Escalabilidad: El uso de blockchain y contratos inteligentes permite a Ethena escalar de manera eficiente, manejando grandes volúmenes de transacciones sin comprometer la velocidad o la seguridad.

Innovación Financiera:La introducción de instrumentos como el 'Internet Bond' permite a los usuarios participar en la economía cripto mientras obtienen rendimientos, democratizando así el acceso a oportunidades de inversión dentro de DeFi.

Generación de rendimiento

Una de las características distintivas de USDe es su capacidad para generar rendimiento para sus titulares. Este rendimiento proviene de dos fuentes principales:

Recompensas por participación: Dado que el colateral implica ETH con participación, las recompensas por participación contribuyen al rendimiento.

Operaciones del Mercado de Derivados:Las tasas de financiamiento y los spreads de base de las operaciones de Ethena en los mercados de derivados proporcionan un rendimiento adicional, lo que hace que USDe sea una opción atractiva para los inversores que buscan rendimientos en sus tenencias.

Principales características de Ethena

Ethena se destaca en el panorama DeFi al ofrecer un conjunto de servicios financieros descentralizados que promueven un ecosistema financiero más inclusivo y accesible. Estos servicios aprovechan la tecnología blockchain para garantizar transparencia, seguridad y eficiencia. Las ofertas clave incluyen:

Plataforma de Inversión: Ethena proporciona una plataforma sólida donde los usuarios pueden participar en varias oportunidades de inversión dentro del espacio criptográfico. Esta plataforma aprovecha algoritmos avanzados y contratos inteligentes para ofrecer asesoramiento de inversión personalizado y gestión automatizada de activos digitales.

Intercambio descentralizado (DEX):Una característica principal de Ethena es su intercambio descentralizado, que permite la negociación segura y eficiente de activos digitales sin necesidad de intermediarios tradicionales. Este DEX admite una variedad de pares de negociación e integra avanzadas piscinas de liquidez para garantizar una ejecución comercial óptima.

Gestión de activos: Ethena ofrece herramientas para la gestión integral de activos, lo que permite a los usuarios hacer un seguimiento, analizar y optimizar sus carteras de activos digitales directamente a través de la plataforma. Este servicio se beneficia de la naturaleza descentralizada de la cadena de bloques, garantizando que los usuarios mantengan el control total sobre sus activos.

Dólar Sintético - USDe

En el centro de las ofertas DeFi de Ethena se encuentra USDe, un dólar sintético que proporciona estabilidad y liquidez dentro del ecosistema. Está diseñado para estar completamente colateralizado por activos de criptomonedas y se estabiliza utilizando técnicas financieras sofisticadas como cobertura delta. USDe sirve como puente entre las finanzas tradicionales y DeFi al ofrecer una alternativa estable, escalable y descentralizada al dólar.

Staking y Yield Farming

Ethena integra mecanismos de participación y agricultura de rendimiento que recompensan a los usuarios por participar en la red y asegurar el protocolo. Los usuarios pueden apostar sus tokens ENA u otros activos compatibles para ganar recompensas. Además, la agricultura de rendimiento en Ethena permite a los usuarios obtener ingresos pasivos a través de la provisión de liquidez, aprovechando los beneficios duales de generación de ingresos y aumento de liquidez dentro de la plataforma.

Gobernanza

La gobernanza es un componente crítico del marco descentralizado de Ethena. La plataforma emplea una estructura DAO (Organización Autónoma Descentralizada), donde los titulares de tokens ENA pueden votar sobre decisiones clave del protocolo, como actualizaciones del sistema, ajustes de la economía de tokens e implementaciones de nuevas funciones. Esto asegura que la plataforma siga siendo receptiva a su comunidad y adaptable al cambiante panorama de DeFi.

Seguridad y Cumplimiento

Ethena pone un fuerte énfasis en la seguridad y el cumplimiento normativo para proteger a los usuarios y sus activos. La plataforma incorpora medidas de seguridad de última generación, como la autenticación multifactor, el cifrado y las auditorías de seguridad continuas. Además, Ethena se adhiere a los estándares regulatorios globales para garantizar que sus operaciones se alineen con los requisitos legales, mejorando la confianza del usuario y la estabilidad de la plataforma.

Interoperabilidad e integración

Comprendiendo la importancia de la conectividad del ecosistema, Ethena está construido para ser interoperable con varias otras plataformas y protocolos blockchain. Esto facilita transferencias de activos sin problemas, mejora la liquidez y permite a Ethena integrar una amplia gama de productos y servicios DeFi, enriqueciendo aún más su ecosistema.

Introducción a USDe y su funcionalidad dentro del ecosistema de Ethena

USDe se erige como el producto insignia de Ethena, un dólar sintético diseñado para proporcionar estabilidad y liquidez dentro del ecosistema de finanzas descentralizadas (DeFi). Como dólar sintético, USDe no está directamente vinculado a ninguna moneda fiduciaria a través de medios tradicionales, sino que está respaldado por activos criptográficos y estabilizado a través de mecanismos financieros avanzados. USDe opera como piedra angular del ecosistema Ethena con varias funcionalidades clave:

Medio de intercambio: USDe sirve como un medio estable de intercambio dentro del ecosistema de Ethena, lo que permite a los usuarios realizar transacciones sin la típica volatilidad asociada con otras criptomonedas. Esta estabilidad lo hace ideal para transacciones diarias y operaciones financieras dentro de la plataforma.

Reserva de Valor:Debido a su estabilidad, USDe funciona de manera efectiva como reserva de valor. Los usuarios pueden mantener USDe para preservar el capital, reduciendo la exposición a las fluctuaciones comunes en los mercados de criptomonedas.

Unidad de cuenta:En el ecosistema de Ethena, USDe proporciona una medida consistente de valor, facilitando una fijación de precios más clara y fiable para bienes, servicios e inversiones.

La estabilidad de USDe se mantiene a través de una combinación de colateralización y estrategias financieras:

Colateralización

Los usuarios crean USDe depositando Ethereum con staking (stETH) y otros, que sirven como garantía. Este proceso vincula el valor de USDe al valor subyacente de stETH garantizado con la seguridad y valor de la red Ethereum.

Cobertura Delta

Ethena emplea estrategias de cobertura delta para gestionar la volatilidad de precios del colateral. Esto implica tomar posiciones opuestas en mercados de derivados para neutralizar el riesgo asociado con las fluctuaciones de precios en Ethereum. Por ejemplo, si el valor de stETH cae, las ganancias de las posiciones cortas pueden compensar la reducción del valor del colateral, manteniendo la estabilidad de USDe.

Generación de rendimiento

Además de sus funciones de estabilidad, USDe también genera rendimiento para sus titulares. Esto se logra a través de:

Recompensas por staking:Al apostar su USDe, los usuarios pueden obtener rendimientos derivados del staking del colateral subyacente de Ethereum.

Participación en Actividades DeFi:USDe se puede utilizar en varios protocolos DeFi para préstamos, endeudamiento y provisión de liquidez, donde los usuarios pueden ganar rendimientos adicionales según su actividad.

Gobernanza y Capacidad de Actualización

Los parámetros y funcionalidades de USDe pueden ser actualizados y gobernados por la comunidad a través del modelo de gobernanza de tokens ENA. Esto incluye decisiones sobre tipos de garantías, mecanismos de estabilidad e integraciones con otros protocolos.

Integración e interoperabilidad

USDe está diseñado para ser altamente interoperable dentro del espacio DeFi. Puede integrarse con otros protocolos y plataformas, mejorando su utilidad y permitiendo casos de uso más amplios como transacciones entre cadenas y provisión de liquidez multiplataforma.

Medidas de seguridad

Ethena prioriza la seguridad de USDe a través de auditorías regulares, desarrollo seguro de contratos inteligentes y colaboraciones con las principales firmas de seguridad. Este compromiso asegura que USDe permanezca a salvo de vulnerabilidades y exploits, reforzando la confianza del usuario.

El papel de USDe dentro del ecosistema de Ethena ejemplifica la convergencia innovadora de los mecanismos tradicionales de estabilidad financiera con la flexibilidad y el potencial de DeFi. Al proporcionar un dólar sintético estable, seguro y multifuncional, Ethena no solo mejora la usabilidad de las criptomonedas en transacciones cotidianas, sino que también empuja los límites de lo que la finanza descentralizada puede lograr.

Cómo funciona el token ENA

El token ENA es el token de gobernanza y utilidad en el núcleo del ecosistema de Ethena. Está diseñado para empoderar a los usuarios proporcionándoles voz en el desarrollo de la plataforma y la capacidad de participar activamente en su economía.

Utilidad del token ENA

Los titulares de tokens ENA tienen derecho a participar en la gobernanza de la plataforma Ethena. Esto incluye votar en propuestas relacionadas con cambios en el protocolo, actualizaciones en el sistema, asignación de fondos del tesoro de la comunidad y decisiones sobre nuevas funciones o asociaciones. El modelo de gobernanza descentralizada garantiza que Ethena siga siendo un proyecto impulsado por la comunidad donde los titulares de tokens pueden dar forma al futuro de la plataforma.

Los usuarios pueden apostar sus tokens ENA para participar en la seguridad y operación de la plataforma. Apostar ENA permite a los usuarios ganar recompensas mientras contribuyen a la estabilidad y gobernanza de la plataforma. Este mecanismo de apuesta es fundamental para mantener la integridad y eficiencia de la red Ethena.

El token ENA alinea los incentivos de varios interesados dentro del ecosistema de Ethena. Los desarrolladores, usuarios e inversores pueden ganar ENA a través de sus contribuciones a la plataforma, ya sea desarrollando nuevas características, proporcionando liquidez o participando en la gobernanza. Esta estructura de incentivos fomenta la participación continua y la inversión en el crecimiento de la plataforma.

Rol en la gobernanza

La gobernanza es un componente clave de la utilidad del token ENA. Los titulares de tokens pueden proponer acciones de gobernanza, que pueden incluir:

- Ajustes a los parámetros del protocolo (por ejemplo, tasas de comisión de transacción, recompensas por participación en la red).

- Actualizaciones en el protocolo Ethena y su infraestructura.

- Asignaciones del fondo comunitario para apoyar proyectos o iniciativas de marketing.

- Socios e integración con otros proyectos y plataformas DeFi.

Mecanismo de participación

El staking de ENA no solo asegura la red, sino que también proporciona un mecanismo para que los usuarios reciban una parte del éxito de la plataforma. Las recompensas por apostar generalmente se derivan de las tarifas de transacción de la plataforma, tokens ENA adicionales liberados a través de mecanismos inflacionarios u otros ingresos generados por las actividades de la plataforma.

- El staking contribuye a la seguridad y estabilidad de la red, ya que los tokens apostados se utilizan para validar transacciones y mantener la integridad de la plataforma.

- Las recompensas se distribuyen a los apostadores como incentivo por su participación e inversión en la red, generalmente basadas en la cantidad de ENA apostada y la duración del apostamiento.

La integración del token ENA en el ecosistema de Ethena como token de gobernanza y utilidad demuestra un compromiso con la descentralización y la participación comunitaria. Al empoderar a los usuarios para guiar la evolución de la plataforma y participar en sus actividades económicas, Ethena garantiza que permanezca adaptable, segura y alineada con los intereses de sus partes interesadas.