Activos Estables en Celo

En el Módulo 4, examinamos los activos estables de Celo, en particular cUSD y cEUR, y su papel en la consecución de la visión de Celo sobre la inclusión financiera. Discutiremos la creación, respaldo y significado de estas monedas estables dentro del ecosistema de Celo y el panorama más amplio de la cadena de bloques. Este módulo también destacará los beneficios y usos de los Celo Dollars y Celo Euro, enfatizando su impacto en la accesibilidad financiera global.

Introducción a los activos estables de Celo: cUSD y cEUR

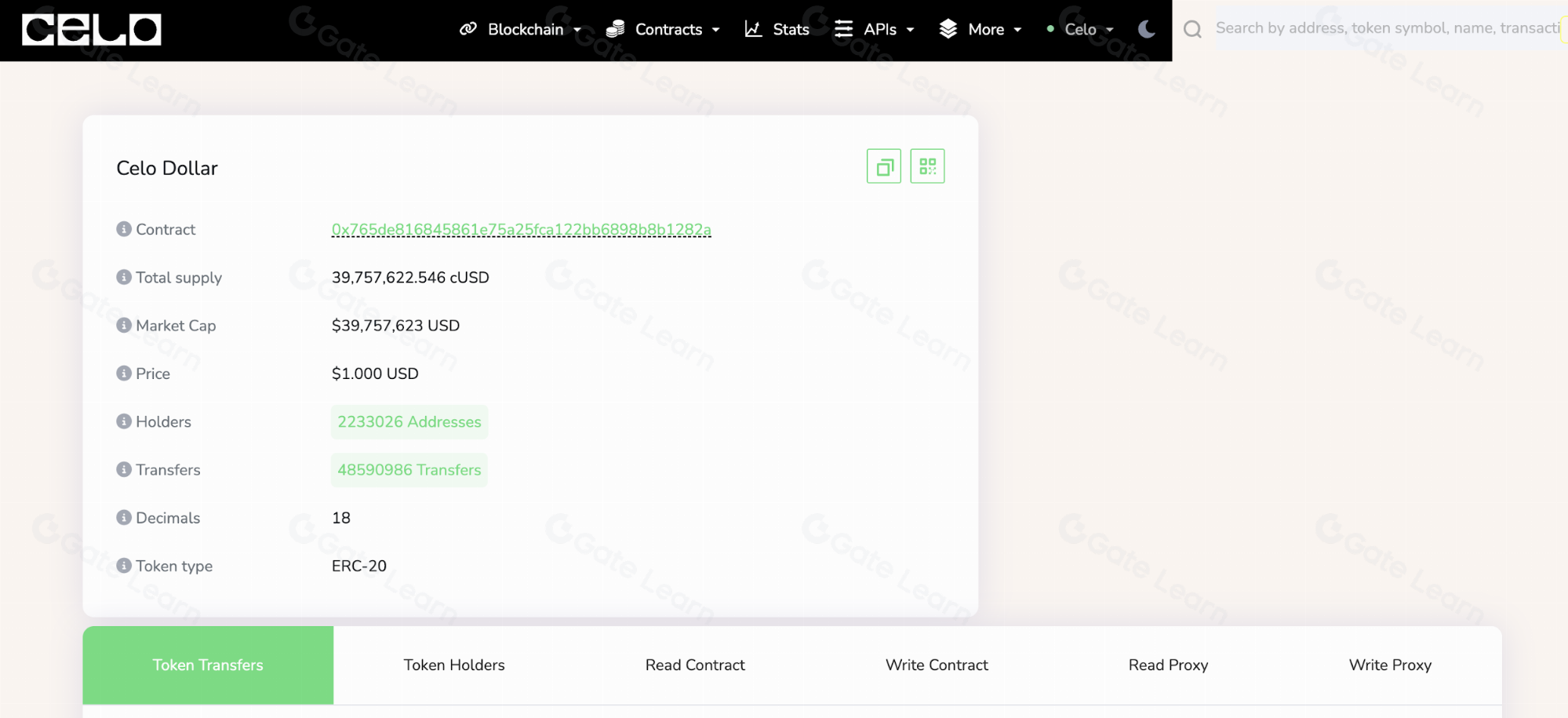

Los activos estables de Celo, incluido cUSD (Dólar Celo) y cEUR (Euro Celo), son monedas digitales ancladas al valor de sus contrapartes fiduciarias respectivas, el dólar estadounidense y el euro. Estables, estas monedas están diseñadas para combinar la eficiencia y accesibilidad de las criptomonedas con la estabilidad de las monedas tradicionales. cUSD y cEUR son fundamentales para la misión de inclusión financiera de Celo, proporcionando un medio de intercambio estable para los usuarios en todo el mundo.

cUSD y cEUR se emiten en la plataforma Celo y están respaldados por una cartera diversificada de activos criptográficos mantenidos en la Reserva Celo. Este respaldo asegura que cada stablecoin mantenga su anclaje a su moneda fiduciaria, proporcionando una tienda de valor confiable. Los usuarios pueden realizar transacciones con estas stablecoins utilizando las aplicaciones de billetera móvil de Celo, lo que hace que los pagos digitales sean accesibles incluso en regiones con infraestructura bancaria limitada.

La creación y mantenimiento de cUSD y cEUR aprovechan el mecanismo de estabilidad Mento de Celo. Este protocolo on-chain ajusta el suministro de stablecoins en respuesta a los cambios en la demanda, asegurando que su valor se mantenga consistente con las monedas fiduciarias que siguen. Los usuarios pueden convertir directamente entre CELO y las stablecoins de Celo a través del intercambio de Mento, facilitando la liquidez y estabilidad.

El enfoque de Celo en la accesibilidad móvil significa que cUSD y cEUR están optimizados para su uso en transacciones móviles. Este enfoque aborda las necesidades de las poblaciones no bancarizadas y subbancarizadas al proporcionar un medio simple, seguro y accesible de participar en transacciones digitales. Los tokens estables pueden enviarse a cualquier persona con un teléfono móvil, lo que los convierte en una herramienta ideal para remesas y microtransacciones.

La gobernanza de cUSD y cEUR, al igual que otros aspectos de la plataforma Celo, es descentralizada. Los poseedores de tokens CELO pueden participar en decisiones de gobernanza que afectan a las stablecoins, incluyendo propuestas para agregar nuevos activos estables o ajustar los parámetros del mecanismo de estabilidad Mento. Este enfoque inclusivo garantiza que el desarrollo de los activos estables de Celo se alinee con las necesidades e intereses de la comunidad.

La introducción de cUSD y cEUR representa un paso significativo hacia el objetivo de Celo de crear un sistema financiero inclusivo. Al proporcionar monedas digitales estables que son fáciles de usar y accesibles en dispositivos móviles, Celo está ampliando el alcance de los servicios financieros a poblaciones que tradicionalmente han sido excluidas del sistema financiero global.

El papel de la Reserva de Celo en la Estabilización de Activos

La Reserva de Celo es un componente crítico del ecosistema, proporcionando el respaldo necesario para garantizar la estabilidad de los activos estables de Celo, cUSD y cEUR. La Reserva tiene una cartera diversificada de criptomonedas, incluido CELO, para respaldar las stablecoins. Esta garantía ayuda a mantener la paridad de cUSD y cEUR con sus respectivas monedas fiduciarias, garantizando su estabilidad y confiabilidad como medios de intercambio.

La composición de la Reserva se gestiona dinámicamente para responder a las condiciones del mercado y mantener el valor de los activos estables. La comunidad de Celo, a través de propuestas de gobernanza y votos, puede ajustar las tenencias de la Reserva, asegurando que permanezca sólida y capaz de respaldar el valor de las stablecoins. Esta adaptabilidad es clave para el papel de la Reserva en la estabilización de activos.

Además de respaldar los activos estables de Celo, la Reserva juega un papel en el mecanismo de estabilidad de Mento. Cuando la demanda de cUSD o cEUR cambia, la Reserva interactúa con el protocolo de Mento para ajustar la oferta de stablecoins, manteniendo su valor alineado con las monedas fiduciarias que siguen. Este proceso implica los activos de la Reserva, incluido CELO, para garantizar que los anclajes de las stablecoins permanezcan consistentes.

La transparencia y la gobernanza descentralizada de la Reserva Celo son fundamentales para su funcionamiento. La información sobre las tenencias y actividades de la Reserva está disponible para el público, lo que fomenta la confianza en la estabilidad de los activos estables de Celo. La participación de la comunidad en las decisiones de gobernanza relacionadas con la Reserva garantiza que opere en el mejor interés del ecosistema Celo y sus usuarios.

Beneficios y usos de Celo Dollars (cUSD) y Celo Euro (cEUR)

cUSD y cEUR ofrecen varios beneficios, principalmente su estabilidad y accesibilidad, lo que los hace adecuados para una amplia gama de actividades financieras. A diferencia de las criptomonedas tradicionales, que pueden ser muy volátiles, cUSD y cEUR proporcionan un valor estable, lo que las hace ideales para las transacciones diarias, los ahorros y las remesas. Esta estabilidad es particularmente valiosa en regiones con monedas inestables, donde cUSD y cEUR pueden ofrecer una reserva de valor más confiable.

La accesibilidad de cUSD y cEUR se ve mejorada por el enfoque móvil primero de Celo. Los usuarios pueden enviar y recibir fácilmente estas stablecoins usando solo un número de teléfono móvil, lo que reduce la barrera de entrada para los servicios financieros digitales. Esta característica es crucial para llegar a las poblaciones no bancarizadas y sub bancarizadas, brindándoles acceso a herramientas financieras que antes estaban fuera de su alcance.

cUSD y cEUR también son fundamentales en el desarrollo de aplicaciones de finanzas descentralizadas (DeFi) en la plataforma Celo. Su estabilidad permite una planificación financiera y una gestión de riesgos más predecibles para los usuarios que participan en préstamos, préstamos y otras actividades DeFi. Los desarrolladores pueden crear servicios DeFi en Celo, aprovechando cUSD y cEUR para crear productos financieros inclusivos.

Además de DeFi, cUSD y cEUR facilitan la donación benéfica y los micropagos. Las organizaciones sin ánimo de lucro pueden usar estas stablecoins para distribuir eficientemente ayuda a personas necesitadas, evitando tarifas y retrasos bancarios tradicionales. Del mismo modo, los creadores de contenido y los proveedores de servicios pueden recibir micropagos en cUSD y cEUR, abriendo nuevas fuentes de ingresos.

La adopción de cUSD y cEUR va más allá de los usuarios individuales y los desarrolladores. Las empresas y comerciantes pueden aceptar estas stablecoins como forma de pago, disfrutando de los beneficios de transacciones rápidas, seguras y de bajo costo. Esta adopción no solo amplía la utilidad de cUSD y cEUR, sino que también contribuye al crecimiento del ecosistema de Celo, impulsando una mayor innovación e inclusión financiera.

Aspectos destacados

- Los activos estables de Celo, cUSD y cEUR, son monedas digitales ancladas al dólar estadounidense y al euro, diseñadas para proporcionar estabilidad y accesibilidad para transacciones financieras.

- La Reserva de Celo, que posee una cartera diversificada de criptomonedas, respalda el valor de cUSD y cEUR, garantizando su estabilidad y fiabilidad.

- cUSD y cEUR están optimizados para el uso móvil, lo que permite transacciones sencillas e inclusión financiera para poblaciones no bancarizadas o subbancarizadas.

- Estas stablecoins admiten una variedad de aplicaciones, desde transacciones cotidianas y remesas hasta DeFi, donaciones benéficas y micropagos.

- Las empresas y comerciantes pueden adoptar cUSD y cEUR para pagos, beneficiándose de su estabilidad, bajos costos de transacción y tiempos rápidos de liquidación, contribuyendo al crecimiento del ecosistema de Celo.