Dự báo giá UDS năm 2025: Phân tích các xu hướng của thị trường và các yếu tố trọng yếu tác động đến định giá trong tương lai

Giới thiệu: Vị thế thị trường và giá trị đầu tư của UDS

Undeads Games (UDS) là một đơn vị nổi bật trong ngành GameFi, đã đạt được các thành tựu đáng kể kể từ khi ra mắt vào năm 2022. Đến năm 2025, UDS ghi nhận mức vốn hóa thị trường là 169.732.299 USD, nguồn cung lưu hành khoảng 102.143.768 token và giá giao dịch quanh mốc 1,6617 USD. UDS đóng vai trò quan trọng tại giao điểm giữa game blockchain và cơ hội kiếm tiền từ tiền mã hóa.

Bài viết này phân tích toàn diện xu hướng giá UDS từ năm 2025 đến 2030, dựa trên dữ liệu lịch sử, cung cầu thị trường, sự mở rộng hệ sinh thái và các yếu tố kinh tế vĩ mô, nhằm cung cấp dự báo giá chuyên sâu cùng chiến lược đầu tư hiệu quả dành cho các nhà đầu tư.

I. Lịch sử giá và tình hình thị trường hiện tại của UDS

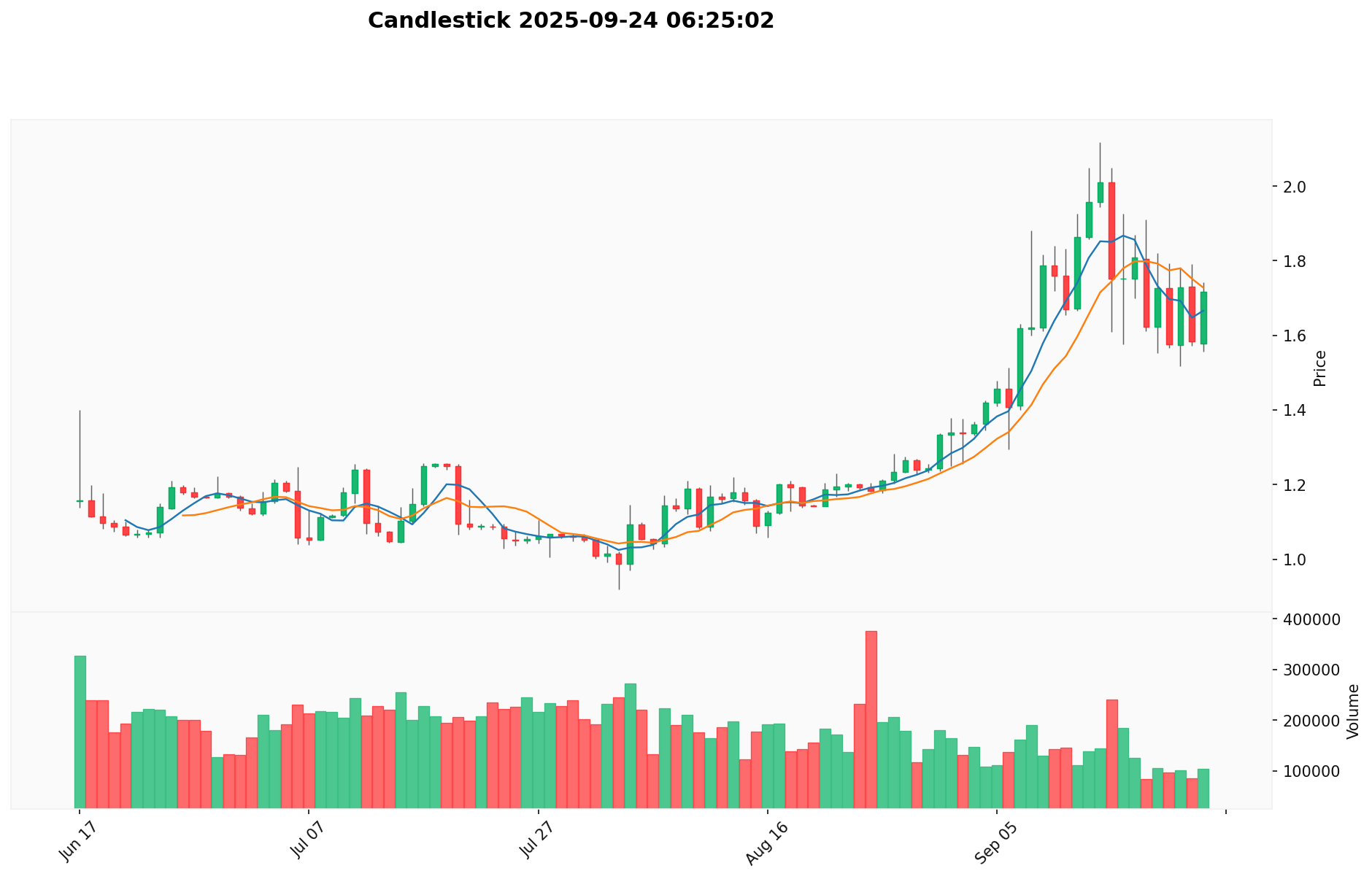

Biến động giá UDS qua các năm

- 2024: Ra mắt lần đầu, đạt đỉnh lịch sử 3,00 USD vào ngày 09 tháng 08

- 2024: Thị trường điều chỉnh, ghi nhận đáy lịch sử 0,0409 USD vào ngày 29 tháng 10

- 2025: Giai đoạn phục hồi, giá đạt mức 1,6617 USD

Tình hình giao dịch hiện tại của UDS

Hiện UDS được giao dịch ở mức 1,6617 USD, khối lượng giao dịch 24 giờ đạt 142.670,23 USD. Trong 24 giờ qua, token tăng 5,88%, phản ánh động lực tích cực ngắn hạn. Tuy nhiên, giá giảm 7,51% trong tuần gần nhất, cho thấy biến động mạnh. Mức tăng 38,99% trong 30 ngày qua xác nhận xu hướng tăng trung hạn. Vốn hóa thị trường hiện là 169.732.299 USD, đứng thứ 328 toàn thị trường tiền mã hóa. Số lượng lưu hành là 102.143.768,25 UDS trên tổng cung 250.000.000, tỷ lệ lưu hành 40,86%. Giá hiện tại thấp hơn 44,61% so với đỉnh lịch sử và cao hơn 3.963,82% so với đáy lịch sử, phản ánh tiềm năng tăng trưởng cùng độ biến động.

Xem giá UDS mới nhất tại đây

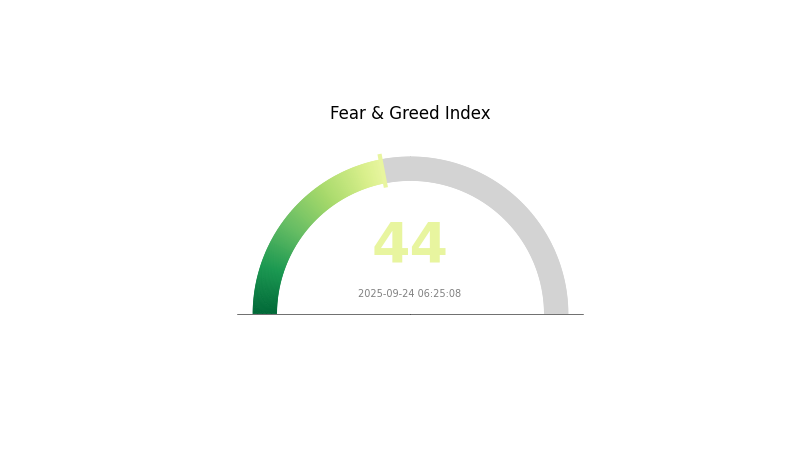

Chỉ số tâm lý thị trường UDS

Ngày 24 tháng 09 năm 2025: Chỉ số Sợ hãi & Tham lam ở mức 44 (Sợ hãi)

Xem Chỉ số Sợ hãi & Tham lam UDS hiện tại tại đây

Tâm lý thị trường tiền mã hóa hiện ở mức thận trọng với chỉ số Sợ hãi & Tham lam đạt 44. Nhà đầu tư nên nghiên cứu kỹ, xác định mức độ chịu rủi ro trước khi quyết định đầu tư. Gate.com cung cấp các công cụ hỗ trợ đầu tư trong điều kiện thị trường hiện tại.

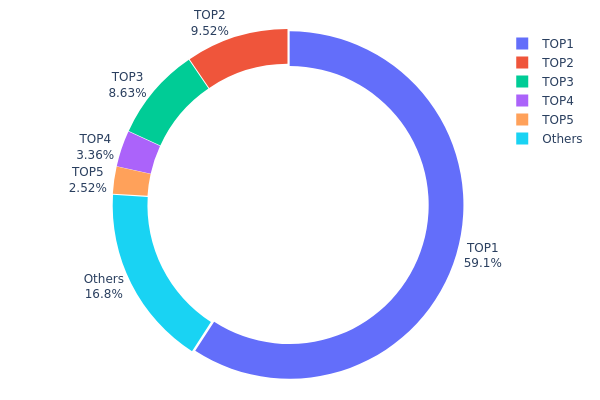

Phân bố sở hữu UDS

Dữ liệu địa chỉ sở hữu UDS cho thấy mức độ tập trung cao. Địa chỉ lớn nhất sở hữu 59,14% tổng cung, tương đương 147.856,23K token UDS. Địa chỉ lớn thứ hai và ba lần lượt sở hữu 9,52% và 8,63%, tiếp tục cho thấy sự tập trung nguồn lực vào các nhà đầu tư lớn.

Cơ cấu phân bố này đặt ra vấn đề về khả năng thao túng thị trường và biến động giá. Khoảng 80% token thuộc về 5 địa chỉ lớn, khiến thị trường UDS có thể biến động mạnh khi các holder lớn thay đổi vị thế. Tính phi tập trung của dự án bị hạn chế khi quyền kiểm soát tập trung vào số ít địa chỉ.

Phân bổ hiện tại cho thấy thị trường UDS còn non trẻ, lượng token luân chuyển chưa rộng rãi. Sự tập trung cao ảnh hưởng đến thanh khoản và có thể hạn chế sự tham gia của nhà đầu tư mới. Việc theo dõi sự thay đổi trong phân bổ này giúp đánh giá mức độ ổn định và mức độ chấp nhận dài hạn của token.

Xem phân bổ sở hữu UDS mới nhất tại đây

| Top | Địa chỉ | Số lượng nắm giữ | Tỷ lệ (%) |

|---|---|---|---|

| 1 | 0xd321...e493a2 | 147.856,23K | 59,14% |

| 2 | 0xb705...12964e | 23.800,00K | 9,52% |

| 3 | 0x6f2a...125b6d | 21.580,08K | 8,63% |

| 4 | 0x0642...ccbf51 | 8.409,47K | 3,36% |

| 5 | 0x65a6...8181a1 | 6.302,70K | 2,52% |

| - | Khác | 42.051,51K | 16,83% |

II. Các yếu tố chính tác động đến giá UDS trong tương lai

Kinh tế vĩ mô

-

Chính sách tiền tệ: Lãi suất do Cục Dự trữ Liên bang Mỹ quyết định có ảnh hưởng lớn đến giá UDS. Nếu Fed chậm giảm lãi suất hoặc chuyển hướng thắt chặt, giá UDS có thể được hỗ trợ thêm.

-

Khả năng phòng ngừa lạm phát: Lạm phát tăng hoặc lãi suất thực âm nâng cao giá trị UDS như tài sản bảo vệ trước lạm phát.

-

Yếu tố địa chính trị: Bầu cử Tổng thống Mỹ, căng thẳng thương mại Mỹ-Trung và các xung đột toàn cầu có thể ảnh hưởng đến tâm lý thị trường và giá UDS.

III. Dự báo giá UDS giai đoạn 2025-2030

Triển vọng năm 2025

- Dự báo thận trọng: 1,56 - 1,65 USD

- Dự báo trung lập: 1,65 - 1,90 USD

- Dự báo lạc quan: 1,90 - 2,20 USD (điều kiện tâm lý thị trường tích cực)

Triển vọng 2027-2028

- Giai đoạn thị trường: Dự kiến tăng trưởng

- Dự báo biên độ giá:

- 2027: 1,20 - 2,72 USD

- 2028: 2,40 - 3,12 USD

- Động lực chính: Gia tăng mức độ sử dụng, cải tiến công nghệ

Triển vọng dài hạn 2029-2030

- Kịch bản cơ sở: 2,80 - 3,25 USD (tăng trưởng ổn định)

- Kịch bản lạc quan: 3,25 - 3,65 USD (thị trường tăng mạnh)

- Kịch bản đổi mới: 3,65 - 4,11 USD (đổi mới công nghệ)

- 31 tháng 12 năm 2030: UDS 3,24 USD (tăng 94% so với năm 2025)

| Năm | Giá dự báo cao nhất | Giá dự báo trung bình | Giá dự báo thấp nhất | Tỷ lệ tăng (%) |

|---|---|---|---|---|

| 2025 | 2,19636 | 1,6514 | 1,56883 | 0 |

| 2026 | 2,77039 | 1,92388 | 1,42367 | 15 |

| 2027 | 2,72268 | 2,34713 | 1,19704 | 41 |

| 2028 | 3,11793 | 2,53491 | 2,40816 | 52 |

| 2029 | 3,64608 | 2,82642 | 1,97849 | 70 |

| 2030 | 4,11004 | 3,23625 | 3,1068 | 94 |

IV. Chiến lược đầu tư và quản trị rủi ro UDS

Phương pháp đầu tư UDS

(1) Chiến lược nắm giữ dài hạn

- Phù hợp với: Nhà đầu tư dài hạn và người đam mê GameFi

- Khuyến nghị:

- Tích lũy UDS khi giá điều chỉnh

- Cập nhật thông tin phát triển của Undeads Games

- Lưu trữ UDS tại ví bảo mật, kiểm soát khoá cá nhân

(2) Chiến lược giao dịch linh hoạt

- Công cụ phân tích kỹ thuật:

- Đường trung bình động: Xác định xu hướng và điểm đảo chiều tiềm năng

- RSI: Đánh giá trạng thái quá mua/quá bán

- Lưu ý khi giao dịch sóng:

- Theo dõi các thông báo game và tin tức cập nhật

- Quan sát tâm lý chung của lĩnh vực GameFi

Khung quản trị rủi ro UDS

(1) Nguyên tắc phân bổ tài sản

- Nhà đầu tư thận trọng: 1 - 3%

- Nhà đầu tư mạo hiểm: 5 - 10%

- Nhà đầu tư chuyên nghiệp: 10 - 15%

(2) Giải pháp phòng ngừa rủi ro

- Đa dạng hóa danh mục: Phân bổ vào nhiều dự án GameFi khác nhau

- Đặt lệnh cắt lỗ: Thiết lập mức cắt lỗ hợp lý hạn chế tổn thất

(3) Giải pháp bảo vệ tài sản

- Khuyến nghị ví nóng: Gate Web3 Wallet

- Lưu trữ lạnh: Sử dụng ví phần cứng cho số dư lớn

- Bảo mật: Kích hoạt xác thực hai lớp, sử dụng mật khẩu riêng cho từng dịch vụ

V. Rủi ro và thách thức tiềm ẩn của UDS

Rủi ro thị trường UDS

- Biến động mạnh: Token GameFi có thể lên xuống giá nhanh

- Áp lực cạnh tranh: Ngày càng nhiều dự án game blockchain ra mắt

- Tâm lý thị trường: Phụ thuộc xu hướng toàn ngành tiền mã hóa

Rủi ro pháp lý UDS

- Quy định chưa ổn định: Khung pháp lý tiền mã hóa và game có thể thay đổi

- Tuân thủ quốc tế: Quy định pháp luật khác biệt theo từng vùng

- Phân loại token: Nguy cơ bị xem là chứng khoán bởi cơ quan giám sát

Rủi ro kỹ thuật UDS

- Vấn đề hợp đồng thông minh: Có thể phát sinh lỗi hoặc bị tấn công

- Thách thức mở rộng: Hiệu năng game có thể giảm khi lượng người dùng tăng

- Khả năng liên chuỗi: Giới hạn về khả năng tương tác giữa các blockchain

VI. Kết luận và khuyến nghị đầu tư

Đánh giá giá trị đầu tư UDS

UDS là cơ hội đầu tư rủi ro cao, lợi nhuận lớn trong ngành GameFi tăng trưởng mạnh. Tiềm năng dài hạn gắn liền với mức độ phát triển của Undeads Games, trong khi biến động giá ngắn hạn vẫn tiềm ẩn nhiều rủi ro.

Khuyến nghị đầu tư UDS

✅ Người mới: Nên bắt đầu với khoản đầu tư nhỏ, ưu tiên học hỏi về GameFi

✅ Nhà đầu tư kinh nghiệm: Xem xét phân bổ trong danh mục tiền mã hóa đa dạng

✅ Nhà đầu tư tổ chức: Nên kiểm tra kỹ năng lực đội ngũ và công nghệ của Undeads Games

Phương thức giao dịch UDS

- Giao dịch giao ngay trên Gate.com

- Tham gia staking UDS nếu được cung cấp

- Sử dụng UDS cho các giao dịch mua bán trong hệ sinh thái Undeads Games

Đầu tư tiền mã hóa tiềm ẩn rủi ro rất lớn, nội dung bài viết không phải là tư vấn đầu tư. Nhà đầu tư cần cân nhắc kỹ lưỡng theo mức chịu rủi ro của bản thân và nên tham vấn chuyên gia tài chính. Không đầu tư vượt quá khả năng tài chính cá nhân.

Dự báo giá OSHI năm 2025: Phân tích xu hướng thị trường và các yếu tố tăng trưởng tiềm năng

Dự báo giá METAN năm 2025: Phân tích xu hướng thị trường và các yếu tố thúc đẩy tăng trưởng

Dự báo giá IXORA năm 2025: Phân tích xu hướng thị trường và các yếu tố thúc đẩy tăng trưởng tiềm năng đối với loại tiền mã hóa đang nổi lên

Dự báo giá BSU năm 2025: Phân tích xu hướng thị trường và các yếu tố thúc đẩy tăng trưởng tiềm năng của token Boise State University

Dự báo giá MONI năm 2025: Phân tích xu hướng thị trường và yếu tố tăng trưởng triển vọng cho tài sản kỹ thuật số

Dự báo giá LUNC năm 2025: Đánh giá tiềm năng phục hồi của Terra Luna Classic cùng triển vọng thị trường trong bối cảnh hậu khủng hoảng

Dòng tiền vào các sàn giao dịch cùng với khối lượng DOT được nắm giữ sẽ tác động ra sao đến thanh khoản cũng như sự dịch chuyển vốn của Polkadot trong năm 2025?

Mô hình Kinh tế học Token: Cách hoạt động của thuế đốt 1,2% của LUNC và cơ chế giảm phát

HEMI là gì: Khám phá công nghệ động cơ V8 cách mạng của Chrysler và di sản về hiệu suất vượt trội

URANUS là gì: Cẩm nang chi tiết về hành tinh băng khổng lồ trong Hệ Mặt Trời