# BItcoin

6.63M

MrFlower_

#GoldBreaksAbove$5,200 Safe-Haven Demand Strengthens as Global Markets Remain Uncertain

#XAU #XAUT #PAXG #Bitcoin

Gold continues to attract strong attention across global financial $markets as investors increasingly move toward safety amid prolonged macroeconomic pressure and unstable risk sentiment. Ongoing uncertainty around global growth, currency weakness, and geopolitical developments has reinforced gold’s role as a primary defensive asset, encouraging both institutional and long-term participants to maintain exposure despite short-term price fluctuations.

The current market environment r

#XAU #XAUT #PAXG #Bitcoin

Gold continues to attract strong attention across global financial $markets as investors increasingly move toward safety amid prolonged macroeconomic pressure and unstable risk sentiment. Ongoing uncertainty around global growth, currency weakness, and geopolitical developments has reinforced gold’s role as a primary defensive asset, encouraging both institutional and long-term participants to maintain exposure despite short-term price fluctuations.

The current market environment r

XRP-6,06%

- Reward

- 14

- 6

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#GoldBreaksAbove$5,200 GoldBreaksAbove$5,200 | Safe-Haven Demand Strengthens as Global Markets Remain Uncertain

#XAU #XAUT #PAXG #Bitcoin

Gold continues to attract strong attention across global financial $markets as investors increasingly move toward safety amid prolonged macroeconomic pressure and unstable risk sentiment. Ongoing uncertainty around global growth, currency weakness, and geopolitical developments has reinforced gold’s role as a primary defensive asset, encouraging both institutional and long-term participants to maintain exposure despite short-term price fluctuations.

The curr

#XAU #XAUT #PAXG #Bitcoin

Gold continues to attract strong attention across global financial $markets as investors increasingly move toward safety amid prolonged macroeconomic pressure and unstable risk sentiment. Ongoing uncertainty around global growth, currency weakness, and geopolitical developments has reinforced gold’s role as a primary defensive asset, encouraging both institutional and long-term participants to maintain exposure despite short-term price fluctuations.

The curr

BTC-5,81%

- Reward

- 3

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊#ContentMiningRevampPublicBeta BTC is holding a critical structure here 👀

Price reacting near key support while liquidity builds above resistance. If momentum confirms, we could see a breakout expansion move.

Watch volume carefully.

Rejection = short-term pullback.

Break + hold = continuation setup.

Risk management first. Emotion last.

$BTC/USDT

#Bitcoin #BTC #CryptoTrading $BTC

Price reacting near key support while liquidity builds above resistance. If momentum confirms, we could see a breakout expansion move.

Watch volume carefully.

Rejection = short-term pullback.

Break + hold = continuation setup.

Risk management first. Emotion last.

$BTC/USDT

#Bitcoin #BTC #CryptoTrading $BTC

BTC-5,81%

- Reward

- 9

- 20

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

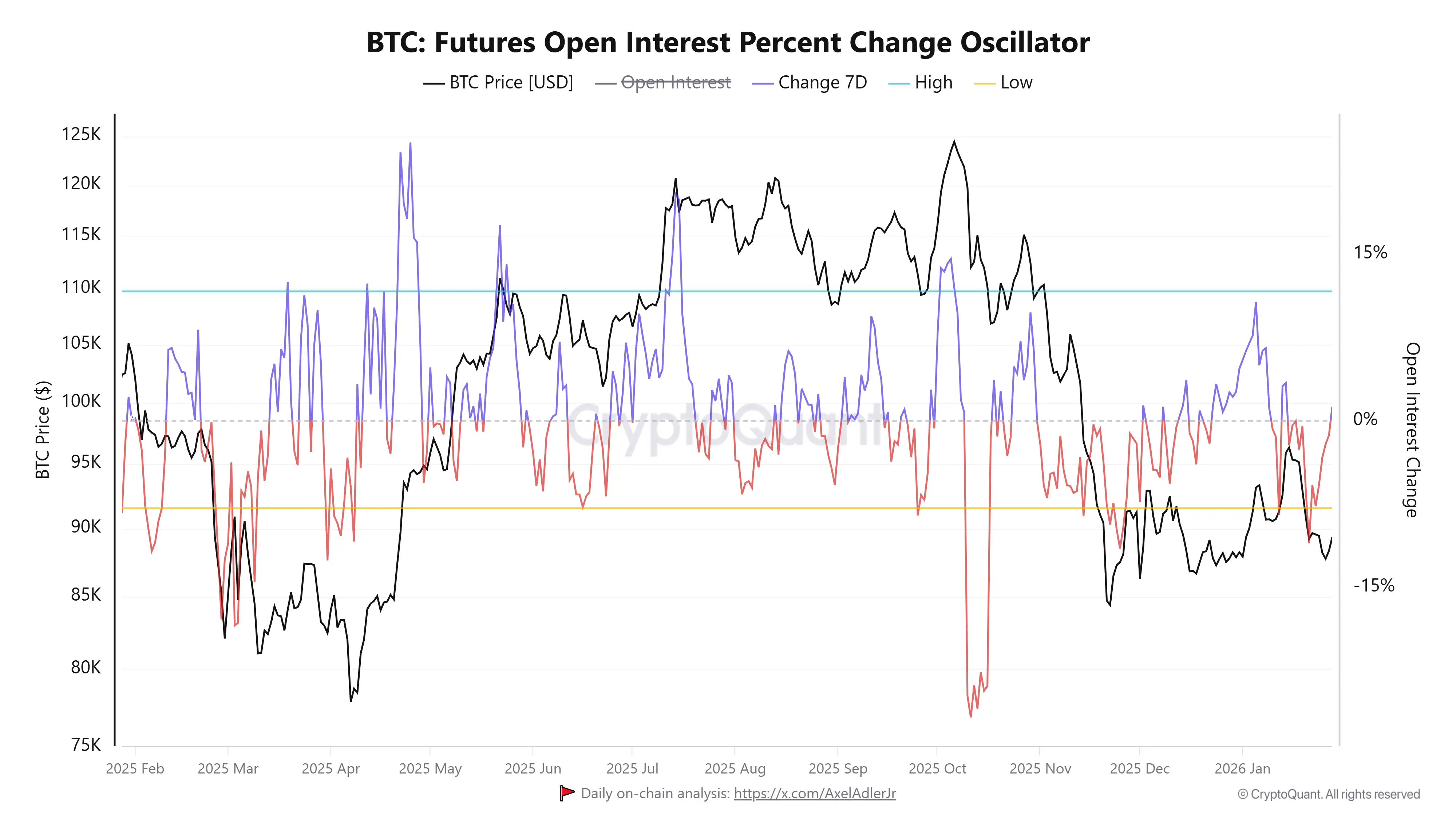

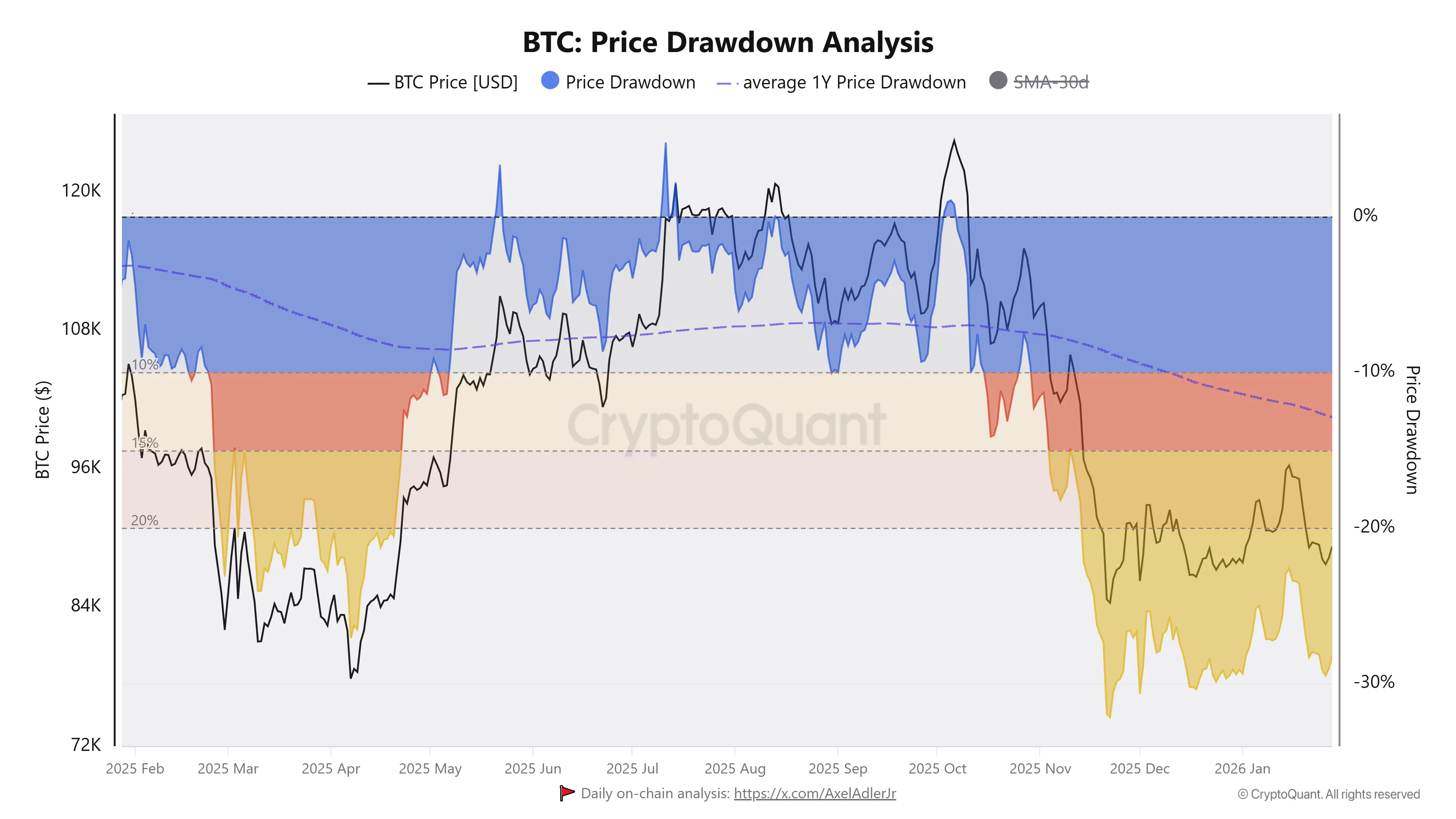

#Bitcoin Shows Signs of Macro Fatigue Amid Ongoing Leverage Reset

Recent quarterly performance highlights a clear shift in $BTC market structure. After a strong mid-2025 expansion phase marked by consistent positive quarterly returns, performance has turned negative in recent periods. This transition suggests the market has moved away from trend continuation and into a corrective or consolidation regime. Such shifts typically reflect weakening marginal demand rather than a structural breakdown, especially following an extended rally.

Drawdown analysis provides further context. Current pullbac

Recent quarterly performance highlights a clear shift in $BTC market structure. After a strong mid-2025 expansion phase marked by consistent positive quarterly returns, performance has turned negative in recent periods. This transition suggests the market has moved away from trend continuation and into a corrective or consolidation regime. Such shifts typically reflect weakening marginal demand rather than a structural breakdown, especially following an extended rally.

Drawdown analysis provides further context. Current pullbac

BTC-5,81%

- Reward

- 3

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

#CryptoMarketWatch CryptoMarketWatch 🚀

The market is showing signs of consolidation, but a few altcoins are making impressive moves:

Top Gainers:

🚀 Somnia (SOMI): +31.2% – Leading the charts!

🚀 Jito (JTO): +24.5%

🚀 Worldcoin (WLD): +19.4%

Major Loser:

🔻 ARPA: -18.5%

📰 Key Market Headlines:

Fed Decision: The Federal Reserve keeps rates at 3.50%–3.75%. Risk assets like crypto remain steady for now.

Gold vs. Bitcoin: Gold hits a new high at $5,500, while BTC remains stuck between $86k–$89k.

US Legislation: The White House will meet banks & crypto firms next week to push pending crypto regul

The market is showing signs of consolidation, but a few altcoins are making impressive moves:

Top Gainers:

🚀 Somnia (SOMI): +31.2% – Leading the charts!

🚀 Jito (JTO): +24.5%

🚀 Worldcoin (WLD): +19.4%

Major Loser:

🔻 ARPA: -18.5%

📰 Key Market Headlines:

Fed Decision: The Federal Reserve keeps rates at 3.50%–3.75%. Risk assets like crypto remain steady for now.

Gold vs. Bitcoin: Gold hits a new high at $5,500, while BTC remains stuck between $86k–$89k.

US Legislation: The White House will meet banks & crypto firms next week to push pending crypto regul

- Reward

- 4

- 4

- Repost

- Share

Dark_Angel :

:

2026 GOGOGO 👊View More

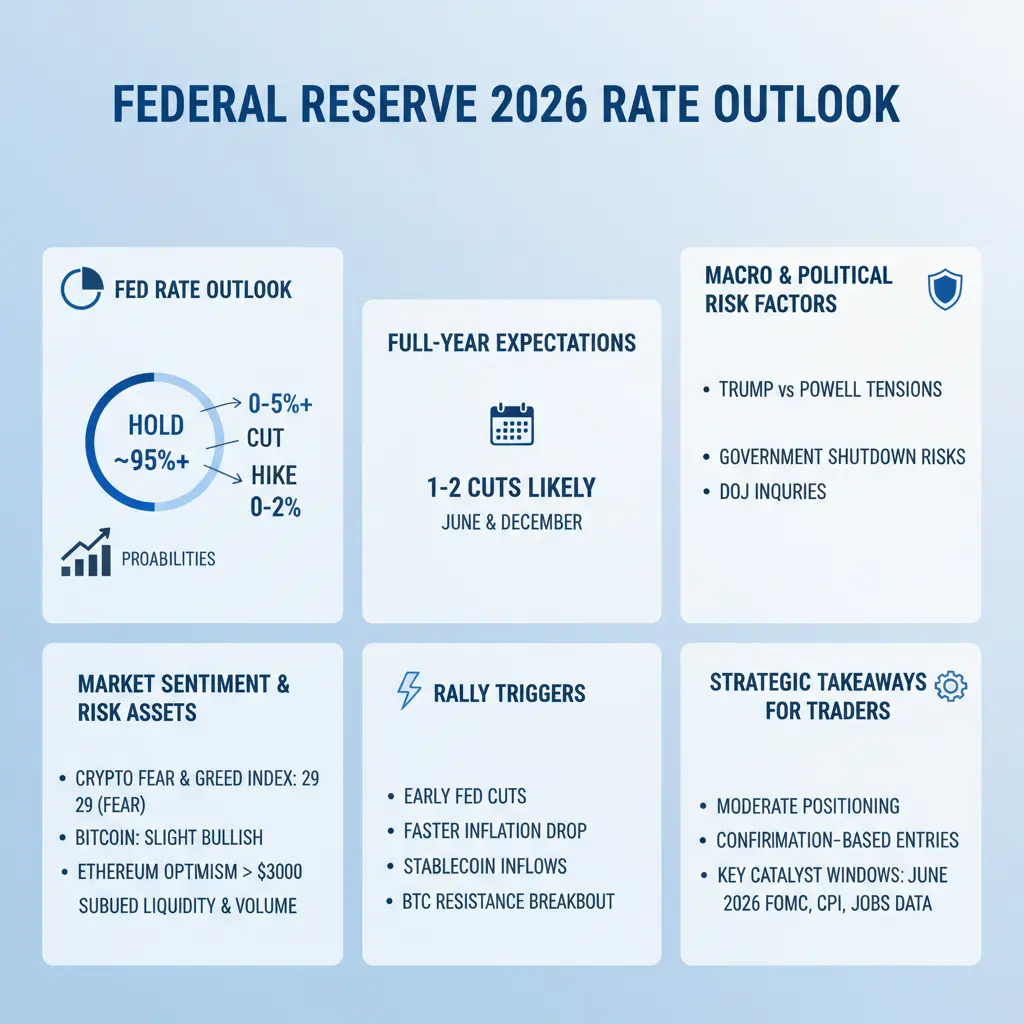

#FedRateDecisionApproaches 🚨

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 7

- 9

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

🔎 #CryptoMarketWatch | Market at a Critical Crossroads

The crypto market is at a decisive inflection point — where long-term bullish structure collides with short-term macro pressure. Volatility is high, but so is strategic opportunity.

🟢 Bullish Pillars (The Bigger Picture)

Despite the noise, the foundation for the next cycle is strengthening:

1️⃣ Institutional Adoption Is Locked In

U.S. Spot Bitcoin ETFs have permanently changed the market. This is not retail speculation — it’s structural capital entering crypto.

2️⃣ Regulatory Clarity Is Emerging

While the U.S. remains uncertain, EU MiCA

The crypto market is at a decisive inflection point — where long-term bullish structure collides with short-term macro pressure. Volatility is high, but so is strategic opportunity.

🟢 Bullish Pillars (The Bigger Picture)

Despite the noise, the foundation for the next cycle is strengthening:

1️⃣ Institutional Adoption Is Locked In

U.S. Spot Bitcoin ETFs have permanently changed the market. This is not retail speculation — it’s structural capital entering crypto.

2️⃣ Regulatory Clarity Is Emerging

While the U.S. remains uncertain, EU MiCA

- Reward

- 3

- 2

- Repost

- Share

TraderMiskinMimpiKaya :

:

btc to 100k Q1 go go go go goView More

With the fall in gold prices, there was an expectation of a rise in cryptocurrencies. However, those who opened LONG positions based on this expectation were liquidated. In the last hour alone, over $180 million worth of LONG positions were liquidated in Bitcoin.

We are in a ruthless market...

#Bitcoin #BTC #GoldBreaks$5,500

We are in a ruthless market...

#Bitcoin #BTC #GoldBreaks$5,500

BTC-5,81%

MC:$181.54KHolders:173

100.00%

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinFallsBehindGold 🪙➡️🥇

Bitcoin’s performance vs. gold is signaling caution. The BTC/Gold ratio is down ~55% from its peak and has slipped below the 200-week moving average, a historically important level marking major regime shifts—not just short-term noise.

Gold is soaking up geopolitical risk and central bank flows, while Bitcoin is acting like a liquidity-sensitive macro asset, reacting to tighter financial conditions.

📌 Key takeaway:

BTC underperformance vs. gold often happens in late-stage risk-off periods.

These phases flush leverage, reset expectations, and quietly create long-

Bitcoin’s performance vs. gold is signaling caution. The BTC/Gold ratio is down ~55% from its peak and has slipped below the 200-week moving average, a historically important level marking major regime shifts—not just short-term noise.

Gold is soaking up geopolitical risk and central bank flows, while Bitcoin is acting like a liquidity-sensitive macro asset, reacting to tighter financial conditions.

📌 Key takeaway:

BTC underperformance vs. gold often happens in late-stage risk-off periods.

These phases flush leverage, reset expectations, and quietly create long-

BTC-5,81%

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊JUST IN: Stablecoin Market Cap Hits All-Time High as $2 Billion Floods Exchanges.

The sidelines are officially emptying. In the last 6 hours, on-chain data recorded a massive $2 billion inflow of USDT and USDC into centralized exchange wallets. This liquidity injection arrives precisely as Bitcoin stabilizes above $91,500, signaling that large capital allocators are finished de-risking from the recent geopolitical scare and are positioning for deployment.

This matters because it represents "potential energy."

Unlike open interest, which indicates leverage, stablecoin inflows represent raw spot

The sidelines are officially emptying. In the last 6 hours, on-chain data recorded a massive $2 billion inflow of USDT and USDC into centralized exchange wallets. This liquidity injection arrives precisely as Bitcoin stabilizes above $91,500, signaling that large capital allocators are finished de-risking from the recent geopolitical scare and are positioning for deployment.

This matters because it represents "potential energy."

Unlike open interest, which indicates leverage, stablecoin inflows represent raw spot

BTC-5,81%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

12.63K Popularity

10.85K Popularity

9.02K Popularity

3.85K Popularity

44.71K Popularity

2.18K Popularity

15.99K Popularity

2.34K Popularity

80.03K Popularity

26.88K Popularity

86.78K Popularity

23.53K Popularity

16.57K Popularity

13.47K Popularity

202.26K Popularity

News

View MoreData: If ETH breaks through $2,932, the cumulative liquidation strength of short orders on mainstream CEXs will reach US$963 million

1 h

Data: If BTC breaks through $87,889, the cumulative short liquidation intensity of mainstream CEXs will reach $2.047 billion

1 h

BTC 跌破 84000 USDT

1 h

Data: 43 BTC transferred out of Cumberland DRW, worth approximately $2.8 million

1 h

数据:2000 枚 XAUt 从 Tether 转入 Abraxas Capital Mgmt (Heka Funds),价值约 1059 万美元

2 h

Pin