Post content & earn content mining yield

placeholder

PlayNameGENTLEMAN

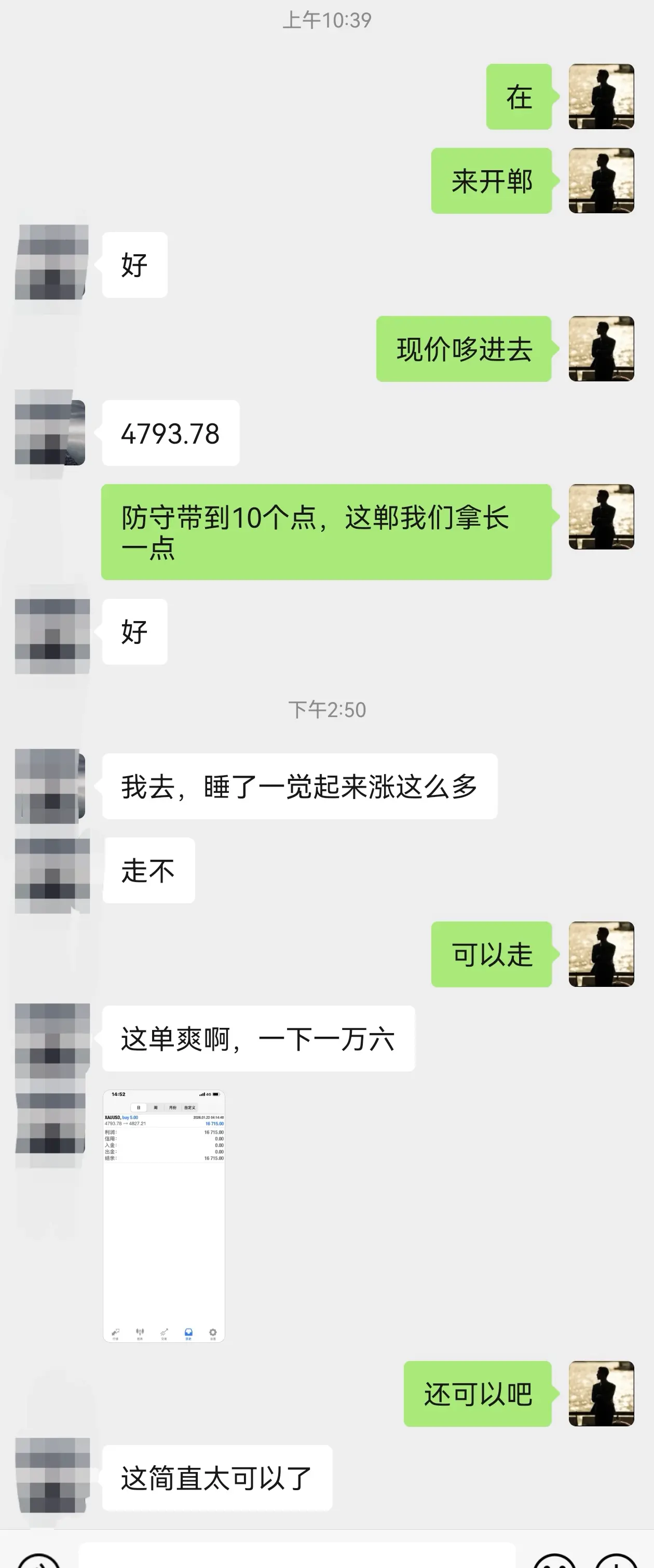

Buy low and add more, with a 34-point profit and an income of 16,000 dollars secured!

View Original

- Reward

- like

- Comment

- Repost

- Share

Gm everyone \n\nHope you did fade me again \n\nFree Mint this Friday which is tomorrow \n\nCheck your address;\n

- Reward

- like

- Comment

- Repost

- Share

🔹 Institutions keep accumulating! BitMine snaps up nearly 35,000 ETH again within two hours

- Reward

- like

- Comment

- Repost

- Share

爱心慈善基金会

爱心慈善基金会

Created By@ChineseMemeHeartTransmitter

Listing Progress

8.40%

MC:

$5.18K

Create My Token

Dear algo,\n\nthis is huge, I can talk to ppl who know the most about distribution on X\'s traffic.\n\nGGGG

- Reward

- like

- Comment

- Repost

- Share

Today, coins are volatile; they might go up or down, so please be cautious when trading, whether in futures or spot markets.

View Original

- Reward

- 2

- Comment

- Repost

- Share

🇺🇸 🔥 HUGE: Investment giant BlackRock ($13 trillion AUM) stated in its 2026 Thematic Outlook that Ethereum could be the biggest beneficiary of the tokenization trend, with 65% of tokenized assets currently built on the Ethereum network.

🌐 Key Highlights:

★ Strong validation from BlackRock for Ethereum

★ Tokenization narrative is becoming a mega-trend

★ Ethereum holds the largest market share in RWA & tokenized assets

📊 Market Impact:

🟩 Strongly Bullish for ETH & the Ethereum ecosystem

🟩 Bullish for RWA / tokenization projects

🗣️ Perspective:

This is very strong long-term bullish news.

🌐 Key Highlights:

★ Strong validation from BlackRock for Ethereum

★ Tokenization narrative is becoming a mega-trend

★ Ethereum holds the largest market share in RWA & tokenized assets

📊 Market Impact:

🟩 Strongly Bullish for ETH & the Ethereum ecosystem

🟩 Bullish for RWA / tokenization projects

🗣️ Perspective:

This is very strong long-term bullish news.

- Reward

- like

- Comment

- Repost

- Share

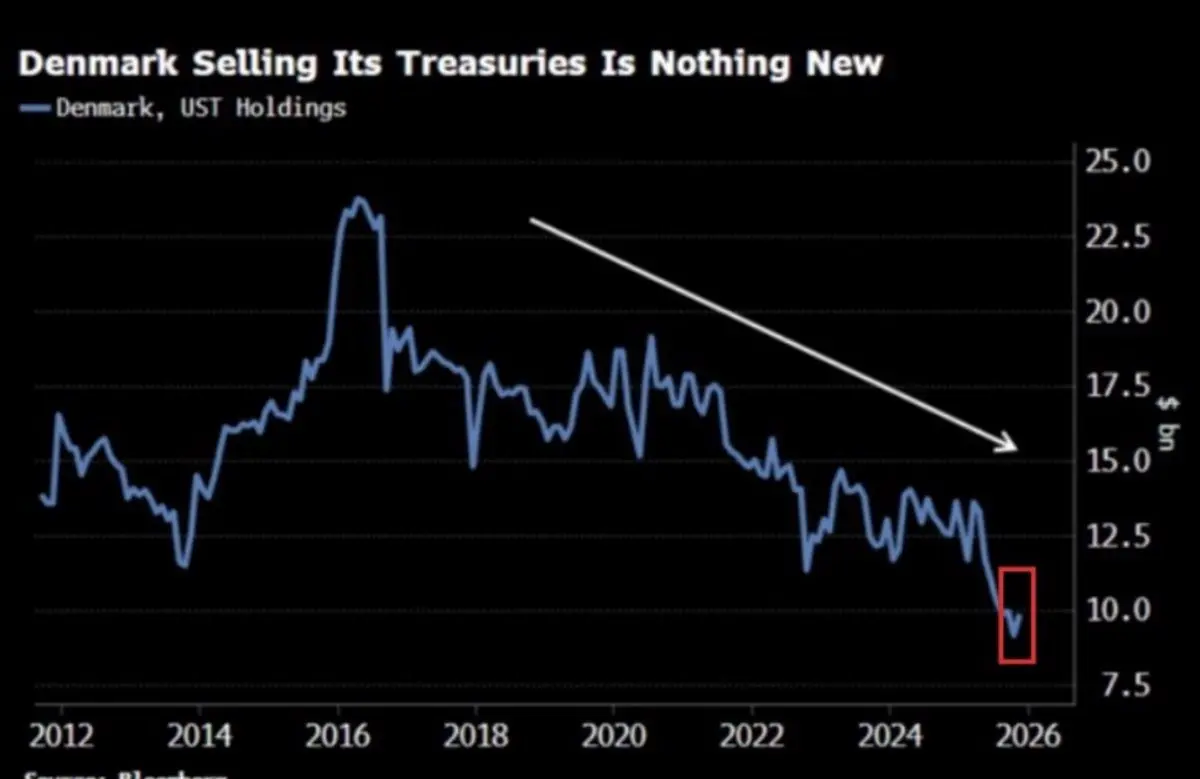

Gm gm fams\n\nDenmark has been cutting US Treasury exposure \n\n- Holdings now around 9B\n\n- down 4B in the last year\n\n- about 30 percent gone\n\n- more than half reduced since the 2016 peak\n\n- Denmark is now less than 1 percent of Europes 3.6T US Treasury holdings\n\n- One of the largest Danish pension funds is exiting Treasuries entirely citing rising credit risk tied to US policy\n\n-No noise just slow capital moving away

- Reward

- like

- Comment

- Repost

- Share

Thank you to all traders for your support and trust. We donate the trading taxes collected daily to the Yanzan Angel Charity Foundation. We welcome everyone's supervision. Hereby, we declare that trading profits and losses are personal investment activities. Wishing all traders good health and abundant wealth. Let's work together to create the hottest charity meme Chinese coin on Gate!

MEME-0,76%

[The user has shared his/her trading data. Go to the App to view more.]

MC:$25.34KHolders:126

64.02%

- Reward

- 2

- 3

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

Everyone, please be careful. There are a few scammers who often use this trick to deceive people into buying newly launched coins. Once they reach a certain level, they run away, leaving you stuck inside. Be extremely cautious.

View Original- Reward

- like

- Comment

- Repost

- Share

Explain to me why you think $1 million isn\'t a lot of money.

- Reward

- like

- Comment

- Repost

- Share

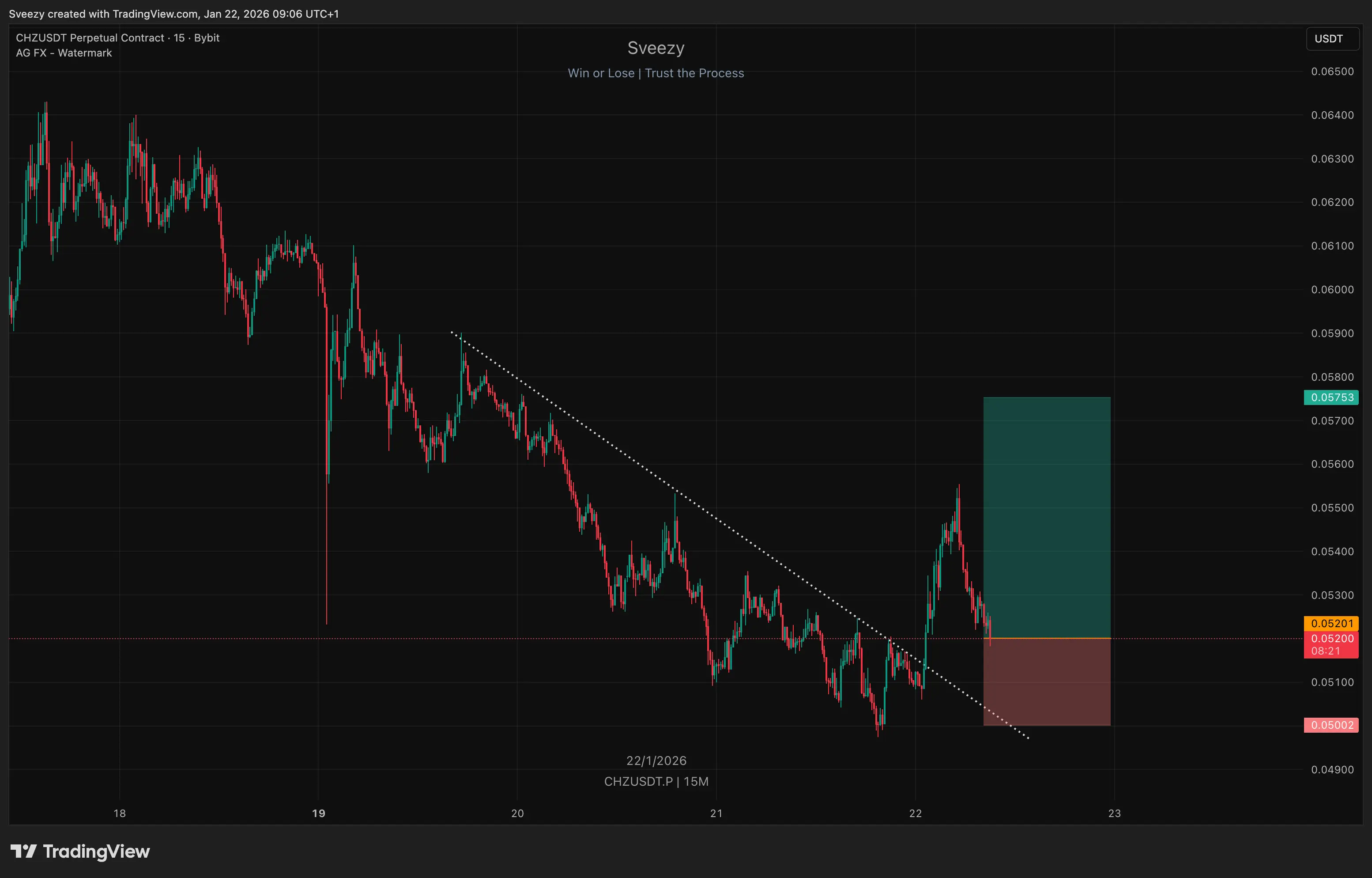

Longed CHZ

(don't go big, important data today)

1% risk

Hard SL: 0.05002

TPs will be given manually (check pinned message if needed)

-----------------------

做多CHZ

(不要重仓,今日有重要数据)

风险控制在1%

硬性止损位:0.05002

止盈目标将手动给出(如有需要,请查看置顶消息) @「」sveezy

(don't go big, important data today)

1% risk

Hard SL: 0.05002

TPs will be given manually (check pinned message if needed)

-----------------------

做多CHZ

(不要重仓,今日有重要数据)

风险控制在1%

硬性止损位:0.05002

止盈目标将手动给出(如有需要,请查看置顶消息) @「」sveezy

CHZ-0,71%

- Reward

- 1

- Comment

- Repost

- Share

The "On-Chain Gold Largest Long" fully closed its PAXG long position at an average price of $4,865, previously opened at approximately $4,415.

On January 22, according to Coinbob's popular address monitoring, influenced by the decline in gold price per ounce overnight and this morning, dropping below $4,800 briefly, the "On-Chain Gold Largest Long" whale on Hyperliquid completely closed its 5x leveraged PAXG long position. The position recorded a profit of $675,000, with an initial size of about $7.3 million and an average price of $4,415. After closing, the address increased its holdings in X

On January 22, according to Coinbob's popular address monitoring, influenced by the decline in gold price per ounce overnight and this morning, dropping below $4,800 briefly, the "On-Chain Gold Largest Long" whale on Hyperliquid completely closed its 5x leveraged PAXG long position. The position recorded a profit of $675,000, with an initial size of about $7.3 million and an average price of $4,415. After closing, the address increased its holdings in X

PAXG-0,89%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

hau

haul

Created By@GateUser-78908d20

Subscription Progress

0.00%

MC:

$0

Create My Token

Tonight at 21:30, the US Initial Jobless Claims data will be released, which is worth paying close attention to:

Previous value: 198,000; Expected: 210,000

If the actual data exceeds expectations, it indicates a marginal weakening of the employment market, market expectations for Fed rate cuts will intensify, the US dollar will come under pressure, and risk asset sentiment is expected to improve. There may be a short-term rebound opportunity for Bitcoin and mainstream cryptocurrencies.

Q3 GDP Final Estimate

Both previous and expected values are 4.30%, and there is likely to be no significant d

View OriginalPrevious value: 198,000; Expected: 210,000

If the actual data exceeds expectations, it indicates a marginal weakening of the employment market, market expectations for Fed rate cuts will intensify, the US dollar will come under pressure, and risk asset sentiment is expected to improve. There may be a short-term rebound opportunity for Bitcoin and mainstream cryptocurrencies.

Q3 GDP Final Estimate

Both previous and expected values are 4.30%, and there is likely to be no significant d

- Reward

- 1

- Comment

- Repost

- Share

$ROSE Good compound / entry area if you\'re not in yet imo. Swept lows into breakout level. Targeting daily highs at 0.026\'s next. \n\nLet\'s get it!

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

🌟 Amazing insight! 🙌 Really loved how you shared this — your perspective is super clear and helpful! 🚀 Keep it up, looking forward to learning more from you! 😊1. Market Trend Deep Analysis

From multi-timeframe charts, Ethereum is currently in a rebound and consolidation phase after a sharp decline.

• Daily Chart (1D): The overall trend is downward, with the price stabilizing after touching around $2837 . Although the MACD histogram is shrinking below the zero line, DIF/DEA are still in a death cross, indicating that the bearish momentum of the major trend has not fully dissipated.

• 4-Hour Chart (4H): The price rebounded after touching $2863 and is now facing resistance at MA21 (yellow line, approximately $3089). If it cannot break through and stab

From multi-timeframe charts, Ethereum is currently in a rebound and consolidation phase after a sharp decline.

• Daily Chart (1D): The overall trend is downward, with the price stabilizing after touching around $2837 . Although the MACD histogram is shrinking below the zero line, DIF/DEA are still in a death cross, indicating that the bearish momentum of the major trend has not fully dissipated.

• 4-Hour Chart (4H): The price rebounded after touching $2863 and is now facing resistance at MA21 (yellow line, approximately $3089). If it cannot break through and stab

ETH1,2%

- Reward

- 4

- 3

- Repost

- Share

All-InIsAFormOfWisdom88 :

:

Tonight, we're still expecting a sharp decline, a plunge like a waterfall of 3,000 feet 😀27.View More

Crypto Market Analysis Today

The market shows interesting movements with maintained volatility. Here are some key points:

1. Main Trend: Accumulation at critical support levels.

2. Sentiment: Moderately bullish based on the latest on-chain data.

3. Strategy: Watch for breakout confirmation before making large position entries.

What are your thoughts on today's price movements? Let's discuss in the comments section! #CryptoUpdate #MarketAnalysis

View OriginalThe market shows interesting movements with maintained volatility. Here are some key points:

1. Main Trend: Accumulation at critical support levels.

2. Sentiment: Moderately bullish based on the latest on-chain data.

3. Strategy: Watch for breakout confirmation before making large position entries.

What are your thoughts on today's price movements? Let's discuss in the comments section! #CryptoUpdate #MarketAnalysis

- Reward

- like

- Comment

- Repost

- Share

What's there to scam? What's worth scamming? All the fees are directly donated; everyone just needs to supervise.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$5.18KHolders:2

8.39%

- Reward

- like

- Comment

- Repost

- Share

XRP Technical Outlook: Price Stabilizes Near $1.90 Support as Downtrend Structure Persists

XRP continues to trade within a well-defined descending channel, following a prolonged corrective decline from the $3.60 cycle peak. While price has recently found short-term support near the $1.88–$1.90 demand zone, the broader structure remains bearish-to-neutral, with XRP still capped below key Fibonacci retracement levels and declining moving averages.

The current rebound appears corrective rather than impulsive, and confirmation of a trend shift is still lacking.

EMA Structure (Bearish Alignment)

20

XRP continues to trade within a well-defined descending channel, following a prolonged corrective decline from the $3.60 cycle peak. While price has recently found short-term support near the $1.88–$1.90 demand zone, the broader structure remains bearish-to-neutral, with XRP still capped below key Fibonacci retracement levels and declining moving averages.

The current rebound appears corrective rather than impulsive, and confirmation of a trend shift is still lacking.

EMA Structure (Bearish Alignment)

20

XRP2,89%

- Reward

- 5

- 7

- Repost

- Share

GateUser-e640aaac :

:

Analysis🥶🥶View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More49.4K Popularity

31.38K Popularity

16.59K Popularity

63.49K Popularity

345.72K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.48KHolders:20.08%

- MC:$3.43KHolders:10.00%

- MC:$3.45KHolders:20.00%

- MC:$3.43KHolders:10.00%

News

View MorePump.fun Price Prediction: As Pump Fund launches, whales continue to reduce their holdings. Will PUMP drop back to $0.0016?

1 m

Pi Network 2026 Major Upgrade: App Studio Opens to the Public, Pi Applications Officially Enter the Usable Stage

3 m

Trump exposes the deadlock between Putin and Zelensky, Russia-Ukraine ceasefire negotiations stuck on land issues

7 m

Alibaba US stocks close more than 3% higher in after-hours trading

9 m

X launches "Getting Started Pack," changing the way crypto users access information

10 m

Pin