From $1T Giant to Lost Asset? Bitcoin Struggles as Gold and Stablecoins Win

Bitcoin is down more than 40% from its peak. Price weakness alone is not unusual in crypto. What makes this phase different is the growing debate about purpose.

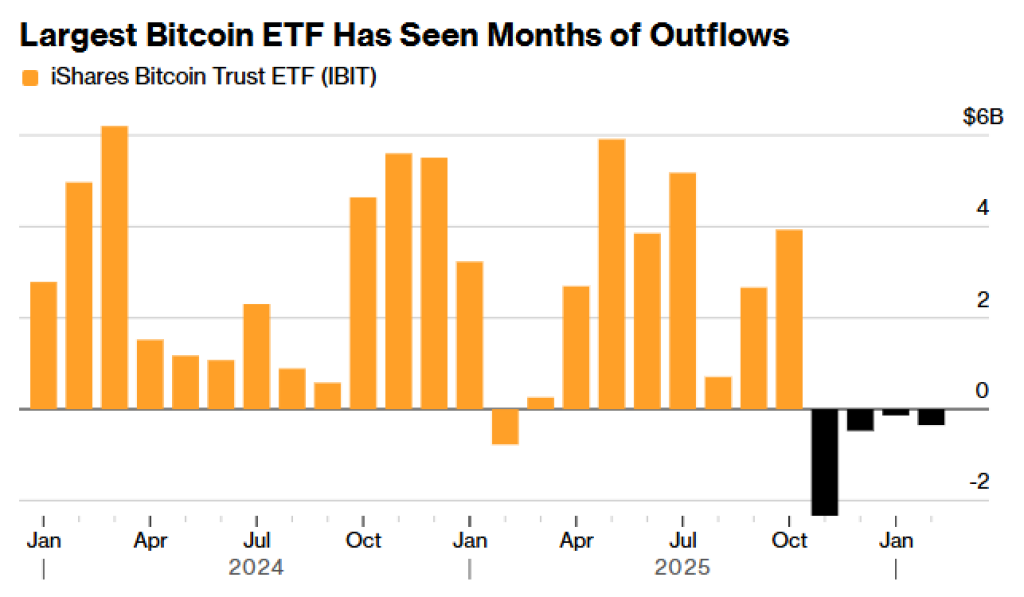

Well-known market analyst Walter, who has over 1.1 million followers on X, ignited that discussion with a blunt post. He argued that Bitcoin is facing a $1 trillion identity crisis. Alongside the tweet, he shared a chart showing persistent outflows from the iShares Bitcoin Trust ETF, IBIT.

The message was clear. This is a test of Bitcoin’s narrative.

- The ETF Outflow Problem

- Gold Is Winning the Hedge Debate

- Stablecoins and New Crypto Narratives

- Is the Core Story Breaking?

- My Take

The ETF Outflow Problem

The image Walter posted shows months of capital leaving IBIT, the largest spot Bitcoin ETF. Earlier in the cycle, inflows were strong and steady. That institutional bid helped fuel momentum and reinforced the idea that Wall Street adoption would provide a long-term floor.

Now the bars on the chart have flipped negative. Consecutive outflow months show capital quietly exiting instead of entering.

ETF flows matter because they represent structured demand. Retail traders come and go quickly. ETF allocations reflect portfolio decisions made by institutions, advisors, and large allocators. When that flow reverses, it signals cooling conviction.

It also weakens one of Bitcoin’s strongest recent narratives: that traditional finance would provide constant structural support.

Source: X/@DeItaone

Gold Is Winning the Hedge Debate

At the same time Bitcoin is struggling, gold has been rallying pretty aggressively. Capital looking for a hedge against macro uncertainty appears to be flowing toward traditional safe havens instead of digital ones.

For years, Bitcoin carried the digital gold label. That branding worked best during periods of expansion and risk appetite. In moments of stress, investors still default to physical gold and sovereign debt.

Walter’s broader point is that Bitcoin’s positioning is being squeezed. If gold performs better during macro tension, Bitcoin’s hedge argument looks thinner.

The outflow chart supports that tension. If Bitcoin were truly capturing hedge demand, ETF flows would likely show accumulation instead of distribution.

Read also: Is Gold a Good Investment? Paper vs Physical Gold Is at an All-Time Extreme

Stablecoins and New Crypto Narratives

Another pressure point comes from inside crypto itself.

Stablecoins now dominate transactional volume. They are fast, liquid, and widely integrated into exchanges and payment rails. For many users, stablecoins handle the practical side of crypto.

Meanwhile, tokenization and real-world asset platforms are drawing attention from institutions. Prediction markets and DeFi applications are expanding speculative use cases beyond simple price exposure.

Bitcoin remains the largest and most established asset in the space. But it is no longer the only story.

When narratives diversify, capital fragments. That makes it harder for Bitcoin to absorb attention purely through dominance.

Read also: Bitcoin’s Deepest Corrections in History: The Real Pain May Not Be Over

Is the Core Story Breaking?

Walter’s sharpest argument centers on momentum. He claims Bitcoin’s main driver has always been rising price. In traditional markets, stocks have earnings. Commodities have supply and demand fundamentals. Bitcoin relies heavily on belief, scarcity, and adoption growth.

When price stalls or declines for extended periods, belief gets tested.

That does not mean Bitcoin lacks value. It means its value proposition must remain clear and compelling. Scarcity still exists. Network security remains unmatched in crypto. Liquidity is deep. Institutional access has improved dramatically compared to past cycles.

The real issue is narrative clarity.

Is Bitcoin primarily a hedge against fiat debasement? A high-beta risk asset? A long-term store of value? A reserve asset for digital finance?

When market participants cannot agree on the answer, identity questions emerge.

My Take

Calling it a $1 trillion identity crisis is a bit dramatic. But the underlying tension is real.

ETF outflows show institutional cooling. Gold’s strength shows competition in the hedge space. Stablecoins and tokenization redirect capital toward functional use cases.

Still, Bitcoin has faced narrative stress before. In 2018 it was declared dead after the ICO collapse. In 2020 it was dismissed during the liquidity crunch. In each case, the asset adapted and returned with a refined story.

Bitcoin’s survival record is strong. Its brand is powerful. Its infrastructure is mature.

The difference this time is competition. Both inside and outside crypto, alternatives are clearer and more specialized.

Whether Bitcoin reasserts dominance or transitions into a narrower role depends on demand recovery and capital flows in the coming quarters.

For now, the chart Walter shared tells a simple story; money has been leaving the largest Bitcoin ETF for months.

And in markets, capital flow often speaks louder than ideology.

Related Articles

Data: If BTC breaks through $71,442, the total liquidation strength of long positions on mainstream CEXs will reach $907 million.

$250,000 BTC by 2029: Peter Brandt Tells Scottie Pippen to 'Buy the Banana' of Bitcoin - U.Today