Post content & earn content mining yield

placeholder

Crypto_Exper

$ZEC3S just bounced hard from the lows around 1.31 and is slowly grinding up. The move isn’t explosive, but it looks controlled and steady. Buyers are defending dips and price is forming higher candles. As long as it stays above the recent support, upside continuation is possible. Chop is expected, but the structure looks better than before.

ZEC3S-0,51%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

OND

ONOD

Created By@M2SYSA

Subscription Progress

0.00%

MC:

$0

Create My Token

Everyone that missed the bottom longs is now shorting here at $70k Ewww

- Reward

- 1

- Comment

- Repost

- Share

$DUSK is on fire right now. Strong breakout, strong volume, and clear trend shift. Price ran fast from the 0.08 zone and is now consolidating after a big move. That’s usually a sign of strength, not exhaustion. If DUSK holds above 0.12, the trend stays bullish. This looks like momentum traders are fully in control.

DUSK62,23%

- Reward

- 2

- Comment

- Repost

- Share

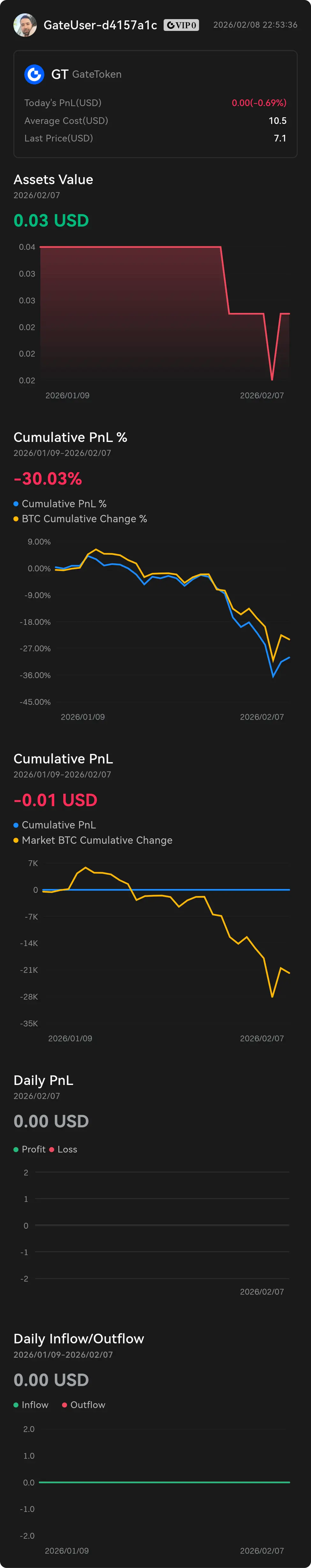

Things you see at the bottom.

- Reward

- like

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF

#BitwiseFilesforUNISpotETF | Gate.io Market Insight

Bitwise’s filing for a spot Uniswap (UNI) ETF is another signal that institutional interest is slowly expanding beyond BTC and ETH into DeFi assets.

For Gate.io traders, this development matters because:

ETF filings often act as long-term structural catalysts, not instant pumps

UNI represents the core of DeFi liquidity, making it a benchmark governance token

Increased institutional attention can improve market depth and volatility opportunities

While SEC approval is still uncertain, this move reinforces a key trend

#BitwiseFilesforUNISpotETF | Gate.io Market Insight

Bitwise’s filing for a spot Uniswap (UNI) ETF is another signal that institutional interest is slowly expanding beyond BTC and ETH into DeFi assets.

For Gate.io traders, this development matters because:

ETF filings often act as long-term structural catalysts, not instant pumps

UNI represents the core of DeFi liquidity, making it a benchmark governance token

Increased institutional attention can improve market depth and volatility opportunities

While SEC approval is still uncertain, this move reinforces a key trend

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Breaking Down Today’s Crypto Market Movements

- Reward

- like

- Comment

- Repost

- Share

MaShang

马上有钱

Created By@Sveta

Listing Progress

0.00%

MC:

$2.41K

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

#GateJanTransparencyReport: Strengthening Trust Through Openness and Accountability

In an industry where trust is everything, transparency is no longer optional—it is essential. The release of the #GateJanTransparencyReport reflects Gate.io’s ongoing commitment to openness, accountability, and user-first principles in the fast-evolving crypto ecosystem. As digital assets continue to mature, exchanges that prioritize clear reporting and verifiable data stand out as leaders shaping the future of responsible crypto adoption.

Transparency reports play a critical role in helping users understand ho

In an industry where trust is everything, transparency is no longer optional—it is essential. The release of the #GateJanTransparencyReport reflects Gate.io’s ongoing commitment to openness, accountability, and user-first principles in the fast-evolving crypto ecosystem. As digital assets continue to mature, exchanges that prioritize clear reporting and verifiable data stand out as leaders shaping the future of responsible crypto adoption.

Transparency reports play a critical role in helping users understand ho

- Reward

- 5

- 3

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

- Reward

- like

- Comment

- Repost

- Share

Market View: $ETH /USDT Sideways → Bullish 📈

ETH formed a strong bounce from the 1,750–1,900 demand zone and is now consolidating above short EMAs. Structure is improving with higher lows, but price is approaching overhead resistance.

Entry Idea 💡: Buy pullbacks around 2,080–2,100 (EMA 20/50 + minor structure support).

Resistance Levels:

2,150–2,200 (range high + supply zone). Break above 2,200 could push toward 2,240–2,300 (EMA 200 area).

Support Levels:

2,050–2,080 (Fib 1.272 + structure), then 1,980–2,000 (key psychological + demand).

Indicators:

RSI steady above 55 → bullish momentum bui

ETH formed a strong bounce from the 1,750–1,900 demand zone and is now consolidating above short EMAs. Structure is improving with higher lows, but price is approaching overhead resistance.

Entry Idea 💡: Buy pullbacks around 2,080–2,100 (EMA 20/50 + minor structure support).

Resistance Levels:

2,150–2,200 (range high + supply zone). Break above 2,200 could push toward 2,240–2,300 (EMA 200 area).

Support Levels:

2,050–2,080 (Fib 1.272 + structure), then 1,980–2,000 (key psychological + demand).

Indicators:

RSI steady above 55 → bullish momentum bui

ETH1,24%

- Reward

- like

- Comment

- Repost

- Share

#当前行情抄底还是观望? Currently, BTC has shown an upward trend in the short term, but the key zone is 72,000-75,000. If it cannot break through, it may continue downward. Over the weekend, it failed four times to break through the 71,500-72,000 range.

The long-term trend remains downward, but since the crypto market is now highly dependent on external economic market movements, there is a possibility of a reversal to the upside if external conditions change significantly.

The long-term trend remains downward, but since the crypto market is now highly dependent on external economic market movements, there is a possibility of a reversal to the upside if external conditions change significantly.

BTC2,78%

- Reward

- like

- Comment

- Repost

- Share

Looking at the first chart, you might think it's very regular—bull and bear cycles!! But when you look at the second chart, you'll see that there is a pattern, but the pattern has changed! Previously, Bitcoin retraced 50%, and the S&P 500 was down 20-25%. This time, the S&P 500 only dropped 5%! So don't rush; the real show is still to come!

BTC2,78%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More165.67K Popularity

18.67K Popularity

395.77K Popularity

8.05K Popularity

18.89K Popularity

News

View MoreData: Over the past 24 hours, the entire network has liquidated $204 million, with long positions liquidated at $60.2181 million and short positions at $144 million.

3 h

U.S. Treasury Secretary Yellen: Gold appears to be a typical speculative sell-off market

3 h

Trump predicts the Dow will reach 100,000 points before the end of his term, after previously "calling the shots" multiple times and the market strengthening afterward.

4 h

Tom Lee: Bitcoin has repeatedly recovered from crashes, and the crypto market recovery has already begun.

4 h

U.S. Treasury Secretary Yellen: Expect the Federal Reserve will not take any swift action on the balance sheet

4 h

Pin