Post content & earn content mining yield

placeholder

TheLittleFollowerOfTheGod

#Gate 2025 年终社区盛典#

Peak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VLZHUVXZCQ&refType=1&refUid=24331625&ref_type=165&utm_cmp=xjdtmcgP

View OriginalPeak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VLZHUVXZCQ&refType=1&refUid=24331625&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

天马

天马🐴

Created By@VKidney

Listing Progress

0.05%

MC:

$3.52K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

Come on, let's make money! Let's go! Keep it up.

View Original

MC:$7.18KHolders:17

16.03%

- Reward

- 6

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Just after coming back, Ethereum started a big drop. It began to decline at 7 AM and is now consolidating around 3200. Brothers, what do you think about this wave?

ETH-3,45%

- Reward

- like

- Comment

- Repost

- Share

Can't believe someone did this 😭

- Reward

- like

- Comment

- Repost

- Share

2026 Market , BTC, ETH SOL, Alt coin LIVE Analysis – Smart Trade Setup

- Reward

- like

- Comment

- Repost

- Share

$ETH is moving with control, not chaos.

Price keeps respecting the rising trendline, every bounce confirms buyers are active and defending structure. That green zone around 2650 to 2800 built the base. Now dynamic support sits near 3050 to 3100, and it’s doing its job.

The pullback we just saw looks clean. No panic, no structure break. This is how strong trends breathe.

Above us, the real test is clear. The 3350 to 3500 supply zone has rejected price before. That red area is where momentum must prove itself.

If ETH holds the trendline and reclaims 3250 plus, continuation stays in play and pres

Price keeps respecting the rising trendline, every bounce confirms buyers are active and defending structure. That green zone around 2650 to 2800 built the base. Now dynamic support sits near 3050 to 3100, and it’s doing its job.

The pullback we just saw looks clean. No panic, no structure break. This is how strong trends breathe.

Above us, the real test is clear. The 3350 to 3500 supply zone has rejected price before. That red area is where momentum must prove itself.

If ETH holds the trendline and reclaims 3250 plus, continuation stays in play and pres

ETH-3,45%

- Reward

- 1

- 1

- Repost

- Share

ALEX37 :

:

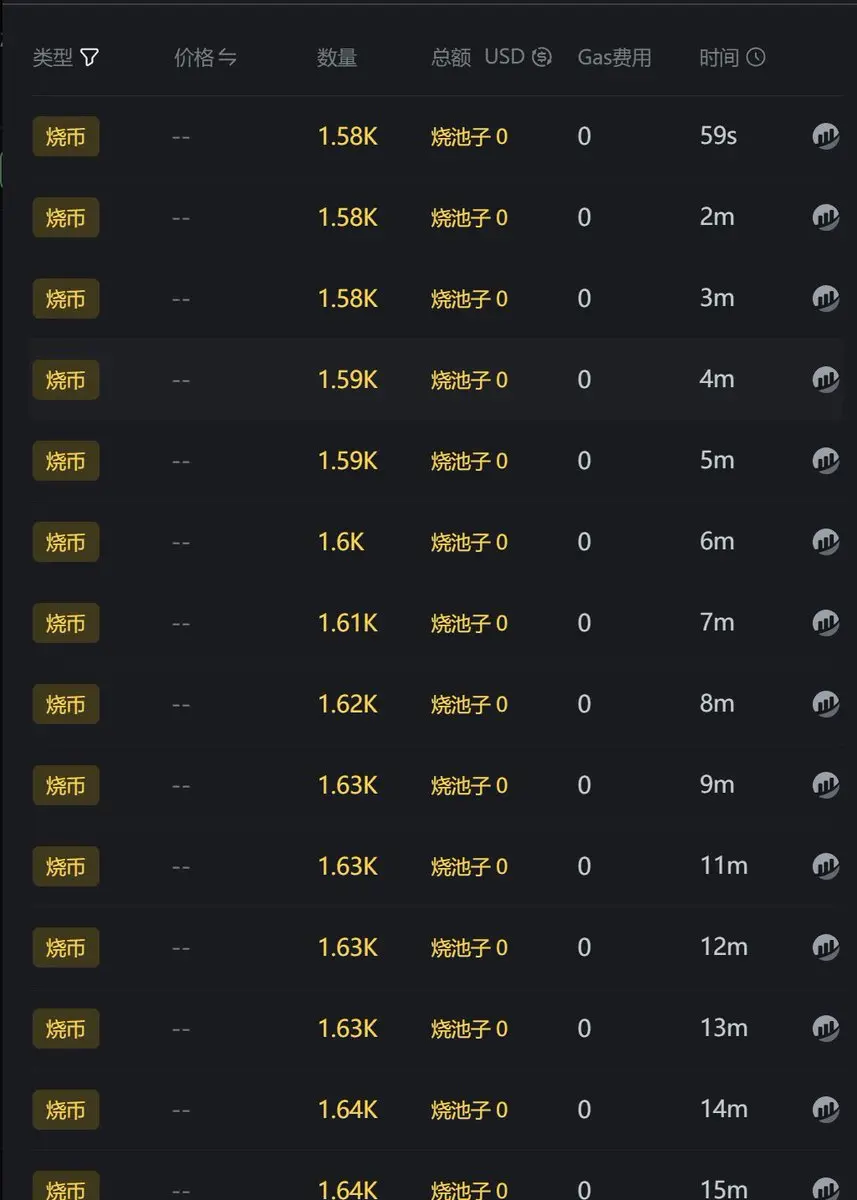

Jump in 🚀In less than three months, JST has been burned by 11%, and this is just the beginning.

250 million JST tokens have been permanently removed from the chain. More importantly, in less than three months, a total of 10.96% of the total supply has been burned.

This speed is perceptible in DeFi.

First, it is not driven by emotions.

The buyback funds come from the SBM USDT reserve, which is the real income accumulated after the first round of burns.

The protocol grows → generates reserves → buyback and burn → supply decreases.

Second, it is not supported by a single product.

sTRX staking has exceeded

View Original250 million JST tokens have been permanently removed from the chain. More importantly, in less than three months, a total of 10.96% of the total supply has been burned.

This speed is perceptible in DeFi.

First, it is not driven by emotions.

The buyback funds come from the SBM USDT reserve, which is the real income accumulated after the first round of burns.

The protocol grows → generates reserves → buyback and burn → supply decreases.

Second, it is not supported by a single product.

sTRX staking has exceeded

- Reward

- like

- Comment

- Repost

- Share

芝麻传奇

芝麻传奇之路

Created By@gatefunuser_e111

Listing Progress

100.00%

MC:

$6.35K

Create My Token

Buy 0.1 BNB of the $Snowball token every minute and burn it, creating a cycle of continuous growth!

Isn't this what the investment role model Mr. Buffett referred to as a snowball?

"Life is like a snowball, the important thing is to find very wet snow and a long slope."

#雪球 #BNB #BSC

Isn't this what the investment role model Mr. Buffett referred to as a snowball?

"Life is like a snowball, the important thing is to find very wet snow and a long slope."

#雪球 #BNB #BSC

BNB-2,15%

- Reward

- like

- Comment

- Repost

- Share

European stocks open sharply lower as Trump’s “Greenland Tariff” threat sparks trade war concerns

Following US President Trump’s sudden announcement over the weekend of tariffs on 8 European countries, European markets opened significantly lower on Monday (January 19), with risk aversion rapidly intensifying.

As of European morning:

• Euro Stoxx 50 -1.7%

• Germany DAX -1.3%

• France CAC40 -0.7%

• UK FTSE 100 -0.4%

• Defense stocks rose against the trend by 1–2%, while export and tech stocks came under pressure.

Risk aversion erupts:

• Gold soared to a historic high of $4690/oz

• Silver rose ab

View OriginalFollowing US President Trump’s sudden announcement over the weekend of tariffs on 8 European countries, European markets opened significantly lower on Monday (January 19), with risk aversion rapidly intensifying.

As of European morning:

• Euro Stoxx 50 -1.7%

• Germany DAX -1.3%

• France CAC40 -0.7%

• UK FTSE 100 -0.4%

• Defense stocks rose against the trend by 1–2%, while export and tech stocks came under pressure.

Risk aversion erupts:

• Gold soared to a historic high of $4690/oz

• Silver rose ab

- Reward

- like

- Comment

- Repost

- Share

gm fam, what happened tonight? why has everything collapsed?

- Reward

- like

- Comment

- Repost

- Share

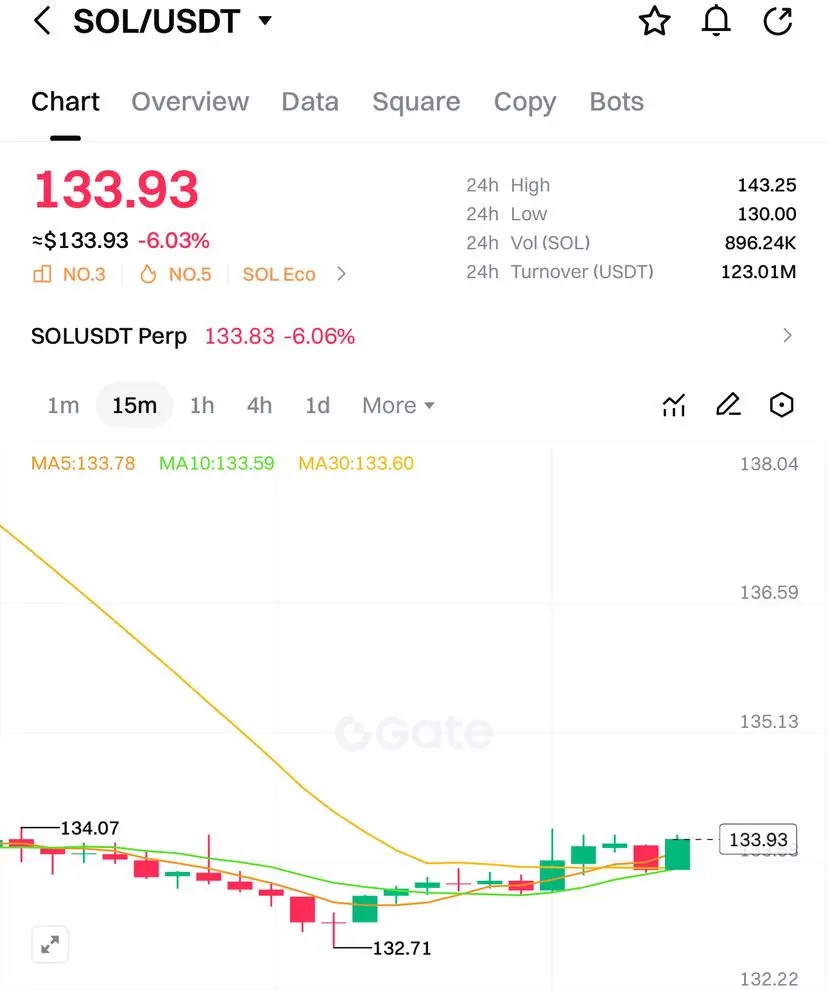

SOL/USDT

SOL has already seen a significant correction, and selling pressure has eased. This could be an area for a relief bounce rather than a complete trend reversal.

→ Consider taking a safer long position near 132 – 133

→ Set a stop loss below 130

→ Bounce targets are between 138 – 142

If BTC weakens, SOL may face difficulties. It's advisable to keep your position sizes small.

SOL has already seen a significant correction, and selling pressure has eased. This could be an area for a relief bounce rather than a complete trend reversal.

→ Consider taking a safer long position near 132 – 133

→ Set a stop loss below 130

→ Bounce targets are between 138 – 142

If BTC weakens, SOL may face difficulties. It's advisable to keep your position sizes small.

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Since @inference_labs rapidly emerged in the Web3 and artificial intelligence fields, it has been leading the way in advancing the infrastructure for trustworthy AI.

The reasoning process of traditional AI systems is often an invisible, opaque black box that is difficult to verify, making it impossible for users and developers to confirm the authenticity or source of model outputs.

The Proof of Inference protocol proposed by Inference Labs achieves proof of AI inference results through zero-knowledge encryption technology. This means that each inference output can be verified on-chain, ensurin

The reasoning process of traditional AI systems is often an invisible, opaque black box that is difficult to verify, making it impossible for users and developers to confirm the authenticity or source of model outputs.

The Proof of Inference protocol proposed by Inference Labs achieves proof of AI inference results through zero-knowledge encryption technology. This means that each inference output can be verified on-chain, ensurin

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More5.06K Popularity

326.18K Popularity

36.66K Popularity

2.02K Popularity

1.85K Popularity

News

View MoreThe International Monetary Fund expects the global economy to grow by 3.3% this year.

3 m

Huang Licheng continues to reduce HYPE long positions and increase ETH long positions, with a loss of approximately $1.87 million in the past day.

8 m

A certain whale is bullish on the future market and is simultaneously going long on BTC and HYPE

9 m

Immunefi(IMU) will be launched on the Gate Instant Exchange platform on January 22, supporting one-click exchange for 2200 cryptocurrencies.

26 m

Japanese Prime Minister: Dissolving the House of Representatives on January 23 and holding early elections

34 m

Pin