Post content & earn content mining yield

placeholder

haideyachi

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVNFAVEOBQ

View Original

- Reward

- 2

- Comment

- Repost

- Share

Market Analysis BTC

- Reward

- like

- Comment

- Repost

- Share

x

马斯克x

Created By@PleaseSpareMyG0uLife

Listing Progress

0.00%

MC:

$0.1

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQAQXFHWUW

View Original

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLISVG0LVQ

View Original

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQVNUFPYVG

View Original

- Reward

- 2

- Comment

- Repost

- Share

JUST IN: The whale index on exchanges hits 2015 highs

According to recent data from CryptoQuant, the proportion of large holders (whales) sending funds to exchange platforms has climbed to 0.64

According to recent data from CryptoQuant, the proportion of large holders (whales) sending funds to exchange platforms has climbed to 0.64

- Reward

- 4

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVLAULANUW

- Reward

- 2

- Comment

- Repost

- Share

Fed’s Kashkari: Waller is fully qualified to serve as Fed Chair — could this prompt a reassessment of the expected policy path?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

2026 is the year you'll earn your first $1,000, $10,000, $100,000, and $1 million in profits.

Claim it.

View OriginalClaim it.

- Reward

- 2

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$8.61K

More Tokens

What's your secret bullrun gem?

- Reward

- like

- Comment

- Repost

- Share

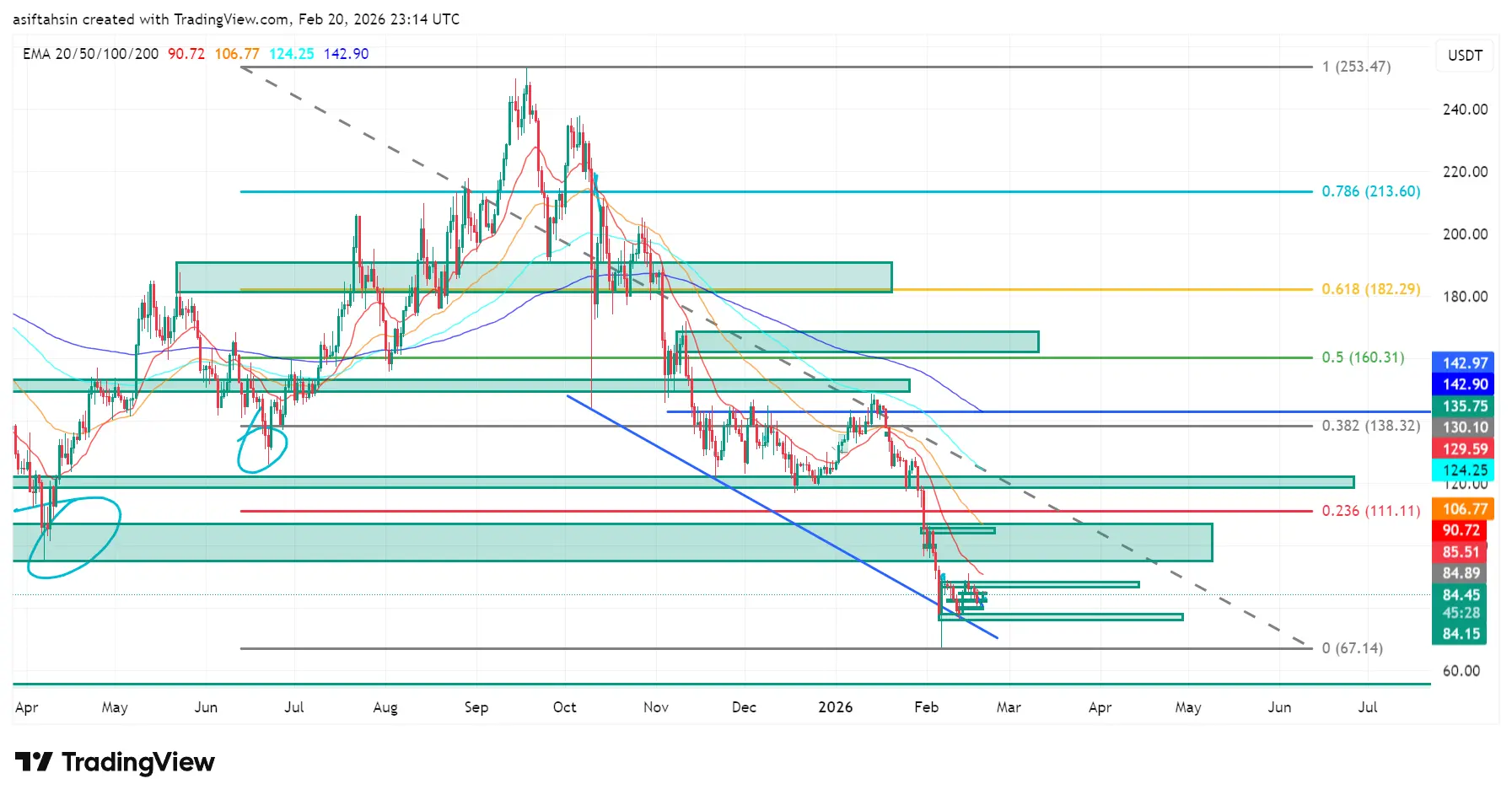

SOL Technical Outlook: Solana Holding Above Macro Base After Losing 0.236

Solana remains in a sustained corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($138) and later 0.236 ($111) confirmed structural weakness, accelerating the decline toward macro support.

Price is now consolidating near $84–$90, just above the macro Fibonacci 0 level at $67.14, forming a short-term base after a sharp selloff.

This is a critical decision zone for SOL’s next major move.

EMA Structure (Strong Bearish Alignment)

20 EMA: $90.72

50

Solana remains in a sustained corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($138) and later 0.236 ($111) confirmed structural weakness, accelerating the decline toward macro support.

Price is now consolidating near $84–$90, just above the macro Fibonacci 0 level at $67.14, forming a short-term base after a sharp selloff.

This is a critical decision zone for SOL’s next major move.

EMA Structure (Strong Bearish Alignment)

20 EMA: $90.72

50

SOL1,39%

- Reward

- 2

- Comment

- Repost

- Share

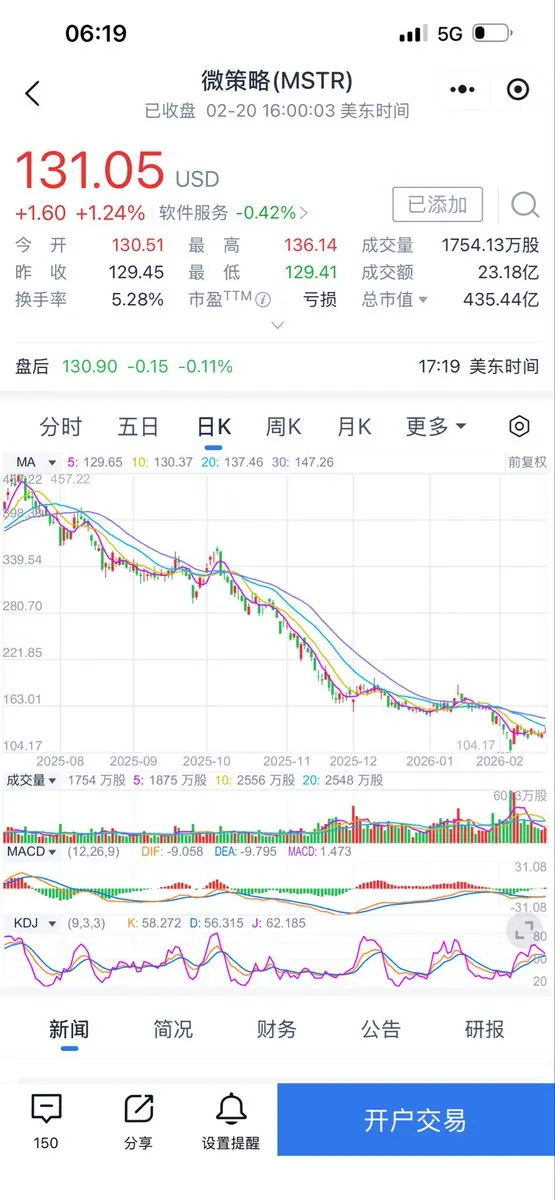

This wave of bottom fishing, half of the position in #Bitcoin for long-term holdings based on the coin-backed strategy, and a micro strategy for cyclical trading. The profit and loss ratio of is quite good.

From a news perspective, the negative news about micro strategy has already been priced in by the market. Even if MSCI's review results in being kicked out of the index again, I believe the probability of a new low is very small. If it can retest $100, that would be a very good buying opportunity.

Looking at the historical performance of micro strategy, it is like leveraged Bitcoin. Fr

From a news perspective, the negative news about micro strategy has already been priced in by the market. Even if MSCI's review results in being kicked out of the index again, I believe the probability of a new low is very small. If it can retest $100, that would be a very good buying opportunity.

Looking at the historical performance of micro strategy, it is like leveraged Bitcoin. Fr

BTC0,92%

- Reward

- 2

- Comment

- Repost

- Share

When others are still warming up, SOL has already started sprinting

The recent market trend is: everyone is testing the waters left and right, only SOL is running seriously. Others are oscillating and repairing, while it is an independent trend; others ask "Should I move," and it has quietly reached a new high for this phase.

Why does this "standout" phenomenon occur? It's simple—funds are also people, and they like efficiency. Solana's on-chain experience is smooth, transaction fees are low, hot projects come one after another, and the profit-making effect forms a positive cycle. Money is the

The recent market trend is: everyone is testing the waters left and right, only SOL is running seriously. Others are oscillating and repairing, while it is an independent trend; others ask "Should I move," and it has quietly reached a new high for this phase.

Why does this "standout" phenomenon occur? It's simple—funds are also people, and they like efficiency. Solana's on-chain experience is smooth, transaction fees are low, hot projects come one after another, and the profit-making effect forms a positive cycle. Money is the

SOL1,39%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 3

- Repost

- Share

CoinWay :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJHVGWLAA

View Original

- Reward

- 1

- Comment

- Repost

- Share

7-Day Friend Invite Fiesta: Check In Daily, Earn USDT Every Day https://www.gate.com/campaigns/4027?ref=UFRFAQ0M&ref_type=132&utm_cmp=7doQBcVs

- Reward

- 3

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More275.4K Popularity

883.78K Popularity

10.64M Popularity

105.15K Popularity

567.06K Popularity

News

View MoreRich Dad Poor Dad author: Has purchased Bitcoin at the $67,000 price level; the US dollar may be impacted by the debt crisis

3 m

Today, the Fear & Greed Index rose to 8, and the market is in a "Extreme Fear" state.

5 m

Data: If ETH drops below $1,868, the total long liquidation strength on major CEXs will reach $832 million.

6 m

10x Research: Altcoin Market Is Fragile and Bitcoin Is Oversold, but Positioning Structure Is Quietly Changing

15 m

BNP Paribas Launches Ethereum Money Market Fund Tokenization Pilot Project

24 m

Pin