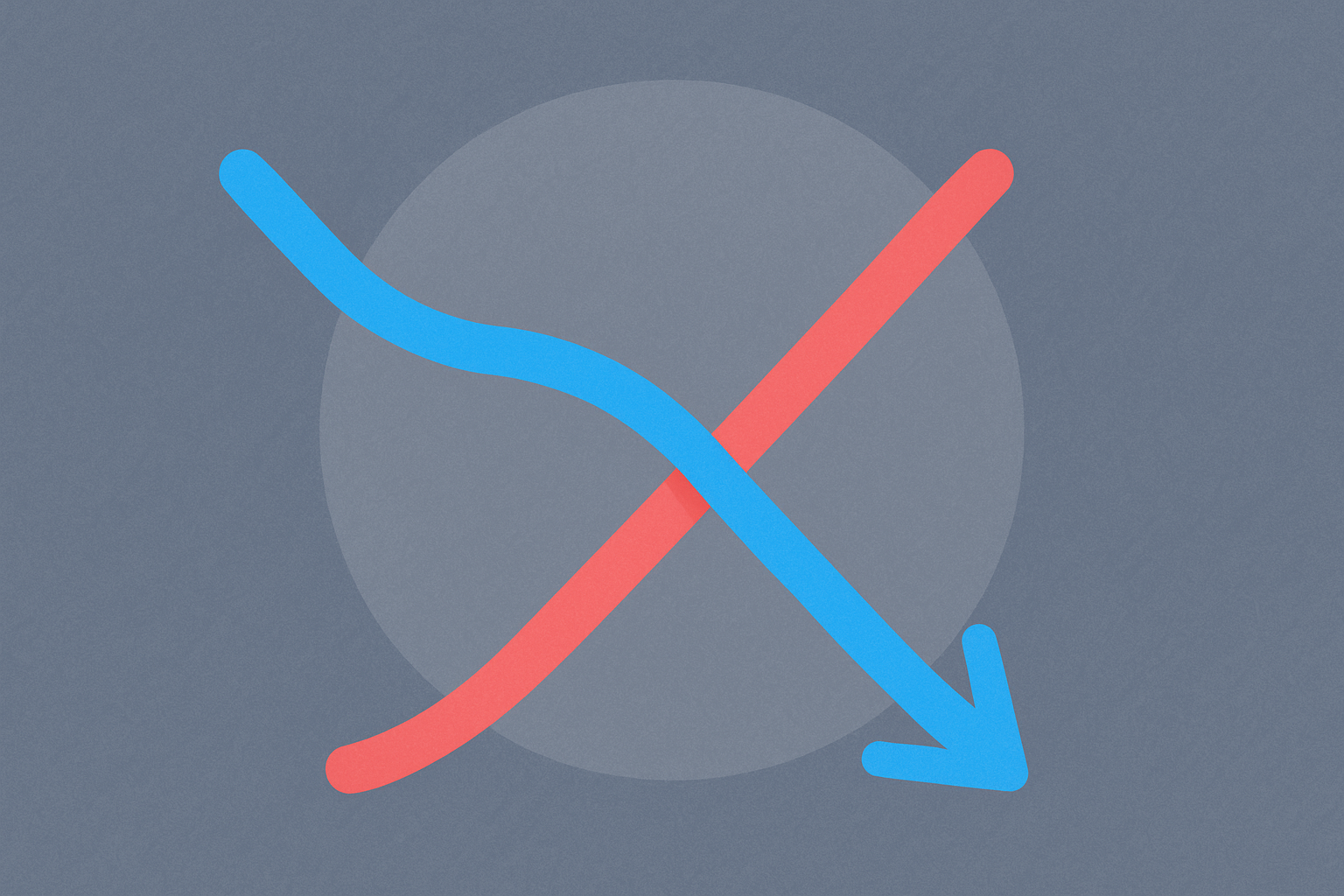

death cross

Death cross is a significant technical analysis indicator, typically viewed as a bearish signal that occurs when a short-term moving average crosses below a long-term moving average. In cryptocurrency markets, the most common death cross formation happens when the 50-day moving average falls below the 200-day moving average, often indicating strengthening bearish sentiment and a potential downward trend. Many traders use the death cross as a sell signal or a trigger to adjust investment strategies, particularly in highly volatile markets like cryptocurrencies, where its warning function becomes even more important.

Key Features of Death Cross

As a technical formation, the death cross has several key characteristics:

-

Formation mechanism: A death cross forms when a short-term moving average (such as the 50-day line) crosses below a long-term moving average (such as the 200-day line), indicating that short-term price momentum has turned negative.

-

Market significance: It's typically interpreted as a strong bearish signal, meaning the short-term market trend has weakened relative to the long-term trend, potentially foreshadowing a larger price decline.

-

Timeframe diversity: Death crosses can form on charts of various timeframes, including daily, weekly, or even hourly charts, with signals on different timeframes carrying varying strengths and reliability.

-

Confirmation signals: Truly effective death crosses usually require confirmation through increased trading volume, price breaking through key support levels, or other technical indicators.

-

Reversal possibility: The death cross is not an absolutely accurate predictive tool, and false signals can occur, especially in sideways or consolidating markets.

Market Impact of Death Cross

The impact of a death cross on cryptocurrency markets is primarily manifested in the following aspects:

-

Sentiment trigger: When major cryptocurrencies like Bitcoin experience a death cross, it often sparks widespread discussion in media and social platforms, intensifying market panic.

-

Trading behavior changes: Many algorithmic trading systems and technical analysis traders adjust their strategies based on death cross signals, potentially leading to collective selling behavior that further accelerates price declines.

-

Historical correlation: Following several major death cross events in Bitcoin's history, significant price adjustments often occurred, reinforcing market attention to this signal.

-

Liquidity impact: After a death cross appears, market liquidity may be affected, with bid-ask spreads potentially widening and trading costs increasing.

-

Institutional response: Some institutional investors also use the death cross as one of their risk management reference indicators, potentially adjusting asset allocation strategies accordingly.

Risks and Challenges of Death Cross

When using the death cross as a basis for trading or investment decisions, the following risks and challenges should be noted:

-

Lag risk: The death cross is a lagging indicator; by the time the signal appears, the price decline may have been underway for quite some time, posing the risk of being "a step too late."

-

False signals: In oscillating markets or low-liquidity environments, death crosses may produce misleading signals, leading to unnecessary trading actions.

-

Over-reliance risk: Relying solely on single technical indicators like the death cross while ignoring fundamental analysis and other market factors may lead to decision-making errors.

-

Market manipulation concerns: In some smaller-cap cryptocurrencies, large holders might exploit the psychological effects of technical indicators by deliberately creating death cross formations to trigger selling.

-

Cycle adaptability differences: Different cryptocurrencies have different price cycle characteristics, and the same death cross signal may have completely different reliability across different assets.

As a classic technical analysis tool, the death cross receives widespread attention in cryptocurrency markets, but its value is best realized when used in combination with other analytical methods. Understanding the limitations and applicable scenarios of the death cross is crucial for cryptocurrency investors and traders. Whether experienced traders or market newcomers, everyone should view the death cross as part of their decision-making reference rather than an absolutely accurate predictive tool. In highly volatile markets like cryptocurrencies, comprehensive risk management strategies are far more important than any single technical indicator.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?