XRP Price Prediction: Price Pulls Back Nearly 19% From High, $3 Becomes Key Support Level

Major Capital Positions for the Next Uptrend

Following a robust rebound in mid-July, XRP’s price retreated from its $3.65 peak. It recently came close to the key $3 round number. The drawdown from the high reached nearly 19%. Despite a shift toward caution in market sentiment, on-chain data signals a different directional trend.

Whales Accelerate XRP Transfers to Cold Wallets

Glassnode data shows that from July 23 to July 26, the total XRP tokens held on centralized exchanges fell sharply—from around 4.45 billion to 4.25 billion tokens. This pattern usually indicates that holders are opting for long-term holding and reduced trading activity, rather than preparing to sell.

On-chain analyst Captain Redbeard commented, “This capital flow shows that most market participants prefer to withdraw XRP from exchanges, likely in response to current volatility, and are waiting for more favorable entry points.”

Insider Selling Triggers Short-Term Correction

Recently, a Ripple co-founder sold $140 million worth of XRP, which resulted in $845 million of realized losses in a single day. However, overall trading volume remains elevated, currently at $6.2 billion. Major capital has not fundamentally changed its long-term bullish positioning due to this latest round of selling pressure.

Correction May Be Approaching Its End

Technically, the RSI dropped from a heated 72 to 59, indicating that the market has exited overbought conditions and may be entering a period of sideways consolidation or a rebound. Some investors may seize the opportunity to accumulate at lower levels.

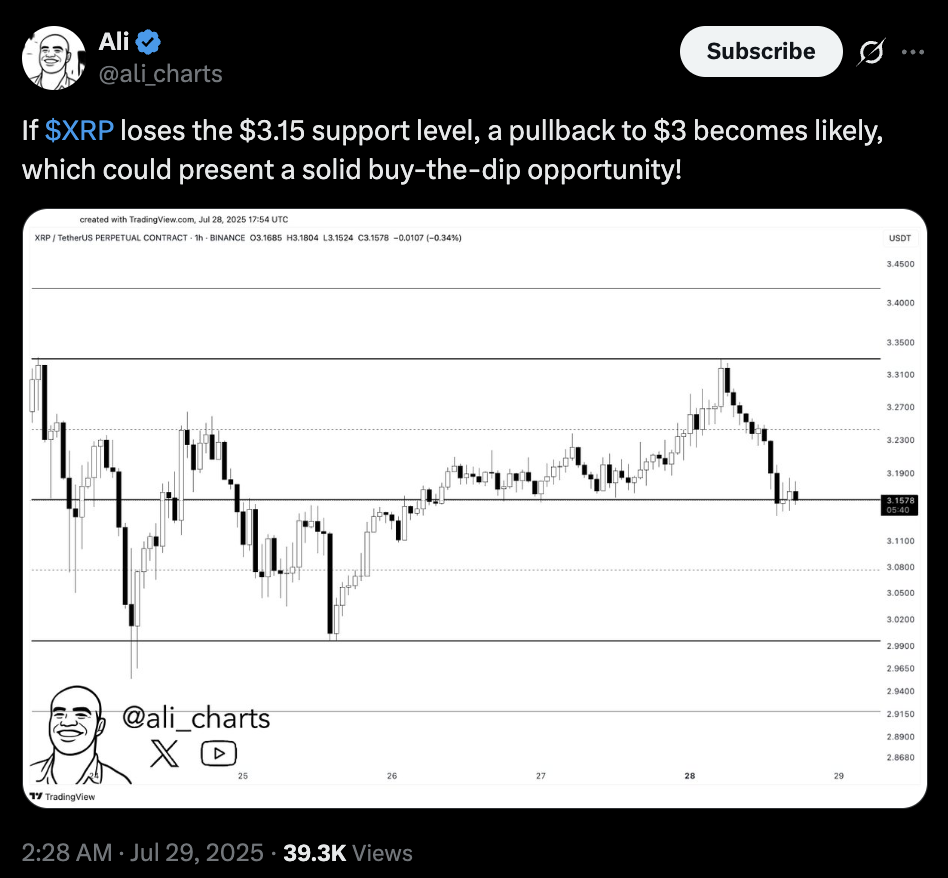

Technical analyst Ali Martinez pointed out that $3.15 is a key support level. If this support level cannot hold, XRP may test $3 or below. However, he added, “This could be a very strong buy-the-dip opportunity.”

(Source: ali_charts)

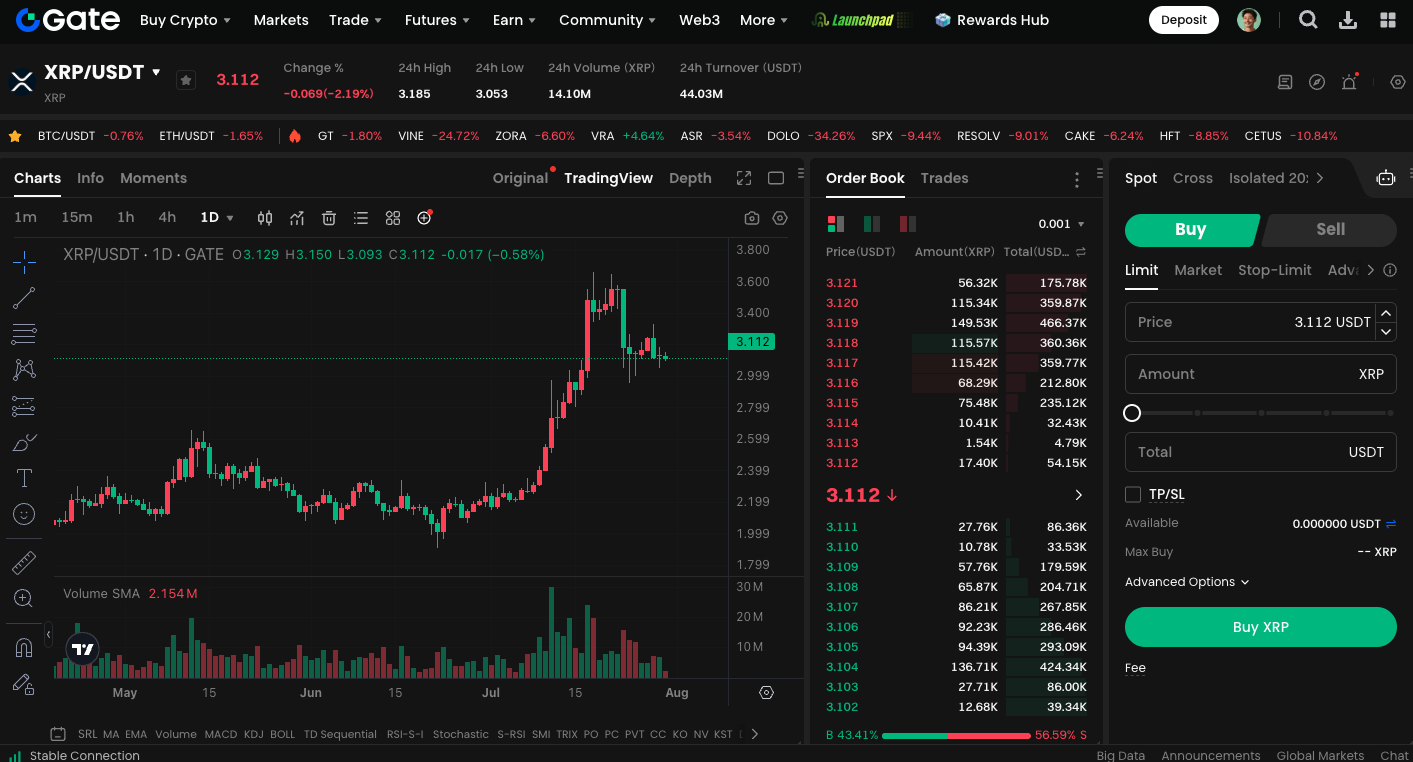

Begin trading XRP spot now at: https://www.gate.com/trade/XRP_USDT

Summary

Recently, XRP has declined nearly 19% after reaching a $3.65 high on July 18, 2025, and is now consolidating near $3.15. While market sentiment has become more neutral, and short-term profit-taking plus insider selling have exerted pressure, on-chain data shows that most large holders are moving tokens off exchanges, signaling a preference for long-term holding. If XRP can maintain the critical $3 support, further rebounds remain possible. This could potentially offer attractive buy-the-dip opportunities.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article