The US SEC has begun to take action against crypto treasury companies. Will the DAT narrative continue?

On September 24, the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) jointly announced an investigation into over 200 publicly listed companies that previously disclosed crypto treasury plans, citing “unusual share price volatility” that occurred immediately prior to the release of such news.

Since MicroStrategy pioneered adding Bitcoin to its balance sheet, “crypto treasury” has become a prominent feature in the U.S. equity markets—stocks such as Bitmine and SharpLink have achieved multi-fold price surges after similar moves. Data from Architect Partners shows that since 2025, 212 new companies have announced plans to raise approximately $102 billion for the acquisition of major crypto assets like BTC and ETH.

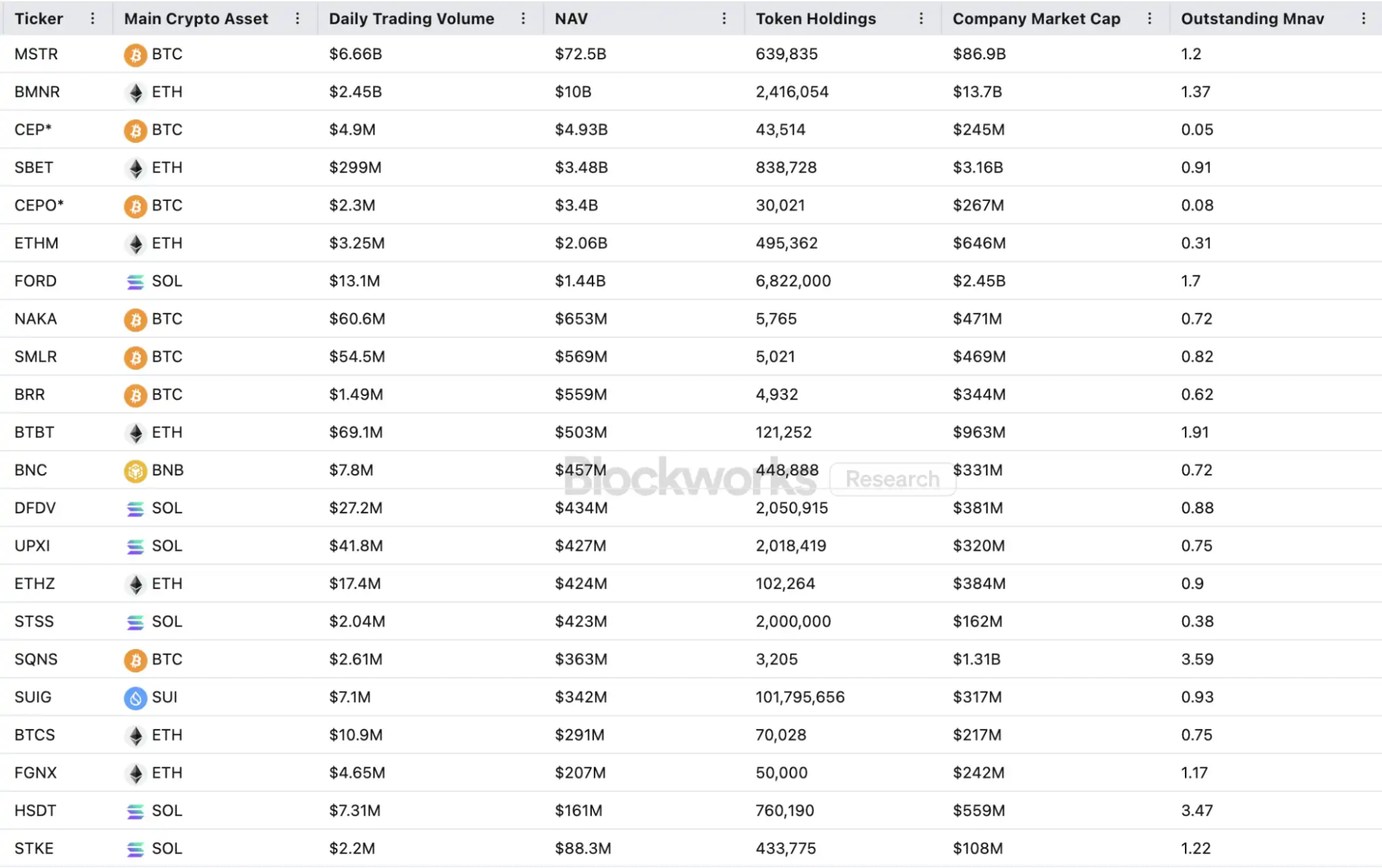

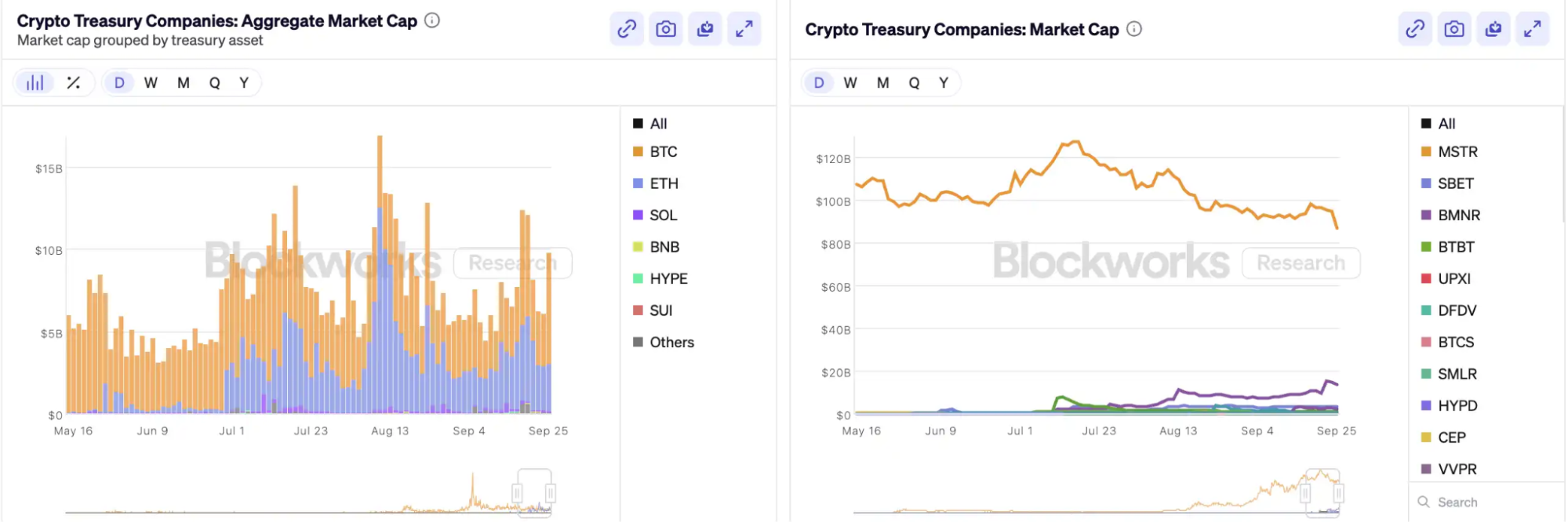

This capital frenzy has driven prices higher but also triggered widespread skepticism. In just one month, MSTR’s market cap to NAV ratio (mNAV) dropped from 1.6 to 1.2, and two-thirds of the top twenty crypto treasury companies now have mNAVs below 1. Market participants are raising concerns about asset bubbles and insider trading, and this emerging asset allocation trend faces unprecedented regulatory scrutiny.

How Do Crypto Treasury Companies’ Flywheels Work?

Treasury companies’ financing flywheels rely on the mNAV mechanism—a fundamentally reflexive logic that gives treasury companies seemingly “unlimited ammunition” in a bull market. mNAV is the market cap to NAV ratio, calculated as the company’s market cap (P) divided by per-share net asset value (NAV); in the context of treasury companies, NAV refers to digital asset holdings.

When share price P exceeds per-share NAV (i.e., mNAV > 1), the company can keep raising capital and reinvesting in digital assets. Each new issuance and purchase increases per-share holdings and book value. This process reinforces the market’s confidence in the company’s story and drives stock prices higher. This sets off a positive feedback loop: mNAV rises → new fundraising → crypto asset purchases → higher per-share holdings → stronger market confidence → further stock price appreciation. This mechanism has allowed MicroStrategy to continuously finance and buy Bitcoin for years without significant dilution.

When stock price and liquidity reach sufficient levels, the company can unlock a full suite of institutional funding channels. These include issuing debt, convertible bonds, preferred stock, and other instruments. The company monetizes market narratives as balance sheet assets, which in turn support higher stock prices and reinforce the flywheel. Ultimately, this is a complex interaction between stock price, narrative, and capital structure.

Yet, mNAV is a double-edged sword. A premium may reflect strong market trust—or just speculation. Once mNAV converges to or falls below 1, the market shifts from “accretion logic” to “dilution logic.” If token prices decline at this stage, the flywheel reverses into negative feedback, hitting both market cap and confidence. Treasury companies’ fundraising is also built on mNAV’s premium flywheel; if mNAV remains discounted, the window for new issuances closes, and small/mid-cap shell companies—already stagnant or at risk of delisting—face total collapse as their flywheel effect evaporates. Theoretically, if mNAV < 1, the rational move is for the company to sell assets and buy back shares to restore balance, though discounted firms may also simply be undervalued.

During the 2022 bear market, even when MicroStrategy’s mNAV fell below 1, the company chose not to sell Bitcoin or buy back shares, but instead preserved its holdings by restructuring debt. This “hold at all costs” philosophy comes from Saylor’s unwavering conviction in BTC, treating it as core collateral that will “never be sold.” Most treasury companies can’t replicate this approach. Many altcoin treasury companies lack stable core businesses and pivot to “buying crypto” as a survival tactic, not out of conviction. When market conditions worsen, they are more likely to sell to cut losses or realize profits, potentially triggering a selloff.

Further reading: “First Token Sale, Delisting: Crypto Stocks Are No Longer the Untouchables of the Crypto Market“

Is Insider Trading Present?

SharpLink Gaming was among the earliest examples to rock the market during the “crypto treasury craze.” On May 27, the company announced plans to acquire up to $425 million in Ethereum as reserve assets, sending its stock price soaring to $52 on the day of the announcement. Oddly, trading volume had already surged on May 22, with the price jumping from $2.7 to $7—before any announcement or SEC disclosure.

This pattern of price movement ahead of news is not unique. On July 18, MEI Pharma announced a $100 million Litecoin treasury strategy, but its stock nearly doubled over the four days preceding the announcement, climbing from $2.7 to $4.4. The company didn’t file any major updates or issue press releases, and its spokesperson declined comment.

Similar anomalies appeared at Mill City Ventures, Kindly MD, Empery Digital, Fundamental Global, and 180 Life Sciences Corp, with abnormal trading preceding crypto treasury announcements. Regulators have taken notice of potential information leaks and advance trading.

Will the DAT Narrative Collapse?

Arthur Hayes, advisor to “Solana MicroStrategy” Upexi, notes that crypto treasury has become a new narrative in the traditional corporate finance sector. He expects this trend to spread across leading asset classes, but cautions that each chain will likely produce only one or two winners.

Concentration effects are accelerating. Although over 200 companies have announced crypto treasury strategies in 2025, spanning BTC, ETH, SOL, BNB, TRX and more, capital and valuations are quickly clustering around a handful of companies and assets—BTC and ETH treasuries dominate the DAT landscape. In each asset class, one or two companies break out: MicroStrategy for BTC, Bitmine for ETH, possibly Upexi for SOL, while most others remain small-scale.

As Michael Saylor demonstrated, institutional fund managers seeking Bitcoin exposure often can’t buy BTC directly or hold ETFs, but can buy MSTR shares. If you package a crypto asset-holding company to fit their compliance requirements, these funds are willing to pay $2, $3, or even $10 for every $1 of book value. This isn’t irrational—it’s regulatory arbitrage.

Late-cycle, new issuers will keep emerging and pursue more aggressive financing instruments for higher share price elasticity. When prices drop, these tactics will backfire. Arthur Hayes predicts that this cycle will feature major DAT blow-ups akin to the FTX implosion, with stocks and bonds facing steep discounts and causing market turmoil.

Regulators are responding to this structural risk. In early September, Nasdaq proposed stricter reviews for DAT companies; today, the SEC and FINRA have launched joint investigations into insider trading. These moves aim to shrink the space for insider activity, raise the bar for new issuances, and limit financing options—reducing the scope for manipulation among emerging DAT companies. For the market, this means false leaders will be purged faster, while true leaders survive and grow with their narrative.

Conclusion

The crypto treasury narrative persists, but increasing thresholds, enhanced regulation, and the clearing of bubbles will occur simultaneously. Investors should understand the underlying financial structures and arbitrage paths, and remain vigilant regarding the accumulation of risks beneath the narrative—this trend in on-chain financial innovation has its limits, with successful companies prevailing and others exiting the market.

Statement:

- This article is reprinted from [BlockBeats], copyright belongs to the original author [kkk]. For any concerns about reproduction, please contact the Gate Learn team; the team will provide assistance in accordance with Gate Learn policies.

- Disclaimer: The views and opinions expressed here are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize these translations unless Gate is cited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?