The PUMP Thesis

Okay, so the last thesis I wrote ending up being profitable, then a complete roundtrip, so proceed with caution if you’re a scared wussy, if you’re a gigachad then here’s my thesis on the casino you get to own… $PUMP.

I should also start by saying, this is not financial advice, if you are taking advice from an anonymous pirate called hoeem on the internet then you’re a silly billy, this is my thesis, and this is my money invested, and if I lose, I lose my money, if I win, I win more money, I don’t make money from you making money, I don’t lose money from you losing money, this is a thesis, so let‘s begin…

Pump is the most successful crypto casino that has ever existed and has a loyal user base happy to gamble on it time after time.

It’s a casino that you get to profit from due to its buybacks.

Every gambler, every streamer, every speculator piling in generates fees. And those fees don’t vanish into some VC black hole. They’re recycled straight back into $PUMP buybacks.

You’re not betting against the house. You are the house.

I’m also writing this as Upbit & Binance just listed $PUMP and there’s a bit of dumping onto the Koreans, so if you are being a little cautious, here’s some magical lines drawn by my good friend Ricardo (he’s good at this):

1. Revenues don’t lie

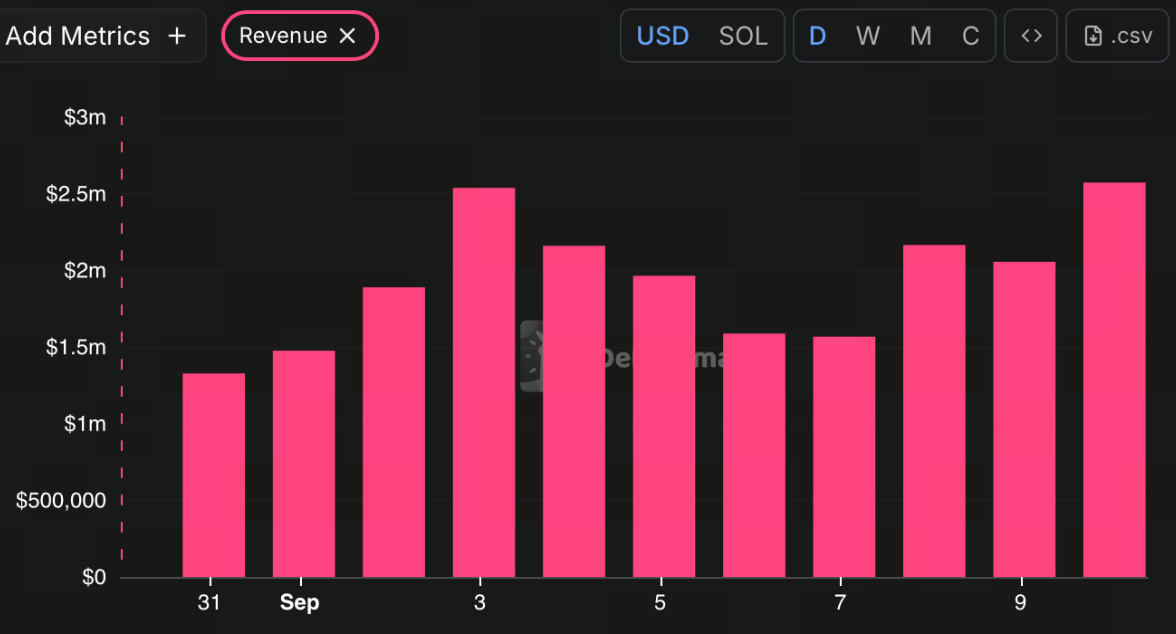

Over the last week:

– Pump revenue = $14m

– Hype revenue = $16m

Similar weekly revenues. Yet Hype trades at 10x Pump’s valuation.

That mispricing won’t hold.

2. Streaming = early innings

Twitch is a $50bn business. It barely pays its streamers. Pump tokenises attention and pays more and is on track to do the same amount of revenue despite it only beginning its journey in the world of streaming.

$1m in streamer token volume = $10k+ in payouts.

Annualised revenue: Pump ≈ $750m. Twitch ≈ $1.7bn.

Market cap valuation: Twitch = $50bn. Pump = ~$2bn.

Even modest adoption sends Pump through $1bn revenue. The spread is absurd.

Since this new method for creators to earn via coins and streaming we’ve seen a spike in revenue.

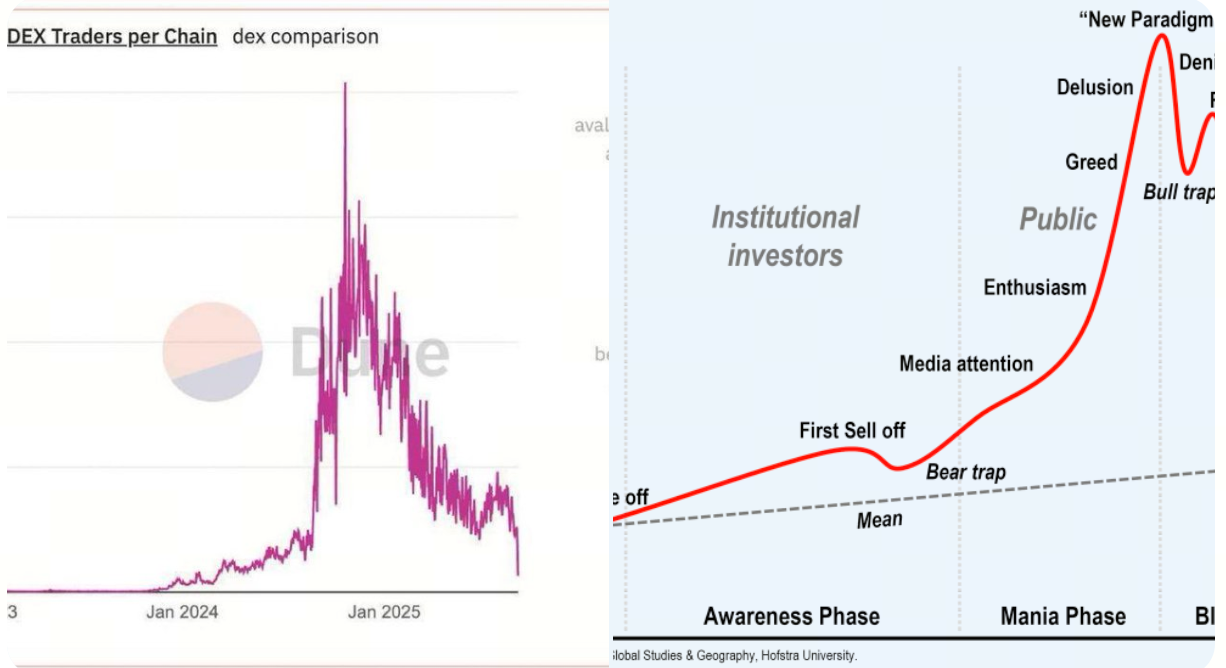

This is whilst Solana DEX transactions are in despair and yet we still see insane revenue being produced by pump dot fun.

3. Gambling meta

Risk-on in Q4? Degens aren’t flying to Vegas. They’re gambling on Pump coins.

Every bet on a new coin that has graduated = more fees.

More fees = more buybacks.

More buybacks = tighter supply.

That’s the loop.

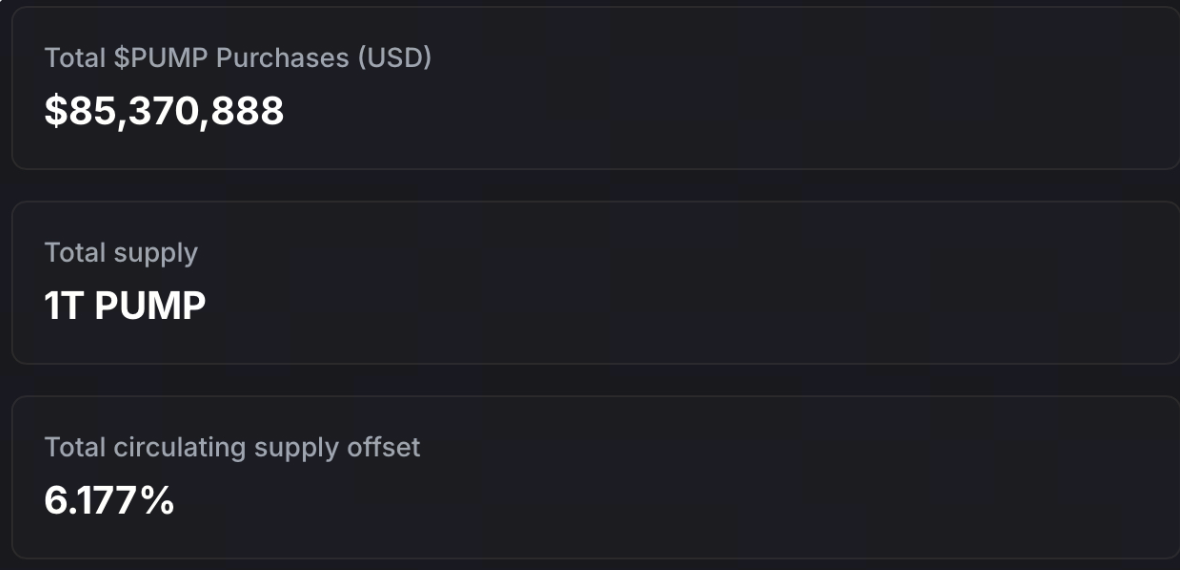

4. The buyback engine

Pump has already bought back ~$85.37m+ worth of tokens… 6.1%+ of circulating supply already.

Daily = $1–2.5m.

Monthly at peak run-rate = $100–150m.

On a $2b mcap token, that’s material.

Liquidity in core pools is only $20–30m. Buybacks hit like a truck.

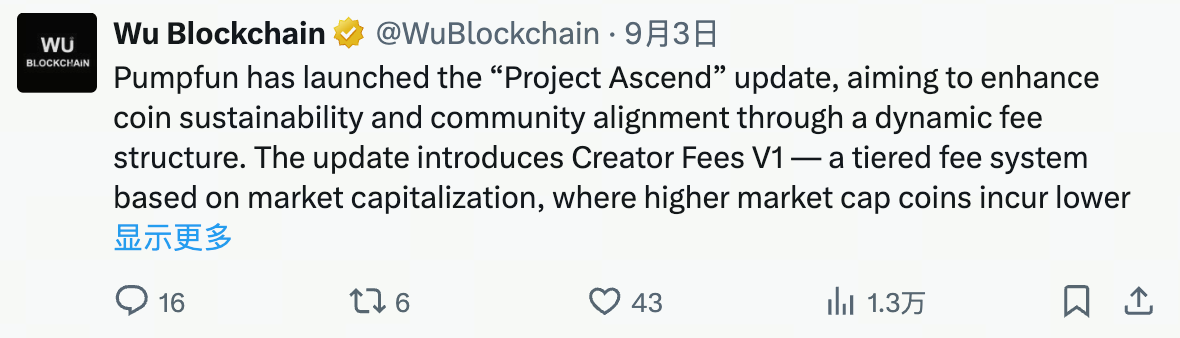

5. Ascend = moat

Memes normally die after hype. Ascend fixes it.

Creators now earn 10x higher fees as their tokens grow.

Within just 24h of its launch: $2m+ paid out to creators.

We can agree or disagree or the ethics of this, I don’t care, it fits my pump thesis for more fees and more revenue and more buybacks.

Knock-ons:

– Pumpswap flipped Raydium + Meteora, doing $878m daily volume.

– MEXC now lists a Pump ecosystem coin every Monday.

– Devs stick around because their income scales with their project.

That’s how you build a moat.

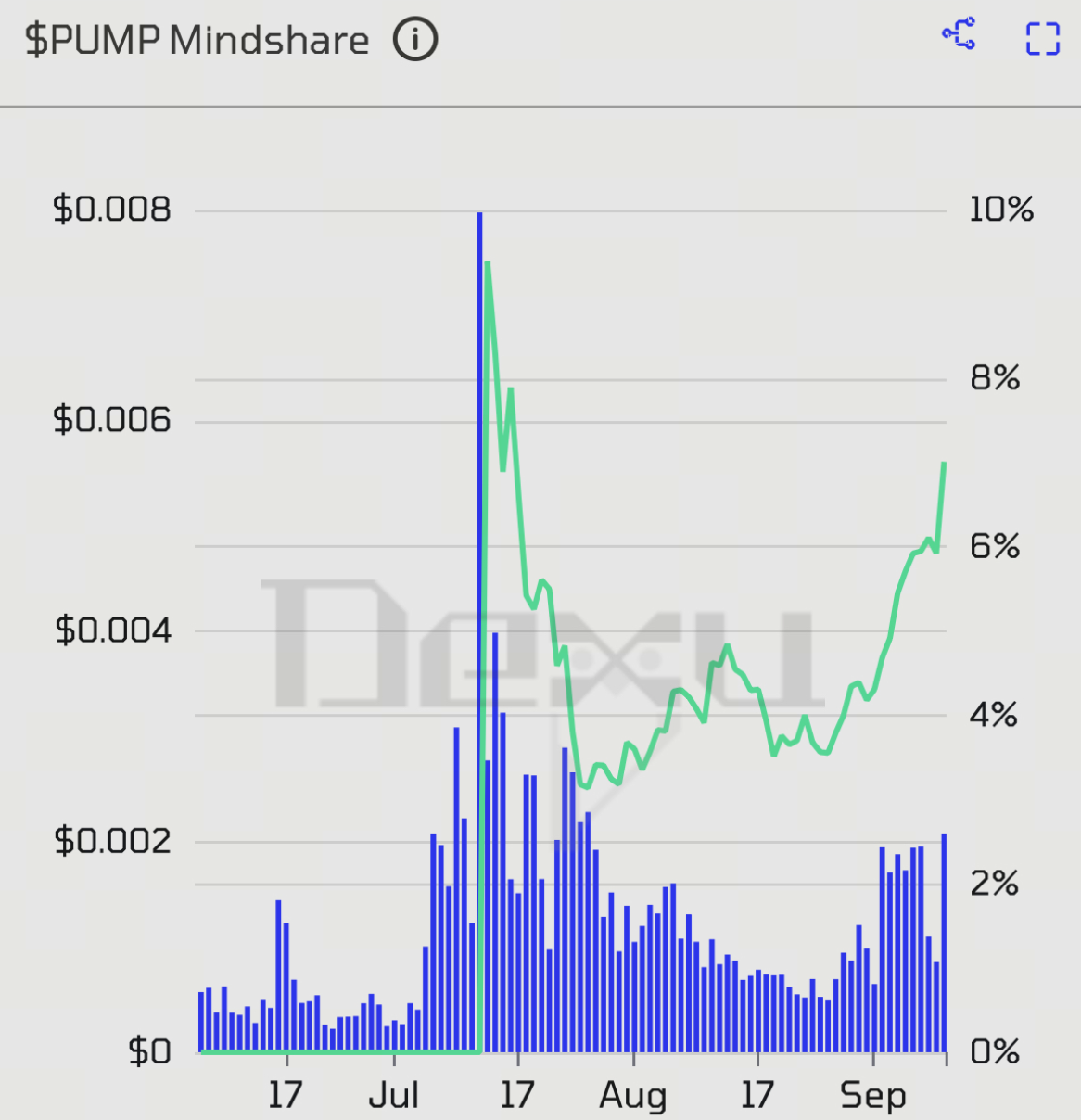

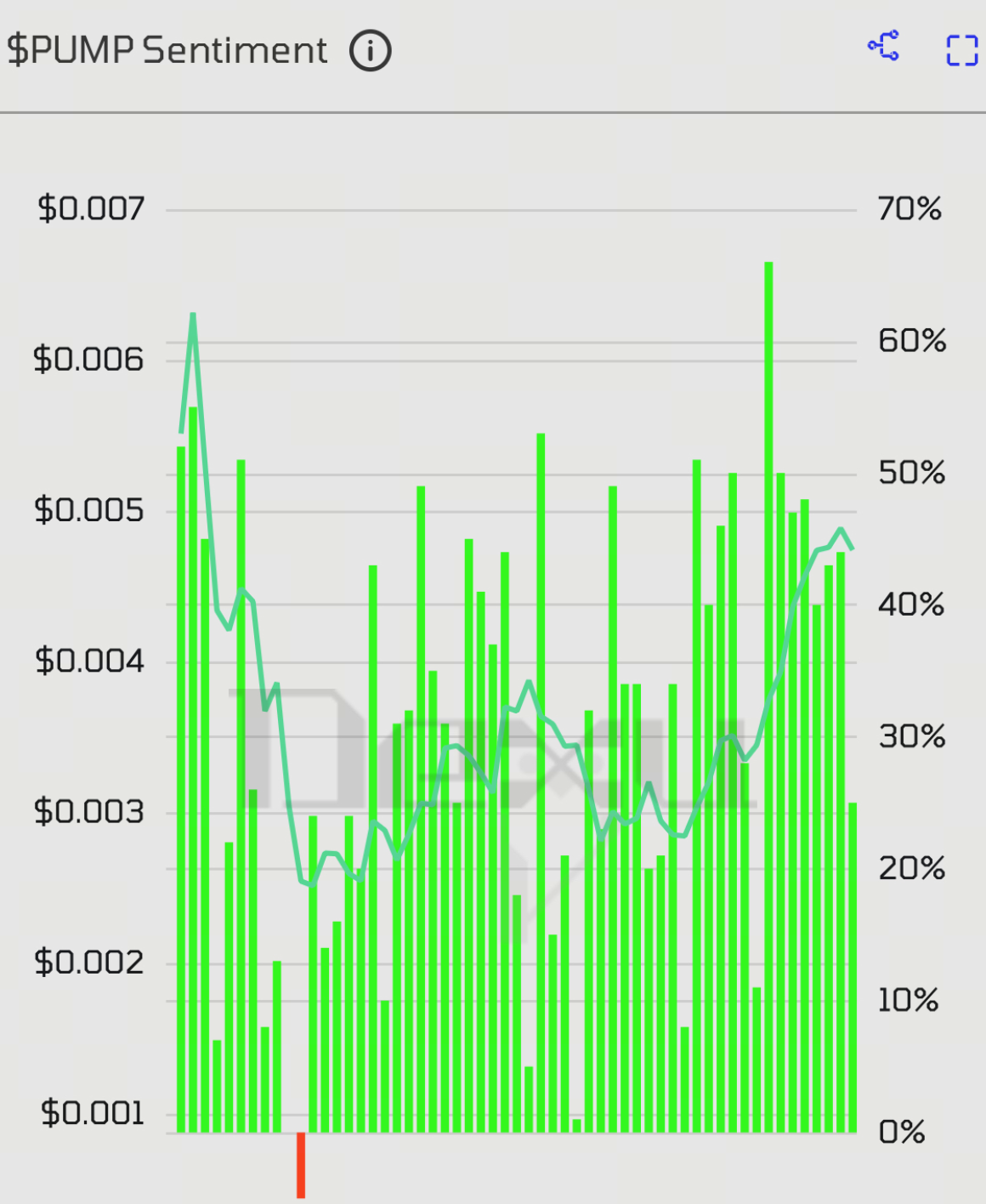

6. Sentiment + mindshare turning

Charts don’t lie either.

– Mindshare: After the early July blow-off, Pump bottomed but kept climbing. Mindshare has rebounded from ~3% to over 6% and rising. Market share of attention is compounding.

– Sentiment: Even after the price collapsed post-ICO, sentiment is starting to trend up but there’s still a tonne of doubters.

(The above data is from @ _dexuai, one of my favourite analytical protocols, if you want access to their data you can use code HOEM for 15% off, thought I should shill them as it’s my boy @ CryptoKoryo love child and he’s the goat)

People capitulated but since then they’ve re-rated the project as revenue + buybacks kicked in.

When mindshare rises, sentiment turns, and fundamentals improve, that’s conviction.

7. Ecosystem expansion

Pump isn’t static. It’s stacking features:

– 98% of revenue recycled into buybacks.

– @ bubblemaps integration for cleaner token discovery.

– Loyalty airdrops retaining users.

– Reframing memes as viral apps.

Every layer strengthens the flywheel.

The bigger picture:

Pump launched messy. Price dumped. Everyone, literally everyone, including myself laughed.

Now?

– Revenues are compounding.

– Buybacks are relentless.

– Mindshare + sentiment are climbing.

– Streaming + gambling metas are early.

Pump isn’t just any casino.

It’s the most successful crypto casino that exists.

It’s the casino you get to own with token buybacks.

Disclaimer:

- This article is reprinted from [crypthoem]. All copyrights belong to the original author [crypthoem]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?