The Current State and Future Outlook of Ethereum Layer2: A Sober Reflection Behind the Prosperity

Introduction

In the scaling boom of the Ethereum ecosystem, various Layer2 solutions have emerged like bamboo shoots after a spring rain. To date, over 150 Ethereum Layer2 networks have been launched. Many projects attract attention with the selling point of “faster and cheaper”, but market data has poured cold water on this: according to L2Beat data, among these 150+ L2s, most have a Total Value Locked (TVL) of less than $1 million, and user activity is extremely thin. Against this backdrop, we must reflect: Can so many Layer2 networks really achieve effective scaling? Is there still a need for large-scale development of new L2s? This article will conduct an in-depth analysis from multiple perspectives including current status data, driving factors, existing problems, and future development, to help readers rationally view the “cold reflection behind the prosperity” of the Layer2 ecosystem.

Analysis of the Current State of Layer2

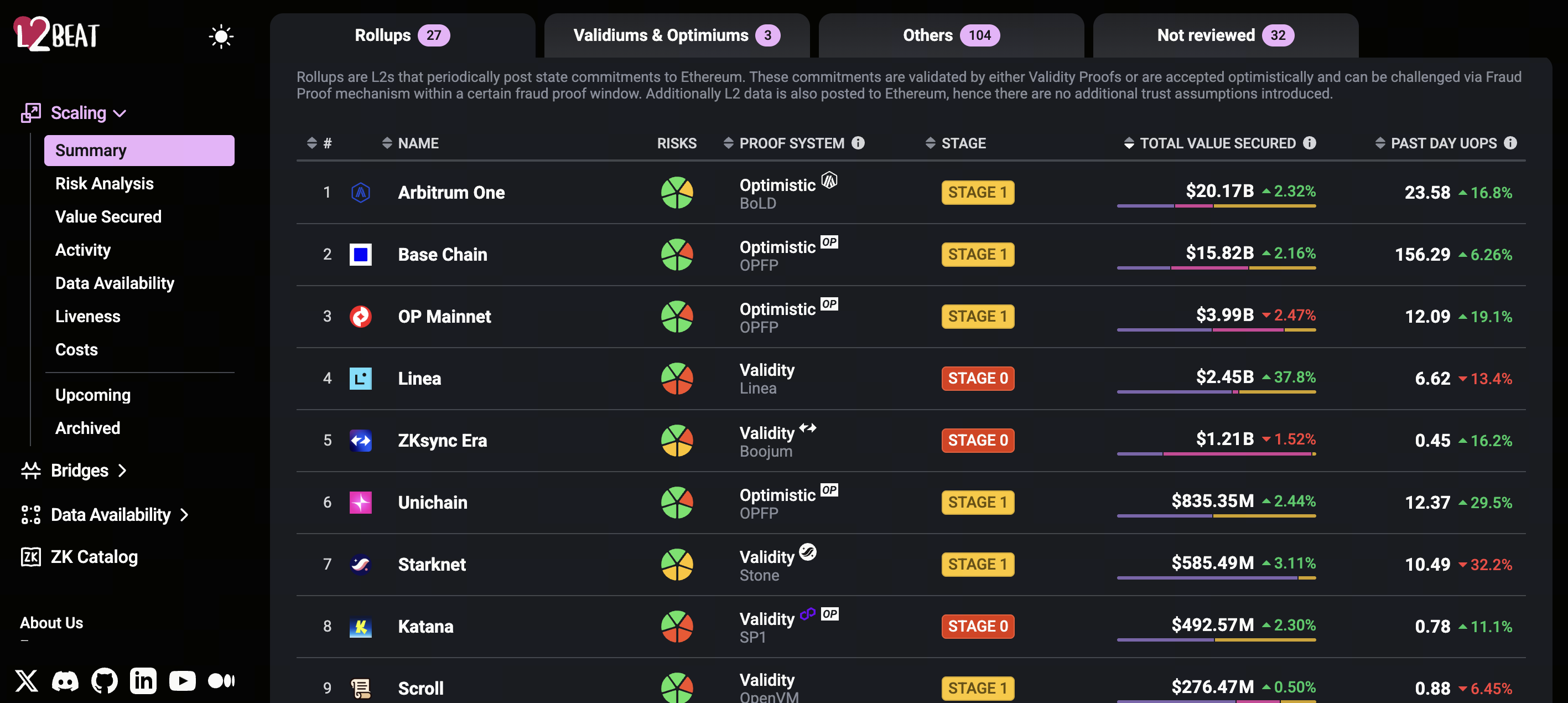

Currently, the Ethereum Layer2 ecosystem presents a pattern where a few leading projects are at the forefront, while the majority of projects are almost neglected. Looking at the data, according to the latest statistics from L2Beat, Arbitrum One ranks first with a TVL of about $20.53B, closely followed by Coinbase’s Base chain with a TVL of about $15.97B. Optimism Mainnet ranks third with a TVL of about $4.14B. Other projects such as ConsenSys’s Linea ($2.57B), zkSync Era ($1.24B), StarkNet ($0.60B), etc., have TVL scales far behind. In contrast, projects like ZKSync Lite, Loopring, Polygon zkEVM have TVLs only in the tens of millions of dollars, and projects like ZERO Network, Zk.Money, INTMAX have only a few million dollars or even less. It can be said that the top five L2 projects account for the vast majority of Layer2 funds in the Ethereum ecosystem, while most other L2 projects only have a small market share.

Source: https://l2beat.com/scaling/summary

In terms of on-chain activity, leading L2s are also far ahead. According to statistics, Arbitrum One’s highest TVL peak in April 2024 exceeded $2 billion, accounting for about 65% of all L2 TVL. As of the end of August 2024, its number of unique addresses reached 37.47M, with active addresses reaching 1.48M in a single day in May 2024; in terms of transaction volume, Arbitrum’s daily transactions once exceeded 5 million, with a daily average of millions, far surpassing Ethereum mainnet’s level of about 1.1 million during the same period. In June 2025, Dune data showed that Arbitrum’s daily active addresses had exceeded 1.2 million. In comparison, other mainstream L2s have relatively low daily active and transaction volumes. For example, Optimism’s active addresses are significantly lower than Arbitrum’s, while Base’s ecosystem is still in cultivation in its early stages. Not to mention the vast majority of small L2 projects, where even basic daily transactions are few and far between—as L2Beat points out, most small L2 projects have “thin user activity”, which can basically be considered as almost unused.

Economic indicators show a similar divergence: Cointelegraph reported that after Ethereum’s Dencun upgrade, the total TVL of L2s reached a record $48.2 billion, with over 90% concentrated in a few Rollup projects. From various aspects, the Ethereum Layer2 ecosystem shows a “Matthew effect”: a few L2 networks have huge volume and thriving ecosystems, while most other L2 networks are almost in a dormant state, with data, liquidity, and users extremely dispersed or even silent.

Reasons for the Surge in Layer2 Numbers and Pain Points

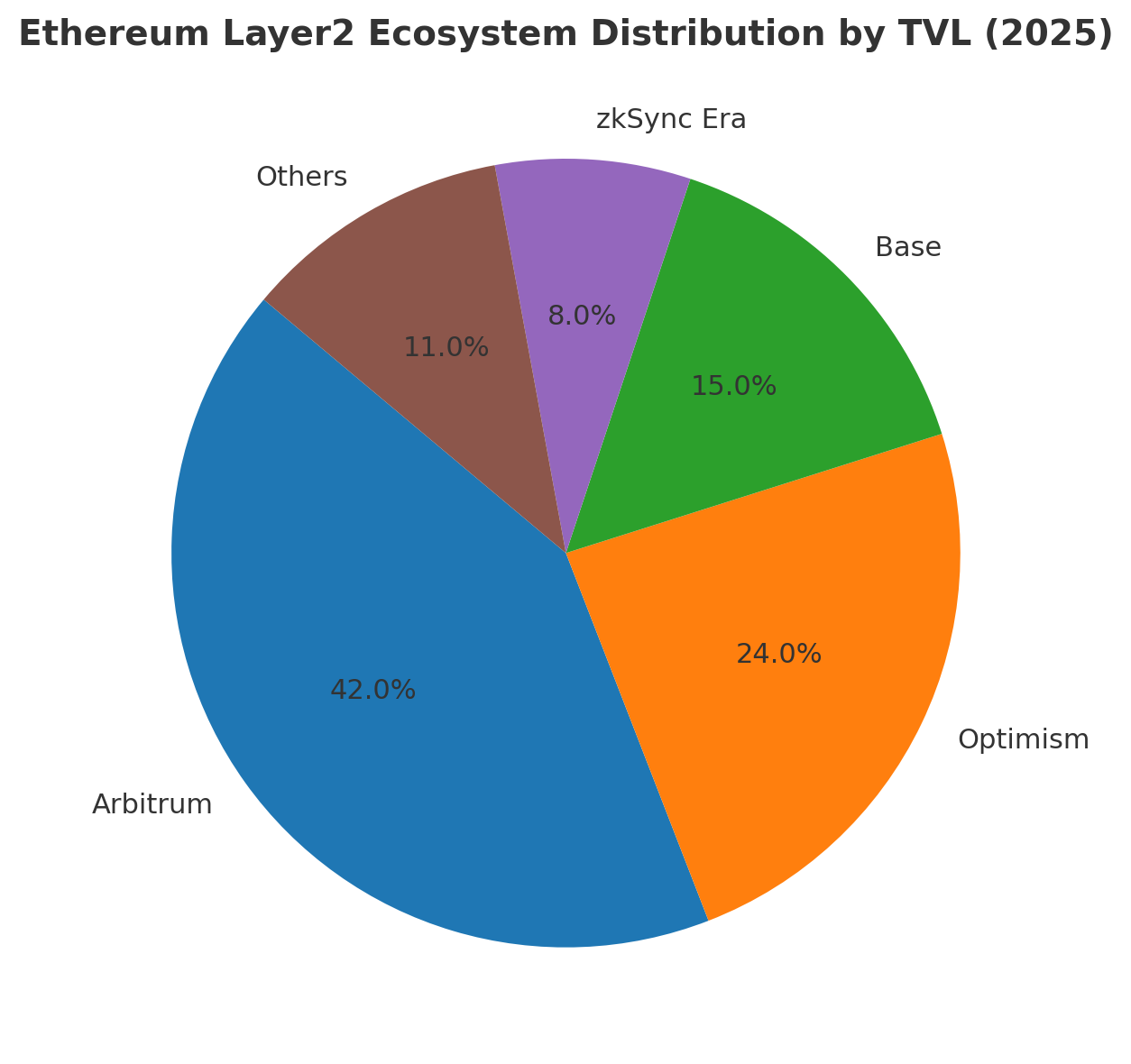

2025 Layer2 Market Share Chart (Source: Gate Learn Creator Max)

Behind this “Matthew divergence” status quo, there are multiple drivers and pressing issues behind the surge in Layer2 numbers:

- Lowered Rollup Technology Threshold: In recent years, the development threshold for Rollup frameworks has significantly decreased. Taking OP Stack as an example, this open-source development toolkit allows any team to “one-click” build their own Optimistic Rollup network. As of mid-2024, OP Stack has supported 26 independent chains (24 of which as L2); Arbitrum’s Orbit framework also has 21 chains running (9 of which are L2). In August 2023, Polygon Labs launched Polygon CDK (Chain Development Kit), focusing on rapid deployment of customizable ZK. These frameworks, like “Lego bricks”, allow developers to quickly copy and modify code to generate new Layer2s. This has greatly reduced the difficulty of building Layer2 from a technical perspective, giving rise to a large number of homogeneous projects.

- Airdrop Expectations and Capital Push: The “airdrop fever” and investment speculation in the crypto field are also important reasons for quickly launching new L2s. Past airdrops from Layer2s like Arbitrum and zkSync have triggered large-scale user migration and speculation waves. For example, after Arbitrum released its airdrop rules, its TVL once soared to $2.25 billion, accounting for 66.9% of the L2 ecosystem, with active addresses exceeding 4 million and weekly active nearly 1.38 million. Similarly, there is a widespread mentality of “use first, earn airdrop later” in the zkSync and StarkNet communities, driving users to flock to new projects after launch. In the capital market, many investment institutions and project teams have seen the incremental space of Layer2 and have openly supported or invested in new L2s, further creating an atmosphere where new L2s have market heat upon launch and their tokens are highly anticipated.

- Fragmented User Experience and Ecosystem Repetition: As L2 networks increase, users and funds face dispersion risks. Each L2 network needs to build its own user interface, wallet support, cross-chain bridges, etc., requiring users to constantly switch between different chains and carry assets, resulting in an inconsistent experience. Moreover, different L2 networks often duplicate the construction of infrastructure and ecosystems, causing resource waste. For example, Arbitrum, Optimism, Base, and other L2s all have their own Token bridges and DeFi applications, with highly fragmented liquidity and users. Users wanting to transfer funds across L2s still need to rely on bridge protocols with questionable security, and users have suffered heavy losses from numerous cross-chain bridge hacks in recent years. In fact, multiple private key leaks and smart contract vulnerability incidents in cross-chain bridges (such as Ronin, Wormhole, Nomad, etc.) have already proven the weak links in bridge security.

- Sequencer Centralization Issue: Mainstream L2s currently generally use centralized Sequencers to improve throughput, but this brings trust and security concerns. For example, after a $2.6 million attack incident on Linea, the zkEVM project launched by ConsenSys, its team promptly suspended the Sequencer and “censored the attacker’s address”, exposing the censorship risk of centralized Sequencers. Cointelegraph points out that currently, the vast majority of Rollups still rely on a single centralized Sequencer, which not only deviates from the decentralized spirit of blockchain but also exposes users to risks such as transaction rejection and MEV monopolization. Although many projects have included Sequencer decentralization in their roadmaps, truly implementing it still needs to overcome the dual challenges of economic incentives and technical design.

In summary, the lowered Rollup technology threshold and speculative heat have rapidly catalyzed the surge in Layer2 numbers, but have also brought multiple pain points such as fragmented user experience, resource waste, and security risks. All of this is worth deep thought for developers, investors, and users: With so many L2s today, is there still a need for each new Layer2?

Is There Still a Need to Develop More Layer2s?

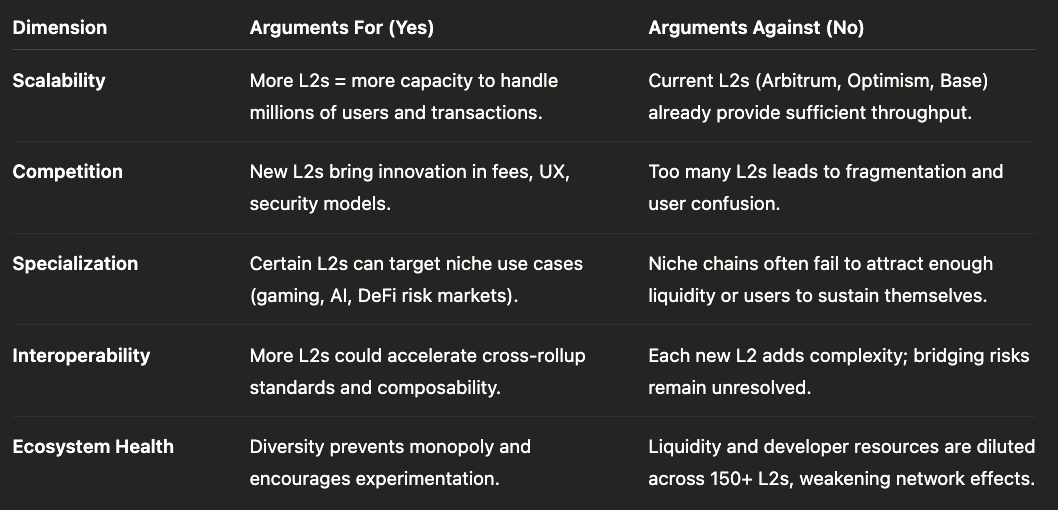

Facing the current crowded Layer2 track, we can conduct dialectical analysis from multiple angles:

- Scaling Needs vs. Resource Waste: On one hand, there is indeed a need for scaling on the Ethereum mainchain. From a macro perspective, applications such as DeFi, NFTs, games, and social networking continue to move on-chain, demanding higher transaction throughput and lower costs. Different scenarios may require differentiated Layer2 positioning—for example, gaming chains may focus more on high throughput, DeFi chains may emphasize secure settlement, and privacy applications may lean towards ZK Rollups. In this case, moderately developing specialized L2s or L3s can indeed provide optimization for specific application scenarios. Vitalik and other Ethereum core developers also believe that Layer2 scaling is the main path currently, and correctly designed L2s can significantly improve user experience and usability. On the other hand, as mentioned earlier, too many highly repetitive L2s may only exacerbate fragmentation and resource waste. Blockchain analyst Paul Brody bluntly states: Only institutions that can bring massive native transactions at once have reason to deploy their own L2. Typical cases are financial giants: JPMorgan’s Onyx division uses L2 chains to tokenize gold; BlackRock’s BUIDL platform puts tens of billions of dollars of government bonds on-chain; Securitize uses L2 to manage billions in assets and provide lending services. These enterprises have huge transaction volumes and on-chain activities are core businesses, making them significantly benefit from using self-built L2s. However, if it’s just to “ride the trend” to do Layer2, TVLs of a few million or even less and users are destined to struggle to support independent development and maintenance costs.

- Active Ecosystem vs. Dormant Chains: Comparing highly active mainstream chains with almost “dormant” chains reveals obvious differences. Leading L2s (such as Arbitrum, Optimism, Base) often have rich ecosystem incentives and project implementations behind them, attracting a continuous influx of users and funds. For example, Arbitrum already has thousands of projects built on it, and its daily transaction volume and active addresses in the millions prove user stickiness and network effects. On the other hand, those L2s lacking ecosystem support and with extremely low traffic, even if launched, struggle to form ecosystem closed loops and become cold or even “neglected” existences.

- Specialization vs. Repeated Construction: One view holds that fully expanding various specialized L2s or modular chains (such as Appchains) can give developers more choices. In fact, Appchain ecosystems similar to Cosmos or Polkadot are already well-known: each application chain can be optimized for specific needs, sharing security or interconnected ecosystems. The launch of Polygon CDK also encourages more teams to create their own “independent” networks. However, this path will change security boundaries (sacrificing Ethereum L1 security) and easily lead to more fragmented assets and users. When too many chains run independently, the liquidity of the entire ecosystem will be diluted, users will need to hold more assets, and the frequency of cross-chain bridge use will increase, potentially reducing overall user experience. Industry veterans warn: “History often repeats itself, when lacking interoperability and liquidity, isolated chains often end abruptly.” Therefore, whether to continue adding L2s without restraint needs careful evaluation of the underlying user needs and resource costs to avoid repeating the mistakes of the private chain era.

Overall, new Layer2s must be “useful and positioned.” If an application scenario indeed requires faster settlement, lower transaction fees, or stronger privacy protection, such as some high-frequency trading, gaming, or enterprise applications, building a dedicated L2 may bring substantial benefits. But for the vast majority of ordinary projects, rather than choosing to fight alone, it’s better to connect to mature L2 solutions, allowing new applications to quickly launch based on existing networks and share existing liquidity. As Paul Brody says, if new Layer2 networks cannot quickly gather a large number of users and traffic, they are likely to be just sunk costs.

Future Outlook

Looking ahead, the Ethereum Layer2 ecosystem will continue to evolve, and its development path can be discussed from technical, ecosystem, and competitive landscape perspectives:

- Technical Aspect: Ethereum has taken an important step — the Dencun upgrade introduced EIP-4844, providing new “Blob” data availability space for Rollups. Research shows that this upgrade reduced the average daily operating costs of six major Rollups from about $888k before the upgrade to $135k, a cost reduction of about 85%. This means that Layer2 transaction fees will significantly decrease, providing a lower threshold for various application expansions. In the future, data availability layers (such as dedicated chains like Celestia) are also in the works, where Rollups can publish data to specialized DA networks to improve throughput. Another core issue is Sequencer decentralization. Some projects (such as Metis) have begun to experiment with PoS decentralized sequencers, and there is consensus that shared sequencers (i.e., the “superchain” concept) are the direction for the next stage. OP Stack’s Superchain proposes to achieve atomic-level cross-chain interaction between multiple L2s through shared sequencer groups and unified security standards. These technological innovations will gradually alleviate security concerns brought by centralization while enhancing interoperability between different L2s.

- Ecosystem Aspect: The ecosystem value of L2 lies in supporting real Web3 applications. In the future, we may see more heavy-asset and heavily regulated scenarios leveraging Layer2. For example, fields such as RWA (Real-World Asset) on-chain, stablecoin expansion, and institutional-grade DeFi all require solutions that combine high throughput, low cost, and asset security. If these applications are implemented, they may bring a new wave of L2 demand. Additionally, once traditional finance, game developers, social media, and other large companies start embracing blockchain, they may prefer mature and secure Ethereum scaling solutions rather than building isolated chains themselves. Given this, future Layer2 growth may depend more on ecosystem-level implementation value rather than pure technology stacking.

- Competitive Landscape: As the number and types of Layer2 increase, different competitive roadmaps have formed within the industry. On one hand is the OP Stack superchain vision — chains like Optimism and Base aggregate liquidity through the same technology stack, achieving multi-chain linkage. In this model, networks based on OP Stack can share assets and users, thus partially avoiding the “fragmentation” problem. On the other hand is the ZK Rollup narrative: many believe that future scaling will ultimately converge on zero-knowledge proof technology, emphasizing security and privacy. Currently, zkSync Era, StarkNet, Linea, etc., are representatives of this camp. If the ZK ecosystem matures, they will become an important pole in the Layer2 field. Finally, there’s the application chain (Appchain) approach, which customizes public chains or specialized chains for specific applications. Although this route allows for high customization to meet personalized needs, as mentioned earlier, it may lead to more fragmentation. The future is likely to be a coexistence of the three: OP Stack networks forming a superchain ecosystem, ZK Rollup networks continuously expanding application scenarios, while some vertical domains may try independent chains and interconnect with mainstream L2s through bridges and cross-chain protocols.

Conclusion

Overall, the long-term value of Ethereum Layer2 is undoubted: it has significantly expanded Ethereum’s throughput capacity, lowered the usage threshold, and allowed more applications to run on-chain. To date, L2 has greatly improved network scaling efficiency, with L2 transaction volume once exceeding the mainnet, and user numbers entering the “million-level” era. However, the current proliferation of Layer2s also reveals risks: excessive speculation, over-segmentation, and technology worship may lead to inefficiency and security vulnerabilities. As industry experts warn, when market dividends recede, rationally evaluating needs and investing resources in truly useful projects is the key to success.

In the future, we need to find a balance between optimism and caution: actively focusing on Layer2 technology and ecosystem evolution (such as EIP-4844, decentralized sequencing, superchains, etc.) to prepare for truly solving scaling bottlenecks; while also avoiding blindly following trends and being wary of duplicate construction and ineffective competition. It’s not necessary to deny the significance of all new L2s, but more focus should be on “whether there is substantial demand”. Only those Layer2s that can bring real business value and user growth can stand out in this scaling race and inject continuous momentum into the Ethereum ecosystem.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?