Robinhood’s Rare Bet: Lighter and Its Brilliant Founder

Perp DEX has emerged as one of the most talked-about trends in recent months. Since HyperLiquid rose to prominence, top projects have showcased their unique strengths. HyperLiquid achieved remarkable growth thanks to its team’s operational prowess, all without external funding. Aster leveraged Binance’s influence to quickly capture market share. Lighter, on the other hand, opted to partner with major investors.

On November 11, Fortune magazine reported Lighter’s latest $68 million funding round, featuring a powerful roster of backers. Notably, Founders Fund, Ribbit Capital, and Haun Ventures joined the round, and even Robinhood—a brokerage rarely known for direct investments—chose to participate.

Beyond the funding, the report also shared Lighter’s little-known origin story.

From Trading to AI and Back Again

Lighter founder Vladimir Novakovski illustrates a key lesson: even the most brilliant minds thrive when focused on their strengths. Unlike many Web3 entrepreneurs who pivoted to AI, Vlad took the reverse route.

Vlad immigrated from Russia to the US as a child. Before most kids learned how to solve quadratic equations, he was already representing the US in international olympiads for informatics and physics. At 16, he entered Harvard and graduated early in just three years. By 18, Citadel CEO Ken Griffin personally invited him to join one of the world’s largest hedge funds and market makers.

After nearly 15 years as an engineer and trader, Vlad co-founded the AI social network Lunchclub in 2017 with Scott Wu, a colleague from investment firm Addepar.

Lunchclub raised around $30 million, and its product attracted a surge of users seeking new connections during the pandemic’s onset. By 2022, however, growth had stalled. “We had three choices: try to make it profitable but stay small; attempt to evolve it into a platform like TikTok or Snapchat, which didn’t seem realistic,” Vlad explained. “The third path: pivot to something we were truly passionate about.”

That year, the founders parted ways. Wu left Lunchclub to start Cognition, an AI coding company now valued at over $1 billion. Vlad led Lunchclub’s transformation, pivoting back to trading—his core expertise. Lunchclub transitioned to Lighter, with 80% of the original team remaining. In 2024, Lighter raised $21 million, led by Haun Ventures and Craft Ventures, with Dragonfly and Robot Ventures joining. The team did not disclose the round publicly at that time.

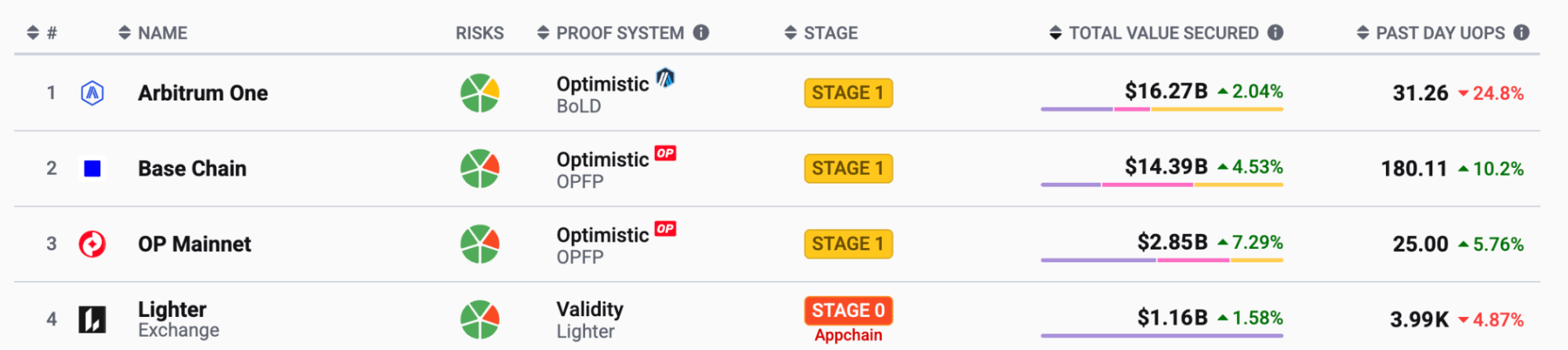

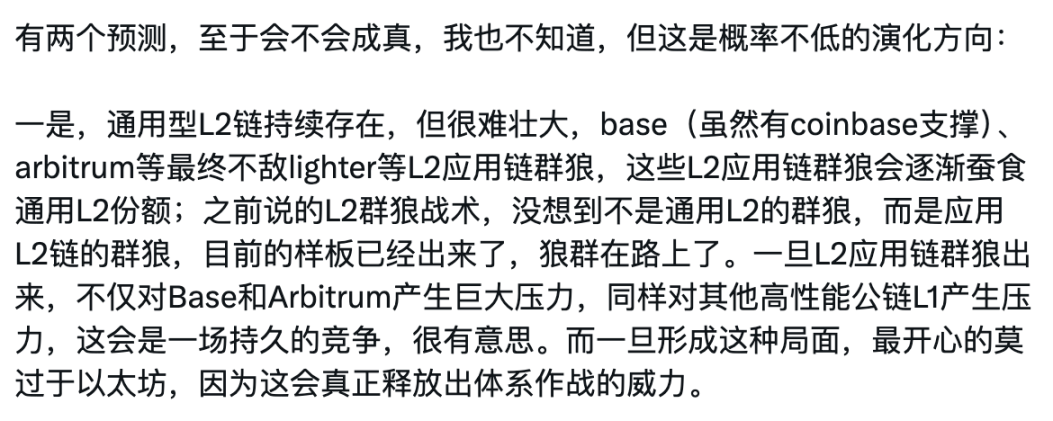

Lighter was not initially developed as a Perp DEX. When Lighter launched on Arbitrum at the end of 2022, it was a spot DEX. The pivot to Perp DEX began in 2023, alongside development of its own ZK Rollup. The mainnet went live in October 2023. Despite operating for just over a month, Lighter is now the fourth-largest L2 by TVL, ranking behind only Arbitrum One, Base, and OP Mainnet. Even OG Blue Fox remarked that it’s surprising to see a custom L2 overtake general-purpose L2s.

What makes Lighter’s ZK L2 unique?

When OP Rollup dominated the landscape, many industry veterans noted, “ZK is the End Game.” Today, with projects like Brevis and ZKsync Airbender, that vision is clear—and Vlad recognized it early.

With a background as both engineer and trader, Vlad designed an L2 purpose-built for DEX operations.

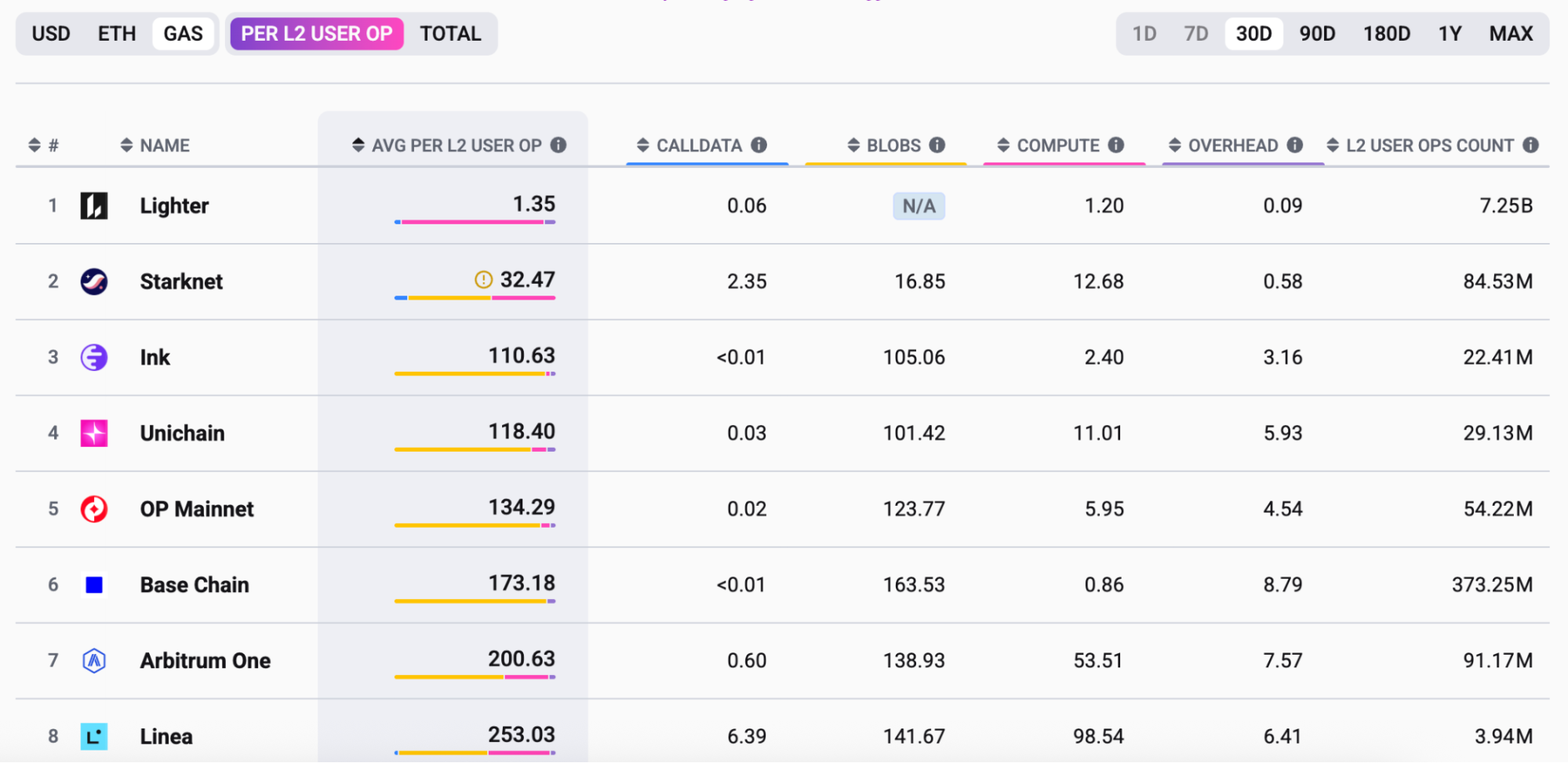

Lighter integrates core exchange logic—matching, clearing, and risk control—into a custom SNARK circuit, anchoring batched final states to Ethereum L1. The result: Lighter’s L2 encodes “exchange logic” directly in ZK circuits, optimizing for rapid trade execution and verification. The sequencer only controls order sequencing; the matching logic is hardwired into the circuit, preventing the sequencer from picking or inserting orders.

This architecture, called “Lighter Core,” is described in company documentation: “Lighter Core’s scalability is driven by a newly developed proof engine, built from the ground up for exchange-specific workloads. It leverages new algorithms and optimized data structures to efficiently generate proofs for exchange operations. All actions execute deterministically via user-signed transactions, with each batch producing a new state and a concise cryptographic proof.”

As explained in “ZKsync Praised by Vitalik May Truly Be Undervalued”, ZK delivers powerful verification advantages. Once trades are ZK-verified, they’re finalized; submitting them to Ethereum L1 is just a procedural step. Lighter makes proofs simpler by introducing complexity into the generation process, while boosting trade speed.

Lighter’s zero-fee trading for retail users has also drawn attention. The company hasn’t specified why it doesn’t charge fees, but its design and Robinhood’s investment provide clues.

Per Lighter’s documentation, the protocol charges no fees to retail traders, but order execution and placement delays are 300 ms and 200 ms, respectively. Advanced accounts for market makers and high-frequency traders pay a fee of 0.002% for order placement and 0.02% for execution, with delays of 0 and 150 ms, respectively. The likely intent is to offer free but higher-latency trades to less price-sensitive retail users, mimicking Robinhood’s Payment for Order Flow (PFOF) model, while charging advanced accounts similar to Robinhood’s market maker commissions.

This model keeps retail traders engaged and allows advanced accounts to profit from high-frequency trading. Lighter collects fees from advanced accounts, delivering a superior user experience and substantial revenue from market makers, resulting in sustained growth in transaction volume and a significant reduction in gas costs.

The second season of Lighter’s points program is currently underway, offering rewards to both retail traders and market makers. Retail users can earn up to 200,000 points weekly, calculated based on trading volume, open positions, and profits, awarded every Friday. As Fortune noted, token warrants were involved in the recent financing, making Lighter points a likely key factor for future airdrops.

Even Geniuses Can’t Do It All

Entering Harvard at 16, graduating in just three years, and being recruited by Citadel’s CEO—this extraordinary story belongs to Lighter founder Vladimir Novakovski. Yet even Vlad, as accomplished as he is, encountered challenges as an AI social entrepreneur.

With engineering and trading acumen, Vlad launched Lighter in Web3, attracting eager investors. Joey Krug, partner at Founders Fund, said Vlad and his team accounted for 85% to 90% of the investment decision.

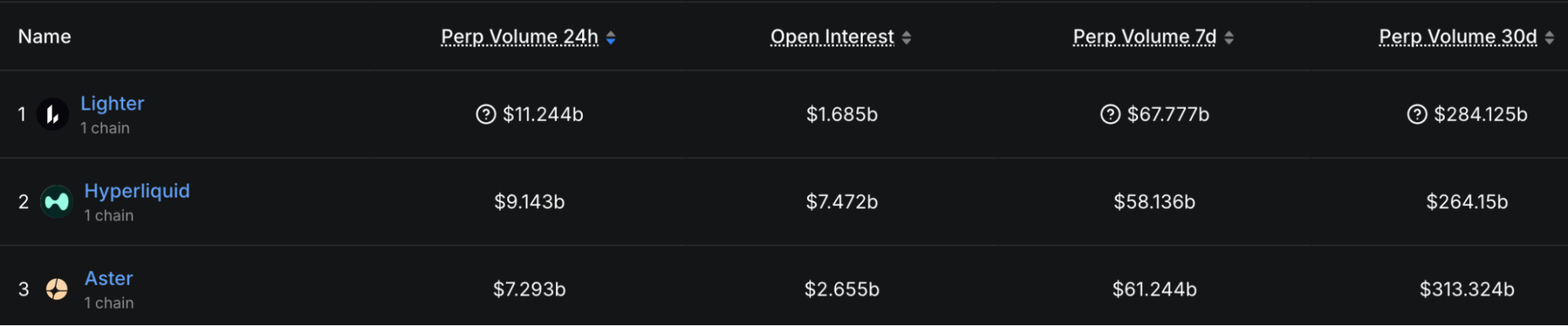

DefiLlama data shows Lighter’s trading volume recently topped the charts. While the zero-fee policy may attract airdrop hunters, it is noteworthy that what was once seen as the endgame for Perp DEXs with HyperLiquid may actually be just the beginning.

Statement:

- This article is republished from [Foresight News]. Copyright belongs to the original author [Eric, Foresight News]. If you have concerns about this republication, please contact the Gate Learn team for prompt resolution according to relevant procedures.

- Disclaimer: The views and opinions expressed here are those of the author only and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated articles without proper attribution to Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer