Low-risk defi can be for Ethereum what search was for Google

Special thanks to Binji, Josh Rudolf, Haonan Li and Stani Kulechov for feedback and review.

One of the important tensions in the Ethereum community for a long time has been the tension between (i) applications that bring in enough revenue to economically sustain the ecosystem, whether that means sustaining the value of ETH or supporting individual projects and (ii) applications that satisfy the underlying goals that brought people into Ethereum.

Historically, these two categories were very disjoint: the former was some combination of NFTs, memecoins, and a type of defi that was backed up by temporary or recursive forces: people borrowing and lending to chase incentives provided by protocols, or a circular argument of “ETH is valuable because people use the Ethereum chain to buy and sell and leverage-trade ETH”. Meanwhile, non-financial and semi-financial applications (eg. Lens, Farcaster, ENS, Polymarket, Seer, privacy protocols) existed, and they were fascinating, but they either got very little usage, or paid far too little in fees (or other forms of economic activity) to sustain a $500 billion economy.

This disjointness created a lot of dissonance in the community, and a large amount of community momentum was backed by the theoretical hope that some application could emerge that fills both boxes at the same time. In this post I will argue that, as of this year, Ethereum has that application, something that can be for Ethereum what search was for Google: low-risk defi, with a goal of achieving global democratized access to payments and savings in valuable asset categories (eg. major currencies with competitive interest rates, stocks, bonds).

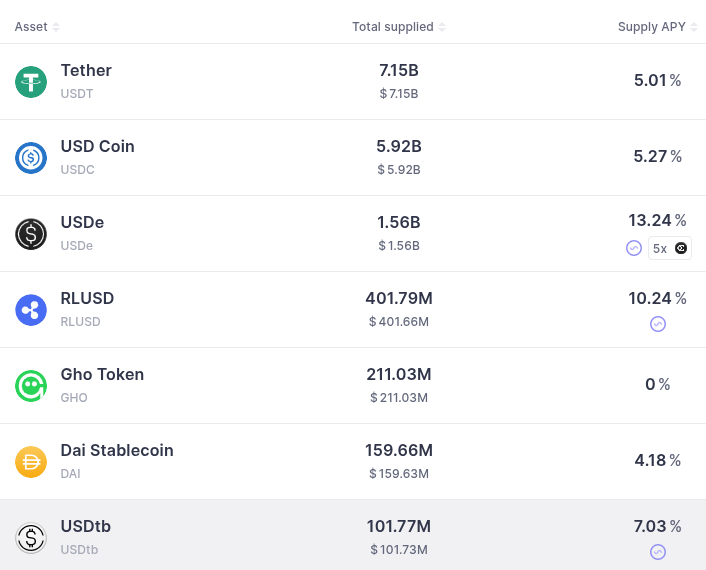

Deposit rates for major stablecoins on Aave.

The analogy between low-risk defi for Ethereum and search for Google is as follows. Google does many interesting and valuable things for the world: the Chromium family of browsers, Pixel phones, their AI work including open-source Gemini models, the Go language, and much much more. But these things are all negligible or even negative as far as revenue generation goes. Rather, the largest revenue generator is search and ads. Low-risk defi can play a similar role for Ethereum. Other applications (including non-financial and more experimental applications) are crucially important for Ethereum’s role in the world and for its culture, but they do not need to be looked to as revenue generators.

In fact, I hope Ethereum can do much better than Google. Google is oftencriticized for losing its way and becoming like the antisocial profit-maximizing corporations that it sought to replace. Ethereum has decentralization baked in at a much deeper technical and social layer, and I would argue that the low-risk defi use case creates a lot of alignment between “doing well” and “being good”, to a degree that does not exist for advertisement.

Why low-risk defi?

By “low-risk defi” I include both the basic function of payments and savings, and well-understood tools like synthetic assets and fully collateralized lending, and the ability to exchange between these assets.

The reason to focus on these applications has two core components:

- These applications provide irreplaceable value, both for Ethereum and for its users.

- These applications are culturally congruent with the Ethereum community’s goals, both for the application layer and for the L1’s technical properties.

Why is defi valuable now?

Historically, I was more suspicious of defi because it did not seem to be providing (1); rather, the main “selling points” seemed to be making money from trading highly speculative tokens (Ethereum’s single largest day in fees was from a badly designed digital monkey sale), or getting 10-30% yield from liquidity farming incentives.

One reason why this was the case was regulatory barriers. Gary Gensler and others deserve serious blame for creating a regulatory environment where the more useless your application is, the safer you are, and the more transparently you act and the more clear guarantees you offer to investors, the more likely you are to be deemed “a security”.

Another reason why is that at the early stages, risk (protocol code bug risk, oracle risk, general unknown-unknown risk) was too high for more sustainable use cases to make sense. If risk is high, the only applications that are worth it are applications whose returns are even higher, and so can only come from unsustainable subsidies or speculation.

But what happened over time is that the protocols became more secure and the risk decreased.

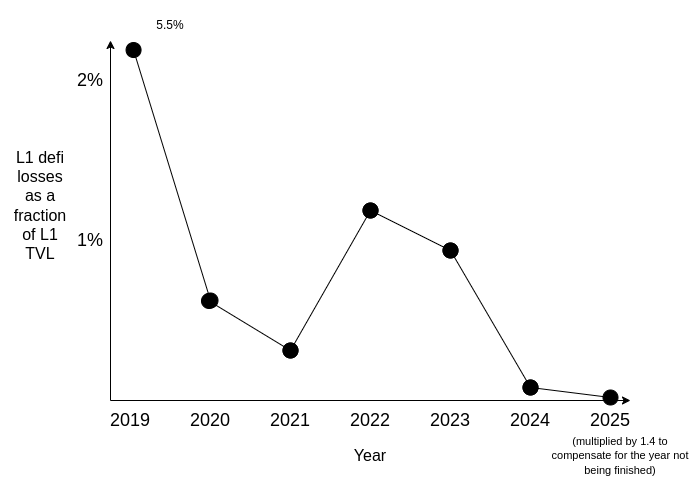

Ethereum L1 defi losses. Source: AI research

Defi hacks and losses continue to exist. But they are increasingly being pushed out to further edges of the ecosystem where users are more experimental and speculative. A stable core of applications is forming that is proving remarkably robust. Tail risks that cannot be ruled out continue to exist, but such tail risks exist in tradfi too - and given increasing global political instability, for many people worldwide the tail risks of tradfi are now greater than the tail risks of defi. In the long run, one could expect the transparency and automated execution in a mature defi ecosystem to make it much more stable than tradfi.

Who are the “non-ouroboros” users for whom all this makes sense? Basically, people and businesses who want access to a global market within which they can buy, hold and trade mainstream assets, but for whom there are not reliable traditional finance channels for getting those things. Crypto does not have magic secret sauce for sustainably creating much higher yields. But it does have magic secret sauce for making the economic opportunities that already exist globally and permissionlessly accessible.

Why is low-risk defi culturally congruent with the Ethereum community’s goals?

Low-risk defi has several nice properties that make it ideal:

- It contributes to Ethereum and ETH economically, both by using a large volume of ETH as a collateral asset, and by paying high volumes of transaction fees

- It serves a clearly valuable and honorable purpose: enabling global permissionless access to well-understood positive-sum mechanisms of economic interaction and wealth-building

- It does not give Ethereum L1 perverse incentives (eg. to over-centralize in search of HFT-friendly efficiencies, which are more appropriate for L2s)

This is a very nice set of properties to have!

Going back to the analogy of Google, one major flaw in its incentive alignment is that advertising revenue gives the company an incentive to suck up as much data as possible from its users and keep that data proprietary. This goes against the open-source and positive-sum spirit that historically motivated its more idealistic efforts. The cost of this kind of incongruence is even higher for Ethereum, because Ethereum is a decentralized ecosystem, and so any activity that Ethereum does cannot be a backroom decision of a few people, it must be viable as a cultural rallying point.

The revenue generator does not have to be the most revolutionary or exciting application of Ethereum. But it does need to be something that is at least not actively unethical or not embarrassing. It’s just not possible to say with a straight face you are excited about the ecosystem because it’s positively changing the world, if its single largest application is political memecoins. Low-risk defi, with a goal of enabling global permissionless access to payments and to the best savings opportunities, is a form of finance that is positively changing the world, and many people in underprivileged regions worldwide can attest to this.

What can low-risk defi evolve into?

Another important property of low-risk defi is that it is naturally synergistic with, or can evolve into, a number of more interesting future applications. To give a few examples:

- Once we have a mature ecosystem of financial and non-financial activity happening onchain (see: Balaji’s ledger of record concept), it starts to make sense to explore reputation-based undercollateralized lending, which is potentially an even more powerful engine of financial inclusion. Both the low-risk defi we build today, and the non-financial wizardry (eg. ZK identity) we build today, are upstream of making this outcome more likely.

- If prediction markets become more mature, we could start to see them being used for hedging. If you are holding stocks, and you believe that some world event is on average likely to make stocks go up, and prediction markets for that event are liquid and efficient, then it’s a rational statistical hedging strategy to bet against that event. Prediction markets and “traditional” defi (heh) happening on the same platform will make it easier to engage in such strategies.

- Today, low-risk defi is often about enabling easier access to the USD. But most of us did not enter crypto to enable USD adoption. Hence, over time we can start moving the ecosystem toward other stable forms of value: basket currencies, “flatcoins” based directly on consumer price indices, “personal tokens”, etc. Both the low-risk defi we build today, and more experimental projects like Circles and the various “flatcoin” projects, are upstream of making this outcome more likely.

For all these reasons, I would argue that a stronger focus on low-risk defi puts us in a position much better for economically sustaining the ecosystem while maintaining cultural and values congruence than search and ads ever could for Google. Low-risk defi is already supporting the Ethereum economy, it is making the world a better place even today, and it is synergistic with many of the more experimental applications that people on Ethereum are building. It is a project that we can all be proud of.

Disclaimer:

- This article is reprinted from [vitalik]. All copyrights belong to the original author [vitalik]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer