Liquidity on prediction markets. Mom, I’m a market maker

More and more people have been talking about prediction markets lately

And while they’re becoming increasingly popular, they do have some downsides

One of them is low liquidity, which plays a major role in trading

What is liquidity

Simply put:

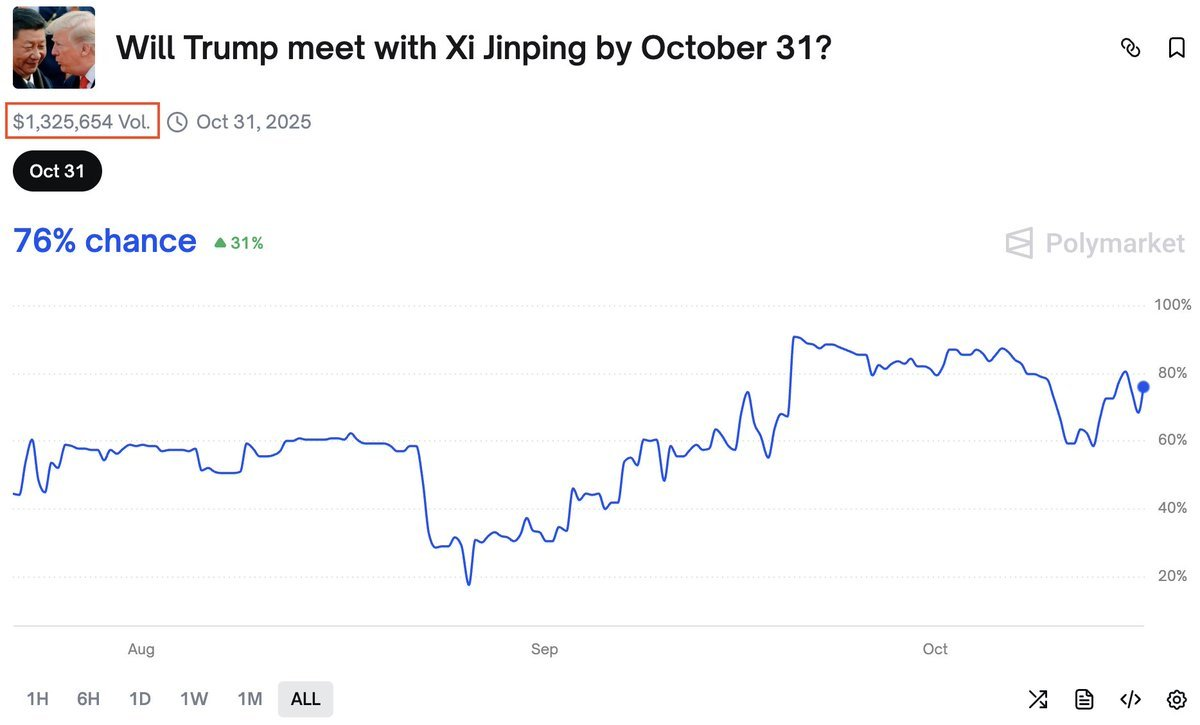

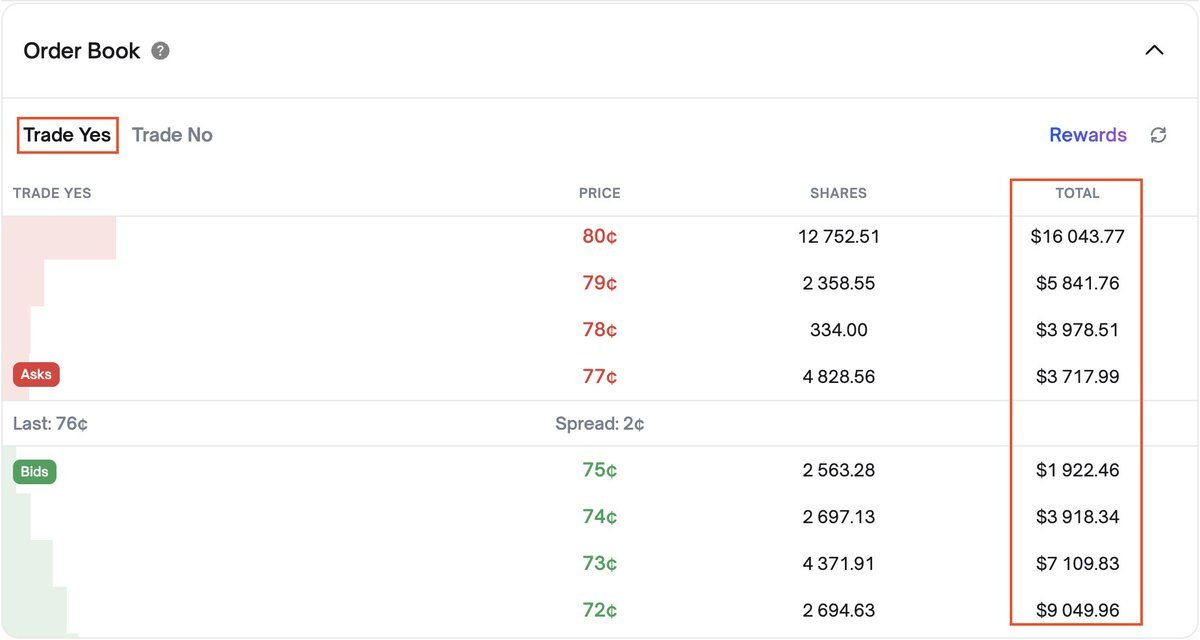

On highly liquid markets, you can buy shares for a large amount without causing big price changes. For example:

highly liquid market

You can buy YES shares at 77¢ for over $3K and it’ll barely move the price

Or place your own order at 75¢ - it might get filled quickly, because there’s enough liquidity and people actively trading

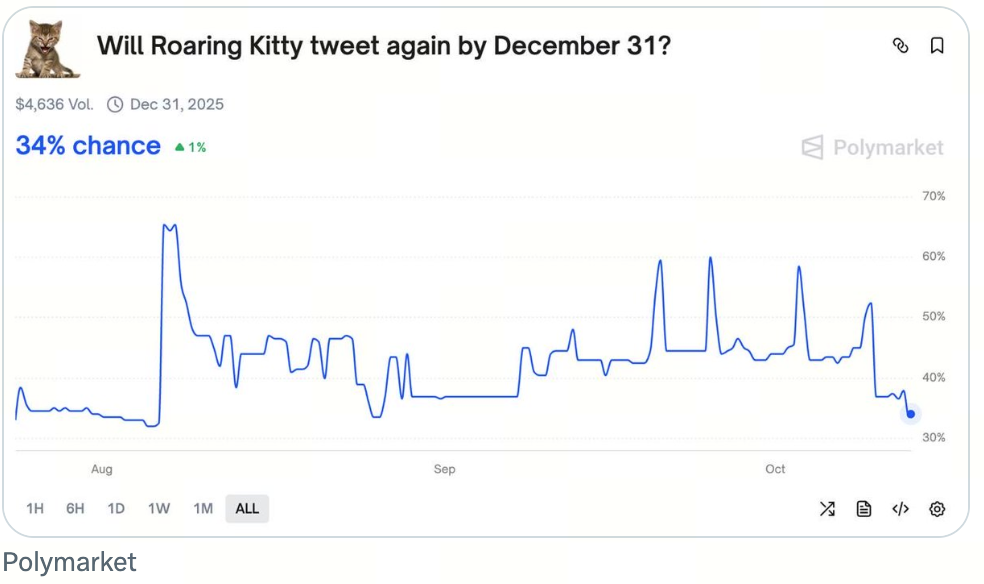

Meanwhile, on low-liquidity markets, even a small purchase can noticeably shift the price

For example, the market I recently wrote about:

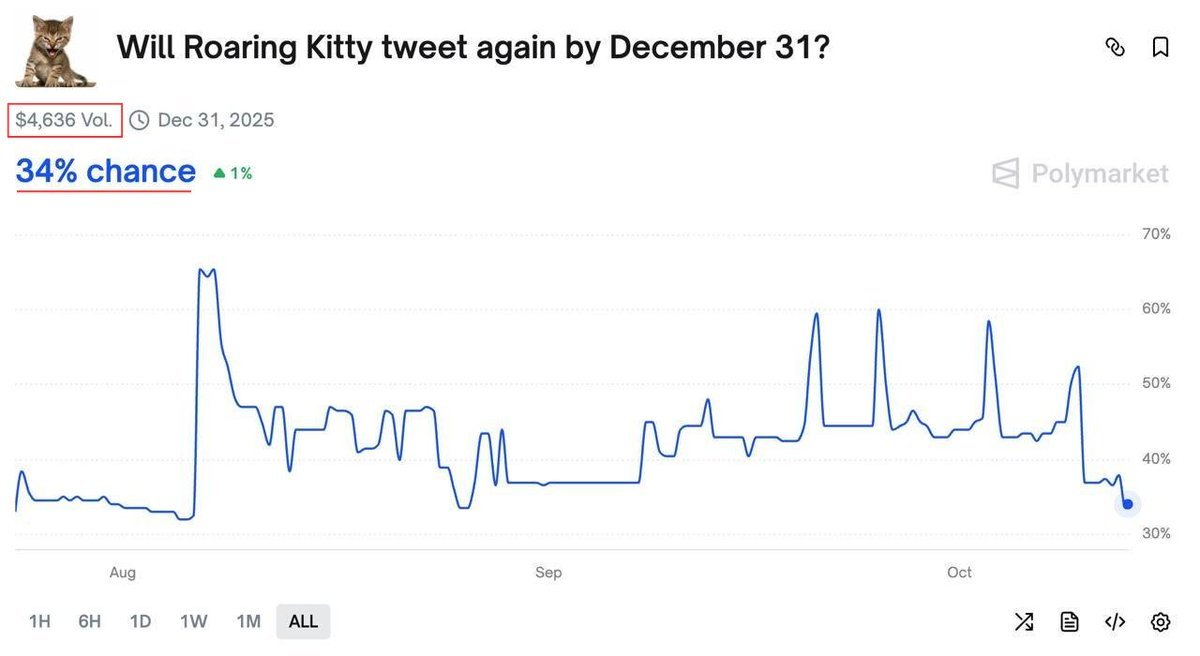

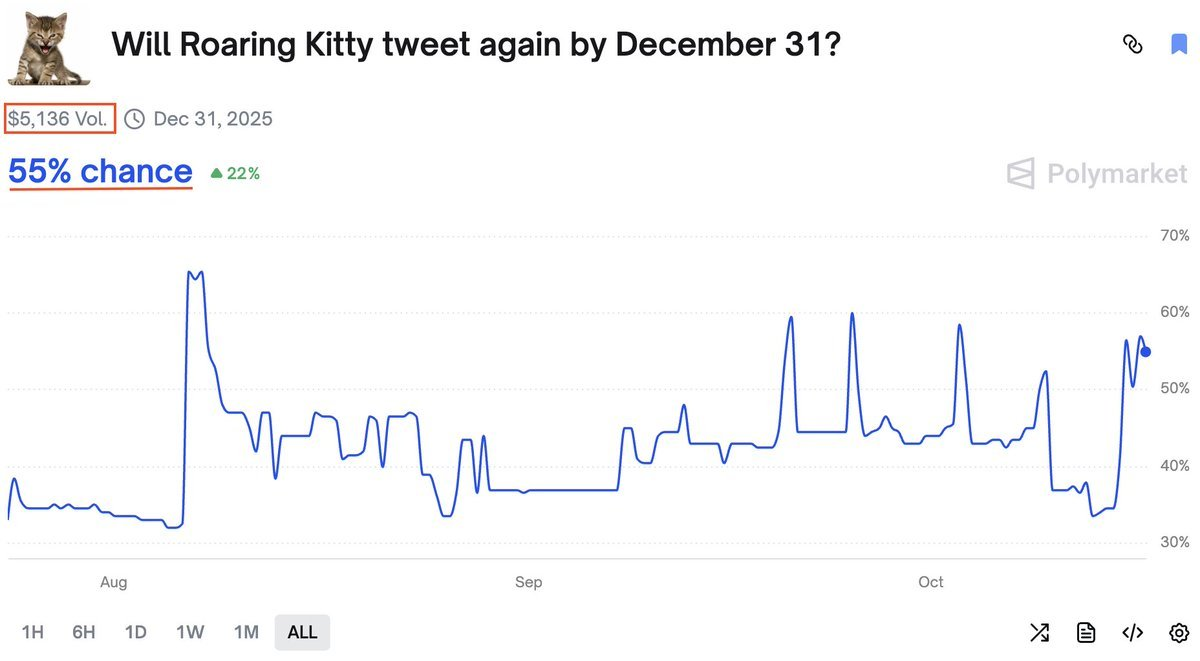

When I wrote that post, the volume was only $4,636 and the probability was 34%

Now the volume has increased by only $500, but it significantly affected the price, raising the percentage to 55%

So, liquidity on prediction markets is a measure of how easily you can buy or sell a position without significantly changing the price

How it used to be

Before 2022, Polymarket used an AMM-based model

AMM (Automated Market Maker) - algorithm that enables trading without a traditional buyer or seller

It works using a formula, and regular users could deposit their funds into the market to earn fees when others traded

However, when a market resolves, one of the tokens becomes worthless, and liquidity providers still hold it

This often led to losses that the trading fees couldn’t cover

As a result, most people providing liquidity through the AMM model ended up unprofitable

More details in the post:

How it works now

At the end of 2022, Polymarket switched to a CLOB model

CLOB (Central Limit Order Book) - basically, the familiar order book system

Here, prices are set by traders themselves, not automatically

This made CLOB markets more profitable and allowed market makers to earn from the spread between buy and sell prices

Polymarket also rewards users for providing liquidity

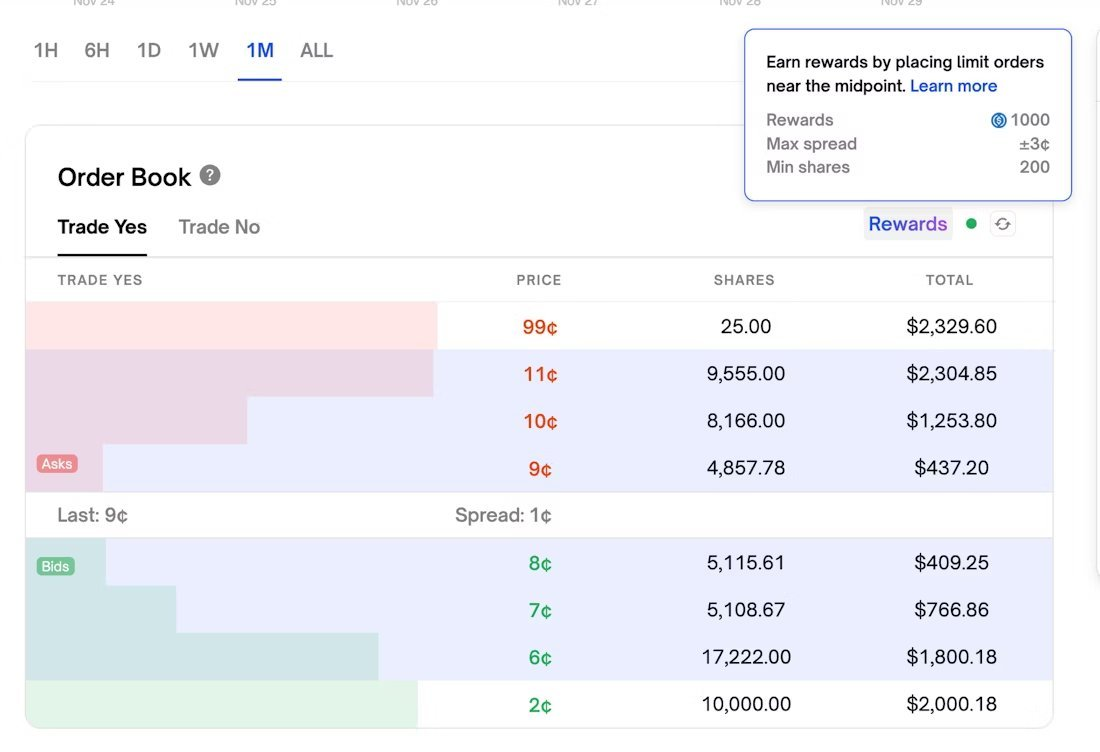

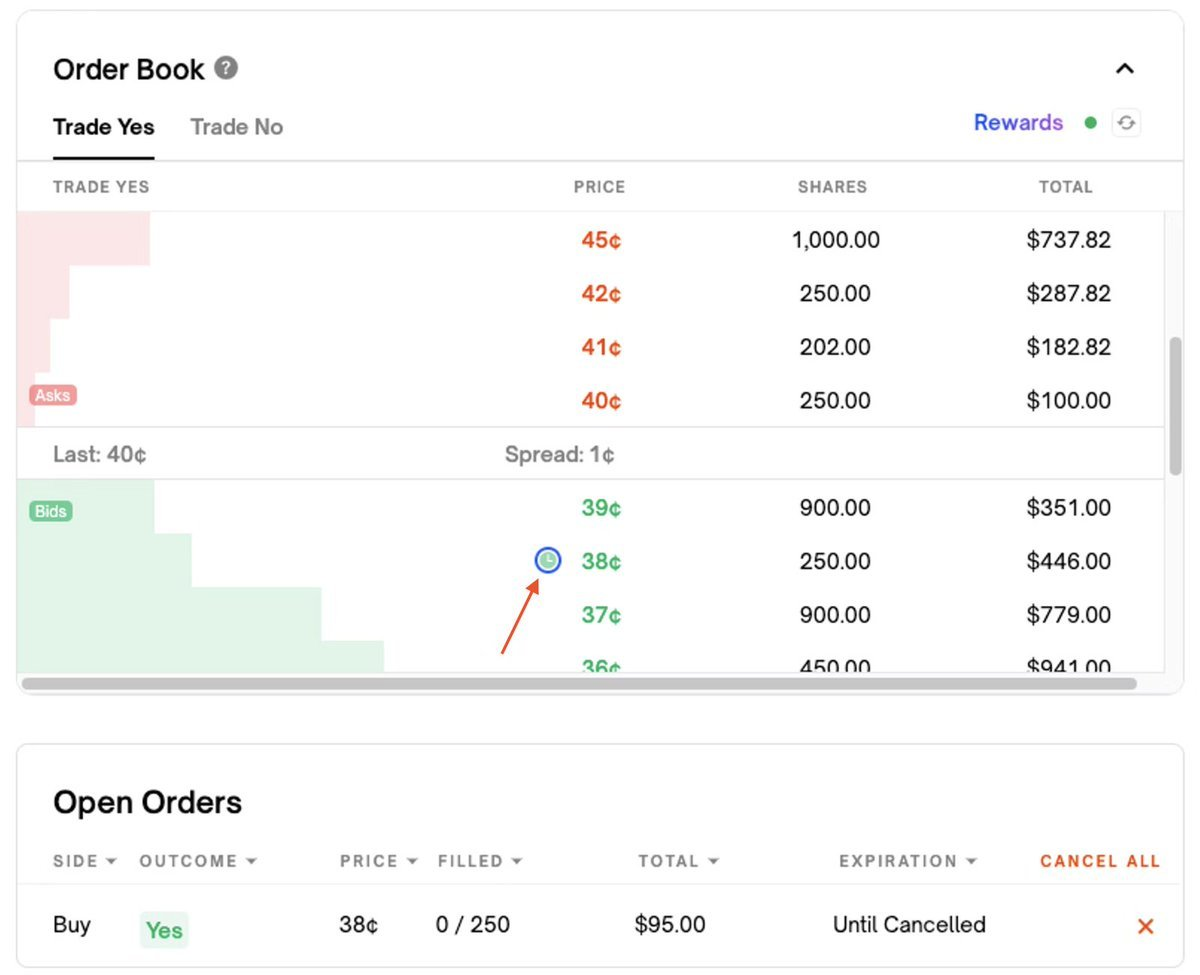

Here’s how it works:

You place a limit order to buy or sell shares on markets where liquidity is needed

In the top-right corner, by hovering over “Rewards” you can see:

- The available rewards

- The maximum spread (eligible orders will be highlighted in blue)

- The minimum number of shares you need to buy or sell

If your placed order is earning a reward, you’ll see a blue highlight around the clock icon

You can find all the information about earning liquidity rewards in the official documentation:

https://docs.polymarket.com/polymarket-learn/trading/liquidity-rewards

Where does the first liquidity come from

Now that we understand what liquidity is and how it works, one question remains

where does the first liquidity come from?

When a market is first created, no one owns YES or NO shares yet, and there’s no set price

Then, someone can place a limit order, for example:

“I’m willing to buy YES shares for 70¢”

If another trader places the opposite order, like:

“I’m willing to buy NO shares for 30¢”

these orders match and create the first price on the market

Then prices are formed as the average between what people are willing to buy for (bid) and sell for (ask)

Bid - the highest price someone is willing to pay for a share

Ask - the lowest price someone is willing to sell for

The gap between bid and ask is called the spread

If the spread is small - 10¢ or less - the interface shows the midpoint price = (bid + ask) / 2

If the spread is larger than 10¢, it shows the last traded price instead of the midpoint

Most and least liquid markets

Some of the most liquid market categories are political markets - partly because the first major boom in prediction markets happened during the US elections

At that time, political markets reached record liquidity and media attention

Meanwhile, some of the least liquid ones I’ve come across are mention markets

Though of course, there are exceptions in every category - it all depends on the specific market, regardless of its type

I hope this article was helpful to you ❤️

Don’t forget to follow me - every time someone does, my cat smiles

Disclaimer:

- This article is reprinted from [0xDoraaa]. All copyrights belong to the original author [0xDoraaa]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?