How to Guage if a Prediction Market Is Worth It

In today’s Onchain Thursday series 54.0, I decided to share elaborately my customized 3-gauge systems, which you can use to evaluate if a prediction market is worth your time.

So, we discuss it all (3 Things You Must Consider).

Let’s dive.

Intro:

If you’re new to the concept of prediction markets, prediction markets are exchanges where participants bet on the outcomes of future events and are increasingly popular in crypto and finance.

However, not all prediction markets are created equal. Gauging whether a particular platform is “worth it” (for your time or money) comes down to a mix of 3 key factors:

- Its market design

- The economic environment

- The user-related factors surrounding it.

Each of these factors are crucial for determining if a prediction market will deliver accurate forecasts, sufficient liquidity, and a trustworthy trading experience for users. Let’s take it accordingly.

1. Market Design: Structure, Mechanism, and Clarity

The concept of market design explores how a prediction market is structured and operated – including the trading mechanism, contract rules, and resolution method. I believe that a good design must align incentives and as well ensure the market functions smoothly:

i) Trading Mechanism:

Prediction markets use different mechanisms to match trades. Some of them like @Polymarket"">@Polymarket, and @Kalshi"">@Kalshi use orderbooks, while others like @ZeitgeistPM"">@ZeitgeistPM use automated market makers (AMMs) such as LMSR.

Models snapshot:

Orderbooks (CDA): efficient w/ high liquidity, but struggle in thin markets.

CPMM (x*y=k): simple but high slippage at extremes.

LMSR: bounded loss & normalized probabilities, but parameter-sensitive.

DLMSR / pm-AMM: newer models tackling liquidity & slippage issues.

ii) Contract Type and Clarity:

Well-designed markets must have clearly defined contracts and resolution criteria. From my observation, contracts are typically binary options (yes/no outcomes paying $1 if the event occurs) or can be multi-outcome or scalar contracts (payout varies by a numeric result).

Note this: It’s important that the question being bet on is unambiguous and has a verifiable outcome. Research notes that “well-defined questions with clear resolution criteria” are a key factor for effective prediction markets.

This is because, if a market’s question is vague or the outcome is subjective, traders will lack confidence that their bets will be fairly resolved.

iii) Outcome Resolution & Oracles:

The design must ensure trust in how outcomes are determined. So, while traditional prediction markets rely on the platform operator or a third party to declare the outcome and pay out winnings, prediction markets in crypto use oracles (trusted data sources on-chain) to feed real-world results into smart contracts.

New to the concept of crypto oracles? This should help: https://x.com/marvellousdefi_/status/1812810604454789141

For instance, @Polymarket"">@Polymarket utilizes the @UMAprotocol"">@UMAprotocol to supply real-world data (e.g. election results) for market resolution.

A robust resolution mechanism prevents disputes and manipulation, thereby upholding market integrity. So, when evaluating a platform, consider:

- Does it have a reliable oracle or arbiter?

- Are disputes possible, and if so, how are they handled?

iv) Fees and Technical Design:

High txn costs or slow systems can k*ll a platform’s usability.

Flash back to the early decentralized markets like Augur (launched in 2018 as a pioneer on Ethereum), but struggled because users faced high gas fees, low liquidity, and poor user experience, which was a factor that prevented them from gaining mainstream traction.

So, you should consider the chain where the product is deployed on, e.g @GroovyMarket_"">@GroovyMarket_ launching on @SeiNetwork"">@SeiNetwork, @Polymarket"">@Polymarket on @0xPolygon"">@0xPolygon, @triadfi"">@triadfi on @solana"">@solana and many more others.

One thing these platforms I mentioned share in common is that the chains they build on ensures lower txn fees and faster trades.

and by simplifying user interfaces. Polymarket, for example, is built on Polygon (an Ethereum sidechain) and uses USD stablecoin transactions, yielding a fast and stable trading experience without exposing users to volatile crypto prices. It also charges 0% trading fees, making it frictionless to trade. Such design choices greatly enhance usability compared to first-generation platforms.

Also, you need to evaluate the fees charged by these platforms (market creation fees, trading fees, deposit/withdrawal fees, fees on profit etc)

In context, a prediction market’s design is worth it if it provides a clear and fair structure: an efficient trading mechanism with adequate liquidity provisioning, transparent rules, and trustworthy resolution.

Poor design (slow trades, unclear rules, or mistrusted outcomes) will undermine the market before it even gets started.

2. Economic Factors: Liquidity, Pricing, and Incentives

I believe every great design needs an economic backbone to succeed, because key economic factors are what will determine whether a prediction market can aggregate information effectively and reward participants accordingly. Let’s take it divisibly.

i) Liquidity & Market Depth:

The concept of liquidity explains the need to have enough active trading and funds in the market so that traders can buy or sell at fair prices without huge slippage.

Over time, sufficient liquidity has absolutely been a vital consideration.

Research finds that the effectiveness of prediction markets depends on “sufficient market liquidity” and a large pool of traders. If only a few people trade, prices can swing wildly or stagnate, failing to reflect true probabilities. So, there need to be a balance.

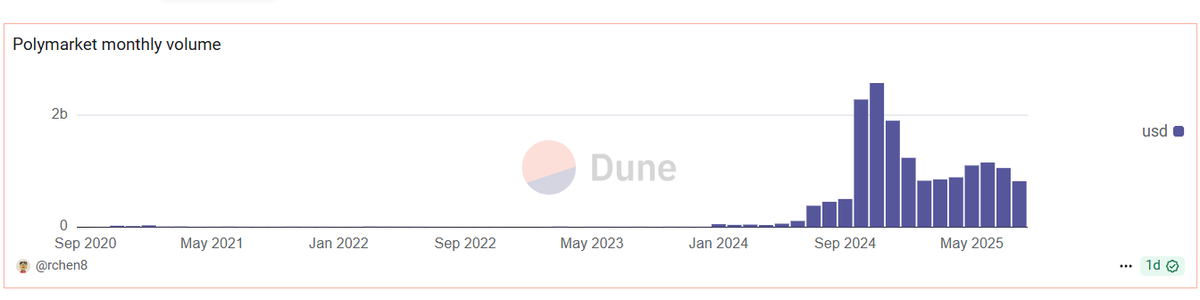

Look for platforms with high volume or liquidity pools. For example, Polymarket has emerged as the largest decentralized prediction market, and accounted for ~94% of total market volume and handling over $8.4 billion in wagers in 2024 alone, even though there a new players to challenge this year.

Such massive liquidity (especially around major events like U.S. elections) means its odds are backed by substantial market depth, making it harder for any single user to manipulate prices.

ii) Accurate Pricing (Information Aggregation):

The core idea of prediction markets is that market prices reveal the crowd’s collective belief about an event’s probability. So, when the economics are sound. i.e. lots of informed traders with money at stake, the market price becomes a remarkably accurate forecast.

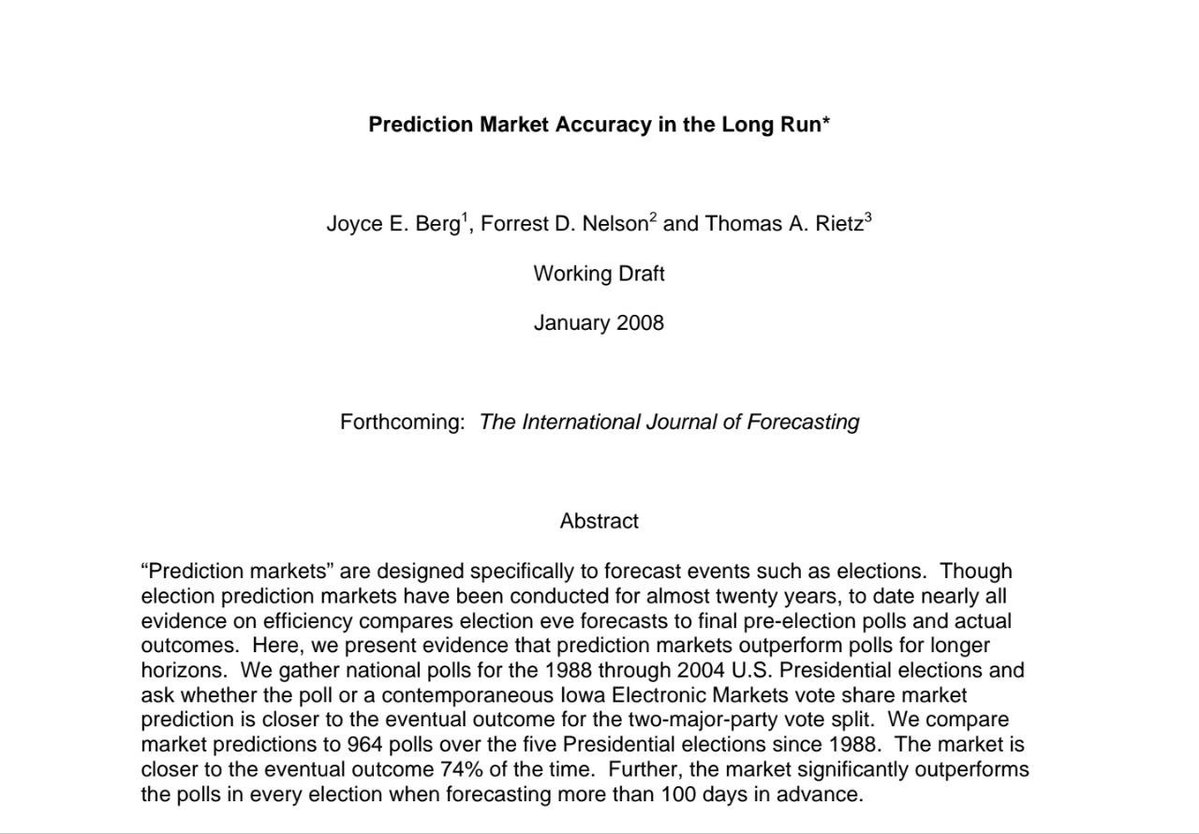

In fact, well-run markets have outperformed polls and experts. Flash back to:

- When the Iowa Electronic Market’s election predictions beat professional pollsters 74% of the time.

- And when Google’s internal prediction market produced more accurate forecasts than company experts.

All of these are well-known example that supports the power of prediction markets.

However, if the market is thin or dominated by uninformed bets, the prices may be less reliable.

Therefore, always consider the track record:

- Does the platform have examples where its odds predicted outcomes correctly when other forecasters failed?

Notably, during the 2024 US election, Polymarket’s odds were closely watched and even outperformed traditional polling, drawing attention from figures like Elon Musk. So, this is an important area to consider.

iii) Incentive Alignment:

The economic design should also cover how traders are rewarded and what it costs to participate. Low or zero fees are a big plus, as high fees can deter frequent trading or arbitrage that keeps prices accurate.

Platforms like Polymarket charge no trading fees, and some other markets even subsidize participation through token rewards or yield. Additionally, some markets could reward information discovery e.g. offering prizes or reputation to the best forecasters to encourage knowledgeable participants.

I believe that a healthy prediction market economy will make it profitable for traders to correct mispriced odds, and as a result, attempts to manipulate prices are usually self-correcting. For e.g, if someone bets irrationally, others have a financial motive to take the opposite side and push the price back to a rational level. That said, if a market is very small, a wealthy manipulator could sway odds temporarily, so again scale matters.

iv) Risk and Regulatory Costs:

Another economic consideration is the risk involved, not just the risk of losing a bet, but counterparty and regulatory risk. On crypto prediction markets, smart contract security is crucial (since funds are held in code).

On centralized ones, you rely on the company’s solvency and honesty.

Note that regulatory crackdowns can always impose costs. for example, Polymarket had to geo-block U.S. users after a U.S. Commodity Futures Trading Commission settlement (which they were fined a sum of $1.4 million) for operating unregulated event markets.

In this time when U.S. users were excluded, liquidity in certain markets presumably dropped. Similarly, some countries outright ban prediction markets.

In late 2024, France, Singapore, and Thailand all blocked access to Polymarket. In reality, these factors can economically impact a platform (reducing its user base or forcing compliance costs).

Thus, a “worth it” market should have a stable legal footing or contingency plans. Otherwise, participants face the economic risk of sudden shutdowns or inability to cash out.

In essence, the economics of a prediction market MUST ensure plenty of skin in the game and fluid trading. The best markets will have ample participation (so that the market odds mean something), low txn costs, and mechanisms to motivate accurate predictions.

3. User and Community Factors: Participation, Trust, and Experience

Anyways, I like to consider user-related factors, essentially the human side of the market, and that is because a prediction market only works as well as its users and the community around it.

So, here are the key points to evaluate include:

i) Scale of Participation:

Prediction markets depend on scale. The more individuals participate, the more effective they become. A large, active user base means diverse information and opinions are being brought to the table.

ii) Diversity of opinion is crucial: If all traders think alike (or collude), the market won’t aggregate independent information. So, it is important to look for metrics like:

- number of active users

- number of bets placed, and open interest etc.

Overall, a platform with thousands of engaged traders is far more robust than one with just a handful of users. Engaged participants with diverse information backgrounds are one of the key drivers that make prediction markets accurate.

For example, Augur was fully decentralized, but its early versions had very few active users, limiting its effectiveness despite the novel technology.

In contrast, Polymarket attained a critical mass of users by offering markets on popular topics (elections, sports, crypto prices) and making onboarding easy (no KYC worldwide, simple web interface). This scale of participation greatly enhances the “wisdom of crowds” effect.

iii) User Experience and Accessibility:

Even for a crypto-native audience, user experience matters. Platforms that are too complex or require tricky wallet setups can drive users away.

Look out for the newer prediction markets with focus on smooth onboarding, because a clean interface, helpful charts, and clear presentation of odds will attract more users, which in turn improves market quality.

On the flip side, cumbersome processes (e.g. needing to manually acquire and stake a specific token just to bet or dealing with long wait times for transaction finality) can make a market not worth the effort for casual traders.

So, always consider how easy it is to use a platform.

- Can you deposit funds conveniently?

- Is it mobile-friendly?

- Is customer support or community help available if something goes wrong?

iv) Reputation and Trust in the Community:

Since real money is on the line, then TRUST is paramount. Trust can vary from transparency (open-source code, audited contracts, or reputable backers) as well as from a track record of fair operation.

So, check if the platform has had any scandals or failures to pay out etc. Community-run and decentralized markets like Poly market seems to be trustless (no central authority holds funds), whereas others like Kalshi have built trust by being fully regulated and compliant, as we saw last year 2024, where Kalshi became the first CFTC-regulated exchange to offer legal event contracts in the U.S., and even winning a court case to offer election betting.

Such regulatory stamp of approval lends credibility and signals users can trust the platform to operate within legal boundaries.

Meanwhile, platforms that operate in a gray area are red flags. It is either you’re decentralized, and codes audited, or you’re fully regulated.

v) User Incentives and Behavior:

Another human factor is why users are participating. Are they hobbyist bettors, profit-seeking traders, or subject-matter experts hedging risks? I believe markets with a strong community of forecasters (including academics or professionals in relevant fields) might yield better insights.

A platform’s culture whether it’s more of a gambling vibe or a serious forecasting tool will affect if it suits your purpose. When deciding if a prediction market is worth using, gauge the community:

- is it active and serious?

- Do they have diverse viewpoints?

The presence of “engaged participants with diverse information” is one proven factor in a prediction market success.

I believe a constructive community will favor markets that are meaningful and resolve correctly, whereas a poorly managed community might indulge in poorly defined or trollish markets.

In summary, the user factor boils down to participation quantity and quality. So, a platform that has a large, diverse, and engaged user base, and that has earned their trust, is far more likely to provide a worthwhile experience.

If a market has barely any users or a toxic community, you may want to steer clear regardless of the technology behind it. After all, prediction markets are a form of crowdsourcing which means without the crowd, there’s not much to source.

Final Thoughts:

When evaluating a prediction market, always come back to the three core considerations:

- market design

- economic viability, and

- user factors.

A platform with a sound mechanism, ample liquidity, and a vibrant, trustworthy community is far more likely to provide value both in terms of profitable trading opportunities and accurate forecasts.

That ends this week’s series Amigos. See you on the next one.

Disclaimer:

- This article is reprinted from [marvellousdefi_]. All copyrights belong to the original author [marvellousdefi_]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?